Unit 4: Monetary Policy & the Federal Reserve

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

Monetary base (M0)

the total amount of currency and bank reserves in an economy. It is the most basic measure of a country's money supply

Fiat money

money that has no intrinsic value (paper money)

What are the uses of money?

Store of Value (putting money in accounts has value), Medium of Exchange (paying with cash), Unit of Account (currency conversions/exchanges)

M1

Cash, checking accounts

M1 is composed of currency in circulation, demand deposits, and other liquid deposits such as savings deposits. Does NOT include M0.

M2

M2 is composed of M1 and other small-denomination time deposits and balances in retail money market funds

M3

M1+M2+ larger time deposits + larger liquid assets

What money type is bank reserves?

M0

What money type is CD’s?

M2

Mia transferred $1,000 from her checking account to a certificate of deposit. How will the M1 and M2 measures of the money supply change?

M1 will decrease, M2 unaffected

Order of Asset Liquidity (Least to greatest)

M3 to M1

House, bonds, savings account, cash

How is money “created”?

By banks giving out loans

Bonds vs stocks

both financial assets

Bonds are basically long-term debts, interest-bearing assets.

Stocks are not interest-bearing, they are equity/stakes in a company

How to find real interest rate

Nominal interest rate - inflation rate

Discount Rate

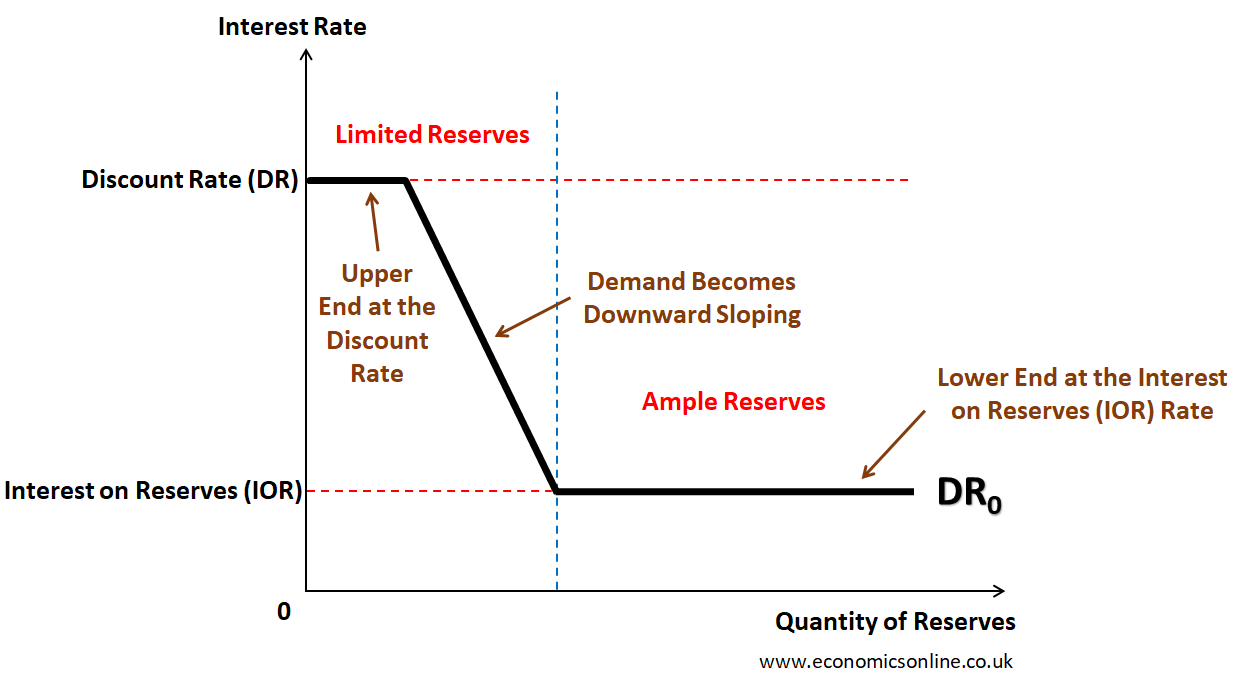

Types of Monetary Policy

Limited Reserves and Ample Reserves

Limited Reserves Policy

Open Market Operations (buying/selling bonds), changing RRR, discount rate

Contractionary Monetary Policy in Limited Reserves

Sell bonds, increase rates/ratio

Ample Reserves Policy, and how they affect Monetary Policy

Administered Rate

When a central bank has "ample reserves," it means there is a large supply of funds available to banks, allowing them to readily lend money, which in turn gives the central bank greater control over short-term interest rates by primarily adjusting the interest rate paid on reserves, rather than manipulating the overall supply of reserves through open market operations; essentially, with ample reserves, the central bank can more precisely target the desired interest rate through administrative means.

Reserve Requirement

The percentage of deposits a bank must keep on hand as cash according to the Federal Reserve

Simple Money Multiplier

1/RRR. How an amount of money put into the bank creates new money (kind of a trickle-down effect with each deposit and loan adding another piece)

How to calculate change in banking system money supply due to a deposit

Take that money, subtract off the RRR, then multiply by simple money multiplier

Excess reserves

What bank holds above Reserve Requirements, for loans

Which of the following explains why the amount predicted by the value of the simple money multiplier may be overstated?

It does not account for the bank’s desire to hold onto excess reserves.

Money Market Graph

quantity of money vs NOMINAL interest rate

MS is vertical, MD downward sloping.

Loanable Funds Market Graph

Investment is financed by national savings in a closed economy.

Shows REAL IR of private sector loans S/D

how does price level affect money market?

The nominal interest rate rises, and the price of previously issued bonds falls.

What is the Bond Market, and how is it affected?

Interest rates

Rising interest rates: Bond prices fall, and new bonds pay higher interest rates than older bonds

Falling interest rates: Bond prices rise, and older bonds pay higher interest rates than new bonds

Inflation

Rising inflation: Bond yields tend to rise

Low inflation: Bond yields tend to decline or remain low

Also Supply and Demand

If a question talks about deposits and excess reserves, what numbers can you use with the multiplier?

ONLY excess reserves and CHANGES in deposits, not the deposits themselves

What happens if there is an increase in household savings?

Supply of Loanable Funds increases, real interest rates decrease.

Discount Rate

Ceiling on Policy rate, what Federal Reserve charges banks for short-term loans

Part of LIMITED reserves

What happens when the Fed buys bonds?

Buy = bigger, so economy increases. This is because Money supply increases, interest rates decrease, investment increases, AD increases.

IOR

Interest on Reserves, part of ample reserves system. Pay banks to keep money in reserves

Transaction demand

Demand for money

What happens if adminstered rates decrease for ample reserves?

Decrease policy on ample reserves is for recession

Demand shifters of Loanable Funds Graph

FADE, foreign demand, All borrowing/lending/credir behaviors, deficit spending, expectations

Supply Shiffters of Loanable Funds

SELF: savings rate, expectations, lending at the discount window, foreign purchases of domestic assets

Liquidity Trap

An economic situation where interest rates are low, but consumers and investors hoard cash instead of spending.

What happens to money demand and IR_real when GDP increases?

money demand and real interest rates do too

what group is most affected by changes to interest rates?

businesses

Tight money policy….

contraction

Federal Funds Rate

Interest banks charge each other

Ample Reserves graph

backward logistic curve

Things that shift MS

reserve req, OMO/bonds, discount rate, administrated rates, feds lowering/raising interest rate

Federal Funds Rate

interest that banks charge each other, regulated bby the Fed. part of AMPLE reserve system