Chapter 4_ Accounting for Inventory and Cost of Goods Sold

1/125

Earn XP

Description and Tags

*

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

126 Terms

🔹 Why is accurate inventory accounting important for pharmacies?

➡ Because inventory and cost of goods sold are major factors in financial operations.

❓ What are the two major issues affecting accounting for inventory and cost of goods sold?

✅ 1. System used to measure inventory and cost of goods sold.

✅ 2. Method of calculating these values when prices change over the accounting period.

✅ True or False:

The method of calculating inventory and cost of goods sold does not change even if prices fluctuate over the accounting period.

🔹 False! The method must account for price changes to ensure accuracy.

❓ Multiple Choice:

Which of the following are major factors in pharmacy financial operations?

A) Customer service quality

B) Inventory and cost of goods sold

C) Employee work hours

D) Pharmacy interior design

B) Inventory and cost of goods sold

❓ What are the two systems used to measure inventory and COGS?

✅ Periodic system

✅ Perpetual system

❓ How does the perpetual system maintain accurate inventory and COGS records?

➡ It constantly updates the balances in inventory and COGS accounts.

✅ True or False:

The perpetual system updates inventory balances only at the end of an accounting period.

🔹 False! The perpetual system updates inventory balances continuously.

❓ Multiple Choice:

Which of the following describes the perpetual inventory system?

A) Updates inventory and COGS constantly

B) Updates inventory and COGS only at the end of the accounting period

C) Does not track inventory changes in real time

D) Only used in small businesses

🔹 Answer: A) Updates inventory and COGS constantly

❓ What does the perpetual system require for each SKU?

💡 A separate inventory account for each SKU.

🔢 What is an SKU?

💊 An SKU (Stock Keeping Unit) is a unique identifier for an item based on:

✅ Size

✅ Strength

✅ Type

✅ True or False?

A single SKU can represent multiple variations of a product, such as different strengths or package sizes.

❌ False! Each SKU is unique to a specific variation of size, strength, or type.

❓ Multiple Choice

Why does the perpetual system require separate inventory accounts for each SKU?

A) To track individual product variations 📊

B) To make accounting more complex 📜

C) To combine multiple products under one category 🔄

D) To avoid tracking different package sizes 🛑

A) To track individual product variations 📊

❓ What information does an SKU account track?

✅ Beginning inventory 📦

✅ All purchases 🛒

✅ All sales 💰

🔄 How often must the inventory account be updated?

💡 Each time a purchase or sale is made!

📖 What does the perpetual system provide for each SKU?

📝 A complete sales history!

✅ True or False?

The perpetual system only updates inventory accounts at the end of the accounting period.

❌ False! Inventory is updated immediately after each purchase or sale.

📂 What is a major challenge of the perpetual system?

⚠ Requires a great deal of record-keeping!

💻 How has computerization affected the perpetual system?

🚀 Made it easier for businesses to adopt and manage!

❓ Multiple Choice

What is a key benefit of the perpetual inventory system?

A) Reduces the need for tracking sales and purchases 📉

B) Provides a complete sales history for each SKU 📜

C) Updates inventory accounts only at the end of the year ⏳

D) Eliminates the need for computerized systems 💻

Answer: B) Provides a complete sales history for each SKU 📜

❓ What types of businesses typically use (common users 🛒) periodic system?

✅ Pharmacies 💊

✅ Hardware stores 🛠

✅ Supermarkets 🏪

🔄 How does the periodic system compare to the perpetual system?

💡 It is simpler to use than the perpetual system!

📂 What accounts are required in the periodic system?

✅ Sales account 💰

✅ Purchases account 🛒

✅ Inventory account 📦

🚫 📂 What accounts are required in the periodic system?

🚫 No accounts for:

❌ Cost of Goods Sold (COGS)

❌ Individual SKUs

✅ True or False?

The periodic system maintains individual accounts for each SKU.

❌ False! It does not track individual SKUs.

❓ Multiple Choice

In the periodic system, where are merchandise purchases recorded?

A) In the inventory account 📦

B) In the purchase account 🛒

C) In the cost of goods sold account 💰

D) In the sales account 🏷

Answer: B) In the purchase account 🛒

❓ Are inventory accounts adjusted for sales or purchases in the periodic system?

❌ No! The inventory account remains unchanged throughout the period.

⚠ What is a major drawback of the periodic system?

📉 The inventory account does not reflect the actual inventory held by the firm.

✅ True or False?

The periodic system ensures that the inventory account always matches the real stock levels.

❌ False! Since no adjustments are made, the inventory balance is often inaccurate.

