Part 1 - Refresher, IFRS, Special Transactions

1/69

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

70 Terms

Part 1 - REFRESHER

Balance Sheet

Asset = What company OWNS & = total of resources needed to operate the business

Equity = What owners CLAIM to company

Liability = What company OWES

→ L + E = total of means of financing of the assets

Theory of Assets

Asset is:

1) resource controlled by the company on the BS date

2) arising from past events or transactions

3) expected to bring future economic benefits

→ can be tangible / intangible as long as it is legally controlled

Recognition of assets:

it is probable that future economic benefits will flow to the company

its cost can be measured reliably

→ ASSET generates VALUE for the business

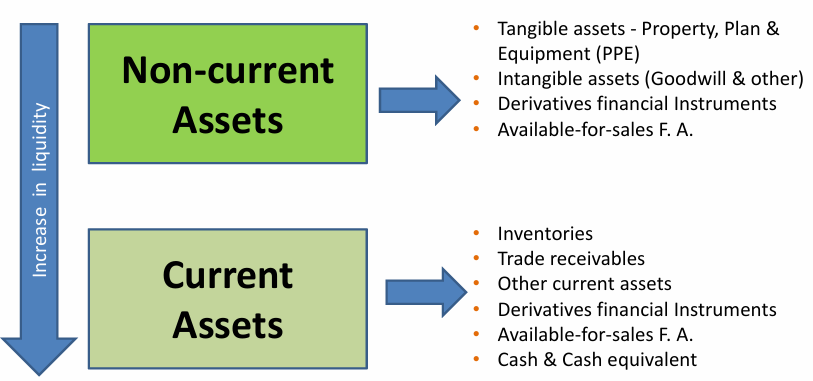

Assets

Theory of Liabilities

Liability is:

1) present obligation as of the balance sheet date

2) Arising from past events or transactions

3) That will likely lead to an outflow of resources (e.g., cash or services) to settle it

Recognition of liability:

it is probable that an outflow of economic benefits will occur

its amount of outflow can be measured reliably

→ LIABILITY represents COST or DEBT for the business

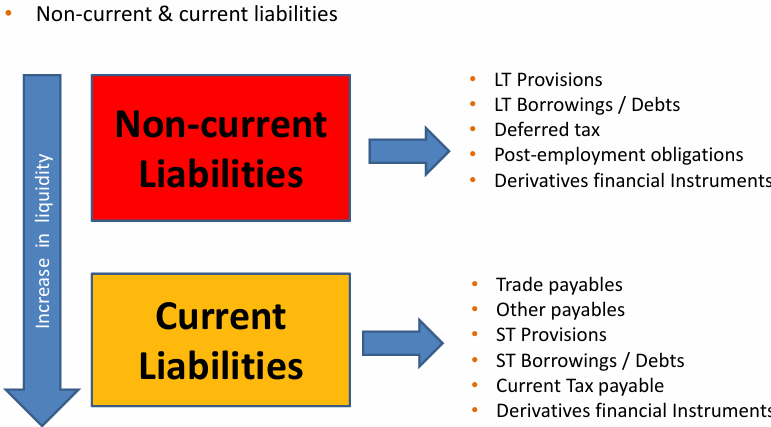

Liabilities

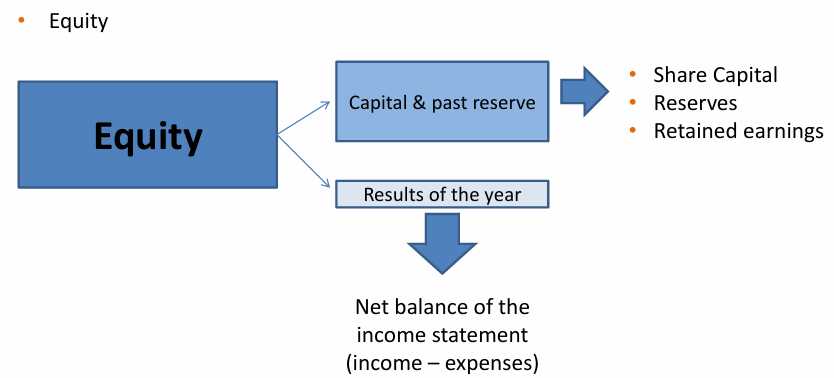

Theory of Equity

= what is left after the company paid all liabilities → what belongs to the OWNERS / SHAREHOLDERS

