Capital Budgeting Decision Tree Concepts

1/16

Earn XP

Description and Tags

A set of vocabulary flashcards covering key terms related to capital budgeting decision rules, project selection, and capital rationing strategies.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

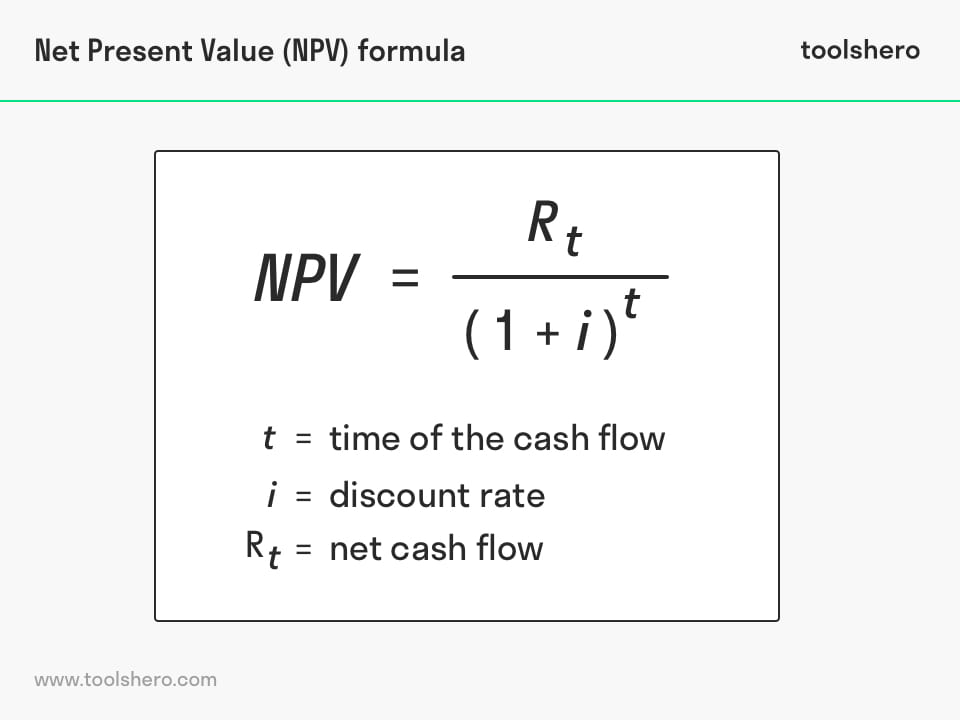

Net Present Value (NPV) formula

Internal Rate of Return (IRR)

The discount rate that makes a project’s NPV equal to zero

Benefit-Cost Ratio (BCR) Formula

PV benefits ÷ PV costs

Independent Projects

Projects whose cash flows do not affect one another, allowing each to be accepted or rejected on its own merit.

Mutually Exclusive Projects

Choosing one project prevents the selection of another.

Capital Rationing

most rewarding or necessary goals!

Maybe company is limited by budget

Equal Lives

A comparison condition where competing projects have the same economic lifespan, permitting direct NPV ranking.

Unequal Lives (Mutually Exclusive)

Rank By NPV over common investment horizon.

Use NPV IRR or BCR?

For Independent project, use largest “BCR” return!

No Fractional Projects

A capital-rationing constraint that requires accepting or rejecting entire projects; the optimal bundle is the combination with the…

accept highest total NPV within the budget.

Fractional Projects

Projects that can be partially accepted (divisible); when allowed, ranking by BCR is appropriate to allocate the budget efficiently.

Rank by NPV

When projects are:

1) mutually exclusive

2) Have equal lives

Rank projects by BCR when

Projects are divisible under capital rationing.

An investment horizon is

The period during which an investor expects to hold an investment before cashing out

projects with BCR > 1

create value

can be ranked by highest ratio when projects are divisible.

a project is acceptable if its IRR?

Exceeds the required return.

When BCR is < 1

Reject project.