❓ Multiple Choice

Why does the periodic system not always reflect actual inventory?

A) It updates inventory in real-time ⏳

B) No adjustments are made for sales or purchases 📦

C) It requires manual stock counting 📝

D) It tracks each SKU separately 🔍

Answer: B) No adjustments are made for sales or purchases 📦

❓ What is the formula for Cost of Goods Sold (COGS) in the periodic system?

📝 COGS = BI + P - EI

BI = Beginning Inventory 📦

P = Purchases 🛒

EI = Ending Inventory 🚫

🔍 What does the BI + P portion of the formula represent?

📦 It represents the total value of merchandise available for sale during the year.

❓ How is the actual cost of goods sold determined?

📉 The amount of unsold inventory (EI) is subtracted from the total merchandise available for sale.

✅ True or False?

The periodic system continuously updates the cost of goods sold throughout the year.

❌ False! COGS is only calculated at the end of the accounting period.

❓ Multiple Choice

Why is Ending Inventory (EI) subtracted in the COGS formula?

A) To exclude unsold inventory from COGS 📦

B) To increase the reported sales revenue 💰

C) To adjust for inflation 📈

D) To match the perpetual inventory system 🔄

A) To exclude unsold inventory from COGS 📦

❓ What happens to the ending inventory (EI) at the end of the year?

🔄 EI becomes the beginning inventory (BI) for the next year.

Why is a physical inventory count necessary in the periodic system?

📋 COGS can only be accurately determined after counting the actual inventory.

✅ True or False?

Firms using the periodic system can generate accurate financial statements at any time of the year.

❌ False! Since inventory is counted only once a year, accurate financial statements are typically produced annually.

❓ Multiple Choice

Why do firms using the periodic system usually generate financial statements only once a year?

A) Inventory accounts are updated daily 📅

B) The system requires a year-end physical inventory count 📊

C) COGS is continuously recorded 💾

D) The periodic system is more advanced than the perpetual system 🤖

B) The system requires a year-end physical inventory count 📊

❓ Which inventory system is more useful for managers?

✅ The perpetual inventory system 📊

🔍 Advantages of the Perpetual System

📌 Provides COGS without a physical inventory count

📌 Allows financial statements to be generated anytime

📌 Helps control inventory levels by tracking SKU sales

📌 Enables measurement of inventory shrinkage (loss, theft, damage)

✅ True or False?

The perpetual inventory system requires a physical inventory count to determine the cost of goods sold (COGS).

❌ False! The perpetual system automatically updates COGS, eliminating the need for frequent physical inventory counts.

❓ Multiple Choice

How does the perpetual system help managers control inventory?

A) By tracking the frequency of sales for each SKU 📦

B) By making financial statements harder to generate 📑

C) By eliminating the need for inventory tracking altogether ❌

D) By preventing theft completely 🚫

A) By tracking the frequency of sales for each SKU 📦

❓ What is shrinkage in inventory management?

🛒 Shrinkage is the loss of inventory due to damage, theft, or errors.

❓ How is shrinkage estimated in the perpetual system?

📊 Shrinkage = Recorded inventory - Physical inventory count

❓ What is the major disadvantage of the perpetual inventory system?

📝 It requires extensive record-keeping

✅ True or False?

Non-computerized pharmacies are more likely to use the perpetual inventory system.

❌ False! Non-computerized pharmacies typically use the periodic system because the perpetual system requires too much record-keeping.

❓ Multiple Choice

Why do some pharmacies continue to use the periodic inventory system?

A) It provides real-time inventory updates 📊

B) It requires less record-keeping 📝

C) It eliminates the need for physical inventory counts ❌

D) It is required by law ⚖

B) It requires less record-keeping 📝

🏥 Why do many businesses switch to the perpetual system?

💻 With computerization, many businesses can now handle the record-keeping required for the perpetual system efficiently.

