IB (Part 2)

1/64

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

65 Terms

Levels of Strategy

Corporate-level Strategy

Business-level Strategy

Operational-level Strategy

Corporate-level strategy

Quest for Economies of Scale

How value is added by the different businesses of the entire organization

ex. Disney leveraging its characters across movies, theme parks..

Business-level strategy

Quest for Competitive Advantage

How single business unit positions itself against rivals

Operational-level strategy

Quest for Operational Effectiveness

How functional components of an organization contribute to corporate and business level strategies in terms of resources, processes & people

ex. HR systems improving employee capability & retention

Paths for companies to diversify

Different industries

Geographies

Within-industry diversification

Different industries

Reduce dependency on a single industry

Spread risk

Leverage existing resources & capabilities across industries

Geographies

Access new customer base

Benefit from global economies of scale

Reduce exposure to local market risks

Within-industry diversification

Product diversification

Customer-segment diversification

Vertical integration

Horizontal integration

Globalization

Globalization of markets: Merging oh historically distinct national markets into a single global marketplace

Globalization of production: Sourcing G&S from around the world to take advantage of cost and quality differences (i.e. Apple designs in the US manufactures in China and sells globally)

Key Drivers of Globalization

Technology Change

Trade Liberalization

Global Institutions

Global Competition

Pro’s of Globalization

Expands economic growth & job opportunities

Increases consumer choice & lowers prices

Encourages innovation & international collaboration

Con’s of Globalization

Potential job losses in developed economies

Environmental degradation & resource strain

Cultural homogenization & loss of local identity

Growing income inequality in some regions

International business challenges

Cross-Cultural Differences: Strategies effective in one country may fall in another

Varying Political, Legal, and Economy Systems: Political risk and policy instability can affect strategy and performance

Global Coordination & Strategy: Need to balance global efficiency with local responsiveness

Ethical & Social Responsibility Issues

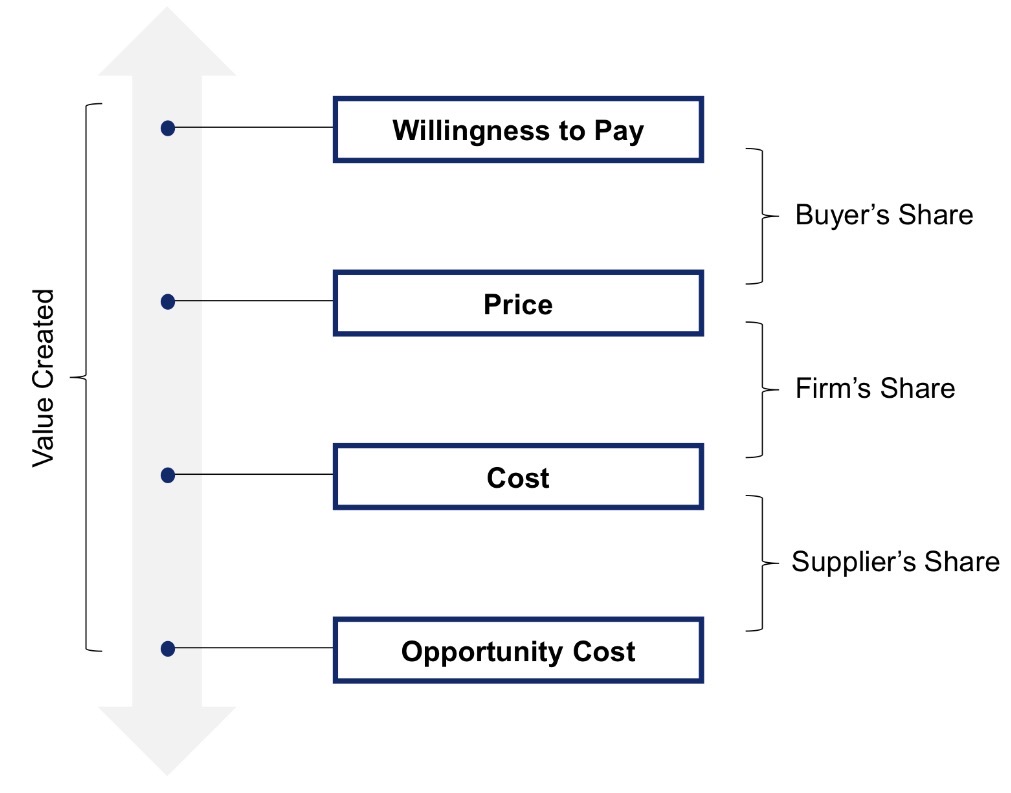

Value creation & Appropriation along the vertical chain

Buyer’s Share

Willingnes to pay (WTP): Firms can increase by improving product quality, customer experience, or offering unique features

