Oligopoly

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

7 Terms

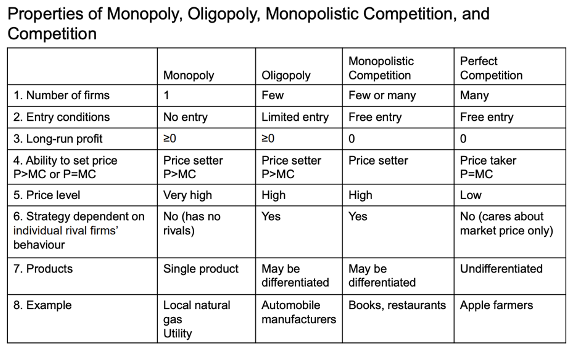

Where do oligopolies fit between perfect competition and monopoly, and what are their key features?

Perfect competition (many price-taking firms) and monopoly (one price-setting firm) are the two extremes of market structure.

In reality, most firms:

Face some competition (unlike monopolies),

But are not price takers (unlike perfect competition).

Oligopoly lies in the middle:

A small number of large firms dominate the market (e.g., Nintendo, Microsoft, Sony; Tesco, Sainsbury’s, Asda).

Firms have market power (P > MC) but face inter-firm rivalry, so they can’t treat the market demand curve as their own.

Substantial barriers to entry exist.

A duopoly is a special case of oligopoly with just two competing firms, leading to even stronger strategic interdependence.

What are cartels and why are the formed?

Cartels - a group of firms that explicitly agree to coordinate their activities to collectively produce the monopoly output.

Oligopolistic firms have an incentive to form cartels in which they collude in setting prices or quantities so as to increase their profits.

The Organisation of Petroleum Exporting Countries (OPEC) is a well-known example of an international cartel.

Canadian Federation of Quebec Maple Syrup Producers is another example

Rationale: A cartel forms when its members believe they can increase their profits by restricting their combined output to the monopoly level.

Why dp cartels often fail?

1. Lack of Market Control Cartels fail if they lack market power to raise prices. Non-cartel firms can increase supply, weakening price control

Example: If OPEC raises oil prices, U.S. producers expand output, reducing OPEC's influence.

2. Cheating Among Members Firms profit by secretly producing more than agreed. If all cheat, supply rises, prices fall, and the cartel collapses.

Example: Firms think, "I can cheat without being noticed." If many do, the cartel fails

What is the basic dilemma of oligopoly

Oligopolies require strategic decision-making—firms must choose to compete or cooperate.

If firms cooperate (Cartel): They produce less output and set high prices together Higher → profits for all firms.

Temptation to cheat: One firm may secretly increase output to gain extra profit. If all firms do this, market supply rises, prices fall, and everyone loses.

The dilemma: Work together → Keep prices high. Compete → Prices fall, profits shrink.

What is the basic strategic setup for firms in an oligopoly, and what are the incentives and risks of cooperation?

In oligopoly, firms choose strategies simultaneously.

Cooperation (like collusion) leads to restricted output, higher prices, and maximized joint profits (similar to a monopoly).

However, there's a temptation to cheat—a firm may increase output to gain extra profit, hurting the cooperating firm.

If both cheat, total supply rises, prices fall, and all firms are worse off—a classic prisoner’s dilemma outcome.

What is a Cournot Duopoly and how does it compare to other oligopoly models?

A duopoly is an oligopoly with two firms. There are three key models of firm interaction:

Cournot Model: Firms simultaneously choose quantities (quantity competition), assuming rivals’ output is fixed.

Stackelberg Model: A leader firm moves first, and others follow, creating a first-mover advantage.

Bertrand Model: Firms compete on price, setting prices simultaneously.

Cournot Assumptions:

Firms are identical (same cost functions, identical products), so they produce the same quantity and charge the same price in equilibrium.

The market exists for one period—each firm chooses quantity once.

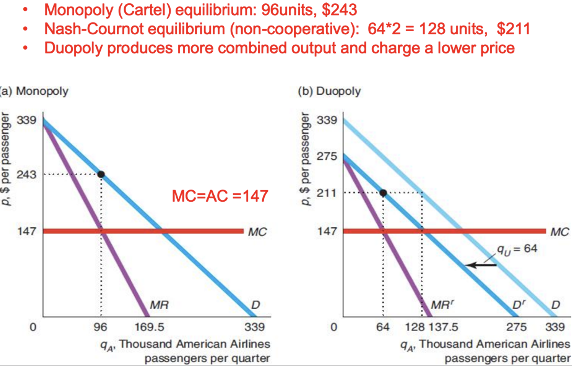

What is a Nash-Cournot Equilibrium, and how does it apply to duopolies like airlines?

In a Nash-Cournot equilibrium:

Firms set output independently and simultaneously, aiming to maximize profits.

Each firm takes the competitor’s output as given, and no firm can gain by changing output unilaterally.

This creates a noncooperative Nash equilibrium—a stable outcome where no firm has an incentive to deviate.

Example: American Airlines and United Airlines on the Chicago–Los Angeles route:

Identical cost structures.

Each airline independently chooses output, assuming the other's output is fixed.

No collusion; equilibrium reached when neither can improve profits by changing their output.