Microeconomics Theme 3 <3

5.0(1)

5.0(1)

Card Sorting

1/140

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

141 Terms

1

New cards

1 niche market

2 diseconomies of scale

3 conflicting objectives (family business)

2 diseconomies of scale

3 conflicting objectives (family business)

why firms stay small

2

New cards

1 higher profits

2 economies of scale

3 increased market share and price setting power

2 economies of scale

3 increased market share and price setting power

why firms grow big

3

New cards

1 internal growth (use profits to increase output)

2 external growth (merger or takeover)

2 external growth (merger or takeover)

how firms grow big

4

New cards

1 financial constraints

2 size of market

3 regulation

4 competition

2 size of market

3 regulation

4 competition

what stops growth

5

New cards

combination of two or more companies into a single firm

merger

6

New cards

horizontal and vertical

2 types of mergers

7

New cards

a merger that occurs in the same stage of production

horizontal integration

8

New cards

a merger at different stages of the production away from the consumer

backward vertical integration

9

New cards

a merger at different stages of the production closer to the consumer

forward vertical integration

10

New cards

two completely different firms merging

conglomerate integration

11

New cards

1 reduce competition

2 economies of scale

3 monopoly power

2 economies of scale

3 monopoly power

advantages of horizontal integration

12

New cards

1 dis economies of scale

2 lack of synergy

2 lack of synergy

disadvantages of horizontal integration

13

New cards

1 control of the supply chain

2 improved access to raw materials

2 improved access to raw materials

advantages of vertical integration

14

New cards

1 no expertise in the industry

2 lack of synergy

2 lack of synergy

disadvantage of vertical integration

15

New cards

1 reduced risk by diversitification

2 increased consumer base

2 increased consumer base

advantage of conglomerate integration

16

New cards

1 lack of synergy

2 no expertise in the market

2 no expertise in the market

disadvantage of conglomerate integration

17

New cards

When a firm splits into two or more independent firms

demergers

18

New cards

1 reduce diseconomies of scale

2 new separate firms can specialise

3 a firm can sell one of its demerged divisions and its assets to increase SNP

4 reduce conflicts between different cultures within a firm

2 new separate firms can specialise

3 a firm can sell one of its demerged divisions and its assets to increase SNP

4 reduce conflicts between different cultures within a firm

Reasons for demergers

19

New cards

business - in SR, there is cost of administration and in LR high returns so increases AC