Price

Price > WTP: Potential customer does not buy

Price < WTP: Potential customer byuys + captures a non-zero value

Supplier’s Share

Identify resources used & quantity of each resource

Negotiated cost rate vs Opportunity cost rate per unit of resource

Cost = Quantity of resource * Negotiated Cost per unit of resource

Opportunity cost = Quantity of resource * Opportunity Cost per unit of resource

Add up all costs

Generic Strategies for Going Abroad

Deployment

Development

Deepening

Deployment

Replication of competitive advantage from home country

Mechanism of creation of value is by aggregating demand

Target homogeneous segments (needs) of market across regions

Standardization of services or products

Development

Identifying where potential new capabilities reside

Goal is to get integrated competitive advantage

Locations should be different enough rather than too different

Deepening

Widen competitive advantage, without changing primary business strategy

Increase WTP by adjusting to local tastes

Decreasing costs by aggregation of demand (non-buyers turning to buyers)

Being internationally dispersed has value for stakeholders

Challenges in New Markets

Liability of being a foreigner

Paradix of being consistent

Liabilities of being a foreigner

Local laws favor domestic firms

Import/Export costs

Cultural differences

Caps on foreign investment

Seperate time zones can be a liability

Different contract structures

Paradox of being consistent

Need for market adaptation

Loss on internal consistency

Dilution of competitive advantage

Complex decision-making

Risk of strategic misalignment

Strategy

Actions that managers take to attain the goals of the firm

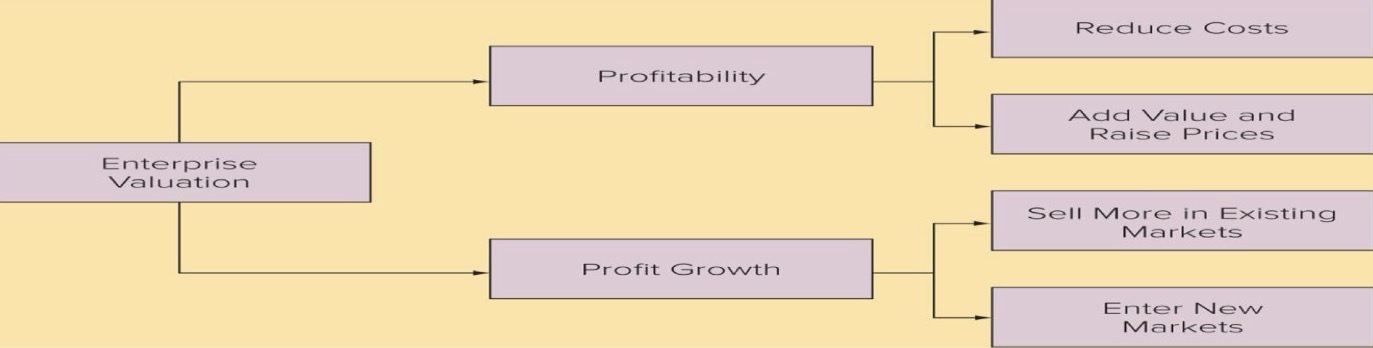

Determinants of Enterprise value

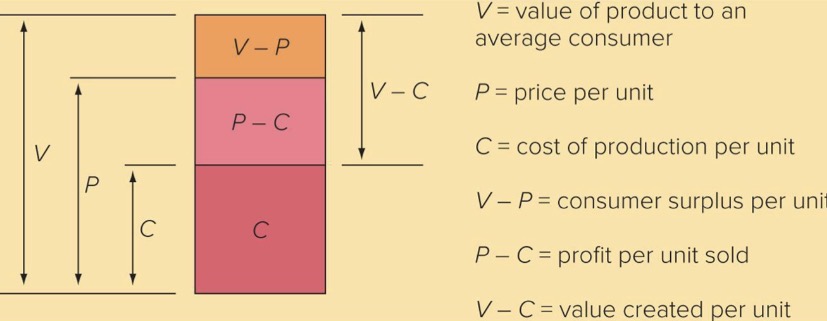

Value Creation

Measured by difference between a firm’s costs of production and the quality that consumers receive in its products

