equations all

1/68

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

69 Terms

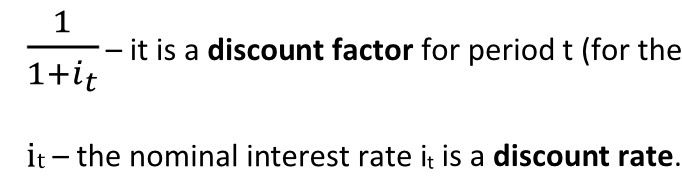

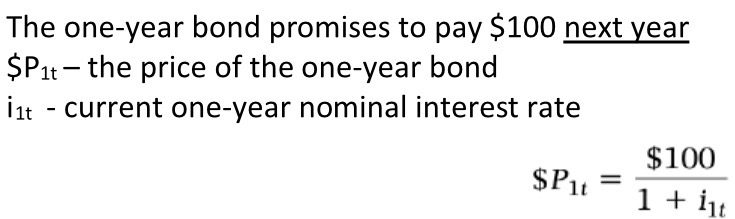

Basic discount factor

Discount factor period t+1

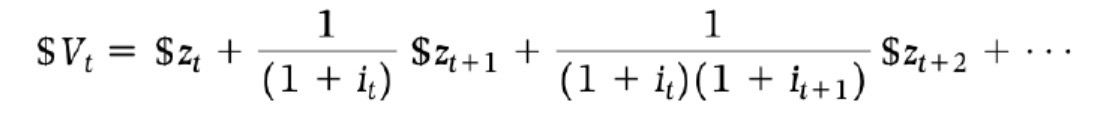

General present discounted value formula

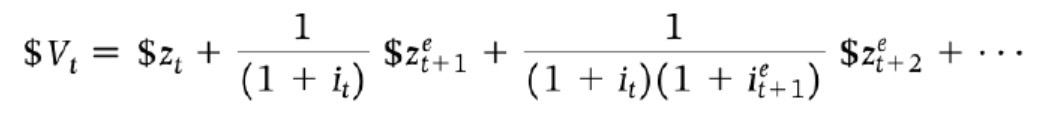

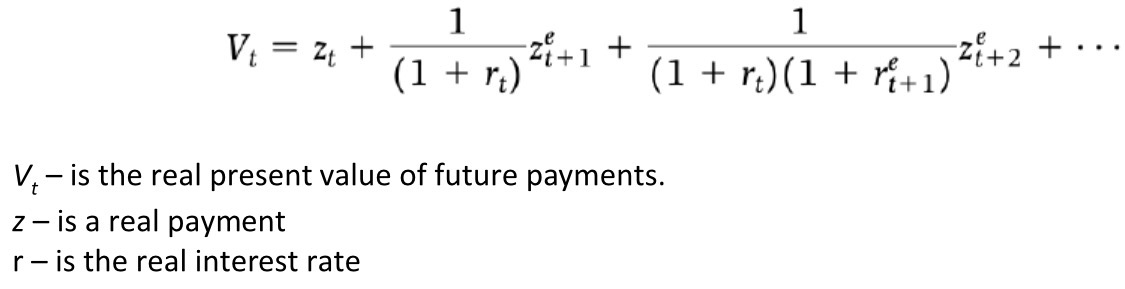

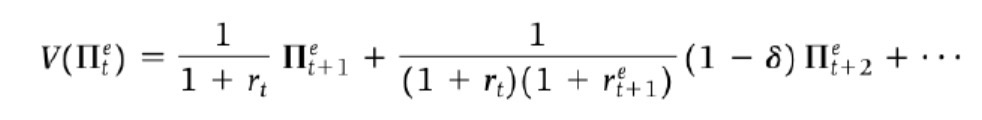

Present discounted value (expected) formula

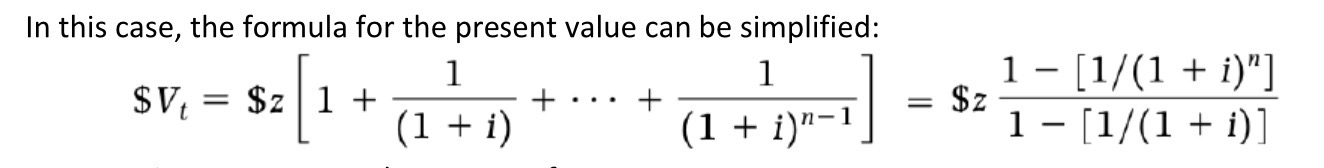

Annuity PV

(Constant returns)

