Macroeconomic Equilibrium

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

When does real national output equilibrium occur?

Where AD intersects with SRAS.

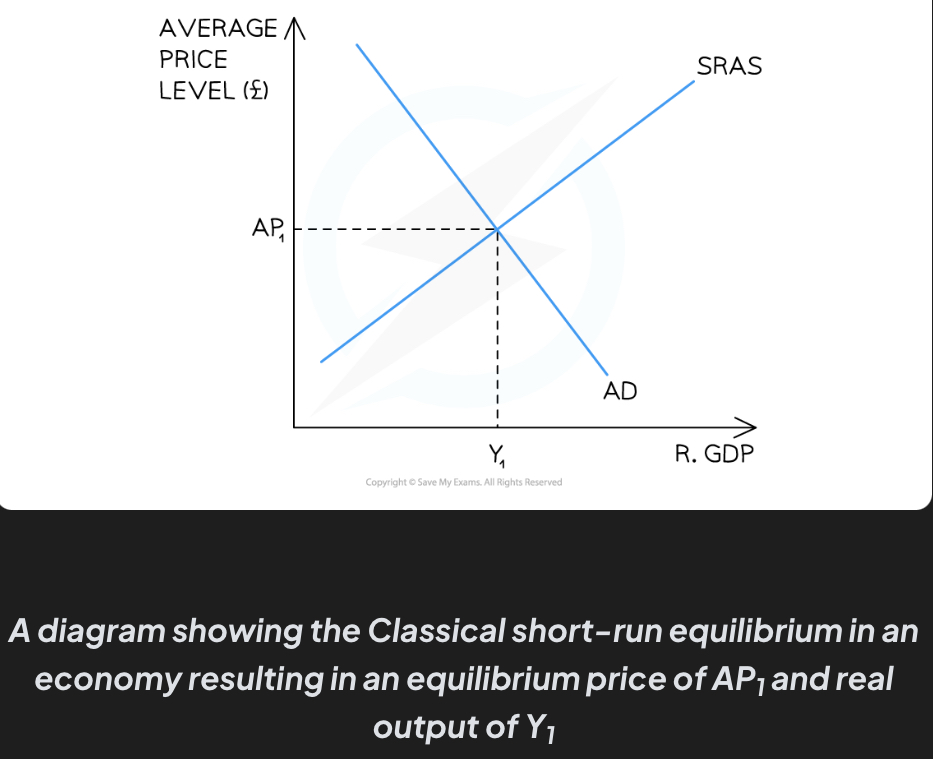

What does the classical short-run equilibrium look like?

According to classical theory, this economy is in short run equilibrium at AP1Y1

Any changes to the components of AD will cause the AD curve to shift left or right creating a new short-run equilibrium

Any changes to the non-price determinants of SRAS will shift the SRAS curve left or right creating a new short-run equilibrium

What do classical economists believe about the long-run equilibrium of real national output?

Classical and Keynesian economists have different views on the long-run equilibrium of real national output

Classical economists believe that the economy will always return to its full potential level of output and all that will change in the long-run, is the average price level

