4.2 Exchange rates

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

Exchange rate

The price of one currency in terms of another

Fixed exchange rate

A system in which the government of a country agrees to fix the value of its currency in terms of that of another country

Floating exchange rate

A system in which the exchange rate is permitted to find its own level in the market through the forces of demand and supply

Link between interest rates and exchange rates

If UK interest rates are high relative to other countries, they will attract overseas investment increasing the demand for pounds

Devaluation

A devaluation occurs when a country makes a conscious decision to lower its exchange rate in a fixed exchange rate

Depreciation

When there is a fall in the value of a currency in a floating exchange rate

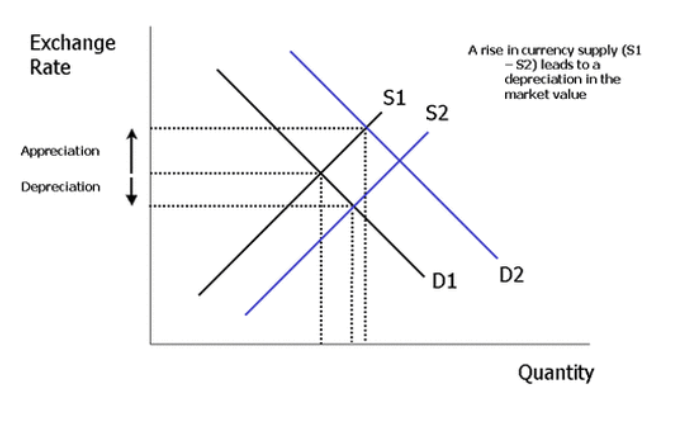

Floating exchange rate system diagram

Money is flowing out of the domestic economy, and increasing the supply of the currency in the foreign exchange market. This causes a depreciation in the value of the currency. S1 to S2

If there is an increased demand for a currency relative to its supply, its value can appreciate. Factors that influence demand include higher interest rates, a strong economy, attractive investment opportunities,D1 to D2

Tools for Managing Floating Exchange Rates

Changes in interest rates e.g. lower interest rates to depreciate the exchange rate: Causes movements of “hot money” banking flows into or out of a country

Quantitative easing: Increase liquidity in the banking system, usually causes outflow of money – depreciation of the exchange rate

Direct buying / selling in the currency market (intervention)

Taxation of foreign deposits in banks cut the profit from hot money inflows: Controls on the free flow of capital into and out of a country

Factors determining a currency’s value

Current account surplus on the balance of payments

Strong inward investment inflows + portfolio flows

Relatively high policy interest rates

Speculative currency demand

Advantages of a floating exchange rate

Reduces the need to hold large amounts of currency reserves

Freedom to set monetary policy interest rates to meet domestic objectives

May help to prevent imported inflation

Insulation for an economy after an external shock especially for export-dependent countries

Partial automatic correction for a current account deficit

Less risk of a currency becoming significantly over/undervalued

Disadvantages of a floating exchange rate

No guarantee that floating exchange rates will be stable

Volatility in a floating exchange rate might be detrimental to attracting inward investment

A lower (more competitive) exchange rate does not necessarily correct a persistent balance of payments deficit

Advantages of a fixed exchange rate

Certainty of currency value gives confidence for inward investment

Reduced costs of “currency hedging” for businesses

Stability helps to control inflation – i.e. it is a discipline on businesses to keep their unit labour costs low

Can lead to lower borrowing costs (i.e. lower yields on bonds)

Imposes responsibility on government macro policies

Less speculation if the fixed exchange rate is credible

Disadvantages of a fixed exchange rate

Reduced freedom to use interest rates for other macro objectives

Many developing countries do not sufficient foreign currency reserves to be able to maintain a fixed exchange rate

Difficult for countries to use a competitive devaluation of their fixed exchange rate - creates political tensions and might lead to a protectionist response

Devaluation of a fixed exchange rate can lead to a surge in cost-push inflation - damaging for competitiveness and has regressive effects on poorer families

Impact of a currency depreciation

Inflation: Higher import prices feed into increased consumer prices, may help the UK to avoid deflation, lower real interest rates

Economic growth: Lower £ is a stimulus to growth e.g. from higher net exports

Unemployment: Competitive currency will help to increase domestic production, export multiplier effect, upturn in tourism /overseas students

Balance of trade: Dependent on price elasticities of demand for exports & imports, possible J curve effect in the short run Weak demand in key export markets including the Euro Zone

Business investment: Should help to improve profitability e.g. overseas earnings of UK plc in US dollars and Euros will be worth more in £s (rising GNI)

Wider effects: Depreciation is similar to a cut in interest rates i.e. an expansion of monetary policy) but there are risks too, including higher costs of importing components, raw materials and capital technologies.