N number of periods

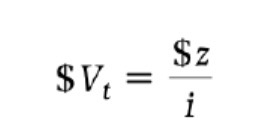

Perpetuity PV

Infinite period

Constant return & values

Present value with the real interest rate

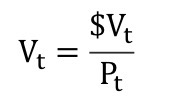

Relationship between real present value, present value, and price level

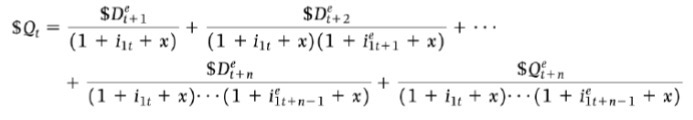

General bond price equation

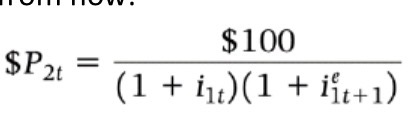

Two year bond price

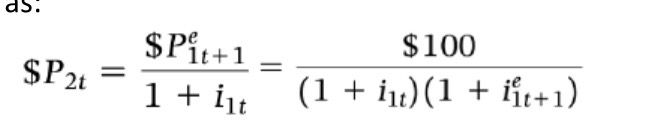

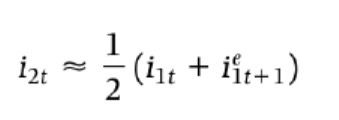

1 & 2 year arbitrage condition bond

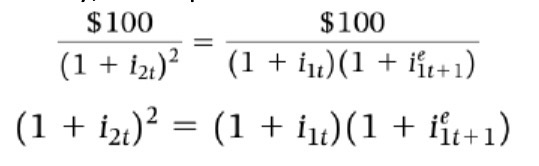

Two year bond yields (where YTM is the constant annual interest rate i)

Simplified bond YTM equation

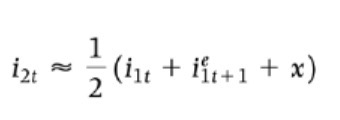

Arbitrage condition risk premium YTM

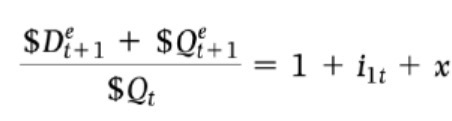

Stock (vs bond) arbitrage condition

Equity premium instead of risk premium

Stock dividend/interest rate annuity

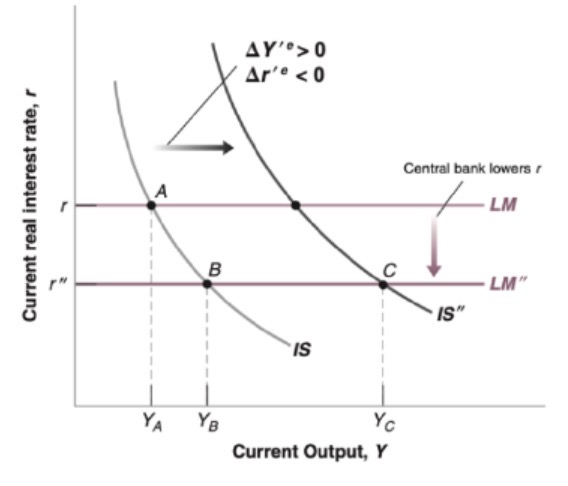

Investor reaction to increased spending (increase in IS curve)

if investors don’t believe the central bank will respond: output increases w no counter action & stock prices rise

If they believe the central bank will take interest rate (LM) action: Hence no change in output & increase interest rate = stock prices fall

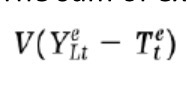

Sum of expected income value (over a lifetime)

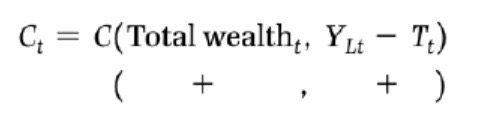

Short run consumption Function (realistic)

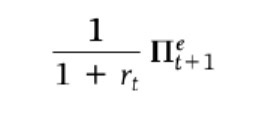

Basic present value of expected profits

Profit in t=1

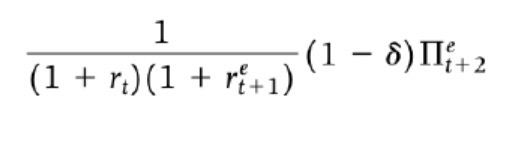

Present value of 2 periods of profit

Profit in t+1=

Present value of profits

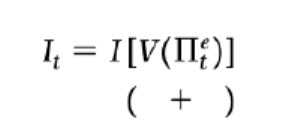

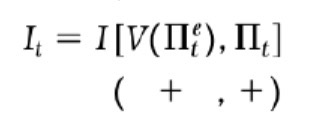

Investment function short term

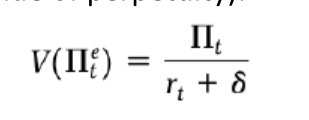

Present value of perpetuity profit

Profit_t=profit expected=t+1

Real interest rate _t = expected=t+1

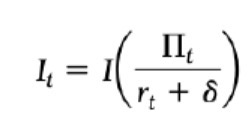

Short term investment function perpetuity case

Static expectations

Realistic short term investment function

Adjusted for difficulty borrowing & the freedom of own/current fund reserve to utilise