YFE is considered to be equal to the Natural rate of unemployment in an economy

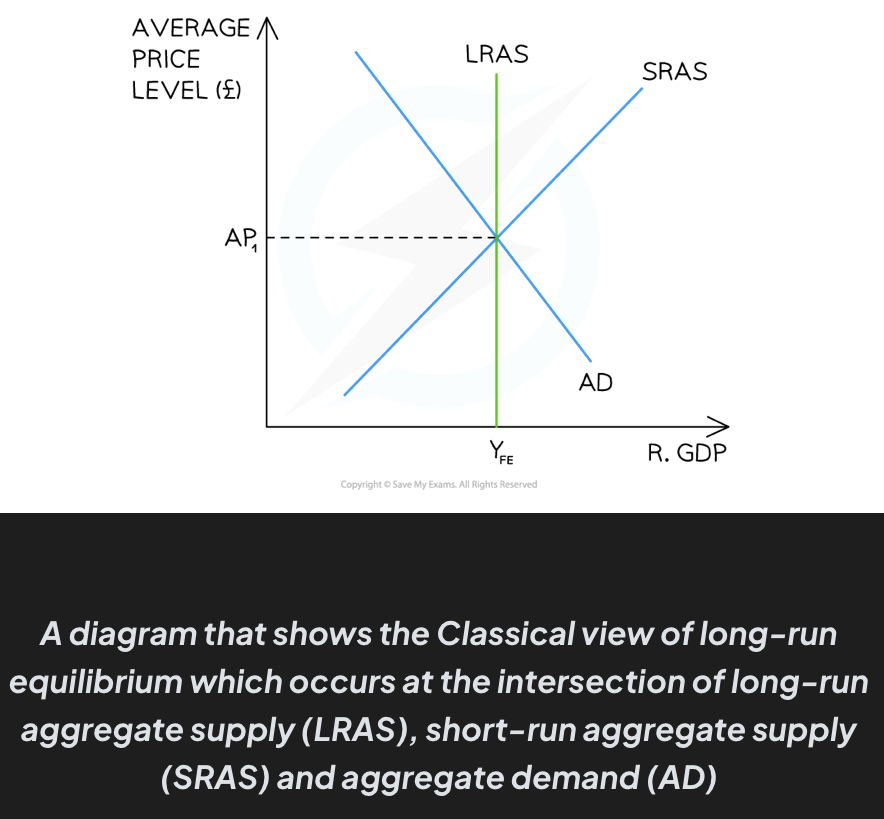

What does the classical view of long-run equilibrium look like?

The LRAS curve demonstrates the maximum possible output of an economy using all of its scarce resources

The SRAS intersects with AD at the LRAS curve

This economy is producing at the full employment level of output (YFE)

The average price level at YFE is AP1

What is the classical adjustment process?

Classical economists believe that in the long run the economy will always return to its full potential level of output and all that will change is the average price level

This is the also referred to as the self-correcting mechanism

When does a deflationary output gap occur?

When the real GDP is less than the potential real GDP.

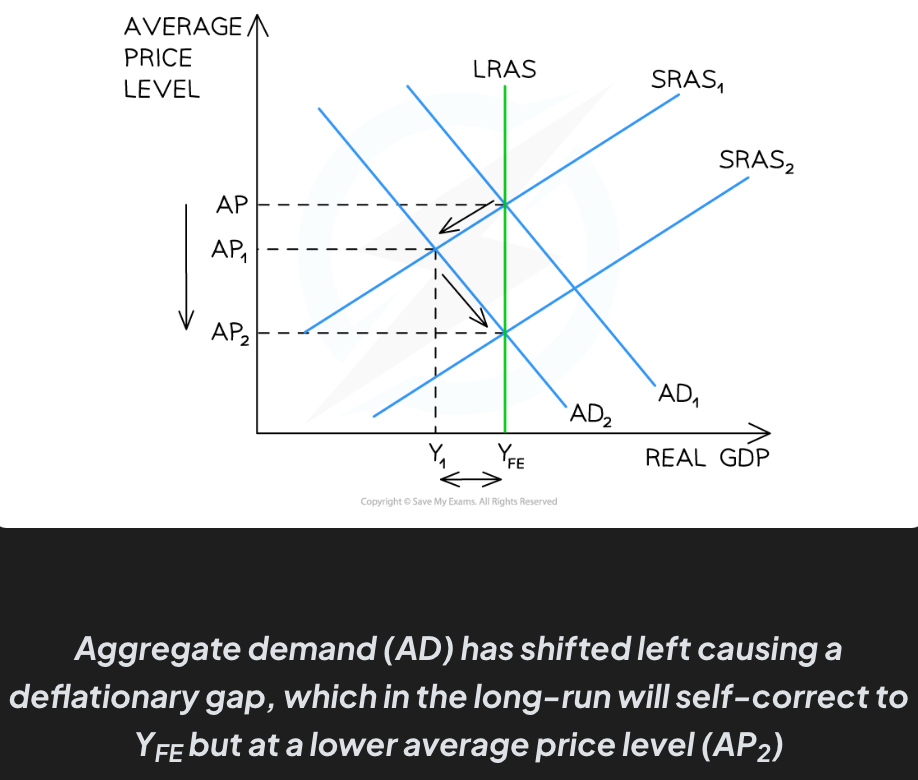

What does the automatic adjustment from a deflationary output gap look like from the classical view?

What is the correction process from a deflationary output gap?

Initial long-run equilibrium is at AP YFE

AD shifts left from AD → AD1, possibly due to the onset of a recession

Output falls from YFE → Y1 and price levels fall from AP → AP1

Due to the fall in output, firms lay off workers

Unemployed workers are now willing to work for lower wages and this reduces the costs of production which causes the SRAS curve to shift right from SRAS1 → SRAS2

A new long-run equilibrium is formed at AP2 YFE

The economy is back to the full employment level of output (YFE), but at a lower average price

When does an inflationary gap occur?