workers - job losses, increase in managers

consumers - impact on price depends on scale of competiton

workers - job losses, increase in managers

consumers - impact on price depends on scale of competiton

impacts of demergers

20

New cards

maximising profits

private sector

21

New cards

maximising welfare of citizens

public sector

22

New cards

An organisation whose main objective is not to make money e.g. charity

non profit organisation

23

New cards

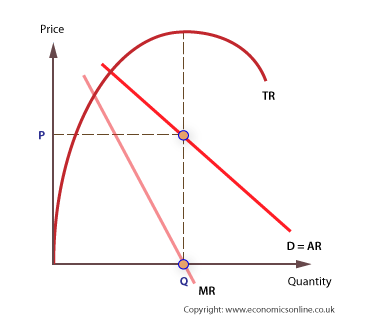

price x quantity

total revenue

24

New cards

total revenue increases

elastic good price decreases

25

New cards

total revenue decreases

inelastic good price decreases

26

New cards

total revenue/quantity

average revenue formula

27

New cards

the revenue you receive per unit of output

average revenue

28

New cards

additional revenue received from one extra unit of output

marginal revenue

29

New cards

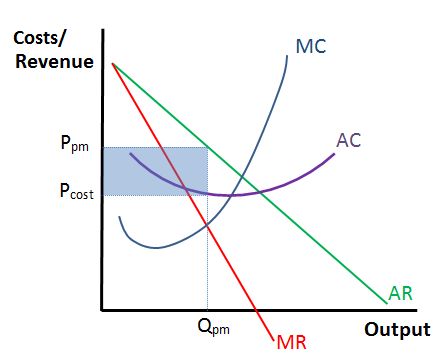

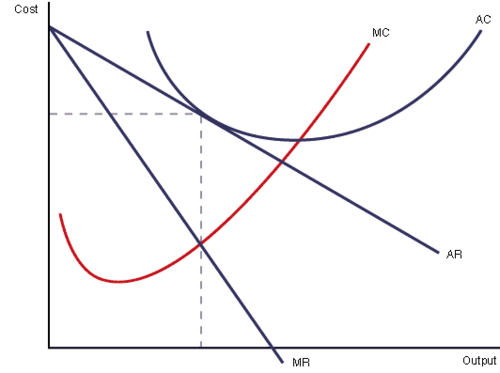

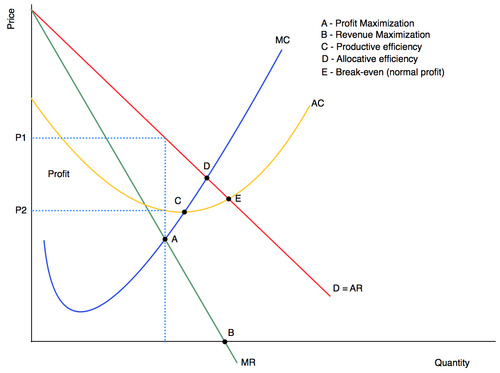

MC=MR

profit maximisation point

30

New cards

MR=0

revenue maximisation point

31

New cards

AR=AC

sales maximisation point

32

New cards

fixed costs + variable costs

total cost formula

33

New cards

total cost/quantity

average cost formula

34

New cards

(AR-AC) x quantity

profit formula

35

New cards

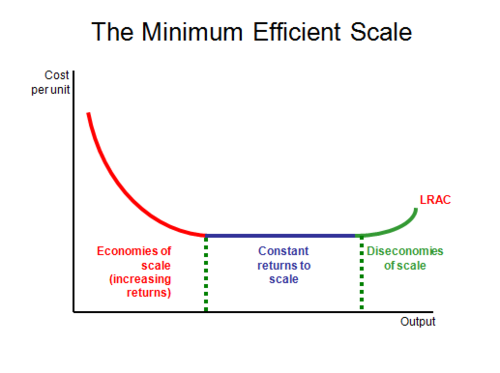

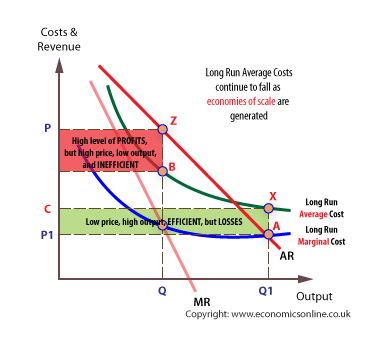

all factors of production is variable

long run average cost

36

New cards

at least one factor of production is fixed (usually capital)

