Macroeconomics Exam 2: Chapters 9, 10, 12

1/113

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

114 Terms

Labor Force

the sum of employed and unemployed workers in the economy

Employed

someone who worked 1+ hours in reference week (or were temporarily away from their jobs).

Unemployed

someone who is not currently at work but who is available for work and who has actively looked for work during the previous month

Not in Labor Force

a person who is not looking for work because he or she does not want a job or has given up looking

Discouraged Worker

people who are available for work, but have no looked for a job in the previous four weeks because they believe no jobs are available

Natural Rate of Employment

frictional unemployment + structural unemployment

Structural Unemployment

unemployment that arises from a persistent mismatch between the skills and attributes of workers and the requirement of jobs

Frictional Unemployment

short-term unemployment that arises from the process of matching workers with jobs

Cyclical Unemployment

unemployment caused by a business cycle recession

Consumer Price Index

a measure of the average change over time in the prices a typical urban family of four pays for the goods and services they purchase

Unemployment Rate

(Unemployed / (Unemployed + Employed) x 100 = ?

Unemployment Rate

(Unemployed / Labor Force) x 100 =

Labor Force Participation Rate

(Labor Force / Adult Population) x 100

CPI (Calculation)

(Cost of the Basket in Current Price / Cost of Basket in Base Year Price) x 100

Inflation Rate

(CPI New Year - CPI Old Year) / CPI Old Year) x 100

CPI Amount in Today's ($)

Amount in Year X(Old)'s $ x (CPI Today / CPI in Year X)

Real Interest Rate

Nominal Interest Rate - Inflation Rate

Structural Unemployment

this type of unemployment occurs when you have lack of skill or when there is organizational problem in the labor market

Frictional Unemployment

this type of unemployment affects skilled workers and happens because of labor market inefficiencies

Cyclical Unemployment

occurs because of business cycle fluctuations

Frictional

most people who are unemployed are unemployed due to _______ unemployment

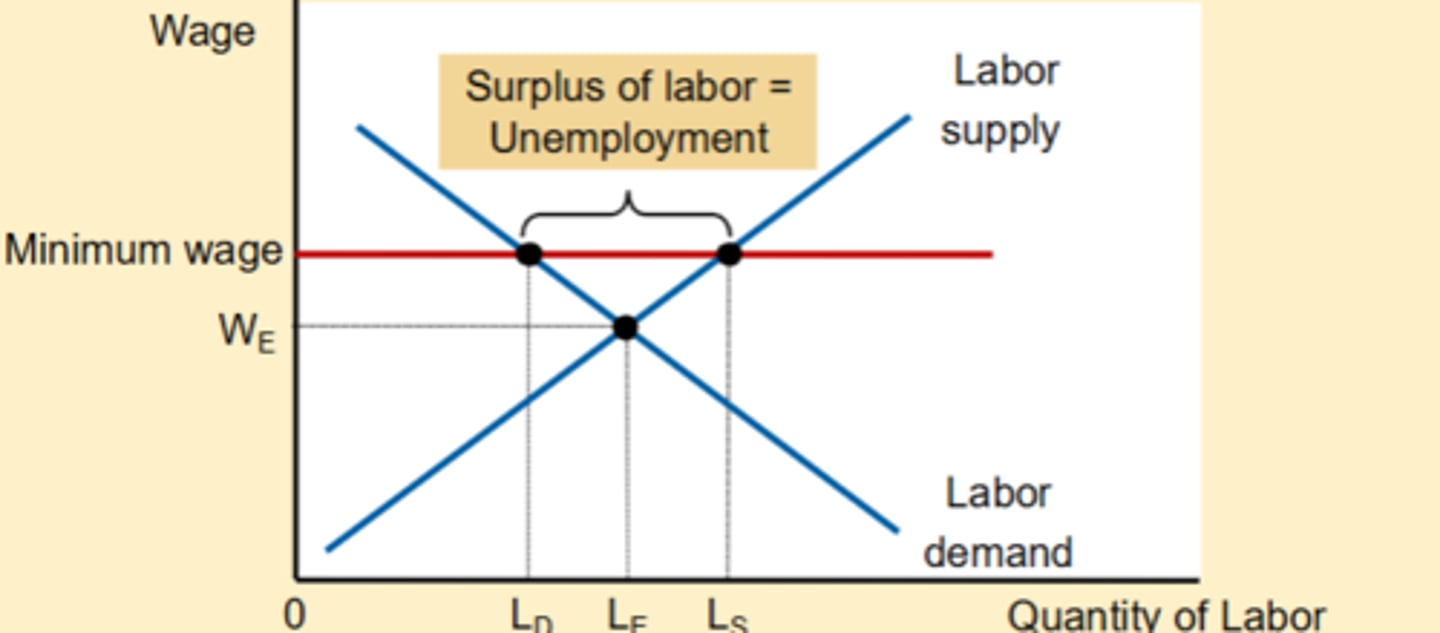

Binding

when there is a surplus of labor in the market the minimum wage rate is ______

Binding

this minimum wage is _______

Substitution Bias

Limitation of CPI - consumers may change their purchasing habits away from goods that have increased in price

