Macroeconomics 5 The Open Economy

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

36 Terms

Openness in Goods and Financial Markets

Openness in goods markets:

▶ The ability of consumers and firms to choose between domestic and foreign goods.

▶ Even countries most committed to free trade have tariffs (taxes on imported goods) and quotas (restrictions on the quantity of goods that can be imported).

Openness in financial markets:

▶ The ability of financial investors to choose between domestic and foreign assets.

▶ Until recently, even some rich countries had capital controls– restrictions on the foreign assets that domestic residents could hold and the domestic assets foreign residents could hold.

Openness in factor markets:

▶ The ability of firms to choose where to locate production, and of workers to choose where to work.

▶ E.g., the North American Free Trade Agreement (NAFTA) or the European Union

Can Exports Exceed GDP?

Since a country cannot export more than it produces, will the export ratio always be less than one?

No, exports may be larger than GDP because exports and imports may include exports and imports of intermediate goods.

In 2017, the ratio of exports to GDP in Singapore was 173%!

Openness in Goods Markets

The volume of trade is not necessarily a good measure of openness.

Tradable goods: Goods that compete with foreign goods in either domestic markets or foreign markets.

Tradable goods represent about 60% of aggregate output in the United States today

Real / Nominal / Fixed exchange rate

(Nominal) appreciation / depreciation

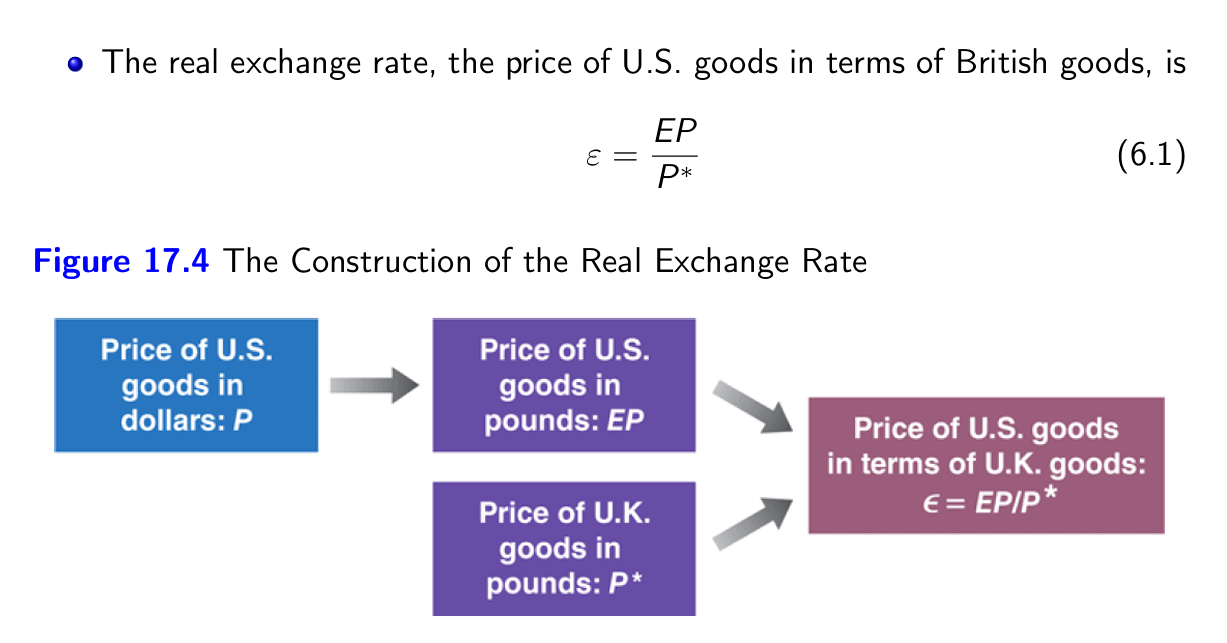

Real exchange rate: The price of domestic goods relative to foreign goods.

Nominal exchange rate: The price of the domestic currency in terms of foreign currency.

Fixed exchange rates: A system in which two or more countries maintain a constant exchange rate between their currencies. In the fixed exchange rate system, revaluations are increases in the exchange rate, and devaluations are decreases in the exchange rate.

(Nominal) appreciation: An increase in the price of the domestic currency in terms of a foreign currency, i.e., an increase in the exchange rate.

(Nominal) depreciation: A decrease in the price of the domestic currency in terms of a foreign currency, i.e., a decrease in the exchange rate.

The Construction of the Real Exchange Rate

Real appreciation / depreciation

Real appreciation: An increase in the real exchange rate, i.e., an increase in the relative price of domestic goods in terms of foreign goods.

Real depreciation: A decrease in the real exchange rate, i.e., a decrease in the relative price of domestic goods in terms of foreign goods.

bilateral / multilateral exchange rates

The multilateral real U.S. exchange rate (or U.S. real exchange rate) requires data on the geographic composition of U.S. trade for both exports and imports.

Openness in Financial Markets

Foreign exchange: Buying and selling foreign currency

Balance of payments: A set of accounts that summarize a country’s transactions with the rest of the world

GDP measures value added domestically.

Gross national product (GNP) measures the value added by domestic factors of production

GNP =GDP+NI

where NI denotes net income– payments received from the rest of the world less income paid to the rest of the world.