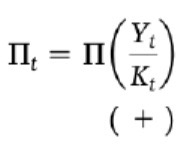

Profit/unit of capital stock

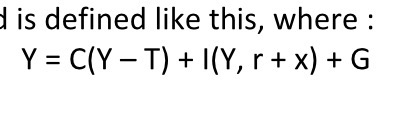

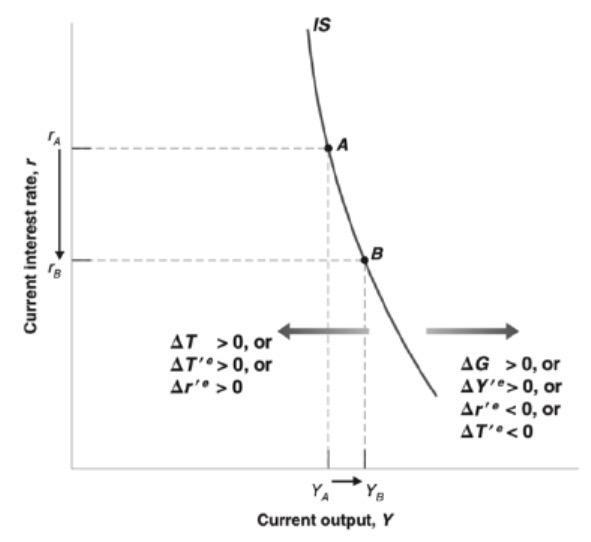

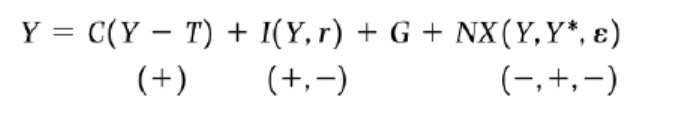

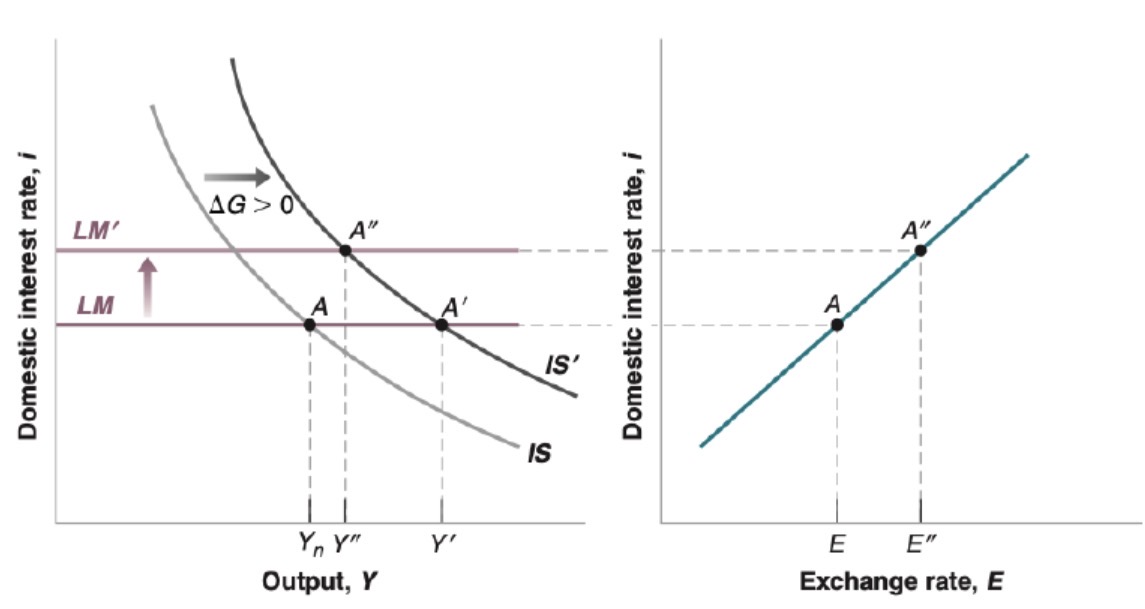

Current IS relation

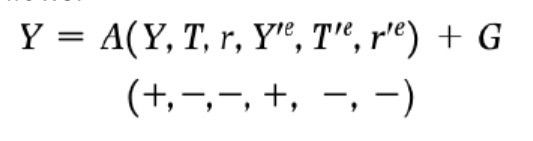

Expectations adjusted IS relation (current period)