When real GDP is greater than the potential real GDP.

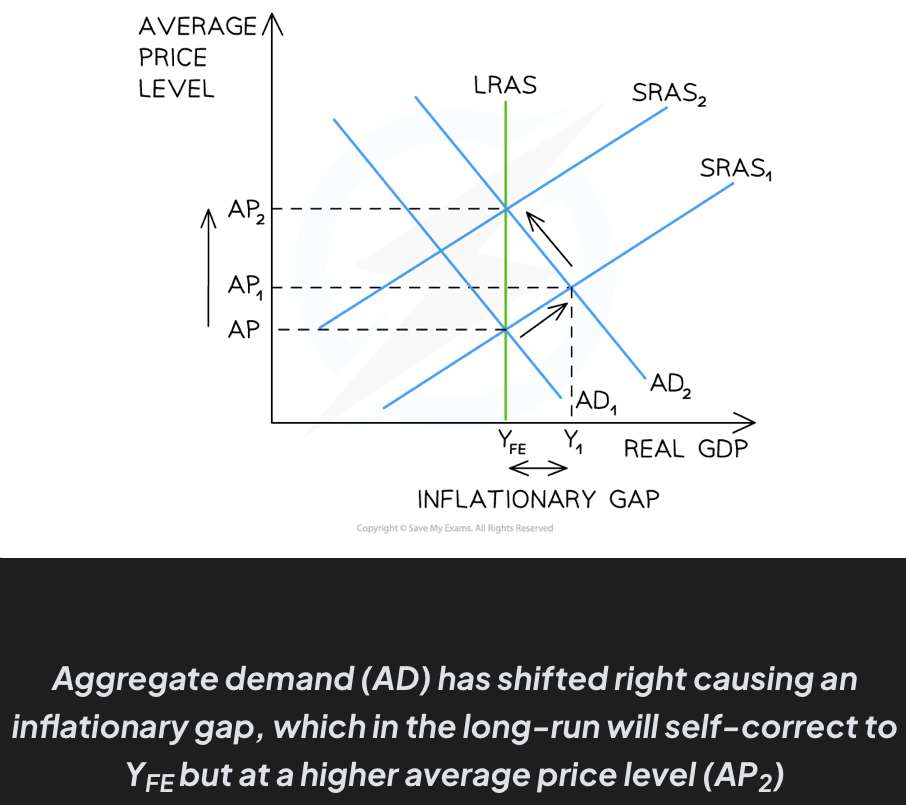

What does an automatic adjustment from an inflationary gap look like from a classical view?

What is the correction process from an inflationary output gap?

Initial long-run equilibrium is at AP YFE

AD shifts right from AD1 → AD2, possibly due to raid expansion of the money supply

Output rises from YFE → Y1 and price levels rise from AP → AP1

Due to the increase in average prices (inflation), workers demand higher wages

Higher wages increase the costs of production which causes the SRAS curve to shift left from SRAS1 → SRAS2

A new long-run equilibrium is formed at AP2 YFE

The economy is back to the full employment level of output (YFE), but at a higher average price

