Q5T10

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

7 Terms

volatility of the rates of return.

The variance of an investment's returns is a measure of the…

Investor panic causing security prices around the globe to fall precipitously

Which one of the following is an example of systematic risk?

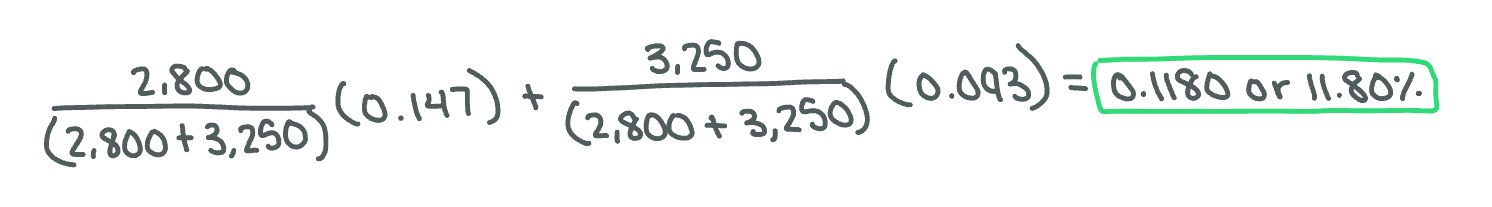

11.8%

You own a portfolio that has $2,800 invested in Stock A and $3,250 invested in Stock B. The expected returns on these stocks are 14.7 percent and 9.3 percent, respectively. What is the expected return on the portfolio?

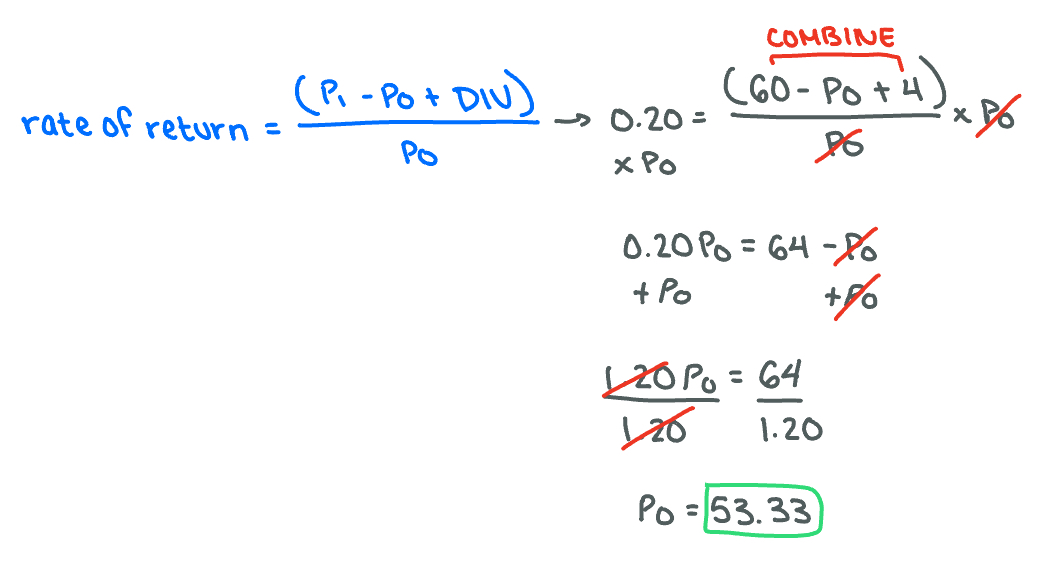

$53.33

Which of the following statements is true for a stock that sells now for $60, pays an annual dividend of $4.00, and experienced a 20% return on investment over the past year? Its price one year ago was…

Il and III

You are considering forming a portfolio of the following six assets.

Stock A with a beta of 1.2

Stock B with a beta 0.5

Stock C with a beta 1.5

Stock D with a beta 1.6

US Treasury bill

A mutual fund of all assets in the market (i.e., a market portfolio).

Your goal is to create a portfolio with a beta of 1.0. Which of the following are possible options for you to achieve this goal?

I. 33% in Stock A, 55% in Stock B, and 21% in Stock D

II. 100% in the mutual fund

III. 25% in Stock B, 50% in the mutual, 25% in Stock C

IV. 30% in Stock A, 50% in Stock C, 20% in US Treasury bill

Weight of debt increases; weight of equity decreases.

Assume that Company ABC currently has 300,000 shares of stock outstanding that trade at $40 per share. It also has 25,000 units of bond outstanding and trading at 95% of par value. Management decides to issue 5,000 shares of new stock. Upon the news of additional stock sales, the company stock price decreases to $35 per share (and hence the new stocks are sold at $35 per share). Bond price does not change in response to the news. How does the capital structure weights of the Company change due to the new stock sales?

11.48

Titan Mining Corporation has 8 million shares of common stock outstanding, 5 million shares of preferred stock outstanding, and 100,000 units of 9 percent semiannual bonds outstanding, par value $1,000 each. The preferred stock pays a dividend of $6 per share. The common stock currently sells for $32 per share and has a beta of 1.15, the preferred stock currently sells for $67 per share, and the bonds have 15 years to maturity and sell for 91 percent of par. The market risk premium is 10 percent, T-bills are yielding 5 percent, and Titan Mining's tax rate is 35 percent. If Titan Mining is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows? Round your answer to the nearest basis point, or hundredth of percent. (NOTE: enter your answer as percent without the percentage sign. For example, if your answer is 5.45%, enter 5.45).