short run cost curve

37

New cards

an additional factor of production will result in a smaller increase in output

the law of diminishing marginal returns

38

New cards

output increasing as cost per unit decreases

economies of scale

39

New cards

1 managerial

2 financial

3 commercial

4 technical

5 marketing

2 financial

3 commercial

4 technical

5 marketing

5 types of economies of scale

40

New cards

employ specialist managers

increase division of labour

increase efficiency

decrease LRAC

increase division of labour

increase efficiency

decrease LRAC

managerial EofS

41

New cards

bigger firms are perceived as less risky by financial institutions

lower interest rates when taking a loan

decrease lRAC

lower interest rates when taking a loan

decrease lRAC

financial EofS

42

New cards

bulk buying decreases LRAC

commercial EofS

43

New cards

specialist capital decreases LRAC

technical EofS

44

New cards

lower unit cost for advertising as the firm expands

marketing EofS

45

New cards

output increases as cost per unit increase

diseconomies of scale

46

New cards

1 lack of motivation

2 loss of coordination

3 poor communication

4 organisational slack

2 loss of coordination

3 poor communication

4 organisational slack

4 types of diseconomies of scale

47

New cards

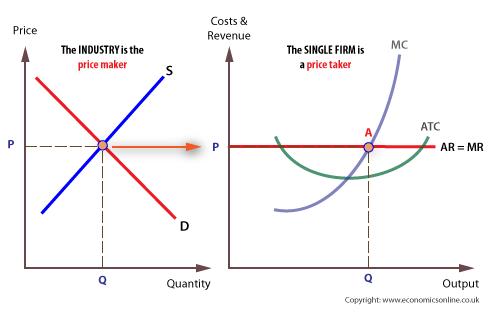

a firm with a lot of market share so they have price setting power

price maker

48

New cards

firms that accept the market price

price taker

49

New cards

1 no barriers to entry or exit

2 infinite amount of buyers and sellers

3 homogeneous good

4 perfect information

2 infinite amount of buyers and sellers

3 homogeneous good

4 perfect information

Characteristics of perfect competition

50

New cards

in the SR they make SNP

new firms enter the market as profits act as a signal

supply increases

in the LR firms make no SNP

new firms enter the market as profits act as a signal

supply increases

in the LR firms make no SNP

price takers making profit in the short run

51

New cards

in the SR they make a loss

firms leave the market as loss acts as a signal

supply decreases

in the LR firms make no SNP

firms leave the market as loss acts as a signal

supply decreases

in the LR firms make no SNP

price takers making a loss in the short run

52

New cards

AR shifts with the dependants of demand PACIFIC

what shifts AR

53

New cards

AC shifts when fixed costs changes but MC does not

AC and MC shifts when variable costs shift

AC and MC shifts when variable costs shift

what shift AC

54

New cards

the production of any particular good in the least costly way (lowest point on the AC curve)

productive efficiency

55

New cards

(P=MC)

allocative efficiency

56

New cards

uses SNP to innovate

dynamic efficiency

57

New cards

(any point on the AC curve)

x efficiency

58

New cards

AVC is higher than AR then the firm leaves the market immediately

shut down point

59

New cards

1 low barriers to entry of exit

2 many buyers and sellers

3 slightly differentiated goods

4 firms aim to profit maximise

2 many buyers and sellers

3 slightly differentiated goods

4 firms aim to profit maximise

characteristics of monopolistic competition

60

New cards

SNP acts as a signal

new firms enter the market

increase in competition

increase in AC (marketing)

decrease in AR

no SNP

new firms enter the market

increase in competition

increase in AC (marketing)

decrease in AR

no SNP

firms in monopolistic competition in the LR

61

New cards

1 5 firms have 60% market share

2 high barriers to entry and exit

3 slightly differentiated goods

4 firms aim to profit maximise

5 firms are interdependent

2 high barriers to entry and exit

3 slightly differentiated goods

4 firms aim to profit maximise

5 firms are interdependent

oligopoly characteristics

62

New cards

high concentration ratio in the market and the demand is inelastic

oligopoly

63

New cards

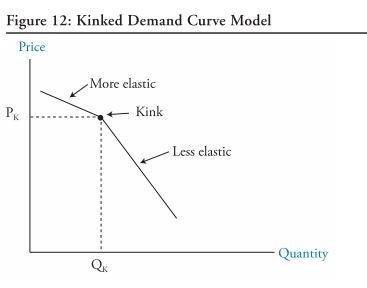

price rigidity

if a firm increases their price, then other firms will not (demand is elastic)

if a firm decreases their price, then other firms will decrease prices (demand is inelastic)

if a firm increases their price, then other firms will not (demand is elastic)

if a firm decreases their price, then other firms will decrease prices (demand is inelastic)

kinked demand curve

64

New cards

two existing firms with high market share engage in price fixing or quality fixing (illegal)

collusion

65

New cards

firms openly speak and cooperates on explicit price fixing

overt collusion

66

New cards

firms indirectly cooperates on price fixing

tacit collusion

67

New cards

1 small number of firms

2 demand is inelastic

3 firms output can be monitored easily

4 incomplete information

2 demand is inelastic

3 firms output can be monitored easily

4 incomplete information

collusion characteristics

68

New cards

1 enforcement problems

2 falling market demand

3 successful entry of non cartel firms into the market

4 market regulators

5 whistle blowers

2 falling market demand

3 successful entry of non cartel firms into the market

4 market regulators

5 whistle blowers

why collusion breaks down

69

New cards

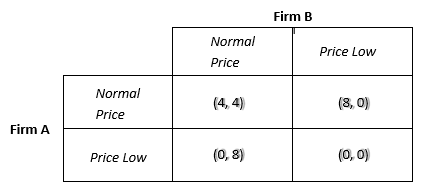

the payoff firms get if they increase price or decrease price

pay off matrix

70

New cards

firms collude and set a high price to gain joint SNP

joint profit maximisation

71

New cards

while colluding a firm could decrease price and break the agreement to gain more SNP while the other firm gain less profit

first movers advantage

72

New cards

one firm supplying the only good or service dominating the market with 100% concentration