IS curve shifters

Anything except Y & r

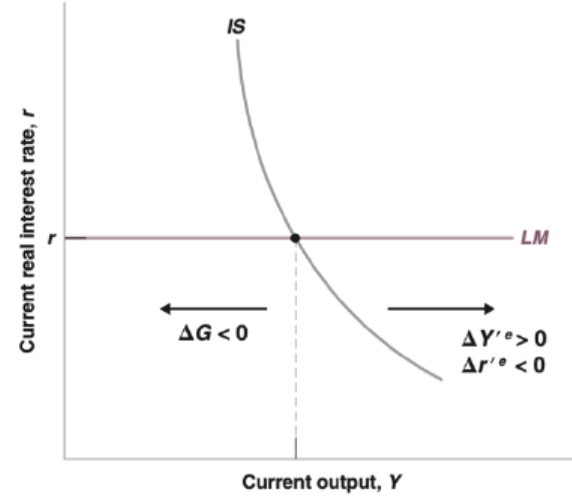

Effect of expectations on IS curve

Announcement of deficit reduction affect on IS curve

Ambiguous:

Depends on :

credibility

Other fiscal/monetary policies

Political state

Plan composition

Real exchange rate (bilateral)

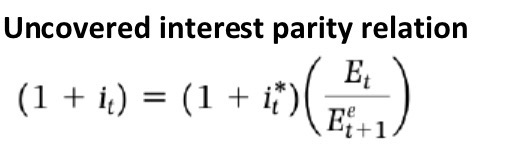

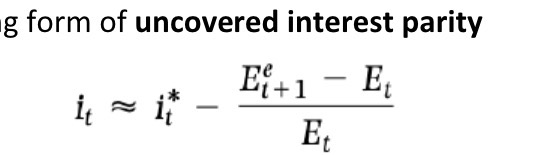

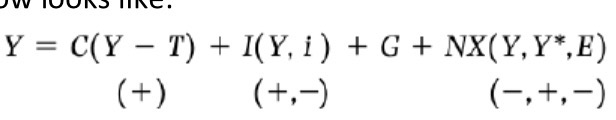

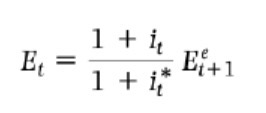

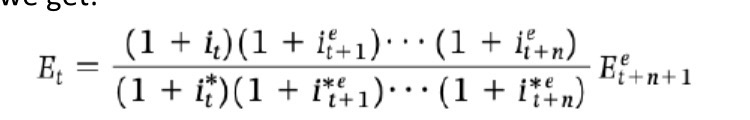

Uncovered interest relation (version 1)

Relies on assumptions

Uncovered interest parity relation (version 2)