Current account

Current account: Transactions above the line record payments to and from the rest of the world.

CA = NX + NI

▶ Exports and imports of goods and services (trade balance)

▶ Net income balance between income received from the rest of the world and income paid to foreigners

Current account balance: The sum of net payments to and from the rest of the world

CA =S+(T −G)−I

Current account surplus: Positive net payments from the rest of the world

Current account deficit: Negative net payments from the rest of the world

Financial account

Financial account: Transactions below the line record net foreign holdings of domestic assets.

Net capital transfers: The difference in foreign aid given and received

Net capital flows or financial account balance: An increase in net foreign indebtedness (holdings of domestic assets minus the increase in domestic holdings of foreign assets)

Financial account surplus: Positive net capital flows

Financial account deficit: Negative net capital flows

Statistical discrepancy: Difference between current and capital account transactions

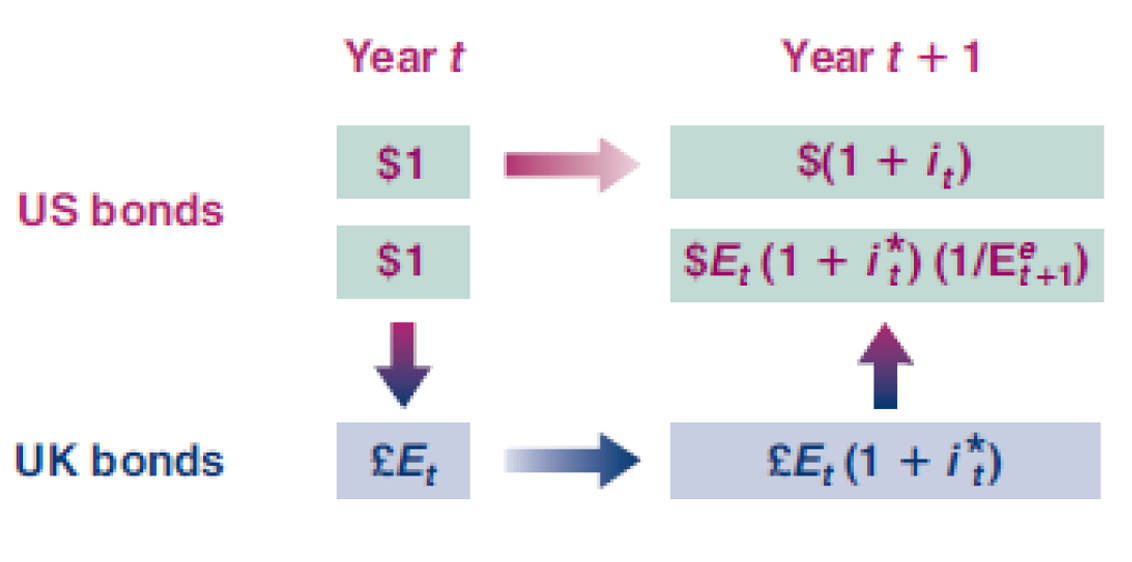

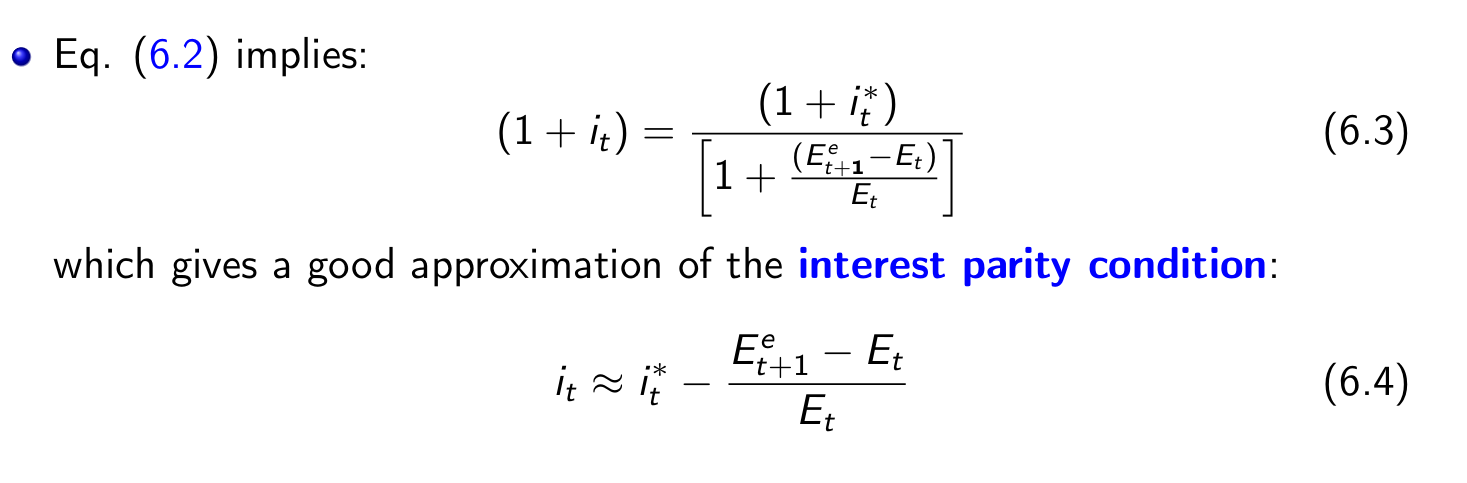