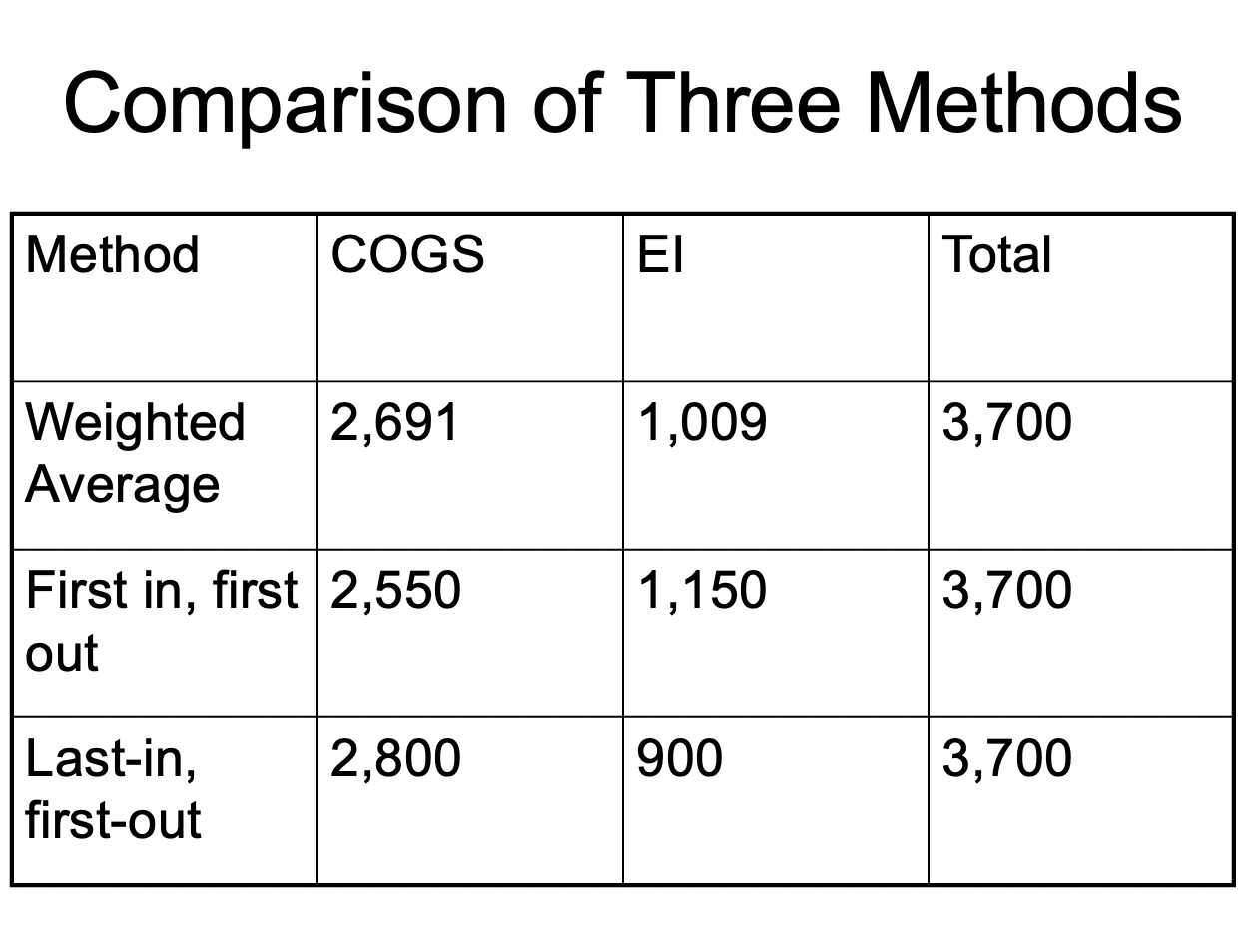

What are the three methods of costing inventory 📦 ?

Weighted Average Cost Method ⚖

First In, First Out (FIFO) ⏳

Last In, First Out (LIFO) 🔄

Difference among the three methods of costing inventory 📦

Weighted Average Cost Method ⚖ → It calculates the average cost of all inventory items available for sale; The cost of goods sold (COGS) and ending inventory are valued at this average cost

First In, First Out (FIFO) ⏳ → assumes that the oldest inventory items are sold first; the remaining inventory consists of the most recently purchased items.

Last In, First Out (LIFO) 🔄 → assumes that the most recently acquired inventory is sold first; the remaining inventory consists of the oldest items.

✅ True or False: Inventory Methods

FIFO usually results in higher reported profits during periods of inflation.

✅ True! Because older, cheaper inventory is sold first, the cost of goods sold is lower, increasing profits.

❓ Multiple Choice: LIFO vs. FIFO

During times of rising prices, which inventory method results in lower taxes?

A) FIFO

B) LIFO

C) Weighted Average

B) LIFO 🔄 → Since newer, more expensive inventory is sold first, it increases the cost of goods sold and lowers taxable income.