pure monopoly

73

New cards

one firm has 25% or more concentration ratio

legal monopoly

74

New cards

one firm has 40% concentration ratio

dominant monopoly

75

New cards

1 one firm in the market

2 high barriers to entry

3 firms aim to profit maximise

4 price setting OR quantity setting power but not both

2 high barriers to entry

3 firms aim to profit maximise

4 price setting OR quantity setting power but not both

monopoly characteristics

76

New cards

government - corporation tax, compete on international market

worker - increase job security, bonuses and perks

consumers - innovation in the market

other firms - secure outlet for suppliers, constant quality for firms

worker - increase job security, bonuses and perks

consumers - innovation in the market

other firms - secure outlet for suppliers, constant quality for firms

benefits of monopoly

77

New cards

government - often avoid tax

workers - low bargaining power, low job security (increase in capital)

consumers - less choice, higher prices, lower quality

other firms - monopsony set low prices for the supplier

workers - low bargaining power, low job security (increase in capital)

consumers - less choice, higher prices, lower quality

other firms - monopsony set low prices for the supplier

costs of monopoly

78

New cards

sunk costs are high so economies of scale is constant

natural monopoly

79

New cards

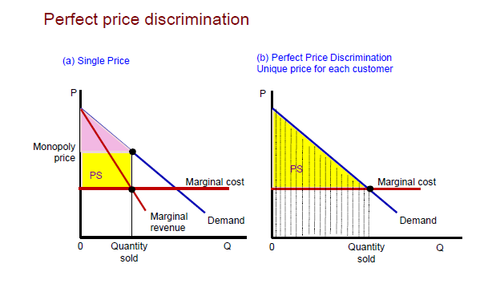

monopolies can discriminate on price on different consumers who have different PED to increase their SNP

price discrimination

80

New cards

demand is inelastic

demand is irresponsive to a change in price

train firms charge higher prices

demand is irresponsive to a change in price

train firms charge higher prices

peak traveller (commuter)

81

New cards

demand is elastic

demand is responsive to a change in price

train firms charge lower prices

demand is responsive to a change in price

train firms charge lower prices

off peak travellers (leisure)

82

New cards

a firm which is the sole buyer of resources or supplies

pure monopsony

83

New cards

firms have some control over their supplier

monopsony power

84

New cards

supplier - secure revenue stream

monospony - increase bargaining power

consumer -

monospony - increase bargaining power

consumer -

benefits of monopsony

85

New cards

supplier - reduced bargaining power

monopsony - suppliers may shut down

consumer -

monopsony - suppliers may shut down

consumer -

costs of monopsony

86

New cards

ease of which firms enter or exit the market

contestability

87

New cards

1 low barriers to entry or exit

2 good information

3 low sunk costs

2 good information

3 low sunk costs

what affects contestability

88

New cards

1 limit pricing or predatory pricing

2 economies of scale and product differentiation

3 patents, copyrights and licensing requirements

2 economies of scale and product differentiation

3 patents, copyrights and licensing requirements

types of barriers of entry or exit

89

New cards

1 no physical location

2 consumers can be reached easily

3 brand awareness reaches further

4 disrupting existing markets

this increases contestability

2 consumers can be reached easily

3 brand awareness reaches further

4 disrupting existing markets

this increases contestability

technology reducing contestability

90

New cards

the additional quantity of output produced by an additional unit of labour

marginal physical product of labour (MPPL)

91

New cards

the additional revenue received by a firm by using an additional unit of labour

marginal revenue product of labour (MRPL)

92

New cards

MPPL x MR

MRPL formula

93

New cards

each additional unit of labour, brings less additional productivity because capital is fixed

the law of diminishing marginal productivity

94

New cards

labour is homogenous

prefect information

perfect labour mobility

workers and firms are price takers and they must accept the industry wage rate

no barriers to entry or exit

prefect information

perfect labour mobility

workers and firms are price takers and they must accept the industry wage rate

no barriers to entry or exit

perfectly competitive labour market

95

New cards

there is an inverse relationship between w/r and quantity of labour

how w/r affects demand for labour

96

New cards

when the w/r is low the capital will be substituted for labour as the labour is cheaper

labour substitution

97

New cards

when the w/r is high the labour will be substituted for capital as the capital is cheaper

capital substitution

98

New cards

capital becoming expensive

deregulation

PACIFIC

deregulation

PACIFIC

shifts in the demand for labour curve

99

New cards

the demand of labour is dependant on the demand of the good

derived demand

100

New cards

we cant workout individual productivity as people work in teams

criticism of the law diminishing marginal productivity