Econ final exam

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

66 Terms

Prices

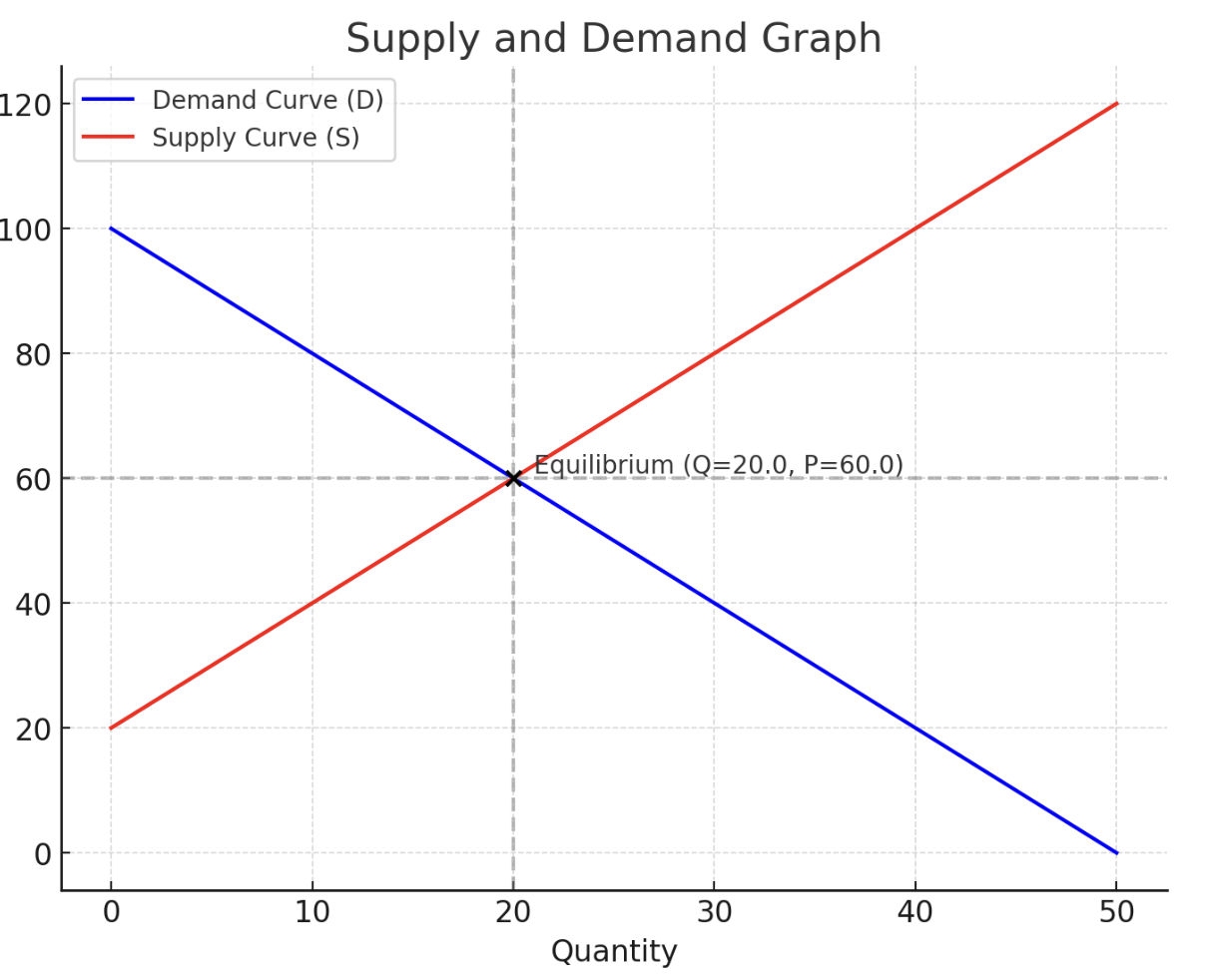

Prices fluctuate depending on the movement of buyers and sellers.;Price correlates with quantity when there is equilibrium