Equity = composed of:

1) Capital & Past Reserve

Share Capital = money investors put in by buying shares

Reserves = profits from past years set aside

Retained Earnings = profits kept in company instead of being paid out as dividends

2) Results of the Year

Net balance of the income statement = income - expenses = profit or loss

→ 1) + 2) = Total Equity

Equity

what can be distributed as Dividends

Dividend = Net income - DeltaReserve

Only the distributable part of equity → retained earnings or reserves

decided after allocation of the result of the year

Theory of Income

Income is:

increase in future economic benefits during an accounting period

Recognition of Income:

can be measured reliably

linked to an increase in assets (receiving cash / receivables) or decrease in liabilities (debt being forgiven)

→ results in an INCREASE in EQUITY, other than those relating to contributions by equity participants

Theory of Expenses

Expenses is:

decrease in future economic benefits during an accounting period

Recognition of Expense:

can be measured reliably

linked to a decrease in assets (using up inventory / paying salaries) or an increase in liabilities (incurring bills to pay later)

→ results in DECREASES in EQUITY, other than those relating to distributions to equity participants

Working Capital Ratio (WCR) - Definition & Formula

= a financial metric that represents a company's ability to meet its short-term obligations and fund its day-to-day operations → minimum cash company needs to operate

WCR = Inventory + Receivables - Trade payables

Depreciation = Tangible & Amortization = Intangible

= measures the portion of the cost of the non-current asset that has been used in generating the revenue → COST of USING

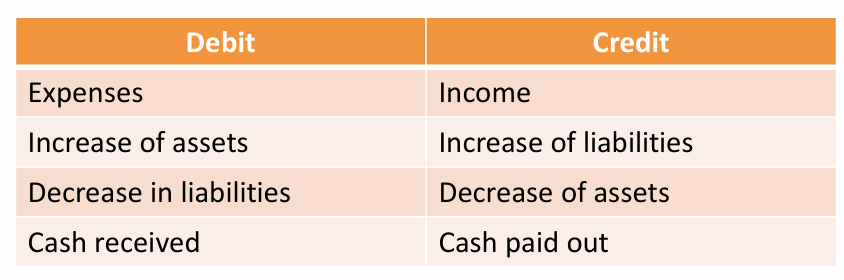

Double entry booking

Part 1 - IFRS

IFRS = International Financial Reporting Standard

= global standard used in many countries

= created bc businesses expanded on a worldwide scale, which underlined the need of having a common set of accounting rules

= ensures transparency, consistency & comparability across different countries (except US)

IFRS - Origin of the differences in accounting systems

legal system (roman law vs. common law)

companies financing (debt vs. equity ; concentrated vs. widespread)

taxation system (unicity vs. dissociation)

accidents of history (crash of 1929, Enron, Worldcom…)

IFRS - Requirements for common accounting standards

globalisation of the markets

cost of living on several markets

lack of transparency for investors

will induce a reduction of the cost of capital

IFRS - Belgium

Belgium Accounting Standard Commission follows IAS/IFRS (apply a set of IAS & IFRS standards)

IAS/IFRS :

Mandatory for all listed companies

Optional for some non-listed companies, if requested

Ongoing discussions about:

Applying IFRS to consolidated accounts of non-listed firms

Using IFRS in statutory (separate) accounts

IFRS - US

Still uses US GAAP (Generally Accepted Accounting Principles)

A conversion to IFRS has been discussed but not fully adopted

Non-US companies listed in the US can file IFRS financial statements

IFRS - What are the four components of the IAS/IFRS Conceptual Framework?

The objective of financial statements

Underlying assumptions

Qualitative characteristics of financial statements

Measurement of the elements of financial statements

IFRS - What is the objective of financial statements according to IAS/IFRS?

To provide information about the financial position, performance, and changes in financial position of an entity that is useful to a wide range of users in making economic decisions

IFRS - What aspects are included under financial position?

Economic resources controlled

Financial structure

Liquidity

Solvency

IFRS - What aspects are included under financial performance?

Profitability

Variability of performance

Ability to generate cash

Predict cash flows

IFRS - What changes in financial position should be assessed?