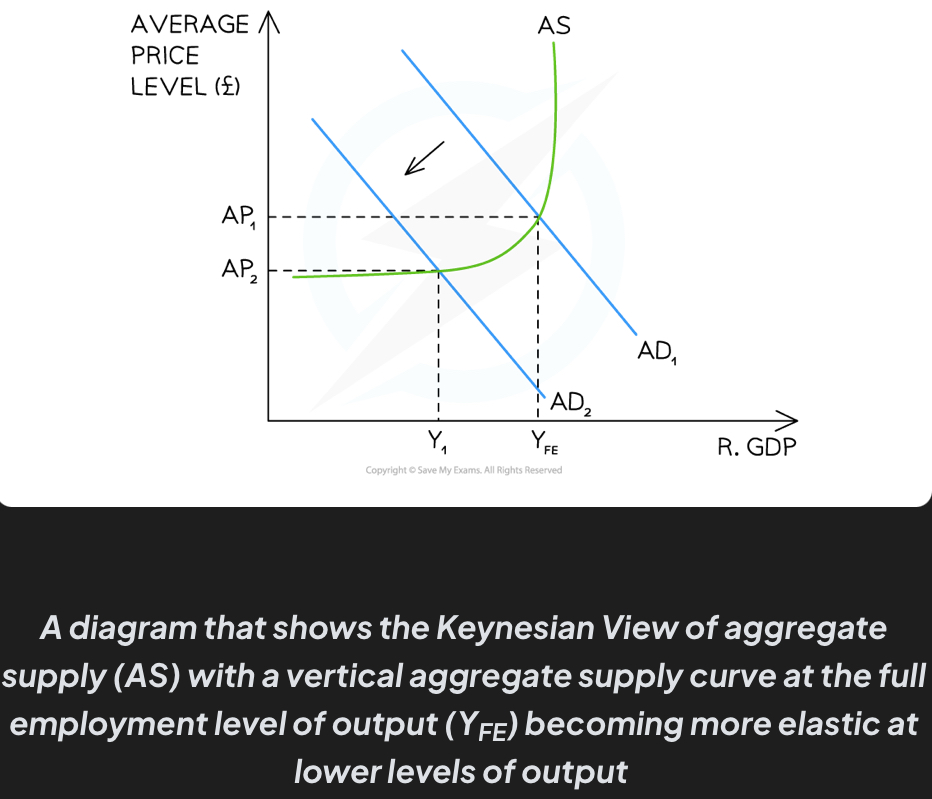

What do Keynesian economists believe about macroeconomic equilibrium?

Keynesian economists believe that the economy can be in long term equilibrium at any level of output

The Keynesian view believes that an economy will notalways self-correct and return to the full employment level of output (YFE)

It can get stuck at an equilibrium well below the full employment level of output e.g. Great Depression

The Keynesian view believes that there is role for the government to increase its expenditure so as to shift aggregate demand and change the negative 'animal spirits' in the economy

What does equilibrium in the Keynesian model look like?

Using all available FOPs, the long-term output of this economy occurs at YFE

The economy is initially in equilibrium at the intersection of AD1 and AS (AP1YFE)

A slowdown reduces aggregate demand from AD1→AD2 and creates a recessionary gap equal to YFE - Y1

The economy may reach a point where average prices stop falling (AP2), but output continues to fall

Prices may be blocked from falling further due to minimum wage laws, the existence of trade unions, or long-term employment contracts preventing wage decreases

This economy may not self-correct to YFE for years

The low output leads to high unemployment and low confidence in the economy

This stops further investment and further reduces consumption

Keynes argued that this was where governments needed to intervene with significant expenditure

What are the assumptions of classical thinking?

Wages are flexible

Any deviation from Yfe is temporary

Demand-side policies are less effective than supply-side policies in generating economic growth

What are the implications of assuming wages are flexible?

Markets self-correct to YFE in the long run due to the fact that wages can easily rise or fall so as to change costs of production

The self-correction is based on automatic short-run supply side changes and there is no need for government intervention

What are the implications of assuming any deviation from Yfe is temporary?

There may be short periods of unemployment when a recessionary gap occurs, however markets will return to YFEwhich corresponds to the natural rate of unemployment (NRU) for an economy

What are the implications of assuming demand-side policies are less effective than supply-side policies in generating economic growth?

Economic growth is generated by increasing the productive capacity of the economy

This thinking follows Say’s Law

Government intervention should focus on increasing the supply-side of an economy

What are the assumptions of Keynesian thinking?

‘In the long run we are all dead’

Wages can be inflexible ‘sticky’ downwards

Governments have to intervene to break negative human emotions

What are the implications of assuming ‘in the long run we are all dead’?

Keynes explained that the idea of markets self-correcting in the long-run was flawed in that the long-run could be a very long period of time indeed

The consequences of severe recessionary gaps and the unemployment they cause can be significant, lasting for generations

What are the implications of assuming wages can be inflexible?

Markets will reach a point where self-correction as a result of falling wagesis no longer viable

Workers will reach a point where they are no longer willing to accept lower wages

Wages may be blocked from falling further due to minimum wage laws, the existence of trade unions, or long-term employment contracts preventing wage decreases

What are the implications of assuming governments have to intervene to break the negative human emotions?

If the emotions are gloomy about the economic outlook, then gloominess will continue

This was the situation in the Great Depression and Keynes advocated that Government spending was required to change the mood in the economy and to help rebuild business and consumer confidence

Once governments had intervened, the self-correcting mechanism would begin to function again