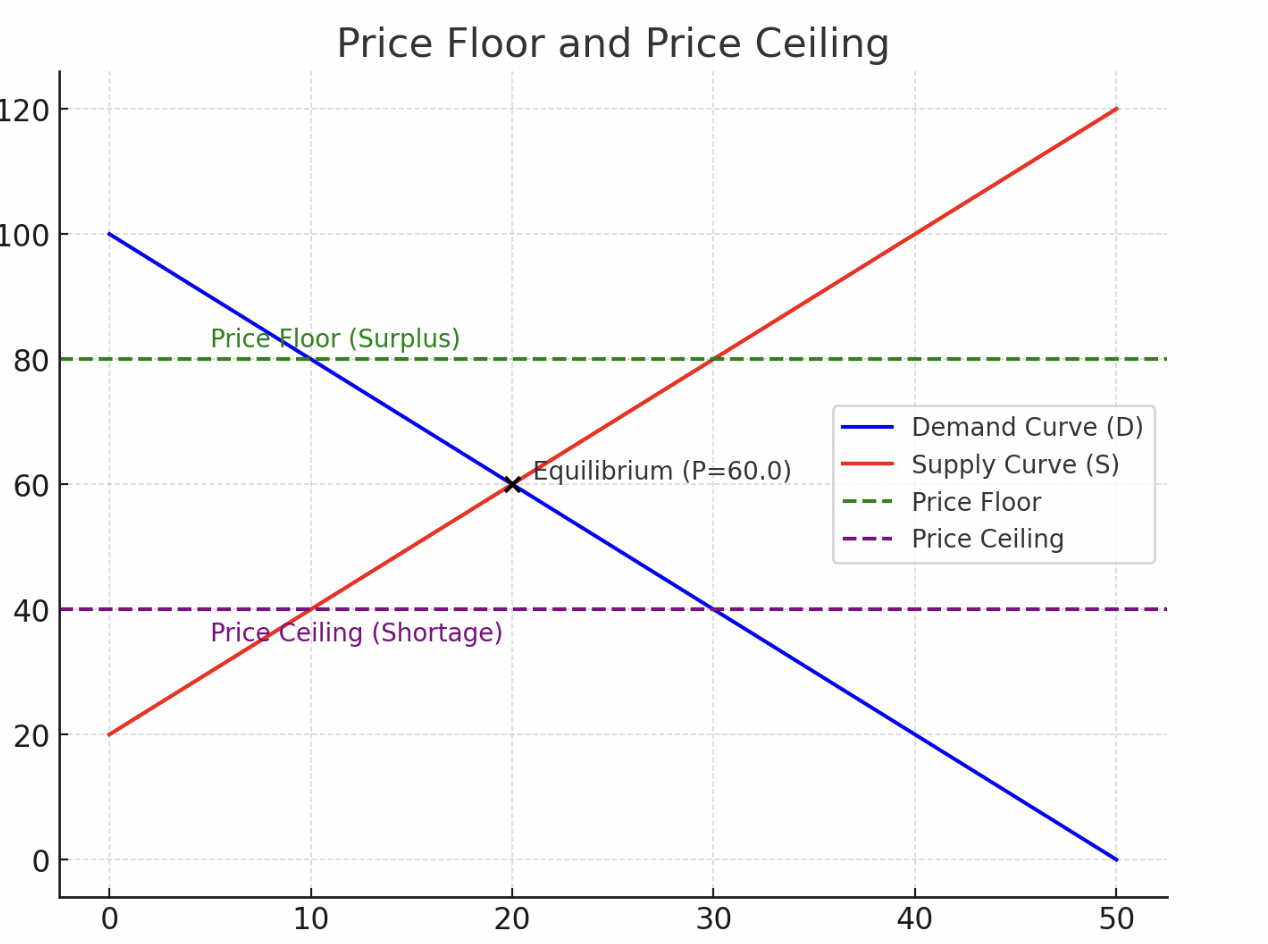

When there is more of a good than there is the demand for it;there is a surplus of a good if it is one cent above the equilibrium

When a stockholder sells an investment for more than they paid.

When a stockholder sells an investment for less than they paid.

When the stock market falls over time

When the stock market rises over a period of time.

Thinking at the margin

the process of deciding how much more or less to do

Land

all natural resources used to produce goods and services

Labor

Workers, people who make the products

Entrepreneur

Use these things to make money, most entrepreneurs fail or take a long time to turn a profit.