Operating activities

Investing activities

Financing activities

IFRS - What are the two underlying assumptions in IFRS financial statements?

accural basis: effects of transaction = recognised when they OCCUR, NOT when cash = received

Accural basis accounting rely on :

Not only past transactions but obligations to pay and resources to be received

Accounting based on legal rights, as opposed to cash basis

going concern: that financial statements are prepared assuming the entity will continue operations in the foreseeable future & it ≠ the intention to liquidate or curtail operations

IFRS - What are the qualitative characteristics of financial statements?

understandability (assumes reasonable knowledge of users)

relevance (to decision making, predictive, confirmatory, materiality concept)

comparability (consistency of acc policies)

reliability (faithful representation, substance over form, neutrality, prudence, completeness)

constraints on relevant + reliable information (timeliness, balance between cost + benefit and qualitative characteristics)

true + fair presentation (use of qualitative characteristics + appropriate acc standards)

IFRS - What is measurement of financial statements in the conceptual framework?

determination of the monetary amount at which the elements of FS are to be recognised + reported

measurement bases :

Historical cost – Most commonly used

Current cost – Value to acquire now

Realizable value – Sale/settlement value

Present value – Discounted future inflows or outflows

Fair value – Market-based value representing the amount at which an asset could be exchanged or a liability settled, in a transaction between knowledgeable, willing parties acting independently and without compulsion → Mainly used for:

Business combinations

Financial instruments

Investment properties

What are the 5 IFRS Financial Reporting Basic Requirements?

The set of IFRS financial statements

IAS/IFRS Balance Sheet (« Statement of Financial Position »)

IAS Income Statement (« Statement of Comprehensive Income »)

IAS Statement of Changes in Equity

Compliance Requirement

What is the set of IFRS financial statements ?

Statement of financial position (Balance sheet)

Statement of comprehensive income: performance (Income statement)

Statement of cash flows: changes in financial position

Statement of changes in equity: shows the movements in the different components of equity

→ share capital, reserves, retained earnings,…

Statement of recognized income & expenses: details income and expenses recognized directly in equity

→ foreign currency translation gains, hedges, certain unrealized gains, available-for-sale investments, actuarial gains on pensions,…

Notes (disclosures) and supplementary schedules → gives a lot of extra information

What is the IAS/IFRS Balance Sheet?

Format of financial statement (FS):

No mandatory format or presentation (bc gives more transparency, flexibility + added value)

Lists of minimum items to be presented “on the face” of balance sheet and income statement

Items (lines) can be added or deleted as appropriate

Under Belgian GAAP, legally imposed preprinted forms for balance sheet, income statement and notes/disclosures, provided by the National Ban

→ IFRS need to show FS that is aligned with the type of activity of company (consulting firm shows less detail in FA)

What are the minimum items requires on the IAS Income Statement (IStat)?

Revenue

Financial expenses

Share of profits/losses of associates or joint ventures (equity method)

Tax expense

Gain/loss on the disposal of assets or settlement of liabilities from discontinued operations (= parts of a business that are planned to be sold → present as 1 aggregate line IStat, separately showinf activities that will no longer contribute to future operations)

Profit or loss

Allocation of result to non-controlling interests and parent equity holders

Basic and diluted earnings per share (IAS 33)

→ revenue = only specific line required for operating activities (choice between nature of expense or function of expense (= used by most companies) & BE GAAP = by nature

What is the Statement of Changes in Equity?

Purpose = Make equity movements understandable to users and show changes in components like capital, reserves, and retained earnings

CAPITAL & RESERVES = items MANDATORY shown separately in BS

movements = typically included in the Statement of Changes in Equity:

Changes in accounting policy

Revaluations (e.g., of property, plant & equipment, or investments)

Currency translation differences

Net result for the period

Dividends paid

Capital increases/decreases

Intra-equity transfers

What are the general compliance requirements for IFRS financial statements?

