econ midterm 2

1/128

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

129 Terms

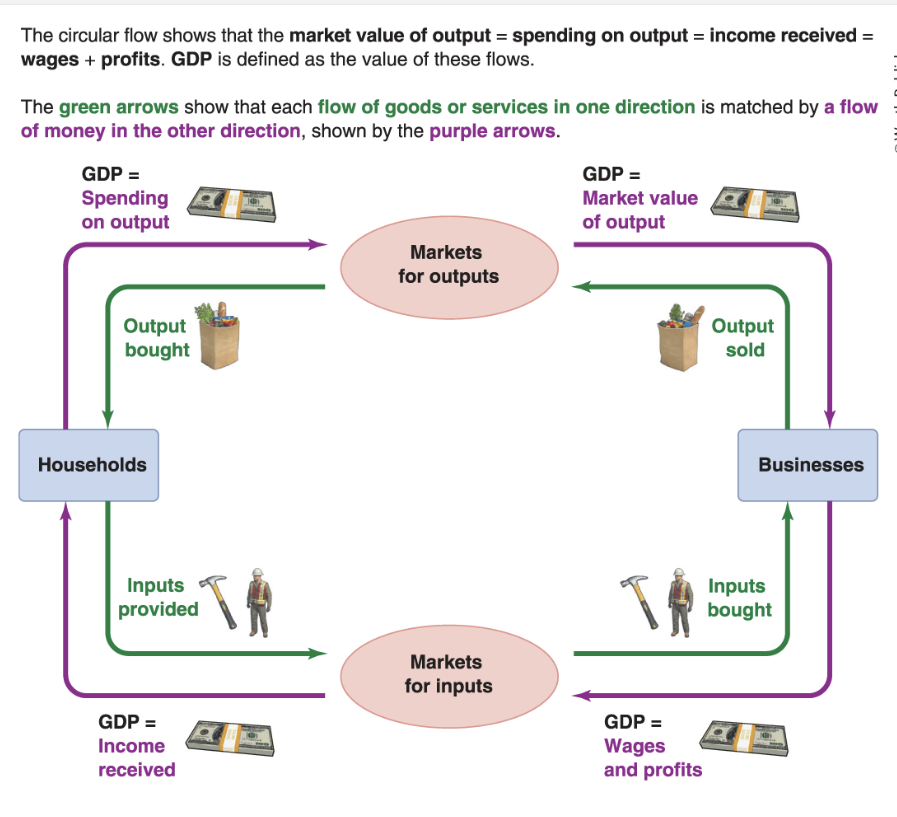

circular flow diagram

simple model showing how the households and businesses in an economy are linked

What is GDP trying to capture?

GDP is the market values of all final goods and services produced within a country in a given year

the GDP of a country tallies up the value of all the goods and services they produce

What kind of spending is included in GDP?

sales of all final goods, the ones we buy and bought for us by the government

ex: vaccines, national defense, schools

OMITS intermediate goods and services: that we buy to make other goods and services

What are the categories of spending that make up GDP?

Y= C + I + G + NX

C- Consumption: household spending; food, gas, services like Netflix, cars, TV, the rent you pay

I-Investment: spending to improve the economy like, buying a new home, building office buildings, spending money on research & development

Government purchases- spend schools, paying teachers

Net exports= Exports - Imports

Value Added

subtract the cost of intermediate inputs from a company’s total sales

think about GDP as all the stuff we make using value added

Profits

share of the money we spend going to businesses

Wages

share of the money we spend going to workers

Why are total spending, total output, and total income all equal?