Expected Returns from Holding One-Year US Bonds versus One-Year UK Bonds

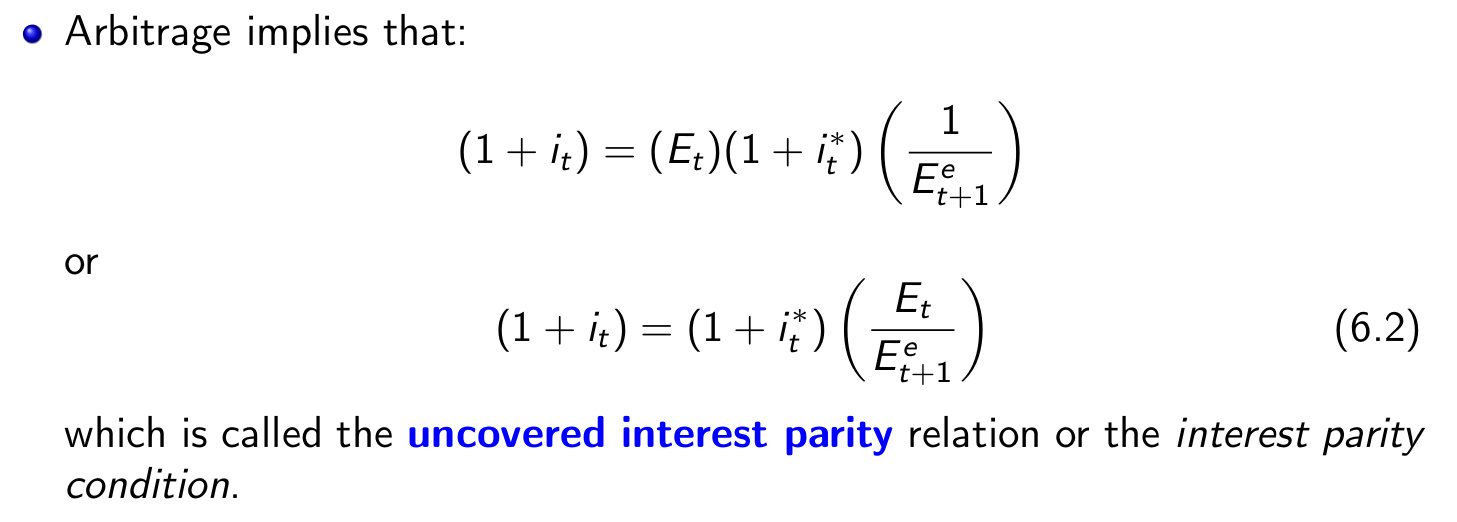

uncovered interest parity or interest parity condition

The assumption that financial investors hold only the bonds with the highest expected rate of return ignores transactions costs and risk.

approximation of the interest parity condition

Arbitrage by investors implies that the domestic interest rate must be equal to the foreign interest rate minus the expected appreciation rate of the domestic currency.

Buying Brazilian Bonds

In September 1993 Brazilian bonds were paying a monthly interest rate of 36.9% while US bonds paid 0.2% monthly.

However, the Brazilian currency (cruzeiro) was depreciating rapidly. It fell 34.6% in August 1993 versus the dollar.

РАССЧИТАТЬ!

Conclusions and a Look Ahead

Openness in goods markets allows people and firms to choose between domestic goods and foreign goods.

▶ This choice depends primarily on the real exchange rate. Openness in financial markets allows investors to choose between domestic assets and foreign assets.

▶ This choice depends primarily on their relative rates of return, and on the expected rate of appreciation of the domestic currency.