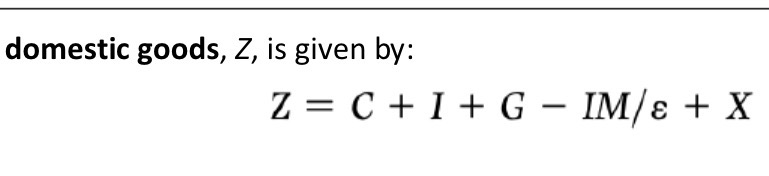

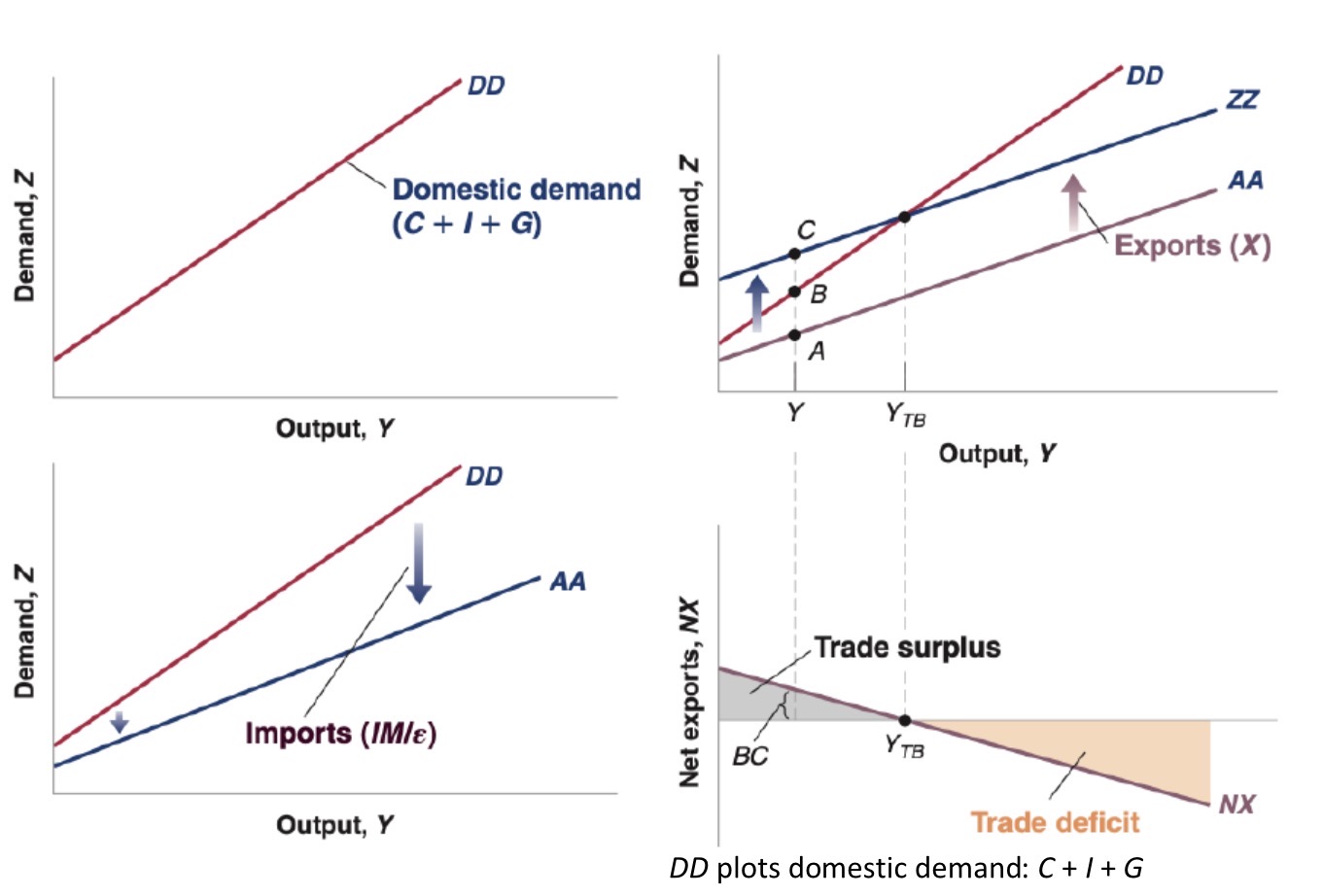

Domestic goods demand relation

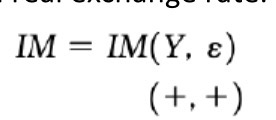

Short term import relation

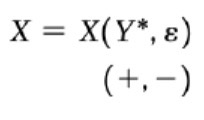

Short term export relation

Exports, imports & domestic demand impact on trade balance

