FAR

1/248

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

249 Terms

What is in a full set of financial statements?

stmt of finn postition- balance sheet(shows finn risk, st liquidity and long term solvency

a classified bs shows current and noncurrent assets and liablites

statement of earnings(I/s)- performance and operating risk

stmt of comprehensive income- net income + OCI

stmt of cf- quality pfo earnings and growth protentional

stmt of owners equity- why the stockholder’s equity changed

Components of a single step vs multi step Income statement

Single step:

all revenues and gains

(all expenses and losses)

_________________________

pretax income

(income tax expense)

_________________________

net income

multistep income statment:

Sales

(COGS)

_________________

Gross Profit

(Operating Expenses)- SG&A, Dep. exp

_______________________

Operating Income

(Nonoiperating gains and losses)- extraordinary/infrequent items)

___________________________

pretax income

(income tax expense)

__________________________

Net Income

±Disc Ops

__________________

Net income

freight out is a selling expense, frieght in is materails

How are disc ops reported

net of tax

below continunig operations and before net icome

When is something disc ops? What could it include?

this is a disposal or held for sale component that represents a strategic shift and has or will have a major effect on an entity’s operations and financial results

includes:

income/loss from the results of operation of the component

gain/loss on disposal

impariment loss of a component

Recoverabioity thest first

calculated by comparing NRV to BV

if the impairment loss ever gets reversed it can not get raised over the orgianl NBV

During f1-m1 two types of foreign currency transactions are discussed. what are these and what are the differences?

Generally foreign currency transactions flow to the income statment

these occur when”

a company buys from or sells to a foreign company with whom it has no ownership interenst

the company agrees to pay or accept payment in a foriegn currency

AP or AR ussually

this flows throguh the incoem statment

AP and AR exchange(spot) rates are evaluated at the date the arrangment is made, each year for the BS prep and when it is settled

However if teh purpose is hedging or if it is an intercompany transaction it flows throguh the statement of comprensive income

What is on the statement of comprehensive income

PUFI

Pension Adjustment

Unrelized gains and losses on AFS debt securities and derivates that are CF hedges

not trading, not equities

Foreign currency items and foreign currency hedges

a foreign subsidary being consolidated with a parent

hedging? idrk

instruemtn specific credit risk

if discount goes up FMV goes down which causes a gain

if discount goes down the fmv of liability foes up and causes a loss

Not: AFS equity securities, not actual pension fund returns

What does the statement of comprehensive income represent?

A change in equity(net assets) of a business enterprise during a period from transactions, other events and circumstances from non-owner sources

what are reclassification adjustments?

Moving AOCI items from OCI to the income statement

maybe when unrealized losses become realized losses

what is on the teh statement of OCI

OCI BOY

± PUFI gains and losses in CY

± reclassification adjustments

______________________

ending AOCI

could use teh one statement approach(which combines it with teh I/S

or the two statment appraoch which gives it its own statement

How is income tax beneift/or expense allocated to OCI

must be done on either: the face of the f/s or in the notes

in fact this is how all tax effects are dealt with for OCI

If the two statement method for reporting comprehensive income is used, companies have the choice of reporting each line net of tax or before related taxes, with one amount shown for the aggregate income tax expense or benefit related to the total of all comprehensive income items. |

This is true for either the two statemnt or one statemnet method |

Reporting requirement for OCI

pretty much everythign besides teh statment of OCI(two or one step appraoch) and AOCI(represented in the IS must be disclosed on face or in ntoes

What are teh filing deadlines for U.S registered companies

60 days for large accelerated files($700 Million market value)

75 days for accelarated filers(75-700mill & 100 mil rev)

90 days for all others(100 mill in rev or less)

Part II, Item 7 of 10k

MD&A

provides perspectives through the eyes of management

should include:

material info relevement to the assesment of the finn condition and results of ops

summarized finn and op results, trends, risks and uncertainties

materail changes relative to the prior period

critical accounting estimates and assumptions

Part 7a will show quantitiave and qualitative disclousures about market risk

what is in part II item 8 of the 10K

the f/s and suplementary data

all f/s and the auditors report and certifications from teh CEO and CFO

10Q filing deadlines

must be filed for teh first 3 quarters:

40 days for large accelarated and accelrated filers

45 days for all others

What time periods are included in the various statements on the 10K

BS covers 2 most recent fiscal years

IS and SOCI covers each of the three years preceding the bs date

socf and changes in ornwers equity’s teh same

what notable differences and time periods are included in the 10Q(when compared with the 10K)

the f/s must include a detailed description of any adjustments that are not normal and reoccurring

lets say this is for the 6/30/y2 fs

BS should show presentations for the end of the most recent fiscal quarter, adn as of the preceding fiscal year

if you didn’t want to do the entire preceding fiscal year you could do the corresponding fisical quarter for last year

we want:

6/30/y2

12/31/y1

could also opt to do 6/30/y1

IS and OCI

most recent quarter, period between end of the preceding fiscal year and teh end of most recent quarter, and for the corresponding period of the preceding fiscal year

quarter of 6/30/y2

period of 1/1/y2-6/30/y2

quarter of 6/30/y1

period of 1/1/y1-6/30/y1

SOCF

the YTD for this quarter and PY YTD

YTD 6/30/y2

YTD 6/30/y1

what iis teh 8-k and what are teh required deadlines

file when there is a material event

you have 4 business days

How to calculate diluted eps given convertible bonds?

the numerator is increased by the after-tax interest expense

bonds x par value x interest x (1-tax rate)

denominator increased by the new shares that would be created

How to calculate diluted eps given preferred stock

the numerator will increase by the preferred dividends that would be saved

denominator: number of shares that will increase by preferred stocks being converted into common stock

how to calculate dilute eps given stock options or warrants

assumes that options or warrants are excercised ath begining of the year and that the company uses those proceeds to purcahse treasury stock

Numerator: not effected

Denominor: effected by the net number of new shares taht can be repurchased by the excersie(strike) price

step 1: calculate net proceeds

step 2: figure out how many shares can be purchased with those proceeds

step 3: figure out how many new shares need to be created

shares needed- shares repurchased

How is dilution from contigent shares calculated

a contract will be settled through CS in teh future

all dilutive contingent shares are included in basic eps if(and as of teh date) all conditions for issuance are met

this is retroactive so if the contract is settled and shares are issued at teh end of period you pretend it was the beginginng

Disclosure requirements for EPS

basic and diluted eps for both continuing operations and net income should be reported on teh face of teh I/S and the effects of disc ops should be reported on the face of the I/S or in the notes

What does it mean for something to be antidilutive? When referring to EPS

for convertiable bonds or convertiable PS this means it makes EPS higher, for options/warrants it means the strike price must be less than the market price

What is the direct vs the indirect method for foreign currency translation

Direct method says how much US$$ we can buy for 1 unit of another currency:

1 peso cost $1.47

Indirect method says the foreign price of unit of domestic currency

0.68 euro buys $1

Book value per share calculation

BV= common shareholders’ equity/common shares outstanding

common shareholders equity= assets- liabilites- preferred equity- dividends in arrears

noncum vs cum dividends

cum diviends use the dividend rate to continually calcualte them

accumm amount is referred to as div in arrears

particpacting vs nonpartcipating ps

o Fully participating means that preferred shareholders participate

in excess dividends without limit.

proratted amoung par value and amount outstanding

o Generally, preferred shareholders receive their preference

dividend first, and then additional dividends are shared between

common and preferred shareholders.

o Partially participating means preferred shareholders participate in

excess dividends, but to a limited extent (e.g., a percentage limit).

ps stock prefernce upon liquidation guidelines

o Preferred stock may include a preference to assets upon

liquidation of the entity.

o If the liquidation preference is significantly greater than the par

or stated value, the liquidation preference must be disclosed.

o The disclosure of the liquidation preference must be in the

equity section of the balance sheet, not in the notes to the

financial statements.

callable ps

• Callable (Redeemable) Preferred Stock

o May be called (repurchased) at a specified price (at the option

of the issuing corporation).

o The aggregate or the per-share amount at which the preferred

stock is callable must be disclosed either on the balance sheet

or in the footnotes.

manditoriyly redeemable ps

is a liability:

o Issued with a maturity date.

o Similar to debt, mandatorily redeemable preferred stock

must be bought back by the company on the maturity date.

o Must be classified as a liability, unless the redemption is

required to occur only upon the liquidation or termination of

the reporting entity.

additional paid in capital

• Generally contributed capital in excess of par or stated value.

• Can also arise from many other different types of transactions.

• May be aggregated and shown as one amount on the balance sheet.