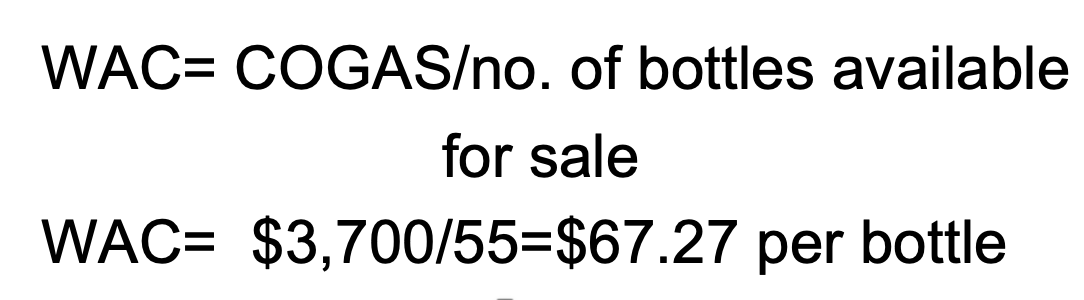

What is the formula for calculating the Weighted Average Cost (WAC) ⚖ per unit?

ex.

Yields a cost that is representative of the cost of the product over the entire accounting period.

Weighted average method/ Weighted Average Cost Method ⚖

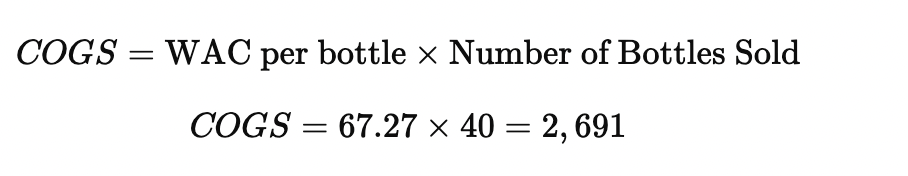

How do you calculate the Cost of Goods Sold (COGS) 📦 using the Weighted Average Cost Method ⚖?

ex. Ending inventory= 15 bots x $67.27/bot = $1,009 and

COGS= 40 bottles x $67.27 /bottle

= $2,691

First In, First Out (FIFO) ⏳ vs Last In, First Out (LIFO) 🔄 (in terms of COGS)?

FIFO leads to lower COGS and higher ending inventory, meaning higher reported profits

LIFO leads to higher COGS and lower ending inventory, meaning lower taxable income (which can be beneficial in inflationary periods)

Comparison of Three methods of costing inventory 📦 ?

❓ What does FIFO ⏳ stand for in inventory valuation?

First in, First out ⏳

→ The FIFO method is based on the assumption that the first units bought are the first sold

LIFO stands for 🔄 ?

Last in, first out 🔄 method

→ based on the assumption that the last unit bought are the first one sold and the first bought are the last sold.

LIFO 🔄 method of assigning cost to inventory can be artificially changed by ?

Buying extra units of goods (💵➕📦) at the end of the accounting period.

→ If prices increase, artificially inflate the cost of goods sold for the period.

Comparison of Method (FIFO ⏳ vs LIFO 🔄)

FIFO will give the lowest cost of goods sold ⏳

LIFO will give the highest. 🔄

(T/F)

If prices do not change 😐, all methods will give the same cost of goods sold.

✅ True!!!

(T/F)

We are allowed to change methods from year to year

❌ False!!

→ A pharmacy must choose one of the methods and use it consistently. It cannot change methods from year to year. (may do so upon duly informing the IRS with a note accompanying financial statements)

❓ Does the inventory valuation method affect the amount a pharmacy paid for merchandise?

✅ No, the valuation method does not change what was paid for inventory.

❓ What financial aspects are NOT affected by the inventory valuation method?

✅ The pharmacy’s revenues and operating expenses.

❓ How does LIFO impact tax payments during inflation?

✅ LIFO minimizes tax payments and maximizes cash flow in a period of inflation.

❓ Do different inventory valuation methods change the total amount of income tax a pharmacy pays over its lifetime?

✅ No, all methods result in the same total tax payments over time, but LIFO can defer taxes to later years.

🔹 True or False: The inventory valuation method affects the pharmacy’s revenues and operating expenses.

❌ False! The valuation method has no effect on revenues or operating expenses

🔹 True or False: The method selected for inventory valuation affects the amount of cash a pharmacy pays for income taxes.

✅ True! The method impacts cash tax payments, with LIFO minimizing taxes in inflationary periods.

🔹 True or False: LIFO permanently reduces the total income tax a pharmacy pays over its lifetime.

❌ False! LIFO only defers tax payments to later years but does not change the total taxes paid over time.

Do Inventory Methods Really Affect Performance?