More value customers place on a firm’s product = high price firm can charged (V - C)

Porter’s strategies for creating value & attaining a competitive advantage

Low cost

Differentiation

To maximize profitability (Porter)

Pick a position on the efficiency frontier that is viable

Align internal operations to fully support that position

Ensure firm has right organization structure in place to execute its strategy

Consistency across strategy, operations & organizations is essential for competitive advantage & superior profitability

International firms are able to

Expand potential size of market for domestic products

Realize location economies

Realize greater cost economies from experience effects

Earn greater return-on-investment

Expanding the market

Successful firms transfer core competencies to foreign markets where indigenous competitors lack comparable competencies

Location economies

Performing a value-creationg activity in the optimal location to lower costs or add value

Cost reduction

Differentiation

Global web: Disperse value chain stages worlwide to maximize value or minimiza costs

Challenges:

Transportation costs

Trade barriers

Political & economic risks

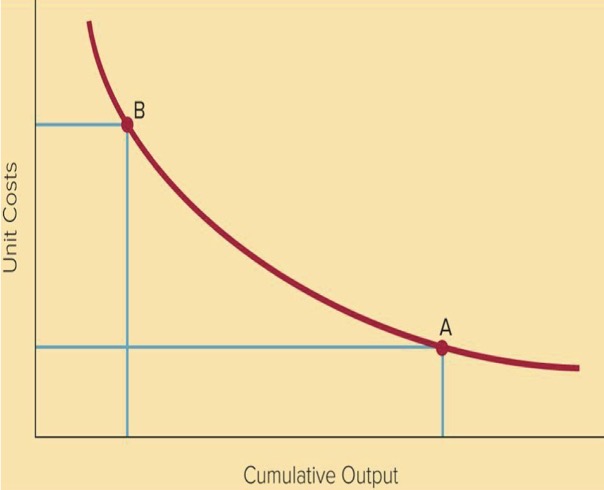

Experience effects

Experience curve describes how firm’s production costs decrease over the life of a product as the firm gains more experience producing it:

A: Learning Effects - Labor productivity improves & Management becomes more efficient

B: Economies of Scale - Producing more units spreads fixed costs over a larger output, reducing unit costs

Leveraging Subsidiary Skills

Using valuable skills developed in foreign subsidiaries and applying them across the firm’s global network to create value

Key steps for managers:

Recognize valuable skills can emerge anywhere

Incentivize local employees to acquire new skills

Identify when new skills are created

Facilitate skill transfer across the firm

Pressures for Cost Reductions

Requires a firm to try to lower the costs of value creation

Greater in industries producing commodity-type products (universal needs) & industries where major competitors are based in low-cost locations

Pressures for Local Responsiveness

Differences in Customer Tastes & Preferences

Differences in Infrastructure and Traditional Practices

Differences in Distribution Channels

Economic & Political demands by host-country governments

Rise of Regionalism (tendency toward the convergence of tastes, preferences… with a broader region composed of 2 or more nations; i.e. EU, North America, Latin America)