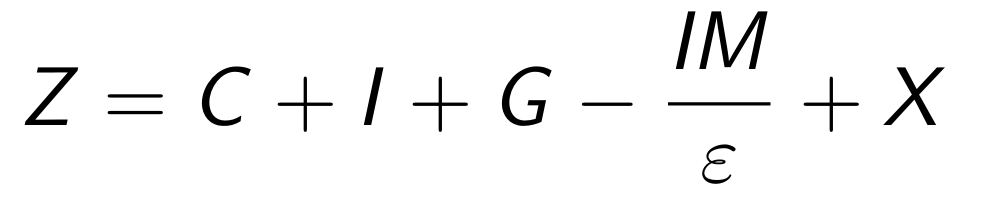

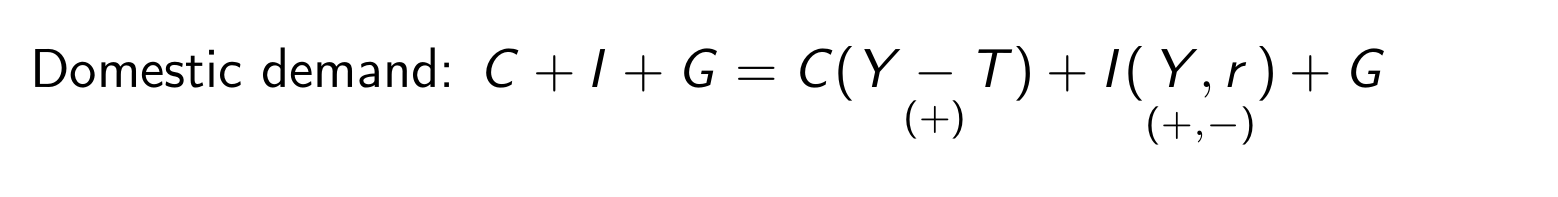

demand for domestic goods

domestic demand for goods

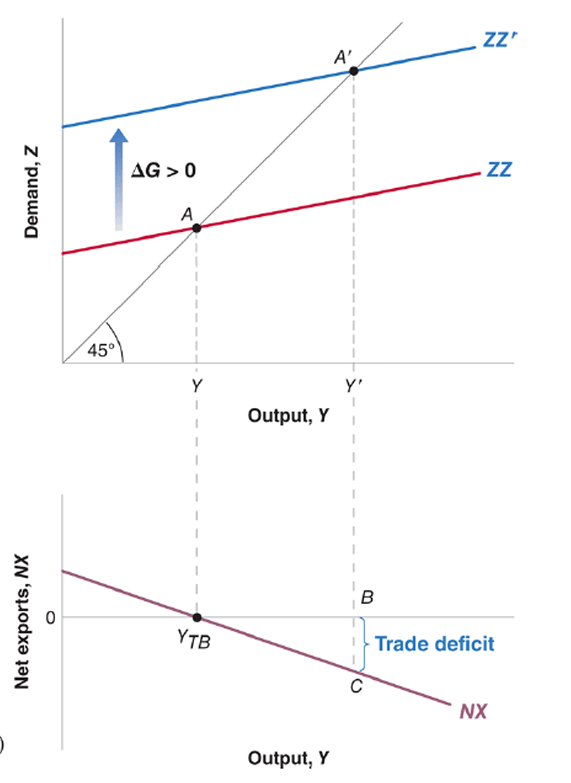

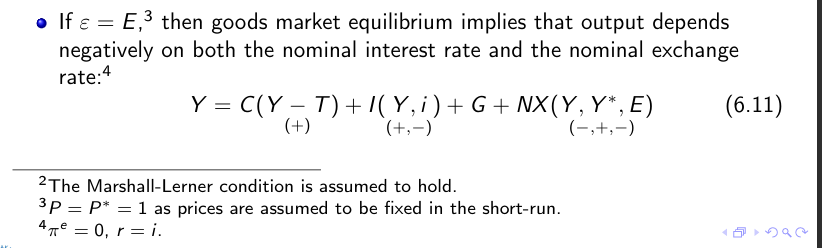

Imports and Exports in the IS Relation in the Open Economy

The Demand for Domestic Goods and Net Exports

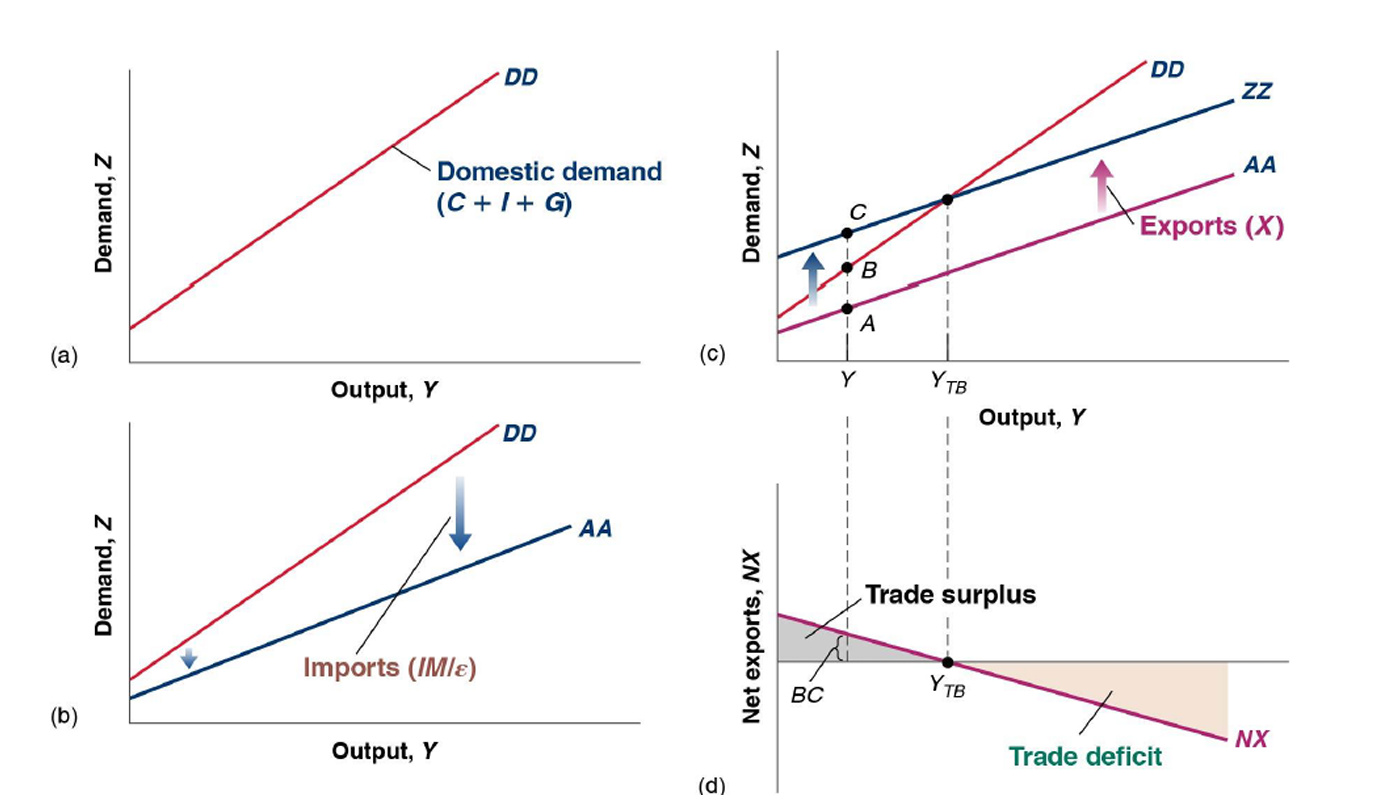

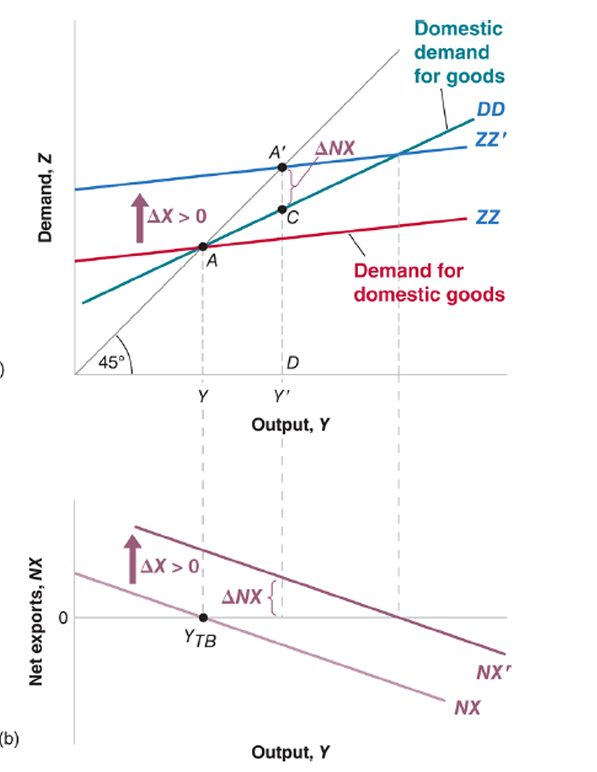

The line AA represents the domestic demand for domestic goods, and the line DD represents domestic demand.

AA is flatter than DD. As long as some of the additional demand falls on domestic goods, AA has positive slope.

The line ZZ represents the demand for domestic goods (including exports).

The distance between ZZ and AA is constant because exports do not depend on domestic income but they depend on foreign income.

equilibrium condition for output