Full compliance with all IFRS/IAS standards is mandatory

Improper accounting can't be corrected by disclosure or notes

If IFRS compliance would be misleading, deviation is allowed only if full disclosure is made (including quantified impacts)

Departure is not allowed because another method than IFRS would also give a true and fair view

Comparative financial statements

Must be provided at least annually

If the balance sheet date changes, financial statements cover a period < or > 1 year

→ disclosure needed:

Reason for the period difference

Fact there will be no comparability for income statement, changes in equity & cash flow statement

Annual Report

Composed of 4 main sections:

Economic Report / Business Review

→ strategic presentation of economic report (company performance, strategy, key figures, invest types…)

CSR / Sustainability Report

→ mandatory in EU, not in US but often required by investors / banks

Financial Statements

→ 5 IFRS requirements seen before

Governance Report / Corporate Governance

→ how company is managed, member of board, executive comite, salary, hierarchy,…

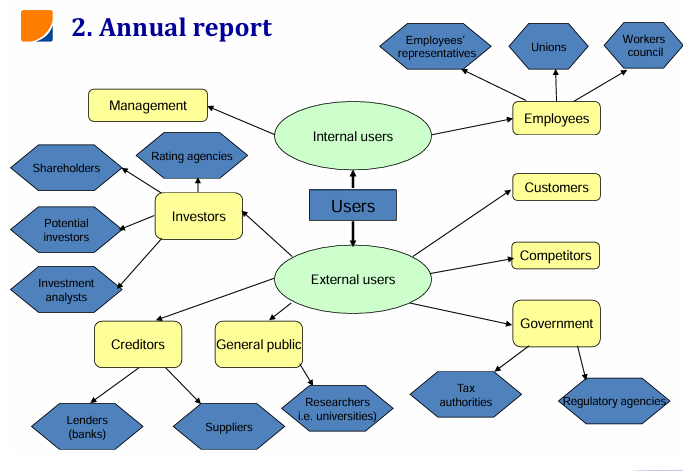

Who reads the financial statement?

Who is the Boss of a Company?

SHAREHOLDERS are the BOSS (not CEO or BOARD)

→ in listed companies:

Shareholders:

elect the board of directors (10 - 15 people) to represent their interests

have voting rights based on the number of shares they hold

approve major decisions such as mergers, K increases, company’s strategic direction

Board of Directors:

acts as link between shareholders + management

appoints CEO + supervises top management

validates + oversees execution of company’s strategy

removes CEO if performance / alignment fails

CEO & Executive Team:

Handle the daily operations + decision-making

Implement the strategy approved by the board

Are accountable to board + by extension to shareholders

CSR = Corporate Social Responsability

= new regulation in EU which obliges companies to prepare an integrated reporting where they present financial & non-financial data (carbon emission, footprint)

= focuses on ethical, social & environmental responsabilities

Is there an equivalent to IFRS for non-financial information (CSR)?

YES

equivalent to IFRS is GRI (Global Reporting Initiative)

mission is to enable organizations to be :

transparent

take responsibility for their impacts

through the world’s most widely used standards for sustainability

In EU = CSRD:

= all things that have to be disclosed in terms of sustainability, if you are a company (harmonized reporting to avoid greenwashing)

Part 1 - SPECIAL TRANSACTIONS

IAS 18 - Revenue recognition

IAS 11 - Long term contract

IAS 16 - P. P. & E.

IAS 40 - Invest properties

IAS 2 - P. P. & E. held for sale

IFRS 16 - Accounting for leases

IAS 21 - Foreign currency transactions

IAS 37 - Provision

IAS 38 - Intangible Assets

Revenue Recognition (IAS 18):

Objective IAS 18

Issues in Rev Recognition

Objective IAS 18:

→ prescribe the accounting treatment for revenue arising from certain types of transactions

2 issues in rev recog:

measurement of revenue based on:

FV of the consideration received

hierarchy for determining FV under IAS 39

→ Use a quoted market price if available

→ If not, use a valuation method based on market inputs and parameters

moment of recog → when to credit the income statement

Revenue Recognition (IAS 18) → types of rev recog:

Recognition of a sale of GOOD when:

Significant risks and rewards of ownership have transferred to the buyer

Seller loses effective control of the goods

Revenue can be measured reliably

→ closely linked to shipping and sales cut-off rules.