Because of the circular flow diagram

Limitations of GDP

markets can fail; we know that if externalities are present, the markets prices we see aren’t equal to the marginal benefits to society

shadow economy is missing: economic activity involving illicit goods, banned services, or under- the- table transactions like babysitting

Real GDP

GDP measured in constant prices

tries to measure how much real stuff we have, so that we can focus on whether our economy has grown in value over time

Calculate Real GDP- compare output this year to output from last year

for everything produced in these 2 years, find average price level

compute GDP for both years using these average prices

Nominal GDP

total value of all good & services produced in a country during a specific period of time using current market prices

To calculate: multiply the quantities of all final goods & services produced in an economy by their current market prices in the same year, & sum up these values

How to measure GDP growth between 2 adjacent years

GDP this year- GDP last year/ GDP last year times 100

How to calculate growth rates

final value- initial value/ initial value times 100

Aggregate production function

how much of everything a country can produce

constant returns to scale, capital has diminishing returns; poor countries can catch up

Constant returns to scale

double all 3 of our inputs, we’ll get twice as much output

Diminishing marginal returns of capital

If we add more and more capital to the economy, holding population constraint, the growth in output will get smaller & smaller

What does the Solow model tell us about economic growth?

capital stock can only grow up to a certain point

physical capita per worker can’t grow forever

key insight: capital accumulation can’t sustain long-term growth

Depreciation- Solow Model

the decline in capital due to wear & tear, damage, and obsolescence

if we want capital stock to grow, we need to replace what is lost, then add even more

Technological progress

can generate continual growth

tech innovation shifts the production function up, more capital accumulation

Property rights- help create growth; but why?

control over a tangible or intangible resource

right to own a company

right to use or extract a natural resource

right to profit off of your own ideas

provide people a incentive to invest in capital, maintain a resource, or develop new technology

Efficient regulation- helps create growth, but why?

make it no harder than necessary for people to start businesses and invest in new enterprises - helps us limit negative externalities

Government stability- helps us create growth, but why?

the incentive to invest in society is higher with a more stable government

How do we measure the labor market?

working age population: 16 and older who aren’t in the military/institutionalized

employed: working people

unemployed: working-age people without jobs who are trying to get a job

Labor force and labor force participation rate

Labor force- unemployed and the employed together

100 times Employed + Unemployed/ working-age population

Unemployment rate

doesn’t figure it all out——- never 0%

100 times unemployed/labor force

Frictional Unemployment

Unemployment due to the time it takes for employers to search for the right workers, and for workers to search for the right job

want to find the right job

Structural unemployment

Unemployment that occurs because wages do not or can not fall to bring labor supply and demand into equilibrium

skills less valuable

What causes structural unemployment? 1st reason

Efficiency wages: higher wage paid to encourage higher productivity, or to attract more- desirable workers

based on the idea that paying workers more might make them more productive

What causes structural unemployment? 2nd reason

Minimum wage: price floor setting a minimum price of selling labor

binding price floors lead to persistent surpluses which means persistent unemployment

Cyclical unemployment

Unemployment due to a temporary down turn in the economy

happens when the macroeconomy shrinks and workers bear the brunt of the economic damage

What is inflation?

generalized rise in the overall level of price

happens when there is a widespread change in prices (upward)

higher prices are the result of inflation

How do we measure inflation?

100 times price level this year- last year/ price level last year

Consumer Price Index (CPI)

a index that tracks the average price consumers pay over time for a representative “basket” of goods & services

Basic steps to calculating CPI

contract the basket; groceries, rent, medical expenses, durables, services

find the prices

tally up the cost of the basket

index- pick a base year and for each year, just divide by the basket cost in the base year, and multiply by 100

What does CPI miss? How is it imperfect?

CPI can only measure price changes for existing goods

quality improvements hide price increases

people change their basket when prices rise

How do we calculate real GDP over time when we are thinking about using the GDP deflator?

pick a base year

use prices from the base year to calculate real GDP in another year

take nominal GDP in that other year, divide by the real GDP from step 2

Multiply by 100

GDP deflator gives us another way to calculate real GDP

What is the money illusion?

mistaken tendency to focus on nominal dollar amounts instead of inflation-adjusted amounts

if the price of everything goes up equally (including wages), inflation doesn’t (necessarily) hurt anyone