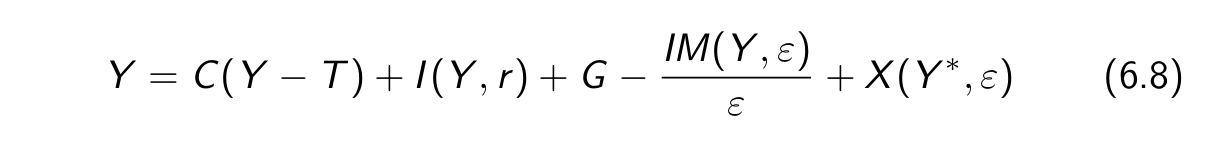

Graphically, equilibrium output is at the point where demand equals output, the intersection of ZZ and the 45-degree line.

Equilibrium Output and Net Exports

The goods market is in equilibrium when domestic output is equal to the demand for domestic goods.

At the equilibrium level of output, the trade balance may show a deficit or a surplus.

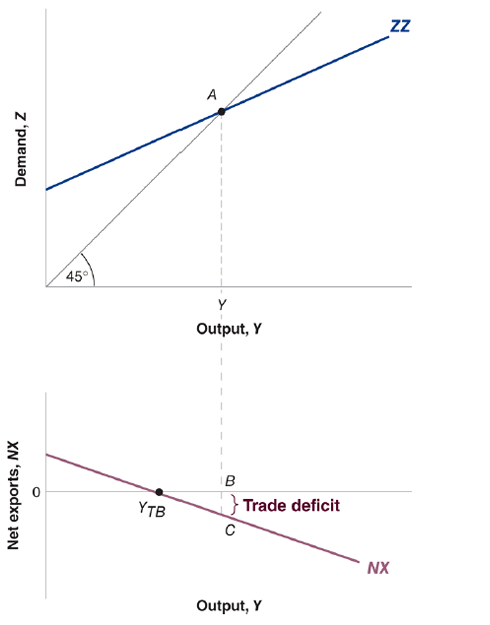

Increases in Demand– Domestic or Foreign

Differences with a closed economy:

▶ Effect on trade balance: An increase in output worsens the trade balance (towards a trade deficit).

▶ Smaller effect of government spending on output: Because ZZ is flatter than DD, the multiplier is smaller in the open economy.

▶ Both effects have the same origin: Some domestic demand falls on foreign goods.

▶ Depends on the share of imports in domestic demand.