Shipped but not billed → rev = recognized

Not shipped & not billed → no rev recognized

Billed but not shipped → no rev recognized

Billed & shipped → rev = recognized

Recognition of a sale of SERVICE

by using percentage of completion method

→ Revenue is only recognized when service is actually delivered, often spread across multiple periods

Recognition of FINANCIAL & other INCOME

→ when it is probable that economic benefit will flow to the entity

Royalties → on an accrual basis (per the fee agreement) = PATENT

Dividends → when the shareholder’s right to receive payment is established = DIVIDENDS

Interest → on a time-proportion basis, using the effective interest rate (pro rata temporis)

Long Term Contract (IAS 11):

Objective IAS 11

Issues in LT Contract

IAS 11 → applies to construction contracts typically lasting more than 1 year + special inventory category = used “Contracts in Progress“

Issues at year end:

Work is in progress (WIP), but the delivery to the client has not occurred yes → which creates the following problems:

advance billings = made: is this a sale then?

cost occurred: should they be recorded in IStat as charges?

contract completed and delivered a profit/loss should be recognized: hasn’t part of the profit/loss already been generated?

Long Term Contract (IAS 11) → types of LT contract recog:

Percentage of Completion (PoC) Method:

Used when revenues and costs can be reliably measured → recognize revenue over time→ % of completion

= (Cost incurred)/(Total estimated costs)

Completed Contract Method:

If not reliably measurable → recognize all revenue and profit only at delivery

in FStat :

Asset = CIP inventory =

(Incurred costs + Estimated profit × % completion) − BillingsIf result is:

Positive (debit): show as a receivable (asset)

→ company has done more work than it has billed for

Negative (credit): show as a liability (due to client)

→ company has billed more than work performed

→ shows net work done BUT not yet billed or collected

Long Term Contract (IAS 11) → BE GAAP vs IAS

BE GAAP:

Board chooses PoC or Completed

Billings = liability

CIP stays as inventory

IAS 11:

PoC mandatory if conditions are met

Deducted from CIP inventory

Reclassified to receivable or liability

P. P. & E. - Default rules for PP&E (IAS 16):

recognition

PPE is initially recognized at cost, which includes:

Purchase price

+ Acquisition taxes & duties

+ Directly attributable costs (e.g., site prep, installation, transport, etc.)

+ Future dismantling/site cleanup costs, estimated and recorded as a provision

+ Borrowing costs: interest on loans is capitalized until the asset is ready for use (as per IAS 23, mandatory since 2009)

- Subsidies: deducted from the cost unless treated as deferred income (per IAS 20)

P. P. & E. - Default rules for PP&E (IAS 16):

depreciation rules

Depreciation* when:

PPE with a finite useful life must be depreciated.

*straight-line, degressive, SYD (not allowed under BE GAAP) / Units of production methods

NO Depreciation when:

PPE with an infinite useful life (e.g., land)

SEPERATE Depreciation when:

1 asset has multiple components with different useful lives

P. P. & E. - Investment properties (IAS 40)

When using the Fair Value Model for investment properties:

No depreciation is applied

Annual adjustments to fair value (market value) is done.

Gains/losses go directly to the income statement

IAS 40 recommends that fair value should ideally be determined by an independent real estate appraiser

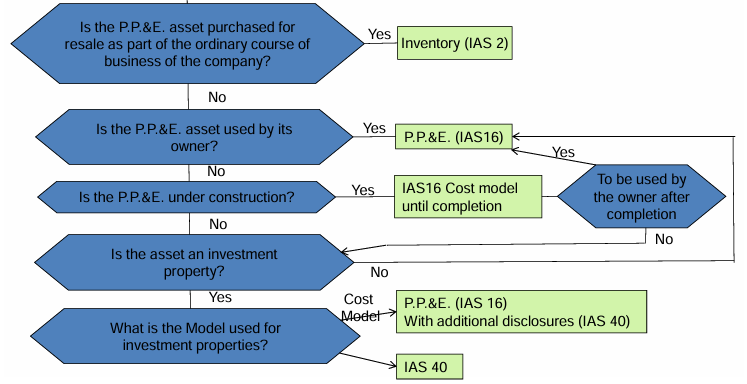

P. P. & E. - Summary

Foreign Currency Transactions (IAS 21):

examples

concepts

Transactions in which the amount is denominated in a foreign currency (FC)

Common examples:

Buying or selling goods/services in FC

Borrowing or lending in FC

Entering a foreign exchange contract (contract that gives the right to buy/sell a certain currency a couple of months before )