❌ NO. Except for their effects on income taxes 🤑

Cost 💸 refers to the amount paid for the item when it is bought

Market value 💱 refers to the replacement value of the item

Lower of Cost or Market Value 📉💲

Relationship of cost 💸 and market value 💱

💸 < 💱, unless ending inventory declines 🏪

Difference between the original and adjusted value is recorded as a loss

Example case:

Loss on write-down of inventory 💸

First ended, First out

First to expire, First out ⏳🥚➡🛒

What is the primary purpose of the FEFO method? ⏳🥚➡🛒

To prevent products from expiring before they are used, minimizing waste. 🚫🗑

Which of the following best describes the FEFO inventory system?

A) Selling the most expensive items first 💰

B) Using or selling the oldest stock first ⏳

C) Randomly selecting inventory for sale 🎲

D) Keeping expired items longer for tax benefits 🧾

B) Using or selling the oldest stock first ⏳

What is a key advantage of the FEFO system?

A) Increased storage space 📦

B) Reducing waste from expired products 🚫🗑

C) Lowering product prices permanently 💲

D) Ignoring expiration dates 🚫📅

B) Reducing waste from expired products 🚫🗑

What do purchases refer to in a pharmacy setting?

Purchases are the merchandise a pharmacy offers for resale to its customers. 💊🛒

How do pharmacies usually pay for their purchases?

They typically make purchases on credit and pay for the merchandise several days or weeks later. 💳⏳

What is the purpose of cash discounts offered by manufacturers?

To encourage pharmacists to pay early and improve cash flow. 💰✨

What is the main reason manufacturers offer cash discounts?

A) To get rid of excess inventory 📦

B) To encourage early payment from pharmacies 💳

C) To increase product prices 💲

D) To force pharmacies to buy in bulk 🏬

B) To encourage early payment from pharmacies 💳

T/F: A "2/10 net 30" discount allows a pharmacy to take a 10% discount if paid within 2 days.

❌ False – It offers a 2% discount if paid within 10 days. 💵💡

How should purchases be recorded if a pharmacy takes cash discounts?

They should be recorded at their discounted prices. 💵✅

What happens if a pharmacy fails to take a cash discount?

The lost discount is recorded as an interest expense, not as part of the purchase price or cost of goods sold. ❌💰

Two factors that affect the final value of purchases and cost of goods sold?

Return of unsatisfactory goods 📦🔄

Shipping costs paid by the pharmacy, which are treated as part of the purchase cost 🚚💰

If a pharmacy misses a cash discount, where should the lost discount be recorded?

A) As part of the cost of goods soldnot as part of purchases. 💳📉 🛒

B) As an interest expense 💳

C) As revenue 💰

D) As a shipping cost 🚚

B) As an interest expense 💳

→ not as part of the purchase price or cost of goods sold.

How is the purchase amount used to calculate Cost of Goods Sold (COGS) on the income statement?

🔹 Gross purchases (discounted price) 💵

➕ Freight-in costs 🚚

➖ Purchase returns & allowances 📦🔄

If a purchase discount is not taken (fails to take purchase discount), how should it be recorded?

As an interest expense 💳, not as part of purchases. 🛒❌

Which of the following is NOT included when calculating the purchase amount for COGS?

A) Freight-in costs 🚛

B) Purchase returns & allowances 📦🔄

C) Interest expense 💳

D) Gross purchases at a discounted price 💰

C) Interest expense 💳

How are pharmacy transactions different from those in a purely consulting pharmacy firm?

Pharmacy transactions involve merchandise sales and require additional accounts for recording purchases and sales. 🛒💊

What additional accounts are needed to record and process merchandise in a pharmacy?

✅ Purchases 🛍

✅ Freight-in 🚚

✅ Purchase discounts 💵🔻

✅ Purchase returns & allowances 🔄📦

✅ Sales 💰

✅ Sales discounts 💳🔻

✅ Sales returns & allowances 📦🔄

✅ Merchandise inventory 📊

How are these accounts affected by debit and credit entries?

Increased by credit ➕📈

Decreased by debit ➖📉

What are the two main reasons for extending cash discounts to patrons?

To encourage faster payments and improve cash flow 💵💨

To reduce prices and increase sales 🏷📉 → 📈🛒

2/10, n/30 📜💳 is stated as?

two/ten, net/thirty 📜💳

What does 2/10, n/30 mean?

If they don’t pay within 10 days, the full amount is due within 30 days 📆✅

If an invoice is dated March 1st with terms 2/10, n/30, what is the last day to receive the discount?

A) March 10

B) March 11

C) March 30

D) April 1

✅ Correct Answer: A) March 10 📆✅

Faster payments improve a pharmacy’s ____

cash flow. 💵💨

Specifies who is responsible for shipping costs and when ownership transfers

Free-On-Board 🚢📦