Effects of a currency depreciation depend on

The length of time lags as consumers and businesses respond

The scale of any change in the exchange rate i.e. a 5%, 10%, 20%

Whether the change in the currency is short-term or long-term – i.e. is a change in the exchange rate temporary or likely to persist

Price elasticity of demand for imports and exports

The size of any second-round multiplier and accelerator effects

When the currency movement takes place – i.e. Which stage of an economic cycle (recession, recovery etc.)

The type of economy (e.g. small developing v large advanced)

The degree of openness of the economy to international trade

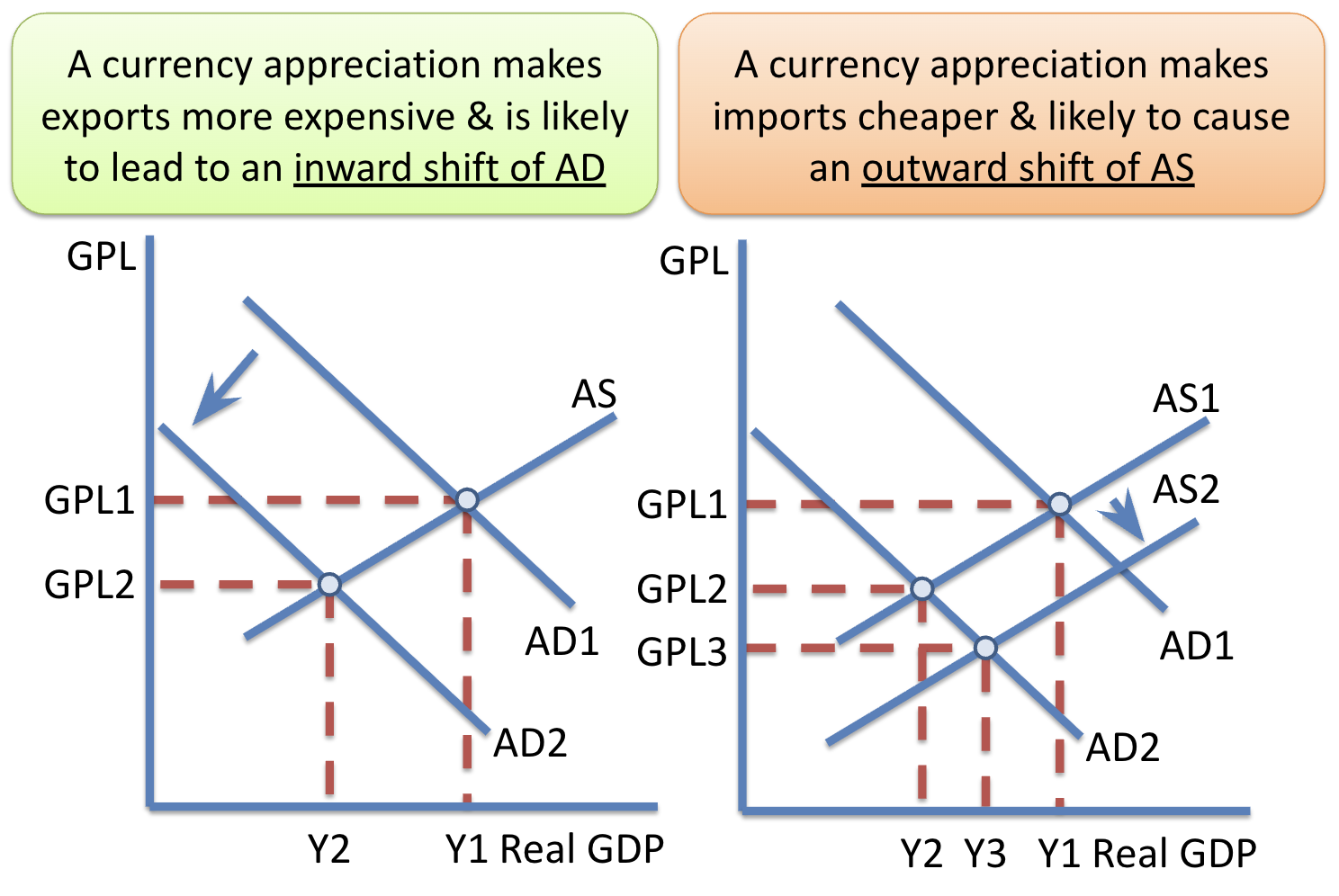

Effects of currency appreciation

Rise in external purchasing power e.g. £1 buys more Euros

Cheaper to import goods and services

Rising demand for imports (depends on elasticity of demand for imports)

Worsening of the trade balance (Trade deficit may rise)

Fall in aggregate demand because of rising leakages from circular flow