Summary:

▶ An increase in domestic demand leads to an increase in domestic output but leads also to a deterioration of the trade balance.

▶ An increase in foreign demand leads to an increase in domestic output and an improvement in the trade balance.

Implications:

▶ Shocks to demand in one country affect all other countries.

▶ Economic interactions complicate the task of policymakers. Policy coordination is not so easy to achieve (incentives to not deliver).

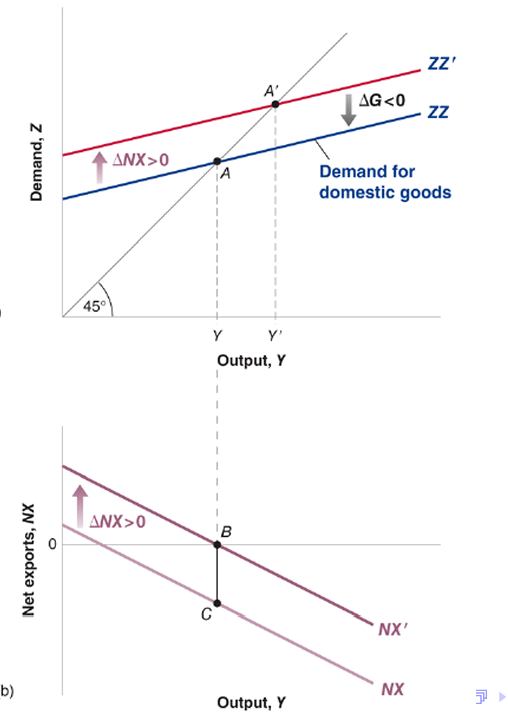

The Effects of an Increase in Government Spending

An increase in government spending leads to an increase in output and to a trade deficit.

The Effects of an Increase in Foreign Demand

An increase in foreign demand leads to an increase in output and to a trade surplus. Trade balance (∆NX) = demand for domestic goods (ZZ)– domestic demand for goods (DD)

The G20 and the 2009 Fiscal Stimulus

The G20 was created in 1999 and is a group of leaders from 20 advanced and emerging countries.

In November 2008, the G20 leaders met to coordinate their responses to the existing crisis in terms of both monetary and fiscal policies.

Over the next few months, most countries indeed adopted discretionary measures, aimed at either increasing private or public spending.

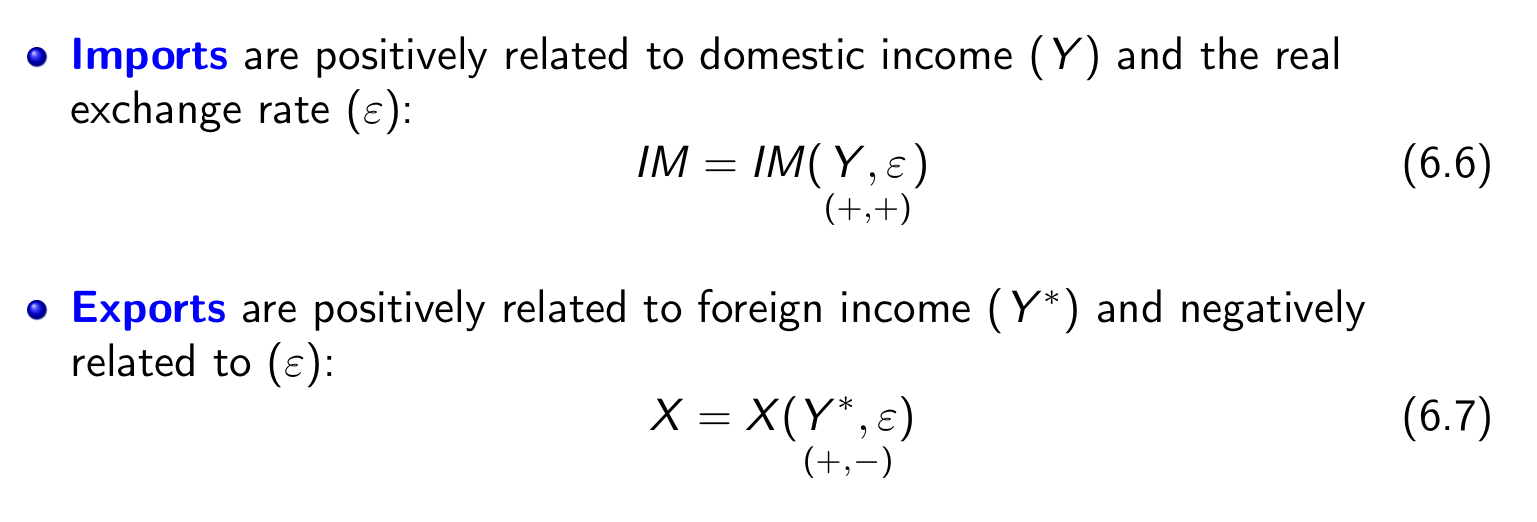

Depreciation, the Trade Balance, and Output

Real depreciation (decrease of ε) affects the trade balance through three separate channels:

▶ Exports, X, increase.

▶ Imports, IM, decrease.

▶ The relative price of foreign goods in terms of domestic goods, 1/ε , increases.

Marshall-Lerner condition: A real depreciation leads to an increase in net exports.