Medium of exchange

money is a medium of exchange: we use money to make transactions simple

Unit of account

we use money to measure value

money tells us the relative value of different products

Store of value

we use money to turn production today into savings for the future

How does inflation erode the usefulness of money?

creates menu costs for businesses- the marginal cost of adjusting prices

create shoe-leather costs for buyers: the costs incurred to avoid holding cash—— when inflation is high, people are discouraged from holding money

Hyperinflation

extremely high rates of inflation

Consequences of hyperinflation

erodes all of the functions of money

— society loses trust in money for transactions, for saving for the future, for everything

Costs of unexpected inflation

confuses price signals

redistributes between lenders and borrowers

What functions do banks have for society?

cornerstones of the financial sector

in the business of taking deposits….. and turning them into loans

pool savings to enable investment

spread risk across many investments and savers

Bank run

when many people try to withdraw their savings at the same time

Consequences of a bank run for society

can be contagious, and threaten the stability of the financial system

Bonds

Debt; an IOU, promising to pay back a loan or debt with interest over time to whoever holds the bond

Functions of bonds and the bond market for society

creates liquidity

moves funds from savers to borrowers

spreads risk

funds government debt

Stock

partial ownership of a business, entitling the owner to a share of the company’s future profits, as well as a say in how the company is run

Dividends

share of company profits paid directly to shareholders

What functions does the stock market have for society?

channel money from savers to investors

create a mechanism to reallocate control of a company

What is a business cycle?

short-term fluctuations in economic activity

business cycle fluctuations cause the economy to operate above or below potential output

Parts of a business cycle

Peak- high point in economic activity

Recession- a period of falling economic activity

Trough- low point in economic activity

Expansion- period of rising economic activity

new business cycle starts when the expansion ends, economy peaks, and a new recession begins

Potential output

the level of output that occurs when all resources are fully employed

the economy is operating at its healthy limit

economic growth in the long-run reflects the fact that potential output rises over time

Output gap

difference between actual and potential output, measured as a % of potential output

100 times actual output- potential output/ potential output

What does a positive/negative output gap mean?

Negative means the economy is producing less than its potential

resources are being under-used

Positive means the economy is producing more than its potential

resources are being over-used

Boom

economy operating above its sustainable potential ex: workers pulling overtime

recessions happen when a boom turns into a bust

Bust

the economy operating below sustainable potential ex: excess unemployment, unused factories of machinery

recessions happen when a boom turns into a bust

Characteristics of the business cycle

recessions are short, sharp: expansions are long, gradual

persistent: economic conditions today are closely tied to economic conditions in the near future

impact of the business cycle is widespread

Leading vs. Lagging indicators

Leading: variables that tend to predict the future path of the economy

Lagging: variables that tend to follow the business cycle with a delay

What are the pieces that make up macro-economic equilibrium?

Quantity: total quantity of output produced in the economy as a whole

measured by real GDP

Price: average price level of all the output produced in the economy

measured by the GDP deflator

Aggregate demand curve

shows the relationship between the price level and to total quantity of output that buyers collectively plan to purchase

slopes down due to decisions about spending today vs. tomorrow

Why do interest rates influence aggregate demand?

if price levels rise, you need more money to buy the same thing

Interest rate effects: the change in the quantity of AD through investment due to the impact of price level changes on interest rates

price levels rise, and interest rates rise. Investment becomes more costly

price levels fall, and interest rates fall. Investment becomes less costly

Aggregate demand shifters

anything that changes the components of GDP

consumption and investment change when business or consumer confidence changes

government spending rises whenever policy makers decide to spend more

Federal reserve can change interest rates to make spending today more/less attractive

exports change whenever global forces change the competitiveness

Aggregate supply

shows the relationship between the price level and the total quantity of output that suppliers collectively plan to produce

slopes upward because a higher average price level leads sellers to produce a larger quantity of output and because of sticky prices

