F3 - Measuring profitability

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

What does ratio analysis allow for?

Allows for a more meaningful analysis of published accounts.

Shows relationship between figures

Used for comparisons over time

Inter and intra business comparisons

Intra means between businesses e.g. to compare performance to competitors or to benchmark.

Inter means within a business e.g. over time within one organisation or between branches.

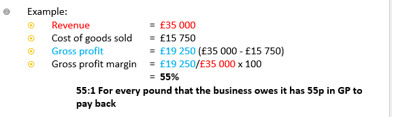

What is Gross profit margin?

Gross profit margin (GPM) is a measure of a firm’s profitability by looking at the relationship between gross profit and revenue.

If GPM is low or failing this may indicate that a firm

Is not managing its costs of sales effectively e.g. are the cost of raw materials increasing?

Sales are in decline

How is Gross profit margin calculated?

Gross profit / revenue X 100

GP / R X 100

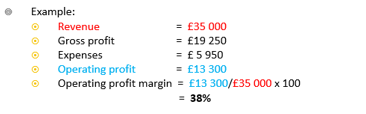

What is Operating profit margin?

Profit margin (or operating profit margin) is a measure of a firm’s profitability by looking at the relationship between operating profit and revenue.

If OPM is low or failing this may indicate that a firm

Is not managing its expenses effectively e.g. wages are increasing or overheads are going up.

Sales are in decline

How is Operating profit margin calculated?

Profit / revenue X 100

P / R X 100

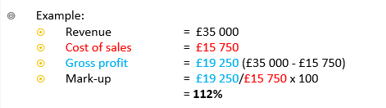

What is Mark up?

Mark-up is a measure of a firm’s profitability by looking at the relationship between gross profit and cost of sales.

If mark-up is low this may indicate that a firm

Is not managing its cost of sales effectively e.g. raw material costs are too high.

Is in a highly competitive market where firms compete on price.

How is mark-up calculated?

Gross profit / cost of sales X 100

GP / COS X 100

What is Return on Capital Employed (ROCE)

A measure on how efficiently a business is using capital employed to generate profits.

What is Capital employed?

All the money invested in the business from, share capital, reserves, long term loans.

How is Capital employed calculated?

Total equity + non-current liabilities

TE + NCL

How is Return on Capital Employed calculated?

Operating profit / capital employed X 100

OP / CE X 100

What is capital employed?

Refers to the total amount of capital that a business uses to generate profits

What is share capital?

The amount of money a company raises by issuing shares to its shareholders.

What are reserves?

Funds set aside from profits for specific purposes or as a safety buffer.

What are retained earnings?

The portion of net profit that is not distributed as dividends but kept in the business.