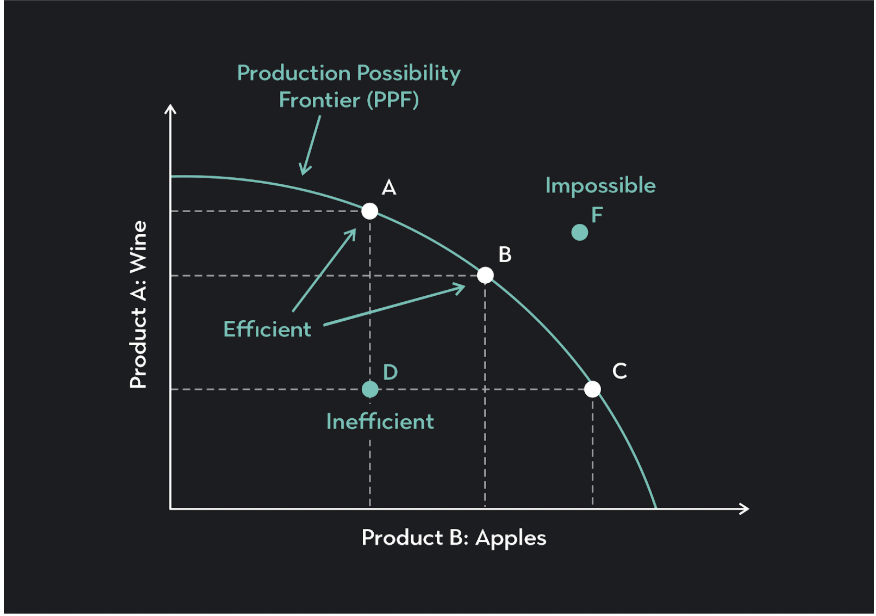

productions possibility curve

demand

the want and ability of consumers to buy something/ will pay for goods and services

Causes of Demand Curve shifts

income

Consumer expectations

Population

Consumer tastes

Income effect

People's income detriment to their demand

As people's income goes up, they will buy more goods

normal goods Income up Demand up, Income down Demand Down

inferior goods Income up Demand down, Income down Demand up

Supply

Supply is seen in the eyes of the producers and is the incentive that as price increases so does supply; Total amount of good/ service at each price point

Causes of the Supply Curve to shift prices can cause the supply curve to shift

Left shift-decrease

Right shift-increase

As input price increases supply decreases

Causes for supply to shift(determinants)

supply determinants.

Price of the good or service (law of supply)

Technology can reduce input cost increasing supply

The global economy sets the relative price

Natural conditions such as weather or natural disasters can slow production

shortage

when there is less of a good than there is the demand for it; If the price is lower than the equilibrium it is a shortage

Money

Anything that a person can use to purchase goods or services. Replaces the need for bartering.

6 characteristics of money

durability, uniformity, limited supply, divisibility, acceptability, portability

uniformity

People must be able to count and measure money accurately;$1=$1 in every marketplace

limited supply

Money would lose its value if there was an unlimited supply of it so it must be regulated and only have a certain amount

divisibility

Can easily be divided into smaller denomination

acceptability

Everyone in the economy must be able to accept the objects used as money

portability

Easy to carry around with you

fiat money

money that has value since the gov. says it has value

representative money

exchanged money for something else of value;:Personal checks/ debit card (checking account) / gold/ silver / IOU note/gift cards

commodity money

Any money that his value in of itself

Banking System

a group or network of institutions that provide financial services for us.

How do banks create a profit?

Banks earn profits by lending money at higher interest rates than they pay on deposits/ex. Checking/ saving accounts

Investment

the process of investing your money in an asset with the objective to grow your money in a stipulated time period; Not consuming today in hopes of growth in the future

Diversification

spreading out of investments to reduce risk

Stock

Stocks consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of share; Partial ownership in a firm in hope that the firm will gain money

Share

A portion of a stock

Risks involved with investment

Purchasing stock is risky because the firm selling the stock may encounter economic downturns that force dividends down or reduce the stock’s value. It is considered a riskier investment than bonds.

Dow Jones Industrial average

an index that shows how stocks of 30 companies in various industries have changed in value.

S & P 500

an index that tracks the performance of 500 of the top stocks

Brokerage account

A brokerage account is a type of investment account opened with a brokerage firm. You can deposit money into a brokerage account and the brokerage firm will execute investment orders at your request. Many investors use brokerage accounts to purchase stocks, bonds, mutual funds or exchange-traded funds online

What gives cryptocurrency its value?

Both scarcity and its demand due to its increasing price are what give cryptocurrency its value.

Supply vs demand

price floor and price ceiling