Acquiring/disposing assets or settling liabilities in FC

Key concepts:

Realized exchange difference: occurs when the transaction is settled

Unrealized exchange difference: occurs when amounts are remeasured at period-end but not yet settled

Foreign Currency Transactions (IAS 21):

recognition

FC transactions must be recorded at the spot rate on the transaction date

Using an approximate rate (e.g., average rate for the month) is allowed for practicality

exchange differences recognition:

during year N :

Realized exchange difference = when transaction is settled in the same period

BS end of the year:

Unrealized exchange difference = possible difference between spot rate and closing rate for monetary items

during year N+1:

difference between last BS amount and subsequent settlement / subsequent BS amount

→ All differences are recognized in income or expense.

Foreign Currency Transactions (IAS 21):

exception

Certain long-term FC items (e.g., loans to foreign subsidiaries or FC borrowings funding investments) are:

Unrealized exchange differences → Not recorded in income BUT go to equity (account: translation reserve)

Cumulative translation reserve recycled into income when the investment is disposed of

Foreign Currency Transactions (IAS 21) - BE GAAP:

For unrealized gains in BS:

Treatment is to record as deferred income (liability) instead of income

Realize as income only when settled

But treating as immediate income is acceptable if consistent with group policy

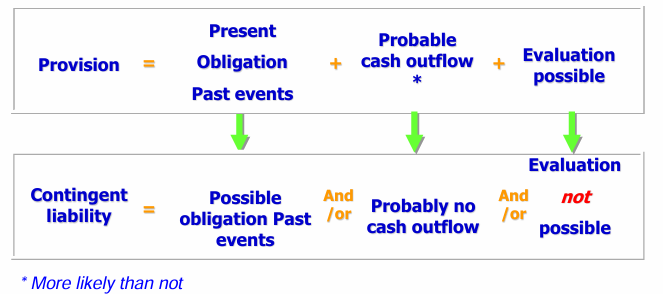

Provisions & Contigent liabilities (IAS 37):

objectives IAS 37

definition

IAS 37 aims to avoid:

Creating excess provisions

Misusing provisions for unrelated purposes

Reversing provisions in a way that distorts profits

Provision:

A liability with uncertainty, e.g., about amount or timing

types: litigation, termination, remediation, dismenting, environment, pension, garantie

Liability:

A present obligation (legal or constructive), arising from past events, that is expected to lead to an outflow of economic resources.

Provisions & Contigent liabilities (IAS 37):

recognition

recognize provision:

Present obligation

– Legal (contract/law) or

– Constructive (past actions created expectations)Obligation comes from a past event (not a future plan)

It is probable that the company will have to pay (outflow of economic resources)

Amount can be measured reliably

Provisions & Contigent liabilities (IAS 37):

obligations

Under IAS 37 company must have a present OBLIGATION to record provision

obligation is:

legal : Required by law, contract, or regulation

constructive : Arises from past actions that create a valid expectation (e.g., company policy or announcements)

→ A board decision alone is NOT enough unless it has been communicated and created a binding expectation

Obligating event:

creates a legal or constructive obligation

independently of entity’s future actions

leaves no realistic alternative to settling the obligation

Provisions & Contigent liabilities (IAS 37):

NO obligations

NO OBLIGATION → it may be a contigent liability or nothing

A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non occurrence of one or more uncertain future events not wholly within the control of the entity

Or

A present obligation that arises from past events but is not recognized because:

it is not probable that an outflow of resources will be required to settled the obligation OR

amount cannot be measure reliably

SUMMARY of RECOGNITION

Contingent liabilities and contingent assets are not recognized in the financial statements

BUT they must be disclosed in the notes, if material

Provisions & Contigent liabilities (IAS 37):

measurement

Use the best estimate of cost at the balance sheet date and consider:

Risks and uncertainties

Expert advice

Weighted average of possible outcomes

Present value (if impact is material)

Future events

Excluding gain on disposal

Reimbursements: Only recorded if virtually certain

Provisions must be reviewed yearly and reversed if not needed

Use provision only for the original purpose

Provisions & Contigent liabilities (IAS 37):

special cases

Future operating losses → ❌ no provision (no present obligation)

