econ u2

1/20

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

21 Terms

circular flow model

private/public sector

factor/transfer payments/income

subsidies

private (businesses) VS public (government)

factor (received via indiv labor) VS transfer (gov programs)

subsidies (gov payments to businesses)

three macroeconomic goals for all countries

high economic growth

low unemployment

stable prices (limit inflation)

gross domestic product (GDP)

dollar value of all final goods/services produced IN a country (annually)

depends on productivity

GDP per capita (person)

GDP/population → each person produces an avg amt of?

best measure of a nation’s standard of living

not included in GDP (3)

intermediate goods

tires of a car don’t count

nonproduction transaction

financial transactions: stocks, real estate

used goods

nonmarket/illegal activites

homemade, drugs, unpaid work

rule of law

fair regulations → political stability → economic growth

calculating nominal GDP - expenditures approach (GICE)

GDP = consumer spending + business investment + government spending + net exports

Consumer: purchase of final goods/services (sandwiches)

durable: fridges, cars

non durable: food

services: repairs

Investment: businesses buying tools

Government: infrastructure, etc. (NOT transfer payments)

Net exports: exports - imports

calculating nominal GDP - income approach (RIPL)

labor (wages from work) + rental (property income) + interest (payment after loans) + profit (money after paying costs)

all FACTOR PAYMENTS (bc each contributed to production)

inventories

goods produced & held for later sale

counted in GDP the year they’re PRODUCED

unemployment def & calculation

workers actively looking for a job (but not working)

unemployment rate = 100 * # unemployed / # in labor force

3 types of unemployment

frictional

structural

cyclical

frictional: temporary/between jobs (HAS transferable skills)

seasonal, fired → looking for new job

structural: loss of jobs (NO transferable skills)

technological unemployment, VCR repair

cyclical: lowered demand for goods/services (recession)

being laid off during great depression

natural rate of unemployment & full employment output (Y)

NRU = frictional + structural

healthy economy

full output (Y) = GDP where cyclical = 0

why’s 0% unemployment bad?

without choices btwn workers, companies have to pay higher wages AND charge consumers higher prices (who are now buying MORE)

rising wages → higher prices → demand even higher wages

unemployment rate can misdiagnose actual

discouraged workers (they’ve given up)

lowers # in LF

underemployed workers (wants more hours)

race/age inequalities (doesn’t show disparity for minorities)

inflation, deflation, disinflation

inflation: each $ buys fewer goods → reduces purchasing power

banks don’t lend and people don’t save

deflation: negative inflation (decrease in prices)

