AP Macroeconomics Unit 2

1/48

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

49 Terms

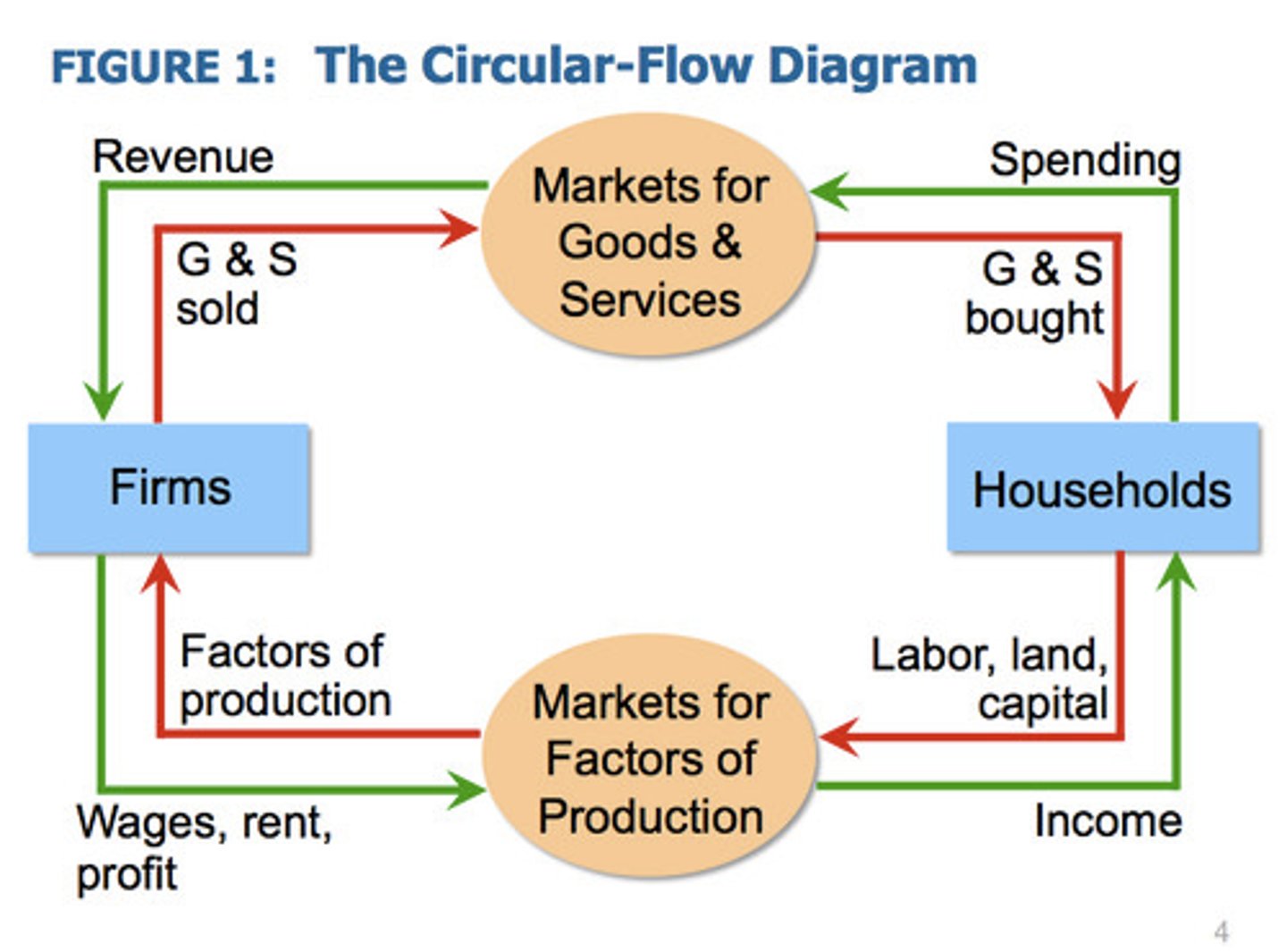

Circular Flow Diagram

A visual representation of the flow of goods, services, and money in an economy, illustrating the interactions between households, firms, and the government.