Onerous contracts → ✅ provision allowed

Example: A contract where fulfilling it costs more than the benefits

Not for normal purchase orders or construction contracts

Provisions & Contigent liabilities (IAS 37):

restructuring

Provision allowed if both:

There’s a detailed formal plan identifying:

Business or part of business concerned

Principal locations affected

Location, function and approximate number of employees to be compensated

Expenditures to be undertaken

When the plan will be implemented

Has raised valid expectation in those affected

→ measurement:

Only direct costs are included

Not future operating costs

Provisions & Contigent liabilities (IAS 37) - BE GAAP

Provisions are required if:

They result from a past event

Likely or certain to occur

May not be reliably measurable

Examples: pensions, major maintenance, guarantees, litigations

no legal or constructive obligation required

⚠ Belgian GAAP is more flexible — allows more provisions than IFRS + restructuring decision of the board of directors = sufficient

Intangible assets (IAS 38):

definition

Intangible asset is:

Identifiable, non-monetary, and has no physical substance

It must be:

Separable (can be sold or transferred) OR

Arise from contractual or legal rights

It is an asset & must be controlled by the entity and bring future economic benefits

Intangible assets (IAS 38):

measurement

An intangible asset is recognized only if:

Probable future economic benefits will flow to the entity AND

Cost can be measured reliably

Intangible assets (IAS 38):

recognition

Types of Intangible assets that are recognized:

Intangible assets purchased separately

Measured at cost, i.e.

Purchase price, including import duties and non-refundable taxes; and– Any directly attributable cost of preparing the asset for its intended use (ex; professional fees, costs of testing,…,etc.)

Intangible assets acquired as part of business combination

If it meets the definition of an asset and is identifiable

Measured at fair value

Internally generated intangible assets which meet the criteria of paragraphs 52-67 of IAS 38 (see below)

→ not recognized as intangible assets

Internally generated goodwill

Internally generated intangible assets which do not meet the definition of an intangible asset or the recognition criteria of paragraphs 52-67 of IAS 38 → i.e. brands, publishing titles, customer lists

Intangible assets (IAS 38) - Research & Development:

definition

Research: early investigation to gain new knowledge → Always expensed

Development: turning knowledge into usable or sellable products → May be capitalized if 6 criteria are met

Intangible assets (IAS 38) - Research & Development:

recognition

Qualifying internally generated intangible assets. Distinction between

Research phase

No asset recognition

Costs are expensed when incurred

Development phase: recognition of an intangible asset if, and only if, an entity can demonstrate:

The technical feasibility

Its intention to complete the intangible asset

Its ability to use and sell the asset

How the intangible asset will generate probable future economic benefits (namely, existence of a market)

Availability of resources (technical, financial and others) to complete the development and to use or sell the intangible asset

Its ability to measure reliably the expenditure

Directly attributable costs

Materials and services

Employee benefits

Fees to register legal rights

Amortisation of patents and trademarks used Recognition

NOT recognized: Internally generated brands, mastheads, publishing titles, customer lists and items similar in substance shall not be recognized Generally cannot be distinguished from the cost of developing the business

Intangible assets (IAS 38):

cost model

Intangible assets are measured at:

Cost − Accumulated amortisation − Impairment losses

Intangible assets (IAS 38):

amortization

Intangible assets with finite useful lives:

Allocate cost systematically over useful life

Assume residual value is zero unless:

A buyer commits to purchase it

There is an active market

Methods:

Reflect usage pattern of generation of economic benefit

If unknown → use straight-line

Must review every year when required by economic circumstances

Intangible assets with indefinite useful lives:

Assets with indefinite useful lives:

No amortisation

Must be tested for impairment yearly

If the carrying amount > recoverable amount → record impairment loss

Intangible assets (IAS 38) - BE GAAP

Formation/start-up expenses → may be capitalized under Belgian GAAP

R&D:

Can be expensed or capitalized if not exceeding a prudent estimate of value

Only direct costs allowed

Revaluation is not allowed

Accounting for Leases (IFRS 16):

before IFRS 16 and now

Before IFRS 16 (under IAS 17):

Only finance leases were shown on the balance sheet.

Operating leases were “off-balance sheet”: no liability or asset recorded.

Under IFRS 16:

→ all leases are on the BS - unless they are:

Short-term (less than 12 months), or

Low-value items (e.g., small office equipment)