ppl will hoard money and not spend

disinflation: price inc at slower rates

real GDP

100 * nominal GDP / GDP deflator

GDP deflator measures prices of ALL produced goods

includes increases in products bought by gov/businesses

CPI measures prices of BOUGHT goods

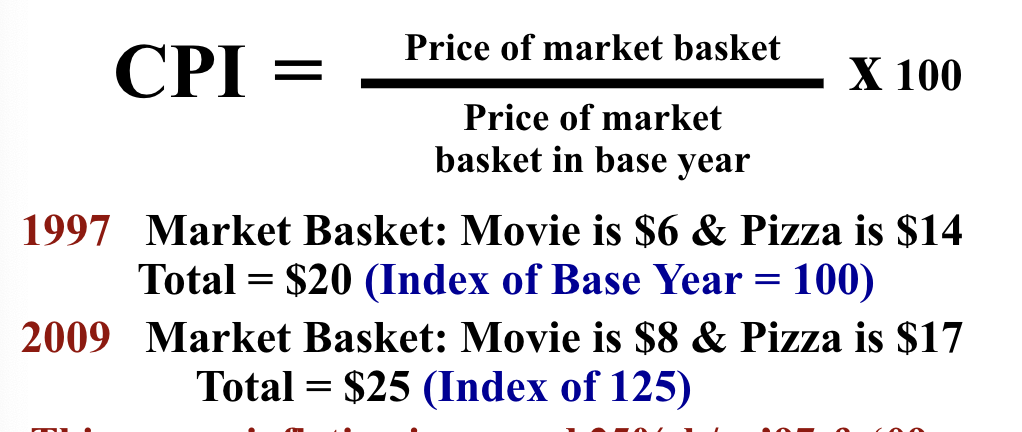

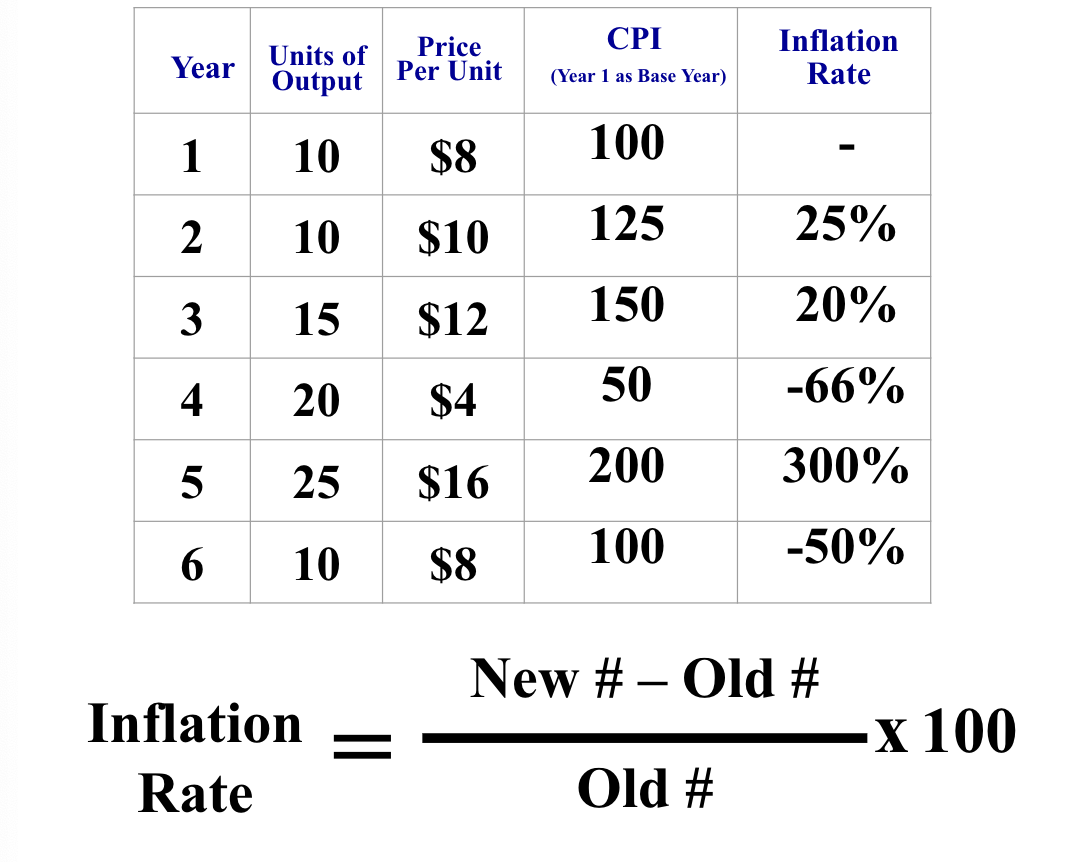

consumer price index (CPI)

CPI = 100 * current MB / base MB

base index = 100

inflation rate

(new - old ) / old

problems with CPI

substitution bias: ppl buy more substitutes (not in MB)

new products: MB isn’t updated to include these

product quality: ignores changes in product quality

costs of inflation

menu costs (updating listed prices)

shoe leather costs (increased cost of transactions)

unit of account costs (currency is unreliable, uncertainty around spending)

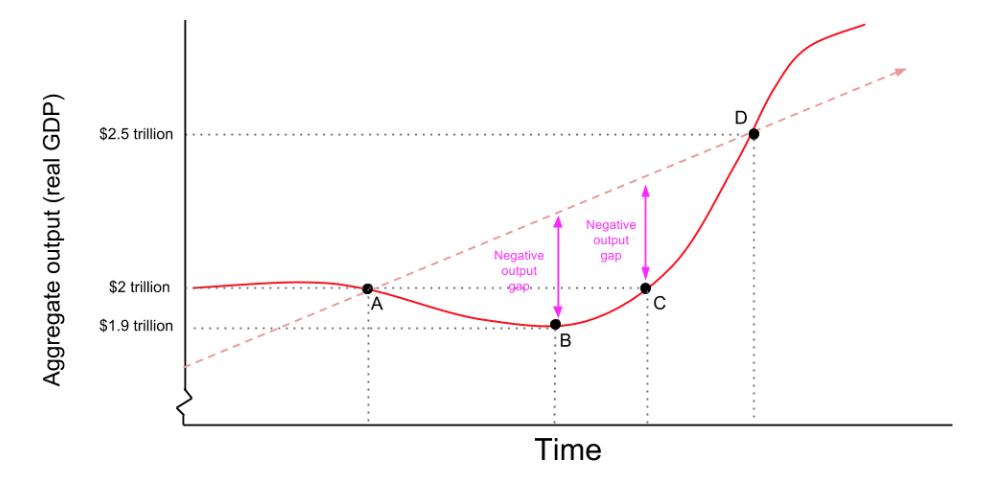

the business cycle

shifts in aggregate supply/demand → short-run fluctuations in real GDP and employment