Depreciation leads to a shift in demand, both foreign and domestic, toward domestic goods. The shift in demand leads, in turn, to both an increase in domestic output and an improvement in their trade balance

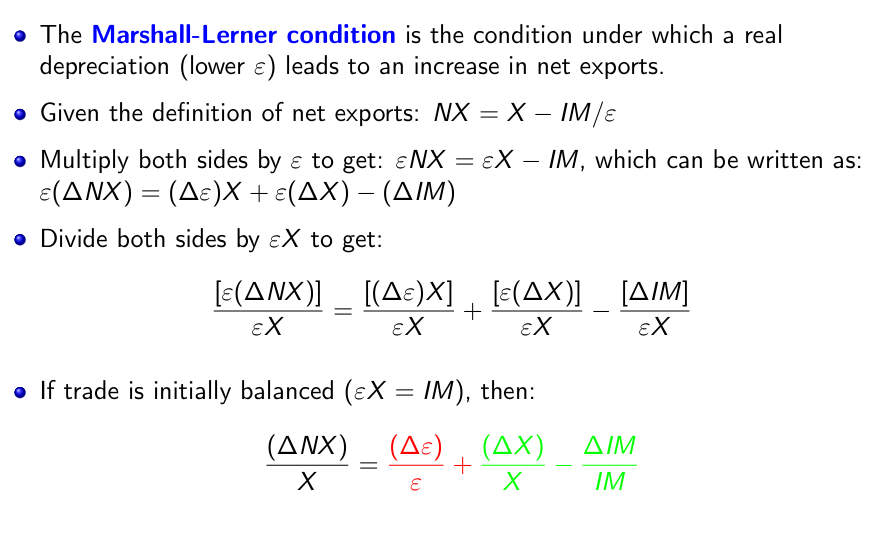

Derivation of the Marshall-Lerner Condition

The Marshall-Lerner condition is the condition that the sum of these tree terms be positive. If it is satisfied, a real depreciation leads to an improvement in the trade balance.

The change in the trade balance (as a ratio to exports) in response to a real depreciation is the sum of 3 terms:

The first term is equal to the proportional change in the real exchange rate. It is negative if there is a real depreciation.

The second term is equal to the proportional change in exports. It is positive if there is a real depreciation.

The trird term is equal to minus the proportional change in imports. It is positive if there is a real depreciation.

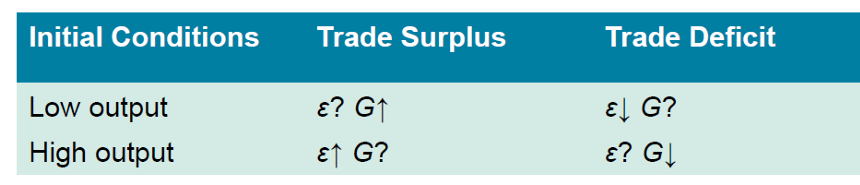

Reducing the Trade Deficit without Changing Output

To reduce the trade deficit without changing output, the government must both achieve a depreciation and decrease government spending.

If the government wants to eliminate the trade deficit without changing output, it must do two things:

▶ achieve a depreciation sufficient to eliminate the trade deficit

▶ reduce government spending so as to shift ZZ back

Exchange Rate and Fiscal Policy Combinations

Saving, Investment, and the Current Account Balance

An increase in investment must be reflected either in an increase in private saving or public saving, or in a deterioration of the current account balance.

A deterioration in the government budget balance must be reflected in an increase in either private saving, or in a decrease in investment, or else in a deterioration of the current account balance.

A country with a high saving rate must have either a high investment rate or a large current account surplus.

Summary

In an open economy, an increase in domestic demand leads to a smaller increase in output than in a closed economy as some of the additional demand falls on imports.

For the same reason, an increase in domestic demand also leads to a deterioration of the trade balance.

An increase in foreign demand leads, as a result of increased exports, to both an increase in domestic output and an improvement of the trade balance.

When a group of countries is in a recession, coordination can help their recovery.

If the Marshall-Lerner condition is satisfied, a real depreciation leads to an improvement in net exports.

A current account surplus (deficit) corresponds to an excess of saving (investment) over investment (saving).