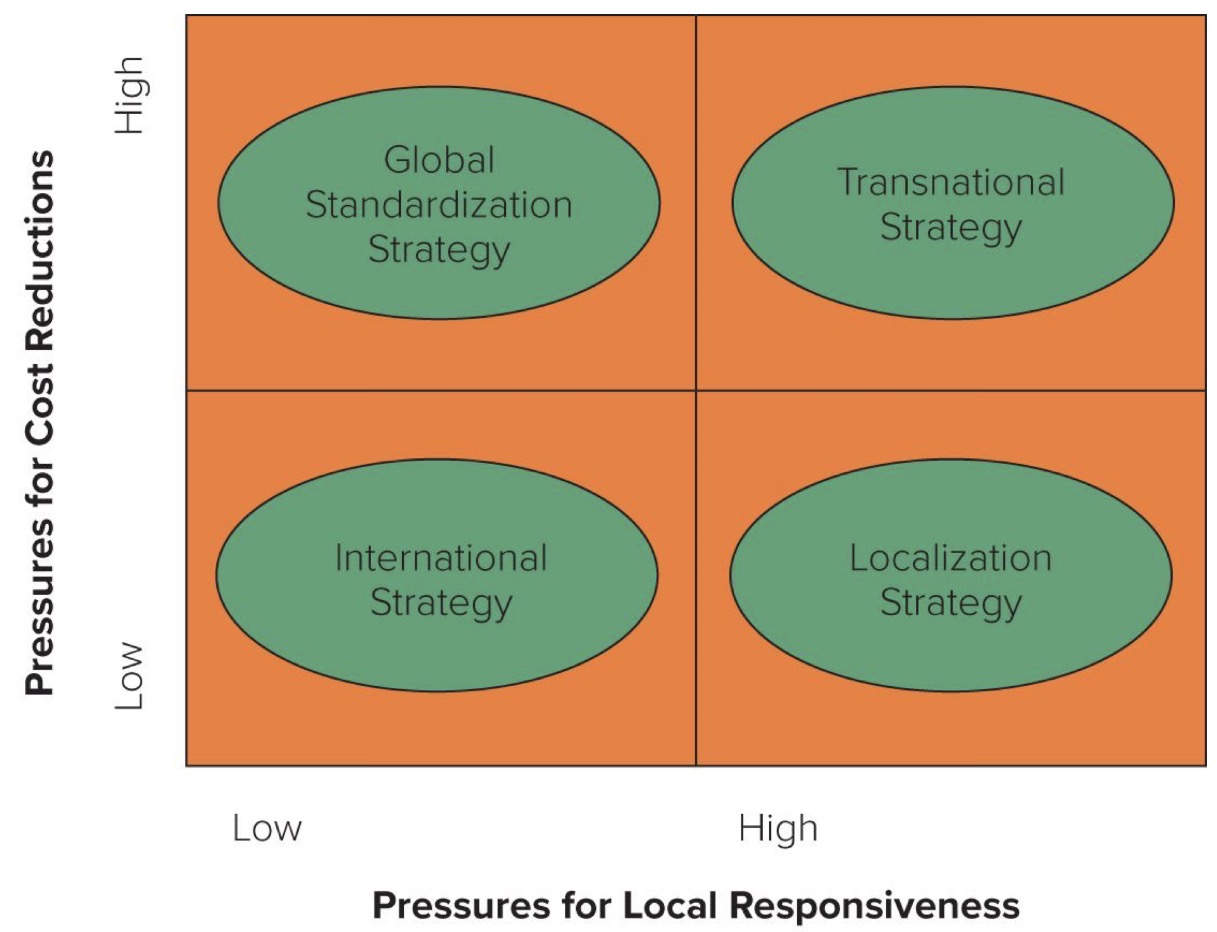

4 basic strategies

International strategy (low pressures for local responsiveness & low pressures for cost reductions)

Global Standardization strategy (low pressures for local responsiveness & high pressures for cost reductions)

Localization Strategy (high pressures for local responsiveness & low pressures for cost reductions)

Transnational Strategy (high pressures for local responsiveness & high pressures for cost reductions)

Global Standardization strategy

Goal: Achieve low cost globally by standardizing products

Concentrate productio, R&D and supply chain in a few lowest-cost locations

Use economies of scale, learning effects, and location economies

Avoid customization across countries

Use when: High pressur for cost reductions & low demand for local responsiveness

Localization strategy

Goal: Customize products to match local tastes & preferences in each national market

Customization reduces ability to gain cost savings from mass production

Use when: Large differences in consumer preferences across countries & low cost pressures

As competitors emerge, it will become less viable and would need to shift to a transnational strategy

Transnational Strategy

Goal: Achieve low costs while differentiating products to meet local market needs

Balance local customization with cost reduction is difficult

Requires complex coordination and management

Encourages multidirectional skill transfer between subsidiaries

Use when: Both cost pressures & local responsiveness is high

International strategy

Goal: Sell domestic products abroad with minimal customization

R&D and product development centralized at home

Manufacturing and marketing in each foreign market

Low local adaptation

Duplication of activities can raise cost

Use when: Cost pressures are not too high & low local responsiveness

As competitors emerge, it becomes less viable and would need to shift to global standardization or transnational strategy

Global strategy challenge

Companies must choose the right strategy for competing on a global stage

3 key strategies

Aggregation

Adaptation

Arbitrage

Aggregation

Achieving economies of scale by standardizing operations across regions

Adaptation

Customizing processes and offerings to meet local market needs

Arbitrage

Exploiting differences, such as offshoring to countries with lower labor costs

Basic Entry Decisions

Which markets to enter?