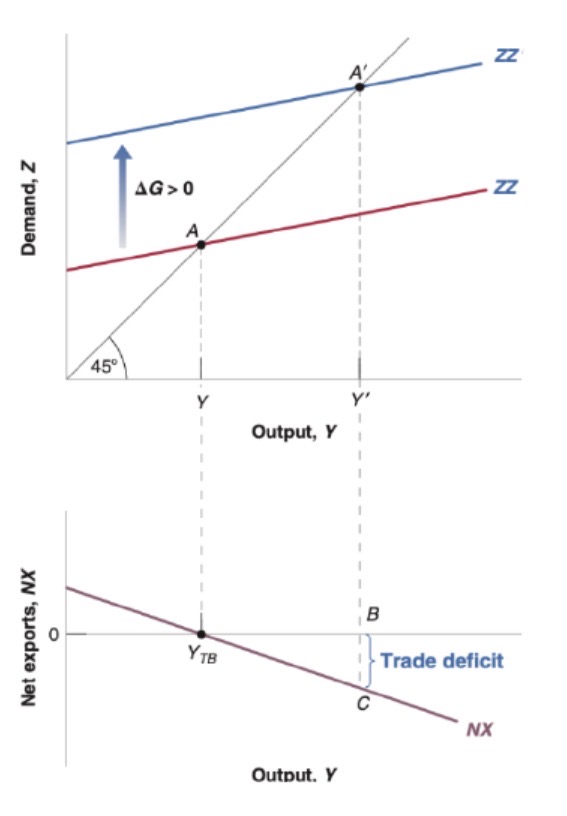

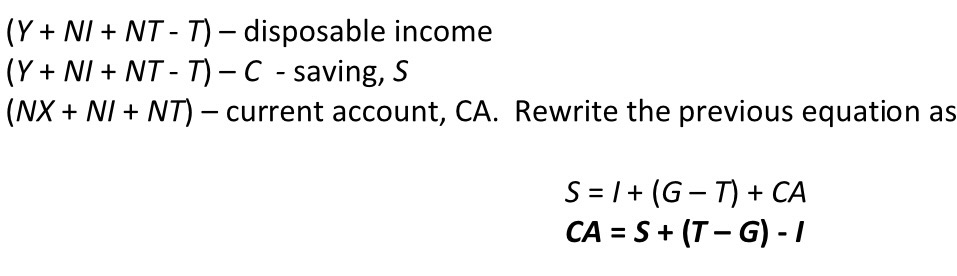

Goods market equilibrium Y=Z

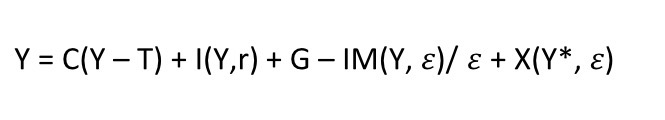

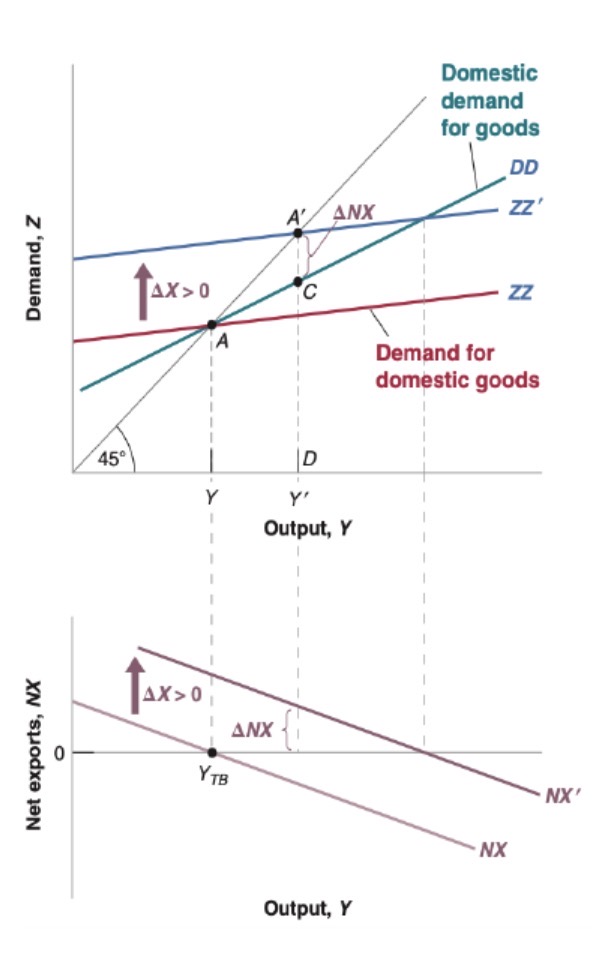

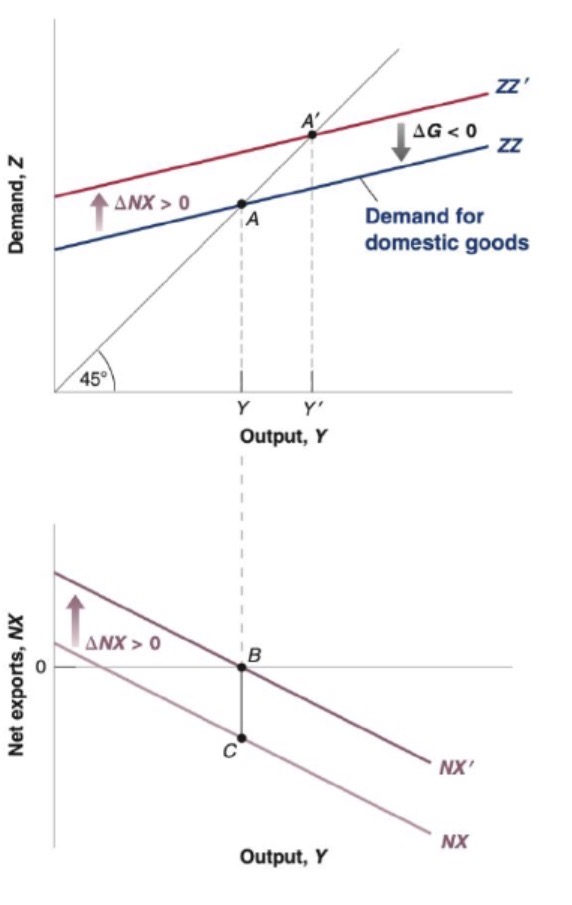

Increase in G effect on goods market

Increase in foreign Y* effect on goods market (domestic)

