3.6 - government debt, budgets, financing

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

17 Terms

government (national/ public) debt

amount of money that a government owes to lenders outside of the government itself

accumulation of deficits minus surpluses

government budget

plan of a country’s revenues and expenditures over a period of time

balanced budget

expenditures = tax revenues

(*rarely happens)

budget deficit

expenditures > tax revenue

(*happens very often )

financed by borrowing

budget surplus

expenditures < tax revenue

financing government debt with borrowing

borrowing withing country

borrowing from foreign countries

*great need for borrowing during recession to finance

borrowing allows for continued spending without increasing taxes

sustainable debt

level of debt where government has

enough revenues to meet its debt obligations (interest + repayment of borrowed amount)

without accumulating arrears (overdue debt payments)

while also allowing economic growth to continue at an acceptable level

ways of borrowing

issuing bonds

directly from financial institutions

issuing bonds explanation

certificate that promises to pay interest at various intervals until the moment it is repaid to the bondholder.

holder of bond = lender

financial investors (individuals, firms, banks) have incentive to buy bonds because income they receive

issuers of bond = borrowers

measurement of debt

debt-to-GDP ratio

share of rGDP od the borrowing country

costs of high levels of debt

debt servicing costs → payment that must be made in order to repay the amount of the loan + interest

poor credit ratings

debt servicing costs explanation

debt servicing costs ↑ = opportunity costs↑ = money to spend on social services and infrastructure ↓

when debt is from foreign lenders they must be repaid in foreign currencies

governments to pay use exports revenue

hence less money for imports

foregone imports = opportunity cost → negative consequences for economic growth

poor credit rating explanation

high credit rating

pay back loans in full and on time without difficulties

low credit rating

difficult to find investors

difficult to borrow from financial institutions

impacts of higher taxation and lower government spending

to achieve budget surpluses

increased income inequality

lower private investment

loss of market confidence

possibility of debt trap

lower economic growth

reasons for increased taxation and decreased spending being politically unpopular

reduced gov. spending and investment may lead to

fall in AD

fall in r GDP

deflationary gap

hence → increased debt-to-GDP ratio

increased income inequality explained

government debt ↑ = bonds issued ↑ = income distribution inequality ↑

buyers of bonds tend to be higher income people

when governments pay them interest it does it through tax revenues

transfer of income away from low income tax payers towards high income

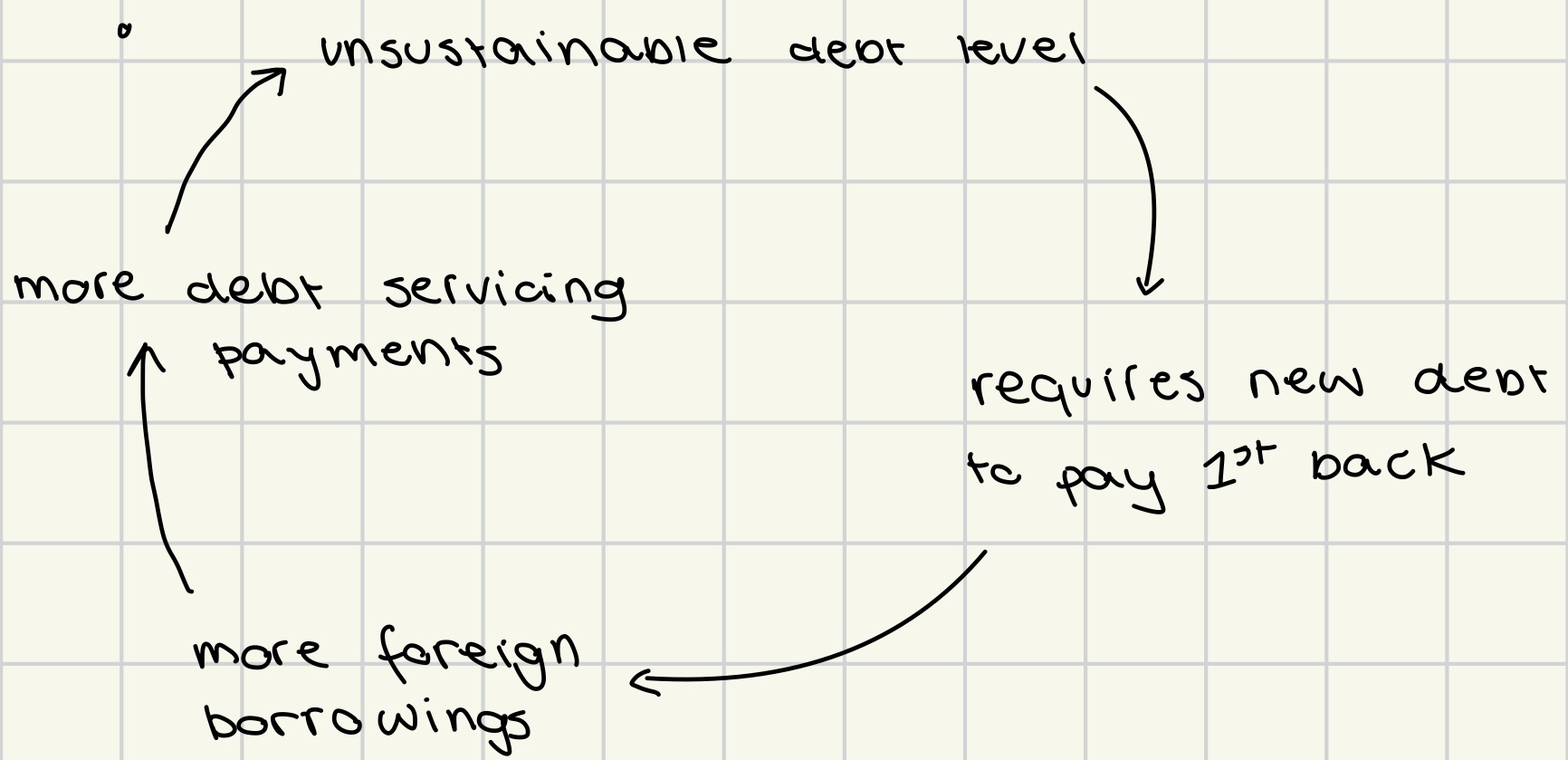

debt trap

country most keep on taking new loans in order to pay back the old ones