If someone gives us(the company) PPE in exchange for CS how is that valued? If we give stockholders PPE as dividends how is that valued?

If we recevie PPE for stock that is valued at the valuation of the stock

if we give PPE we recognize it at net realizable value and recognize a gain or loss on the difference in NRV and BV

Formula to calculate Retained earnings

Net income/loss

– Dividends (cash, property, and stock) declared

± Prior period adjustments

± Accounting changes reported retrospectively

Retained earnings

approriated retained earnings

Classification of Retained Earnings (Appropriations)

• May be classified as either appropriated or unappropriated.

• The purpose of appropriating retained earnings is to disclose to the shareholders (usually the common shareholders) that some of the retained earnings are not available to pay dividends because they have been restricted:

o for legal or contractual reasons; or

o as a discretionary act of management for specific contingency purposes.

E.g., debt covenants, protect credit

rating, maintain financial ratios, etc.

no requirement to approriate cummulative PS

What happens after the approriated retained earnings are used

any excess is transferred into unappropriated Re

What happens to gains and losses of treasury stock

the "gains and losses" are recorded as a direct adjustment to stockholders' equity and are not included

in the determination of net income; and

Cost vs par method of treasury stock journal entry at buyback, GIVEN

orginal issuance:

10,000 shares $10 par value, CS sold for $15 per share

buy back:

200 shares were repurchased for $20 per share

Cost:

Treasury Stock(price x sh) 4,000

Cash 4,000

Par:

Treasury Stock(sh x par) APIC-CS(orginal price-par x sh) Retained Earnings(sale p.- og pr s sh) Cash(sale p. X sh) *PIC-Ts could’ve been used instead of RE |

Given:

orginal issuance:

10,000 shares $10 par value, CS sold for $15 per share

buy back:

200 shares were repurchased for $20 per share

What is the je under the cost and par method for the following:

100 shares repurchased for $20 were resold for $22(par was $10)

Cost:

Cash(sh x price) 2,200

Treasury Stock(sh x og. price) 2000

APIC-TS(og. Price-sale price x sh200

Par:

Cash(sh x price) 2,200

Treasury Stock(sh x par) 1,000

APIC-CS(sale price-par x sh) 1,000

for cost use APIC- TS for all gains and for losses where there is enough in APIC-TS otherwise use RE

How do you account for donated Treasury Stock

• A company's own stock received as a donation from a shareholder.

• There is no change in total shareholders' equity as a result of the donation, but the number of shares outstanding decreases, resulting in higher book value per common share.

• The company should record donated stock at fair market value,

as follows:

DR Donated treasury stock (at FMV) $XXX

CR Additional paid-in capital (at FMV) $XXX

• If the donated stock is sold, the journal entry would be:

DR Cash (at sales price) $XXX

DR Additional paid-in capital (if SP < original FMV) XXX

CR Additional paid-in capital (if SP > original FMV) $XXX

CR Donated treasury stock (at book value, or original FMV) XXX

if there is a gain/loss flow into apic

How to account for stock subscription

In short I issue stock with the expectation the investor will pay me back later

• Frequently, a corporation sells its capital stock by subscription.

• This means that a contractual agreement to sell a specified number

of shares at an agreed-upon price on credit is entered into.

• Upon full payment of the subscription, a stock certificate evidencing

ownership in the corporation is issued.

accounting methods:

• When the subscription method is used to sell capital stock:

o a subscriptions receivable account is debited;

o a capital stock subscribed account is credited; and

o a regular additional paid-in capital account is credited.

• Subscriptions not paid for at year-end are treated as a contra-equity item,

offsetting the amount of par (or stated) value and additional paid-in capital

related to subscriptions not paid for at year-end.

• If subscriptions are paid after year-end but before the financial statements

are issued, the subscriptions receivable may be reported as an asset and

will increase paid-in capital at year-end.

at collection date get rid of receivable

at issuance:

get rid of the CS subscribed account and flwo into CS

At par value APIC-CS has already been accoutned for

What to do when someone defaults on a stcok subscription

three options assuming the customer paid for some but not all:

Issue stock in proportion to amount paid

refund the partial payment

Retain the partail payment as liquidated damanges and trasnfer the the CS Subscribed into APIC

Stock rights accounting practices

Stock Rights

• Provides an existing shareholder with the opportunity to buy additional shares.