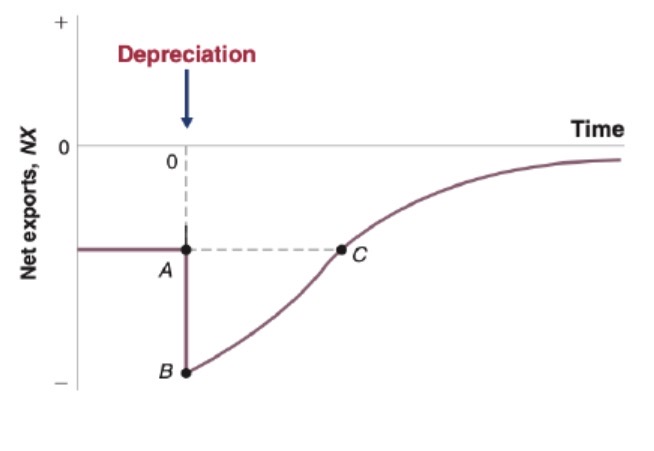

Marshall-Lerner condition

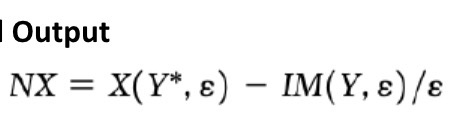

Net exports relation

Utilizing marshall-Lerner to combat trade deficit

Current account function

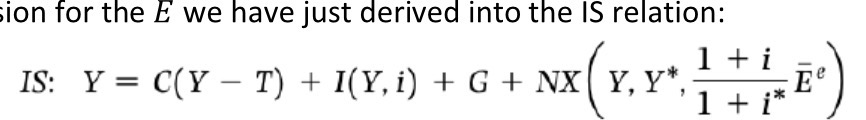

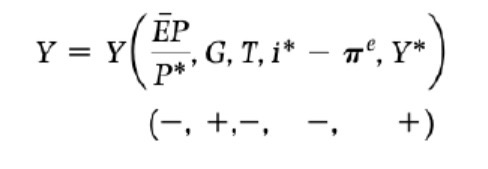

Goods market equilibrium inc. trade & exchange rate

Goods market equilibrium inc. trade (if domestic & foreign Price is given & hence no Inflation )