Sticky wages

wages (and other input costs) tend to adjust sporadically and with a delay

Menu costs

reflect the cost to change the price a business sells products for

when price levels rise, some businesses can’t afford to raise their own prices instantly

Recessions are ??? and expansions are???

recessions are short and sharp

expansions are long and gradual

zero lower bound

the nominal interest rate can’t go below zero

long-term unemployed

people who have been unemployed for 6 consecutive months or longer

marginally attached

someone who wants a job and who has looked for a job within the past year, but who isn’t counted as unemployed because they aren’t currently searching for work

underemployed

someone who has some but wants more hours, or whose job isn’t adequately using their skills

Human capital

the knowledge and skills that make a worker more productive (denoted H)

Physical capital

describes the tools, machinery, and structures we work with (denoted K)

Monetary policy

setting interest rates in an effort to influence economic conditions, usually done by central banks

Fiscal Policy

the government’s use of spending and tax policies to influence government decisions

Expansionary monetary policy

by lowering interest rates, the Fed can induce consumers and businesses to spend more now

Contractionary Monetary policy

raises interest rates, AD shifts left

dampens inflation but at the costs of lower output

Fiscal Multiplier

a measure of how much GDP changes as a result of both direct and indirect effects flowing from an extra dollar of spending

fiscal policy

involves the government using spending and taxation to influence the economy, aiming to manage economic conditions like employment, inflation, and growth through tools like tax cuts, increased spending, or reduced spending

monetary policy

actions taken by a central bank, like the Federal Reserve in the US, to influence the money supply and credit conditions to achieve macroeconomic goals like price stability, full employment, and stable economic growth

efficient markets hypothesis

an investment theory which suggests that the prices of financial instruments reflect all available market information

fundamental value

the perceived value of a security (which may differ from its market value), generally calculated using DCF techniques. Also known as intrinsic value.

Inflation target

publicly stated goal for the inflation rate. The Federal Reserve has stated that the is 2% on average

What is the Fed’s dual mandate?

stable prices - maintain inflation at a low and stable level, so that inflation doesn’t overly influence or distort people’s economic decision-making

Maximum sustainable employment: maintain employment in the economy at the level that allows the economy to operate at its potential output

Why does the Fed target 2% inflation instead of 0%?

to provide a buffer against deflation and allow for greater flexibility in using monetary policy to stimulate the economy during downturns

zero inflation rate could lead to “zero lower bound”

Key features of the Fed- regionally diverse

there are 12 district banks in the Federal Reserve

spread across the country, to keep an eye on the economy

local business leaders and community reps run the district banks

Key features of the fed- Independent

The government gave the Fed it’s job, but the gov can’t dictate policy of the Fed

Independent central banks have been shown to lead to more stable inflation

Key features of the Fed: Subject to oversight

Federal government still has big-picture control of the Fed

All of the powers the Fed has were given to it by the Congress

Federal Funds Rate

The nominal interest rate that banks charge other banks to lend overnight

Real Interest Rate= Nominal Interest Rate- Inflation

The Taylor Rule

A recipe that describes how the Fed often sets the interest rate in order to manage its dual mandate

How the Fed controls interest rates

By influencing banks and their reserves

Bank Reserves

The cash that banks need to keep on hand to make payments

Interest Rate on reserves: The Floor Approach

The interest rate the Fed pays banks to keep reserves

Discount Rate: The Ceiling Approach

The interest rate on loans that the Fed offers to banks through the discount window

Serves as a safeguard, banks will almost never charge each other a higher interest rate

Overnight Reverse Repurchase Agreements: The Floor Approach

The Fed sells government bonds overnight and buys them at a higher price the next day

Why does the Fed need alternative tools other than the interest rate?

Makes it more or less valuable for banks to make loans

Forward Guidance

Providing Information about the future course of monetary policy in order to influence expectations about interest rates

— only works if people believe the Fed

Quantitative Easing

Purchasing large quantities of longer-term bonds, in order to lower long-term interest rates

By doing this, the Fed makes it easier for people to make long-term investment