(1AA3) Chapter 7 - Current Liabilities

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

Liabilities (according to IFRS)

Something your business already owes

Can be paid by:

Cash

Give another asset

Deliver goods or services you own (i.e unearned revenue)

Converted to shares (creditor accepts equity instead of cash)

Current liabilities

Obligation due within one year or within a company's operating cycle

Operating cycle

The time it takes for a company to convert its investments in inventory into cash flows from sales

Typically is one year

Types of current liabilities

Known amounts

Provisions (less certainty about timing or amount)

Types of known current liabilities

Accounts Payable

Accrued liabilities

Income tax payable

Unearned revenue

Current portion of long-term debt

Payroll liabilities

Sales tax payable

Short-term notes payable

Dividend Payable

Accounts Payable

Amounts owed to suppliers

Accrued liabilities

Expenses incurred (used), but not paid

insurance payable

Rent

payable

Interest payable

Unearned revenue / Deferred revenue

Cash advances from customers for services that have not been delivered yet

Current portion of long-term debt

Business has a debt that is due after 1 year

Long-term liability on the balance sheet

As time passes, the business must reclassify the portion of debt into a current liability

Payroll liabiliites includes;

Payroll deductions

Payroll expenses

Payroll deductions

Paid by employers to the government on behalf of employees

Income taxes

Canada Pension Plan (CPP)

Retirement fund

Employment Insurance (EI)

Security in case they lose their job at some future date

Payroll expenses

Salary expenses

Canada Pension Plan (CPP)

Employer's CPP contribution = Employee CPP contribution

Employment Insurance (EI)

Employee EI contribution x 1.4

Why are Income taxes, CPP and EI considered a liability?

The liabilities will remain in the books until the company pays the money to the government

Hence why they owe this, making it a liability

Sales tax payable

The tax added to purchases when shopping

3 Types of Sales Tax Payable

Goods and services tax (GST)

Provincial/regional sales tax (PST)

Harmonized sales tax (HST)

Harmoinized sales tax (HST)

Ontario only has HST

HST combines GST and PST = 13% in Ontario

Value-added sales tax

Businesses that buy a product and resell it for a profit will receive an input tax credit (ITC) for the HST they paid

Input tax (or Tax recoverable)

Tax paid when purchasing goods

Output Tax (or Tax payable)

Tax collected when selling goods or services

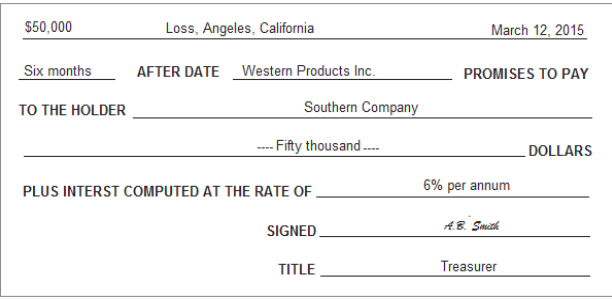

Notes Payable and Notes Receivable (OR promissory notes)

Written promise to pay a sum at the maturity date

Plus interest

Why are notes payable and notes receivable issued?

Gives the lender stronger legal protection

The borrower signs it, the lender keeps it as proof

Example of issues N/R/NP

Dates in which journal entries should be made for notes payable/receivable

Initial transaction

End of accounting period

First interest payment date

Final payment

Interest

The cost of borrowing money

Stated as an annual percentage date

Maturity date

The date at which the debtor must pay the note

Principal

The amount of money borrowe dby the debtor

Term

The length of time the debtor must repay the note