FMI Lec3 Interest Rates and Valuation

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

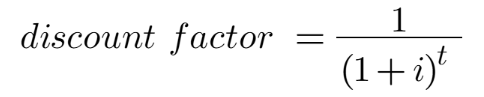

discount factor

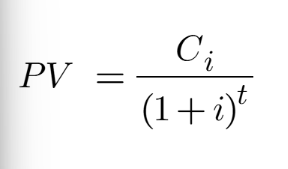

PV

Internal Rate of Return

the actual return with actual prices + actual sell

YTM

i where PV = Price

what determines price

yield

features of a par bond

price = face value

yield = coupon rate

What kind of bond has a coupon rate > yield

premium

price > par

What kind of a bond has yield > coupon rate

discount bond

price < FV

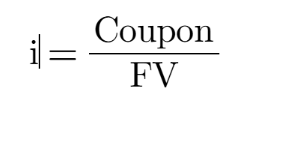

Coupon rate

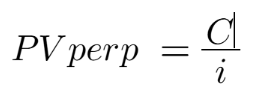

PV of a perpetuity

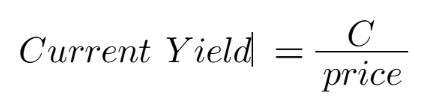

Current yield

Estimate yield of a L-T bond if price is near par by estimating like a perpetuity

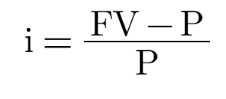

easiest way to find i

interest rates and prices are ___ related

inversely

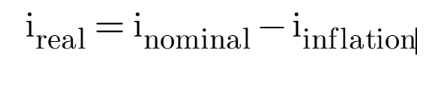

Nominal rates vs. Real rates

Nominal: advertised rates

Real: adjusted to reflect value after inflation

how to find real interest rates

What can fed do to try to stimulate spending and borrowing?

lower real interest rate to 0, making it effectively free to borrow

The issue with deflation

deflation causes real interest rates to always be positive (consider the equation for real interest rates)

with deflation, real interest rates can never be 0

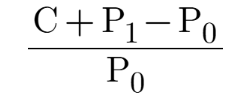

Rate of Return

all payments received divided by P0

Why is Rate of Return not the Yield to Maturity

the only time RoR = YTM is if its held to maturity

YTM does not change

RoR will change depending on sale of bond, price at time of sale

interest rate risk

the risk of losing money if i changes

if maturity = holding, then IRR =?

0

Reinvestment risk

risk that your reinvested coupon payments will be at lower i

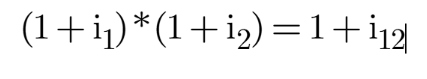

How to find annual return between 2 spot rates

What is duration

PV-weighted average time to receive cash flows

a measurement for IRR. longer duration → higher IRR

Duration equation

If maturity rises, duration ___

rises

If coupon rate lower, duration __

raises

When yields lower, duration __

raises. This is because it gives more weight to later coupon payments as it is discounted less