Quality Bias

Limitation of CPI - products like cars and computers have become more durable and better quality over time (it is hard to isolate the pure inflation part of price increases)

New Product Bias

Limitation of CPI - the basket of goods changes only every 10 years; there is a delay to including new goods (ex. cell phones in 2010s)

GDP Deflator

measures the average change in prices of all goods and services produced domestically in an economy

Constant

the natural rate of employment is stable but not _______

Higher

the CPI and GDP deflator show similar long-run inflation trends, but the CPI usually reports slightly _______ inflation since it captures changes in consumer import prices, while the GDP deflator reflects price changes in all domestically produced goods and services.

Business Cycle

alternating periods of economic expansion and economic recession

Rule of 70

a shortcut to estimate how many years it takes for an economy (or any variable) to double in size, by dividing 70 by its annual percentage growth rate

Labor Productivity

the quantity of goods and services that can be produced by one worker or by one hour of work

Labor Productivity

Y/L = (Y = real output, L = Quantity of Labor)

Capital

manufactured good that are used to produce other goods and services

Technological Change

improvements in capital or methods to combine inputs into outputs

Potential GDP

refers to the level of real GDP attained when all firms are operating at capacity

Financial Markets

markets where financial securities, such as stocks and bonds, are bought and sold

Stocks

a financial security representing partial ownership of a firm

Bonds

a financial security promising to repay a fixed amount of funds; essentially a loan from a household to a firm

Financial System

Financial System

the system of financial markets and financial intermediaries through which firms acquire funds from households

Liquidity

the fianncial system allows savers to quickly convert their investment into cash through _______

Risk Sharing

by allowing investors to spread their money over many different assets, investors can reduce their risk while maintaining a high expected return on their investment through _______

National Saving

Private Saving + Public Saving

National Saving

National Income (GDP) - Consumption - Government Purchases = ?

Transfer Payments

TR = ?

Factors of Production

Y = ?

Government Purchases

G = ?

Consumption

C = ?

Taxes

T = ?

Private Saving

Y + TR - C - T = ?

Public Saving

T - G - TR = ?

Total Saving

Y - C - G = ?

Budget Surplus

T > G + TR = ?

Budget Deficit

T < G + TR = ?

Balanced Budget

T = G + TR = ?

Investment

Savings = _______ ?

