M1: Understanding the financial planning process & M2: Financial Statements

1/30

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

Financial Literacy

the ability for people to make informed judgements and decisions to take effective actions. About your current and future situation.

Net-Worth-to-Earnings ratio =

net worth / annual earnings

Net Worth =

Total Assets - Total Liabilities

Financial Planning

process of planning your spending, financing and investing as to your optimise financial situation

6 Steps to Financial Planning

Define financial goals, be specific and focus on results, make them realistic (consider current situation and reasonable expectation), prioritise goals and define time frame→ have $200

Develop financial plans and strategies to achieve goals → save a certain amount each month

implement financial plans and strategies

develop budget to monitor control and progress towards goals

evaluate results by using financial statements

review and redefine in light of new information → prepare financial statements

Types of Goals

Short-term goals: within the year

Intermediate-term goals: within next 2-5 years

Long-term goals: periods greater than 5 years

personal financial plan:

specifies your financial goals and describes the spending, investing and financing so you can achieve tour goals

Average Propensity to Consume (APC)

income spend on current needs / total income then turn into % by / 100/1

eg 60% = spending 60% if income so every $1 they earn they spend 0.6c

What determines personal income:

Age, martial status, education (higher income and higher employment), where you live, career choice

Reserve Bank

Government setting level of interest rate and take charge of economy to manage inflation and stabalise the economy

controls money supply → increase price of good if there is more money.

used to stimulate or contract economic growth → if economy is looking like there will be a recession, reserve bank reduce the supply of money and adjust.

interest rate management (role of OCR - offical cash rate)

effect on exchange rates

Economic Cycles

→ expansion - economy good everything happy

→ recession - decreasing economy

→ depression - lose jobs, cant raise family,

→ recovery - prices are cheaper and economy will grow

The Financial Wonder

The power of ‘compounding’ with the understanding of ‘time value of money’.

Present Value (PV)

How much money you currently have

Interest Rate (r)

How much you earn each year as a percentage od your principle

Future Value (FV)

any money that we will consider to have in the future

Time period

today is 0 - goes up in years.

Compound Interest Equation

Principle + interest = Total savings

PV + Interest (PV*r) = FV

PV*(1+r) = FV

FV3 =

PV * (1 + r)3

FVn =

PV * (1 + r)n

Balance sheet

A statement of your financial position at one point in time

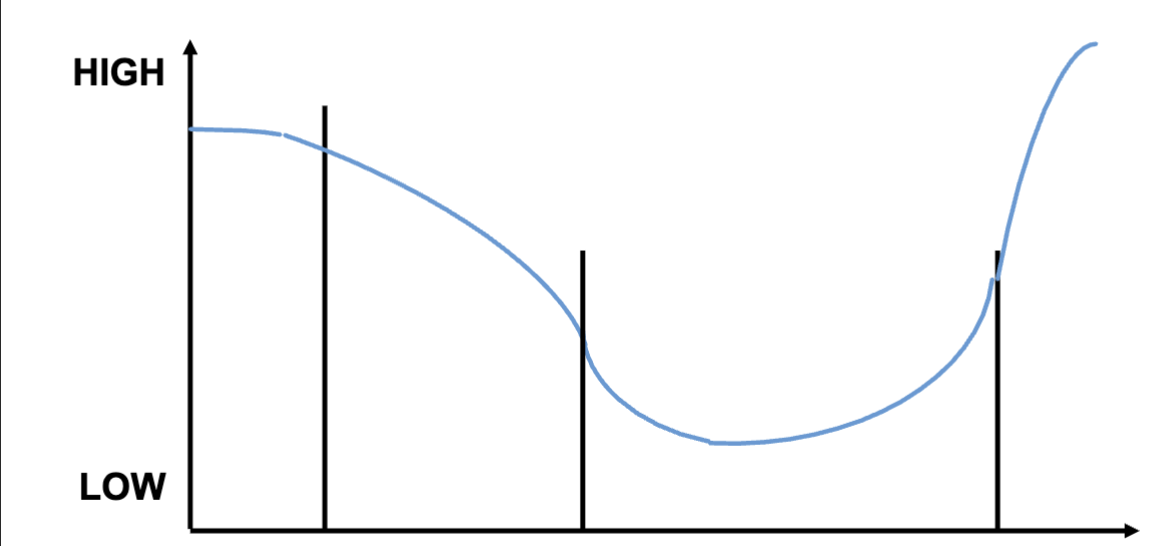

What is this called? And what is located on the ‘x’ axis?

Economic Cycles

→ expansion - economy good everything happy

→ recession - decreasing economy

→ depression - lose jobs, cant raise family,

→ recovery - prices are cheaper and economy will grow

What Balance sheet summarises

Assets (what you own)

Individual level

Bank account

Car

Investments

Jewellery

Furniture

House

Liabilities (what you owe)

Car loan

Credit card balances

Student loan

Unpaid monthly bills

Mortgage

Net Worth

(Subtract total liabilities from total assets to determine net worth.)

Balance Sheet Equation

First equation of accounting

Assets = Liabilities + Net Worth(Equity)

A = L + E

E = A - L

Revenue Statement

Statement of Financial Performace

A measure of your financial performance over a given time period.

For example – the revenue statement of ‘you’ for the year ended 31 March 2020.

Total Income – Total Expenses = PROFIT OR LOSS. (indv. Surplus or Deficit)

For us, as individuals, this is usually recorded on a cash basis (i.e. when we actually receive or pay money).

For companies, this is usually recorded on an accrual basis

Balance Sheet Ratios

Solvency ratio & Liquidity ratio

Solvency ratio

Shows the state of your net worth at a given point in time.

Indicates your potential to withstand financial problems.

Total net worth / Total assets

Liquidity ratio

Current: asset or a liability that is expected to be turned into cash within one year

Liquid: Subset of current assets. An asset which will be turned into cash within one week

Measures your ability to pay current debts (liabilities) with existing liquid assets.

Liquid assets / Total current debts (liabilities)

Revenue statement ratios

Saving ratio & Debt service ratio

What Revenue statement summarises

Income & expenses

Saving Ratio

Cash surplus: total income - total expenses

Shows the percentage of after-tax income being saved during a given period.

Debt Service Ratio

Indicates ability to repay loan obligations promptly with after–tax income.

Total monthly loan payments / monthly income