When to enter those markets?

On what scale?

Choosing foreign markets

Factors for entry:

Market size

Spending power

Costs & risks

Value creation potential

Suitability of its products to that market

Nature of indigenous competition

Choosing timing of entry

First-mover advantages:

Peempt rivals & build brand

Capture demand & customer loyalty

Build sales volume & experience curve

Create switching costs

First-mover disadvantages:

High learning costs

Risk of business failure

High promotion & customer education costs

Choosing Scale

Large-scale entry: Shapes competition, high risk, less flexible

Small-scale entry: Learn market gradually, lower risk

Strategic commitment: Long-term, difficult to reverse

No right scale: Depends on risk-reward tradeoff

Modes on entry

Exporting

Turnkey projects

Licensing

Franchising

Joint ventures

Wholly owned subsidiarie

Pro’s & Con’s of Exporting

Pro:

No establishment costs

Experience curve and location economies

Con:

May be costly if cheaper production abroad exists

High transport costs

Tariff/import barriers

Pro’s & Con’s Turnkey projects

Pro:

Less risky than FDI

Con:

No ongoing interest in foreign market

May create competitors

Risk of giving away proprietary knowledge

Pro’s & Con’s Licensing

Pro:

No development costs & risks

No barriers to investment

Good use of existing intellectual property

Con:

No control over operations

Limits firm’s ability to coordinate strategic moves

Risks losing technology

Pro’s & Con’s of Franchising

Pro:

Lower costs & risks

Helps build a global presence quickly

Con:

Set up subsidies

Quality Control

May inhibit firm’s ability to take profits out of one country to support attacks in another

Pro’s & Con’s Joint Ventures

Pro:

Local partner’s knowledge of the host country

Shared costs and risks

Political considerations

Con:

Loss of technology control

Lack of control over subsidiaries

Can lead to conflicts and battles for control between investing firms

Pro’s & Con’s Wholly Owned Subsidiaries

Pro:

Reduces risk of losing control over technology

Tightly control operations in different countries

Location and experience curve economies

100% share of profits

Con:

Bear full cost and risk

Problems associated with acquisitions

Acquisition

Firm seeks to enter a market where there are already well-established incumben enterprises

Global competitiors also interested in establishing presence

Pro:

Fast market entry

Can preempt competitors

Often less risky than building from scratch

Con:

Often produce disappointing results:

Risk of overpaying

Culture clashes during integration

Greenfield ventures

No incumbent competitors to be acquired

Good when competitive advantage relies on transferring unique routines or capabilities

Pro:

Full control over building the subsidiary

Con:

Slower to establish

Risky but less risky than aquisitions

Preemption by competitors

Factors influencing a mode of entry choice

Core competencies and entry-mode

Pressures for cost reductions and entry mode

Core competencies and entry-mode

Technological Know-How:

Licensing or joint venutres are risky since foreign partner could learn the technology & become a competitior

So company prefer wholly owned subsidiaries to protect their

Only license it if tech becomes outdated quickly

Management Know-How:

Franchising or ventures are safe enough

Less risk

Pressures for Cost Reductions and Entry Mode

High cost pressures prefer exporting and wholly owned subsidiaries

Allows tight control over global operations

Enables using profits from one market to support competition in another market

Strategic alliances for internationalization

Pro:

May facilitate entry into a foreign market

Allow firms to share the fixed costs

Brings together complementary skills and assets

May help the firm establish tech standards for the industry that will benefit the firm

Con:

May give competitors a low-cost route to new tech and markets

Partner selection

A good partner:

Helps the firm achieve its strategic goals

Has capabilities the firms lacks

Is unlikely to try to opportunistically exploit its partner

Choosing a partner:

Collect as much info as possible

Gather data from informed third parties

Get to know the potential partner before committing

Alliance Structure

Reduce the risk of giving away too much to partner

Use contractual safeguards

Agree in advance to swap skills and technologies

Cross-licensing agreements

Managing the Alliance

Be sensitive to cultural differences

Build trust

Build relational capital