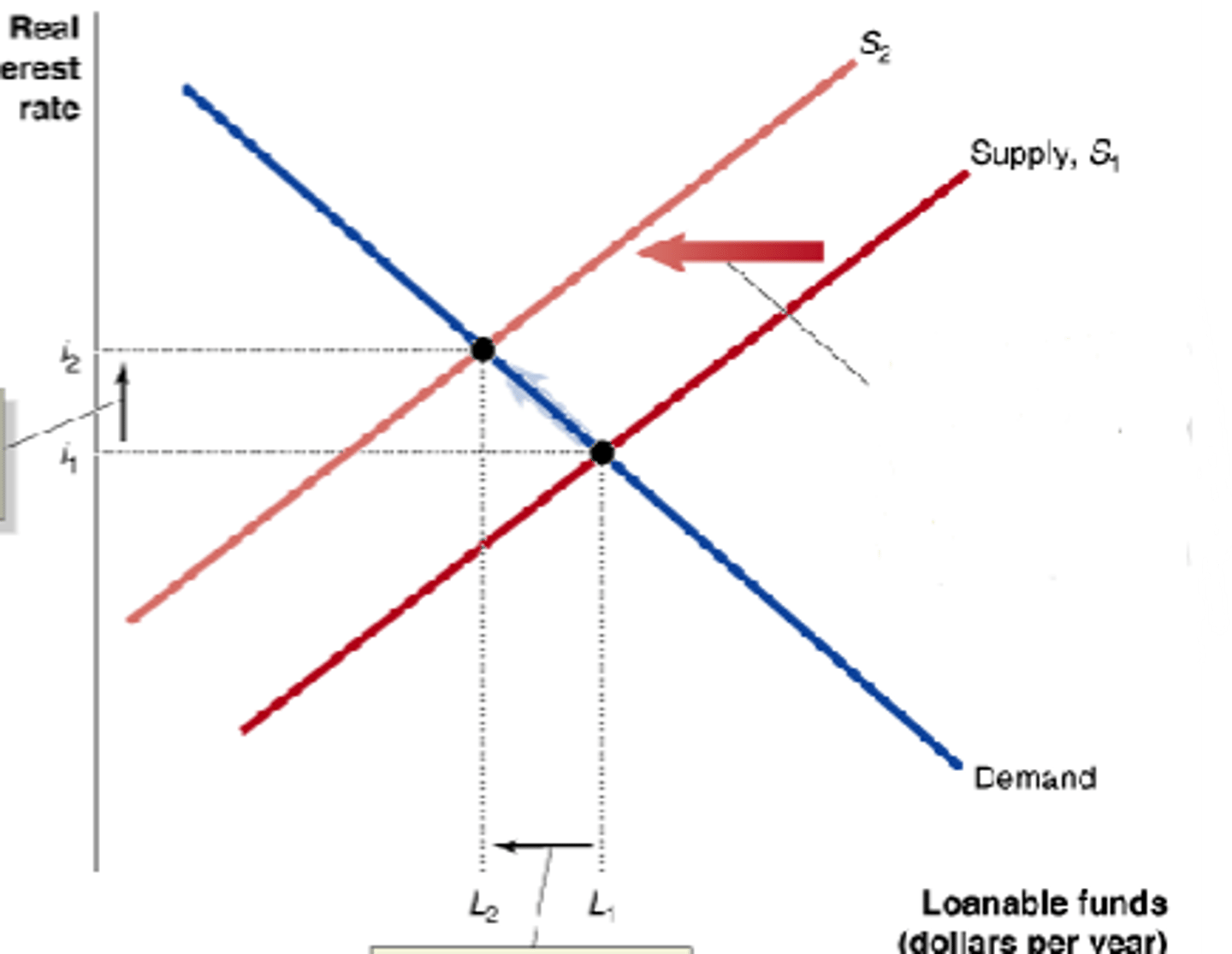

Crowding Out

the decline in private expenditures as a result of increases in government purchases

Crowding Out

this figure shows _______ _______

Expansion (Boom)

a period when economic activity is rising

Peak

the highest point of the business cycle — the economy is at full capacity

Recession

a period when economic activity declines

Trough

the lowest point of the business cycle — the end of the recession

The Great Moderation

relative stability of average annual growth rate of GDP since the 1950's

Rule of 70

Number of Years to Double = 70 / Annual Growth Rate

Three Key Roles of The Financial System

1. Risk Sharing

2. Liquidity

3. Information Sharing

Supply

in the market for loanable funds, households are on the _______ side

Demand

in the market for loanable funds, firms are on the _______ side

Services

manufacturing (especially durable goods) is more strongly affected by recessions; the economy is based more on _______ now, decreasing the effect of the business cycle on GDP

Unemployment Insurance

before the 1930s, _______ _______and other government transfer programs like Social Security did not exist; these programs increase the ability of consumers to purchase goods and services during recessions

Government Policies

economist believe that active _______ _______ to lengthen expansions and minimize the affects of recessions have had the desired effect; the debate over the role of government in this way became particularly intense during the recession of 2007-2009

Instability

the severity of the Great Depression of the 1930s was in part caused by _______ in the financial system; similar _______ exacerbated the recession of 2007-2009

Low

inflation rate is (usually) _______ during a recession

High

unemployment rate is (usually) _______ during a recession

1

average length of recession since the 1950's is less than _______ year(s)

Low

real interests are _______ during a recession

Hurt

durable goods tend to _______ during a recession

Aggregate Expenditure

total spending in the economy: the sum of consumption, planned investment, government purchases, and net exports

Planned investment

I = ?

Planned Investment

planned spending by firms on capital goods, and by households on new homes

Planned Investment

Actual Investment - Unplanned Changes in Inventories

Net Exports

NX = ?

Net Exports

the value of exports minus the value of imports

Aggregate Expenditure

C + I + G + NX =

Actual Investment

the total amount that businesses actually spend on capital goods plus changes in inventories during a given period

=

if AE /= GDP, inventories are unchanged and the economy is in equilibrium

<

if AE /= GDP, inventories rise and GDP + unemployment decrease

>

if AE /= GDP, inventories fall and GDP + unemployment increase

Consumption-Smoothing

most people prefer to keep their consumption fairly stable from year to year, a process known as _______-_______

Consumption Function (C)

a + m x YD =

Autonomous Consumption

a = ?

Autonomous Consumption

consumption that does not depend on income

Induced Consumption

m x YD = ?

Induced Consumption

consumption that depends on income

Marginal Propensity to Consume (MPC)

m = ?

Marginal Propensity to Consume (MPC)

Changes in Consumption / Changes in Disposable Income

Marginal Propensity to Save (MPS)

Changes in Saving / Changes in Disposable Income

1

MPS + MPC = ?

Potential GDP

GDP at natural rate of unemployment

Multiplier Effect

Changes in Real GDP / Changes in Autonomous Spending