Chapter 8 – Money and Banking

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

3 Money Functions

Medium of exchange, store of wealth, unit of account

Medium of exchange

An intermediary used to facilitate trade which avoids the barter system inconvenience

Store of wealth

allows people to hold and accumulate wealth

Unit of Accounts

can be used to value goods and services, record debts, and make calculations

Characteristics of Money (6)

Accepted by the general public, durable, portable, divisible, standardized (easily recognized but not easily copied), controlled by central authority.

Gift Economics (history of economics)

One group invites another to a ceremony and gives gifts, eventually notes were made of who owed whom

Barter

Trading one good for another, widely valued goods can eventually become commodity money (salt, gold, beads…)

Coins (gold, 700 BCE)

Metal tokens used as currency, originating as a standardized medium of exchange in trade and commerce. Debasing the currency using cheap metals can lead to inflation. This led to the standardization of weight to buy and sell goods

Paper Money - 13th century

An IOU from a reputable person for deposited wealth

Merchant Banks (17th century)

These banks printed their own paper money for others, could be redeemed at the bank (Canadian Tire money)

Chequebooks (19th century)

Instructions to a bank to transfer money

Bank of Canada (20th century)

Governments took over all currency production. Since 1935, the Bank of Canada issued FIAT money. declared to be money by law

Types of Money (5)

Commodity, coins, paper, chequebook (bank deposits), digital

Fractional Reserve Banking

A banking system where banks hold only a fraction of deposits as reserves and lend out the remainder, thereby creating money.

Money Supply

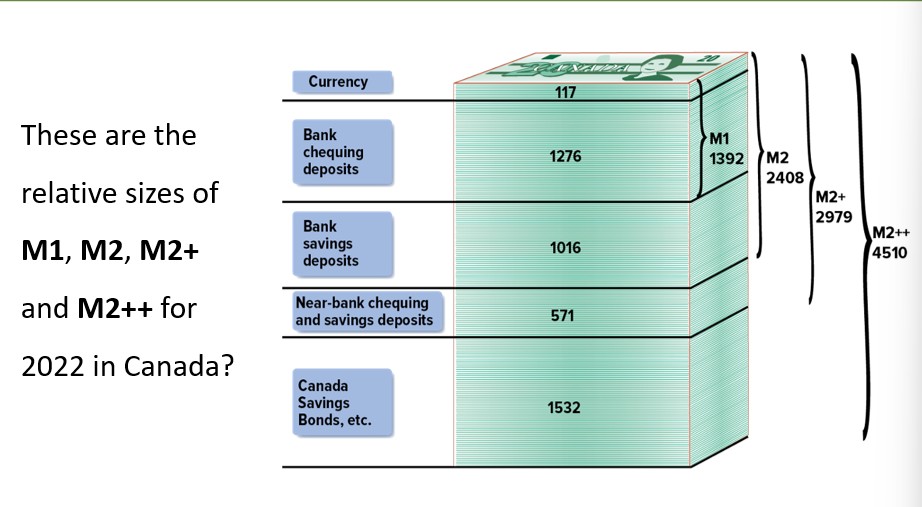

M1 = currency in circulation + demand deposits (most liquid, tightest measure)

M2 = M1 + notice and personal term deposits

M2+ = M2 plus deposits at near banks

M2++ = M2+ plus Canada Savings Bonds and mutual funds (largest measure)

Financial Institutions act as intermediaries between:

households, businesses, and goverments’s that have funds available for lending, and

others who want to borrow those funds

two broad categories - banks and near banks

Chartered Banks

Canadian commercial banks which have received charters under Bank Act (Big 6)

Near banks or nonbank financial intermediaries

Near banks included credit unions, trust companies, and mortgage and loan associations, not defined under the Bank Act but still act like chartered banks (example, ATB (provincial bank), Presidents Choice Financial)

Chequing deposits (demand)

depositors can demand their deposits in cash anytime

Saving deposits (notice)

depositors may need to give notice to the bank before making a withdrawal - non chequable deposits

Personal term deposit

Deposit for a specific term such as 6 months

Money supply picture

These are the relative size of each category

What is included as not money?

Currency in the vaults or tills of banks, gold, financial securities (stocks, bonds), cheques (only representing movement of money from accounts), credit cards, debit cards.

If David deposits $240 into a chequing account at a commercial bank, has the money supply changed?

Later, if this gets transferred to his savings accounts in the same bank has M1 and M2 changed?

No, the amount in circulation has decreased

M1 is less because chequing deposits decreased. M2 does not change.

Canadian Banking System (3)

Banks - makes most profits from interest on loans

Spread - the difference between the interest rate a bank charges borrowers and the rate it pays savers

Target Reserve Ratio - The fraction of deposits that a bank wants to hold in cash

Target Reserve Ratio

The fraction of deposits a bank aims to hold in reserve as cash to ensure liquidity and meet withdrawal demands.

Excess Reserves

Reserves in excess of what the bank wants to hold as its target reserves. Every time a bank issues a loan, it creates money

Creating Money

Banks use excess reserves to make loans, loans are eventually deposited, creating new money. Process continues until no more excess reserves

Money Multiplier 1

The increase in total deposits that would occur in the whole banking system as a result of a new deposit in a single bank.

The bigger the target reserve ratio, the smaller the money multiplier

The smaller the target reserve ratio, the bigger the money multiplier

Money Multiplier 2

Also works in reverse if under-reserved. Banks can call in loans, decreasing deposits. The money multiplier will be smaller if: banks increase their target reserve, people hold more cash, insufficient creditworthy loan applications, in a recession and limited loans