1.2.9 - taxation and subsidy

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

define specific tax

where a fixed sum is added on to the cost of the product

what is VAT

a tax levied is the percentage of the selling price, meaning a higher amount of tax is paid at higher prices

what is an indirect tax

a tax levied on expenditure on goods and services

what is an excise duty

an indirect tax on particular goods/services designed to discourage consumtion

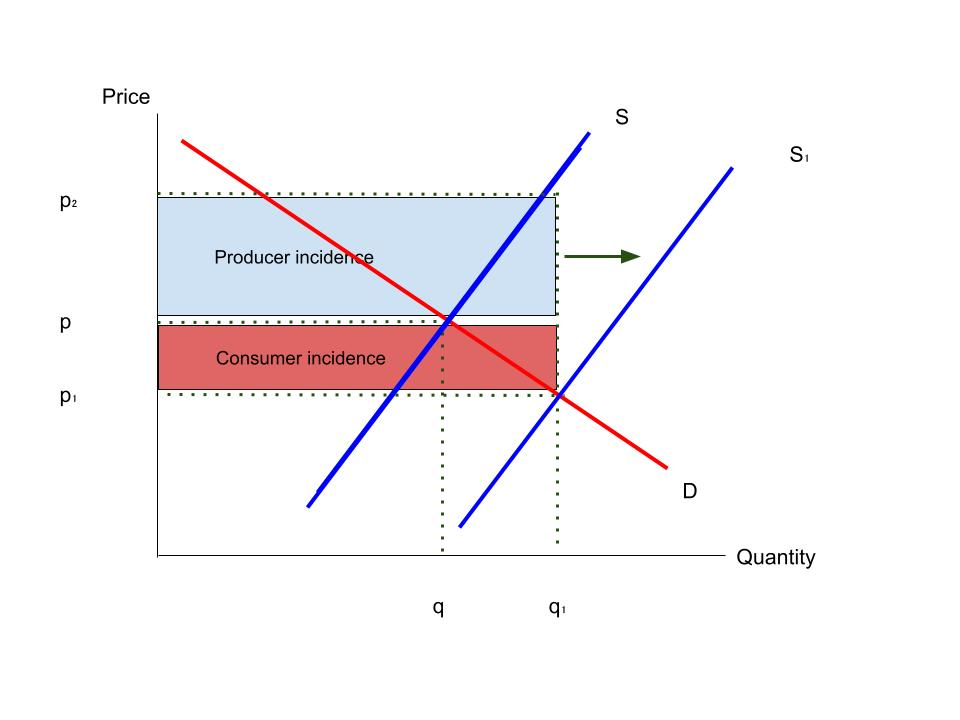

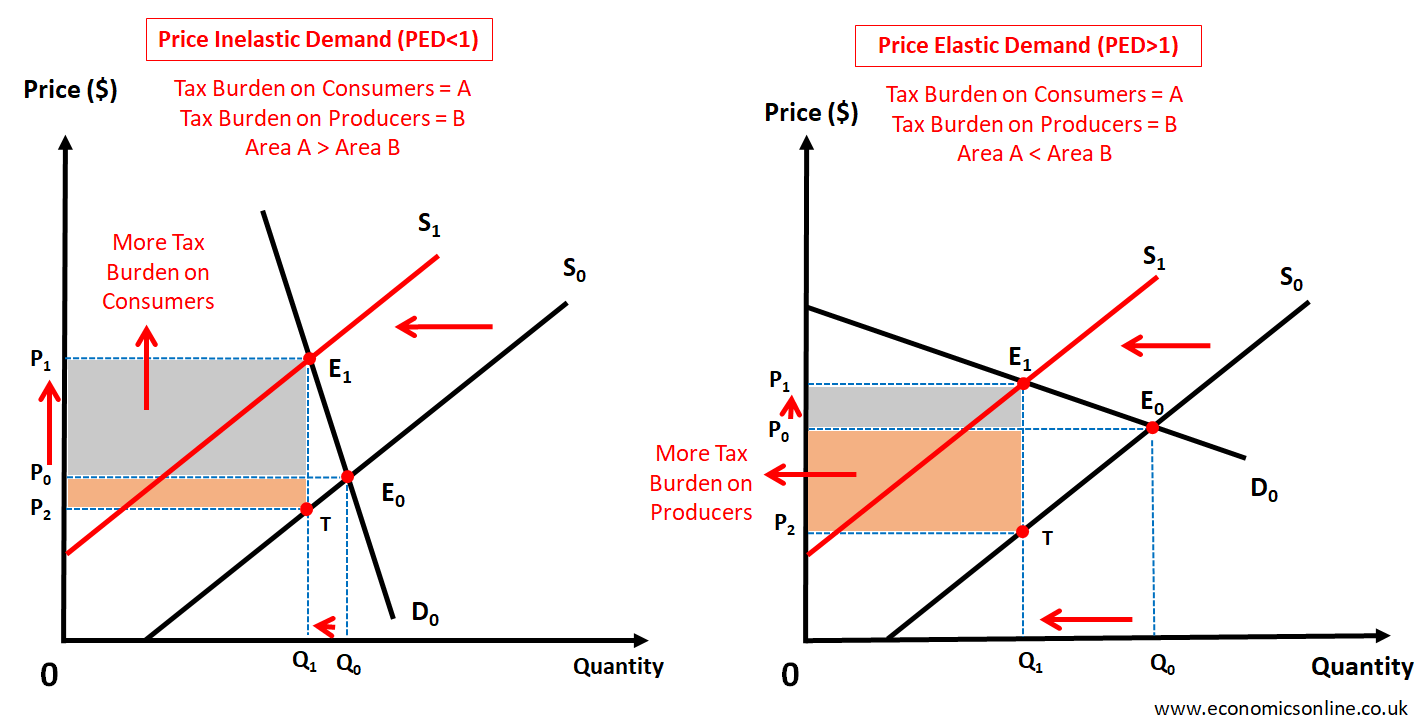

what is incidence of tax

the burden of paying sales tax is divided between buyers and sellers

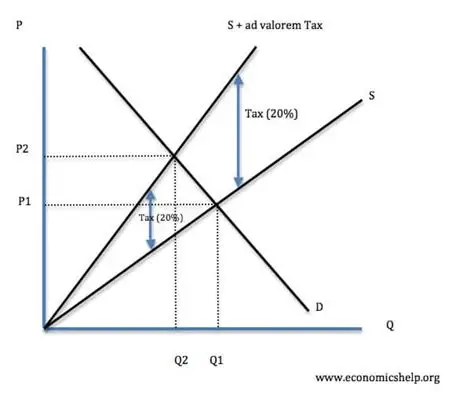

AD valorem tax

a tax levied is the percentage of the selling price

draw inderect tax diagram - show incidence of tax

draw VAT diagam - show incidence of tax

draw subsidy diagram - show subsidy amount