Equilibrium in the Goods Market

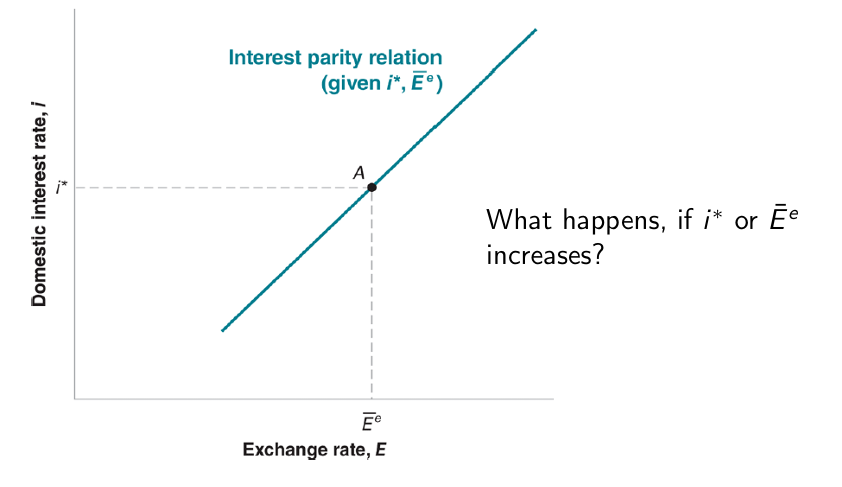

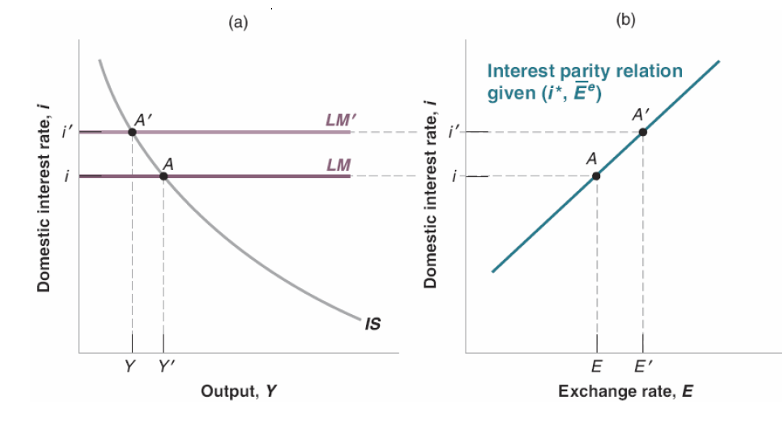

The Relation between the Interest Rate and the Exchange Rate Implied by Interest Parity

A higher domestic interest rate leads to a higher exchange rate– an appreciation

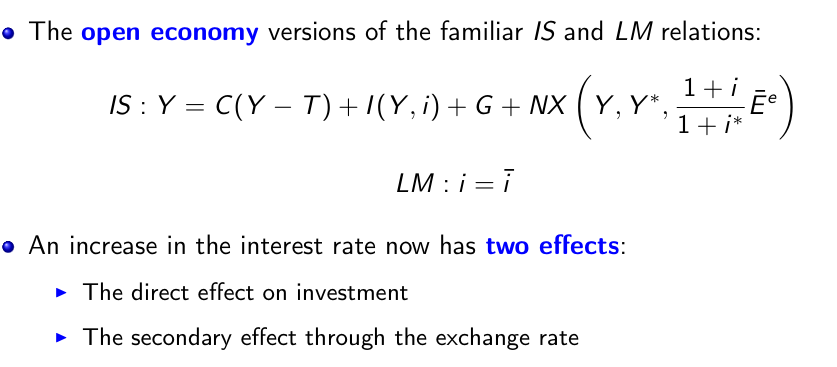

IS-LM relation in the open economy

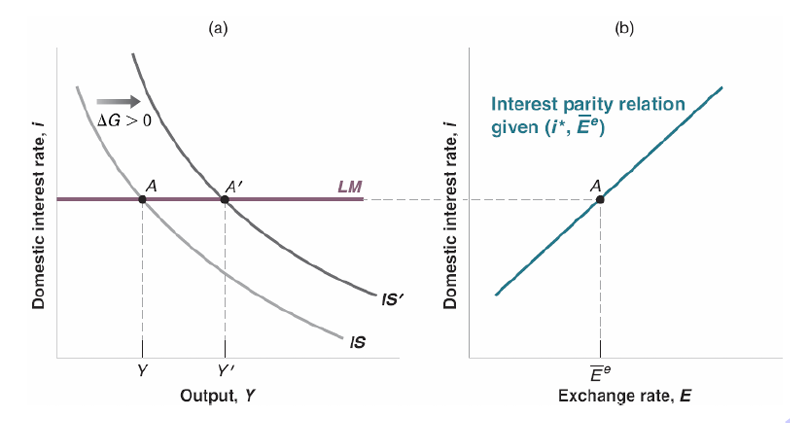

The IS-LM Model in an Open Economy

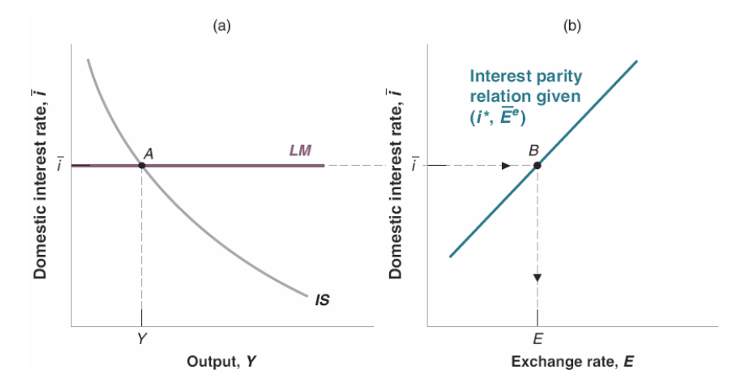

An increase in the interest rate reduces output both directly and indirectly (through the exchange rate). The IS curve is downward sloping.

The Effects of an Increase in the Interest Rate

An increase in the interest rate leads to a decrease in output and an appreciation.

The Effects of an Increase in Government Spending with an Unchanged Interest Rate

An increase in government spending leads to an increase in output. If the central bank keeps the interest rate unchanged, the exchange rate also remains unchanged.