household

A group of individuals living together and making joint economic decisions, such as consumption and savings.

firm

An organization that produces goods and services for the market.

government spending

spending by all levels of government on final goods and services; the total expenditures made by the government on goods, services, and transfer payments.

transfer payments

Payments made by the government to individuals without expecting a good or service in return (i.e. welfare, unemployment benefits)

imports

goods produced abroad and sold domestically

exports

goods produced domestically and sold abroad

net exports

spending on domestically produced goods by foreigners (exports) minus spending on foreign goods by domestic residents (imports)

product market

the market in which households purchase the goods and services that firms produce; the place where final goods and services are bought and sold to households or consumers

factor/resource market

The market where factors of production (land, labor, capital, entrepreneurship) are bought and sold. Especially, capital and labor

Intermediate goods

goods used as inputs in the production of final goods.

finals goods

goods that are consumed by end-users.

employed

paid employees, self-employed, and unpaid workers in a family business; either part time or full time

unemployed

people not working who have looked for work during previous 4 weeks and still remain jobless

labor force

sum of employed and unemployed

unemployment rate

the percentage of the labor force that is unemployed.

labor force participation rate

The percentage of the working-age population that is in the labor force.

discouraged worker

A person who has given up looking for employment due to the belief that no jobs are available.

underemployed

Individuals who are working part-time but desire full-time employment or are working jobs that don't fully utilize their skills.

frictional unemployment

A type of unemployment caused by workers voluntarily changing jobs and by temporary layoffs; unemployed workers between jobs.

structural unemployment

unemployment resulting from a mismatch between the skills of the labor force and the requirements of available jobs.

cyclical unemployment

unemployment that rises during economic downturns and falls when the economy improves

natural rate of unemployment

The level of unemployment that exists in the economy when it is producing at its potential output.

efficiency wages

Wages set above the equilibrium to attract and retain higher-quality workers.

inflation

A general increase in the price level of goods and services over time.

deflation

A general decrease in the price level of goods and services over time

disinflation

a reduction in the rate of inflation

price index

a number that compares prices in one year with some earlier base year; a measurement that shows how the average price of a standard group of goods changes over time

market basket

representative group of goods and services used to compile the consumer price index (i.e. Food and Beverages (milk, chicken, full service meals...); a selected mix of goods and services that tracks the performance of a specific market or segment.

consumer price index

A measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services; measures the overall change in consumer prices based on a representative basket of goods and services over time.

real values

values that have been adjusted for inflation, thus stripping the price effect and enable side to side comparison of actual output

nominal values

values unadjusted for the effects of inflation

menu costs

the costs to firms of changing prices

shoe leather costs

the costs associated with increased transactions due to inflation.

unit-of-account costs

arise from the way inflation makes money a less reliable unit of measurement

nominal GDP

The total value of goods and services produced in a country, measured in current prices.

real GDP

The total value of goods and services produced in a country, adjusted for inflation.

base year

The year used as a reference point for constructing a price index.

GDP deflator

is an economic metric used to measure inflation; helps determine the rise in prices of goods and services. This metric includes all final goods, including exports. a measure of the price level calculated as the ratio of nominal GDP to real GDP times 100; a measure of the overall price level of goods and services produced in an economy, relative to the base year.

Business Cycle

a period of macroeconomic expansion followed by a period of contraction; the recurring fluctuations in economic activity, including expansion, contraction, peak, and trough.

expansion/recovery

the phase of the business cycle characterized by economic growth and increasing employment.

contraction

the phase of the business cycle characterized by a decline in economic activity.

recession

a significant decline in economic activity, lasting for an extended period.

peak

the point at which the economy reaches its highest level of output before entering a contraction.

trough

the point at which the economy reaches its lowest level of output before entering an expansion.

potential output

The real output (GDP) an economy can produce when it fully employs its available resources; the maximum sustainable level of output an economy can produce without causing inflation.

output gap

the gap between real GDP and potential GDP, the difference between actual output and potential output.

positive output gap

When actual GDP is above the productive potential of the economy and it is in boom; when actual output exceeds potential output.

negative output gap

When actual GDP is below the productive potential of the economy; when actual output is below potential output.