Financial market equilibrium

E is given,

Financial & goods market equilibrium

Mundell-fleming model

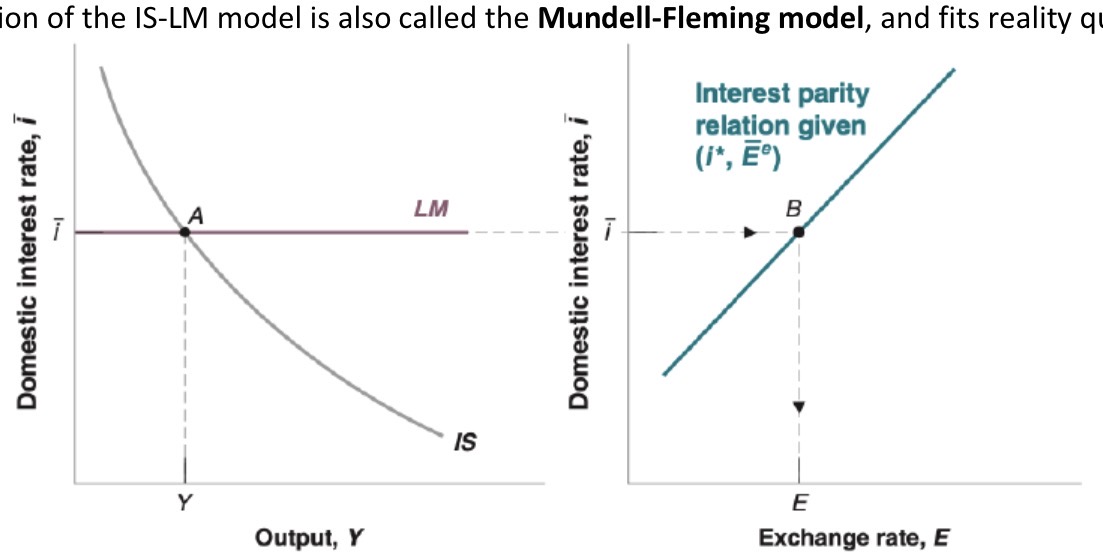

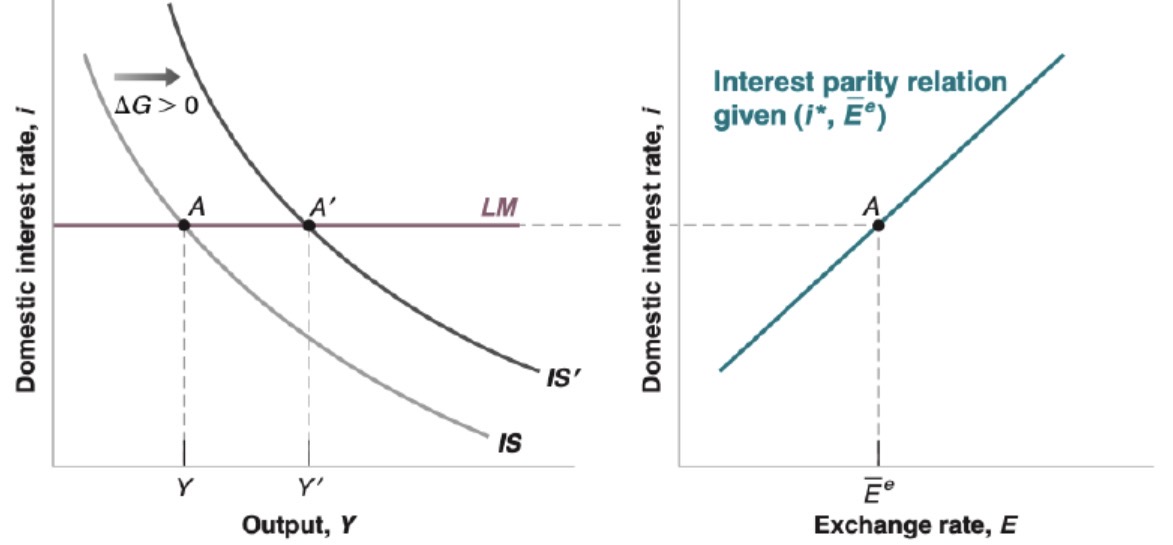

Affect of fiscal policy on open economy

Affect of monetary policy on open economy

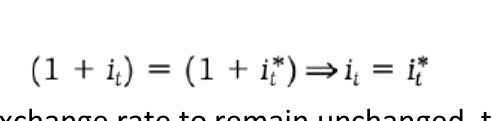

Fixed exchange rate (pegged) interest parity relation

IS relation under fixed exchange rate

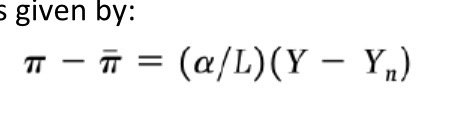

Medium run Philips curve

Expected inflation = constant

Medium run Exchange rate movement (flexible rate)

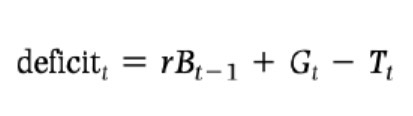

Nominal budget deficit

Real budget deficit

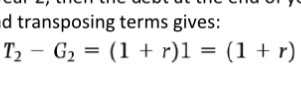

Pay back debt condition (2 year)

Primary deficit=zero

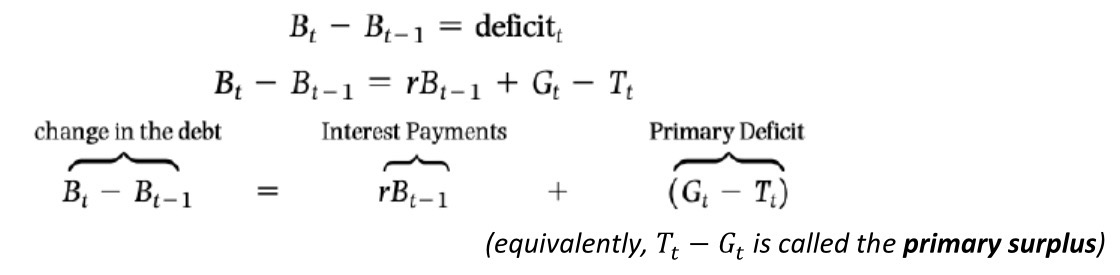

growth in government debt

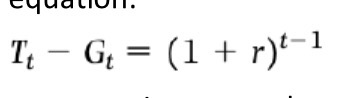

Debt repayment condition

Surplus of (1+r)^t-1

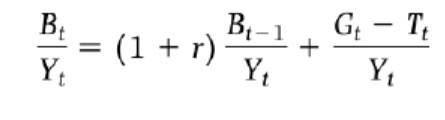

Debt to gdp ratio derivation step 1

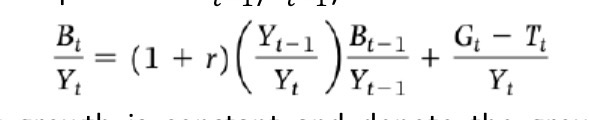

Debt to gdp ratio derivation step 2

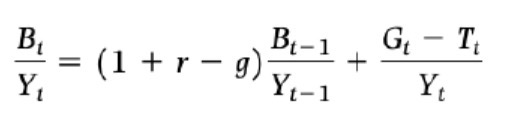

Debt to gdp ratio derivation step 3

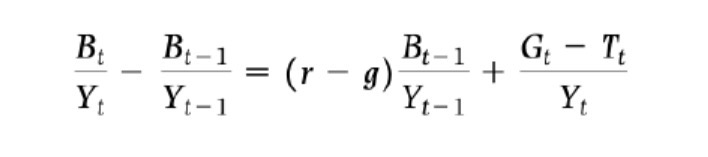

Debt to gdp ratio derivation step 4

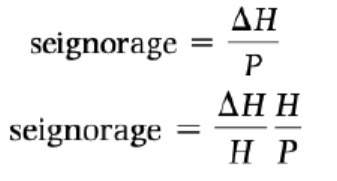

Seignorage

Govt revenue as a result of money printing

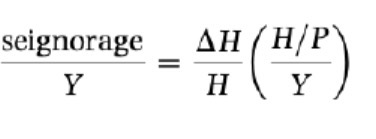

Seignorage / monthly gdp (Y)

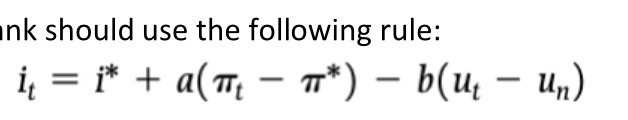

Taylor’s interest rate rule

Rules bank should follow for interest rate & inflation