• The right usually carries a price below the stock's market price on the date the rights are granted.

• The issuance of stock rights requires a memorandum entry only.

• It is possible that the rights may subsequently be redeemed by the company, which will cause a decrease in stockholders' equity in the amount of the redemption price.

JE:

no JE until excersised, when excercised:

Cash

Common stock

APIC

Scrip Dividends

• May be used when there is a cash shortage.

• A special form of notes payable whereby a corporation commits to paying a dividend at some later date.

• On the date of declaration:

o retained earnings is debited; and

o notes payable (instead of dividends payable) is credited.

• Some scrip dividends even bear interest from the declaration date to the date of payment (and, thus, require accrual).

Liquidating Dividends

• Occur when dividends to shareholders exceed retained earnings.

• Dividends in excess of retained earnings would be charged

(debited) first to additional paid-in capital and then to common or

preferred stock (as appropriate).

• Reduce total paid-in capital.

What are stock dividends?

• Distribute additional shares of a company's own stock to its shareholders.

• The treatment of stock dividends depends on the size (percentage) of the dividend in proportion to the total shares outstanding before the dividend.

o The size of the stock dividend dictates the amount by which to reduce

retained earnings.

o Small stock dividend: RE by FMV

o Large stock dividend: RE at par

How are small stock dividends accoounted for?

If stock dividend involves less than 20%-25% shares of outstanding stock, account on FV |

Announcement: RE xx CS-Dividend distribution xx APIC-CS xx |

Issuance CS- dividend distribution xx CS-Par xx |

How are large stock dividends accounted for?

If the stock dividend involves more than 20%-25% shares of outstanding stock, account for par value of the stock |

Annoucment RE xxx CS-Div Distrivutionn xx |

Issued CS-Div distribution Common @par xx |

Compare stock dividends and stock splits over the following categories:

Par Value |

# of shares |

Stockholders equity |

Journal entry? |

Stock Dividend | Stock Split | |

Par Value | No effect | Decreases based on amount of split |

# of shares | increases | increases |

Stockholders equity | NE(retained earnings decreases and common stock increases) | NE(no change in composition) |

Journal entry? | Yes! | No! |

What is a reverse stock splut

Reverse Stock Splits

• Involve reducing the number of shares outstanding and increasing the

par (or stated) value proportionately.

• One way to reduce the amount of outstanding shares is to:

o recall outstanding stock certificates; and

o issue new certificates.

statement of changes in SE

• Provides specific information about changes in an entity's primary equity

components, including:

o capital transactions and distributions to shareholders;

o a reconciliation of retained earnings; and

o a reconciliation of the carrying amount of each class of equity capital,

paid-in capital, and accumulated other comprehensive income.

How is donated TS accounted for?

Same as regular

How are stock dividends and stock splits accounted for in WASCO

act as if it happened at the beigning of the year

How are stock dividends accounted for on the book of the receipients?

Not as incomw

How to calculate comprensive income(also is it before or after tax)

Net Income

± any post tax PUFI items

_______________

Comprhensive Income

Notes:

The individual components of other comprehensive income may be either reported on a before tax basis with an aggregate tax amount reported after these items or individually on a net of tax basis.

Should interest paid be included in foreign exchange gain/loss?

Yes

What are teh accounting effects of the fo

How are purchase orders accounted for

No JE requried

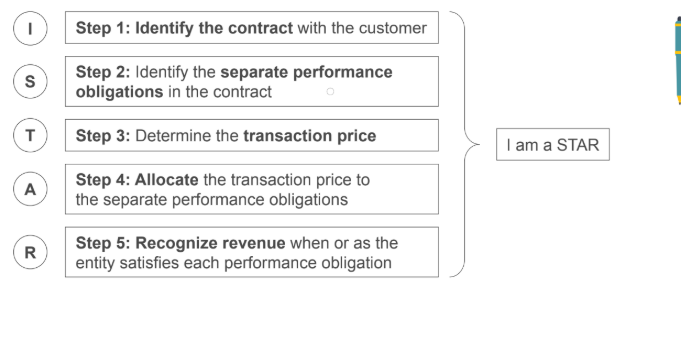

What is the five step approach for determining revenue recog.?

What happens during the first stpe of the rev. recog process: idenitfy the contract

What if the criteria aren’t met

What if money has been given(like a deposit) but the criteria are not all met

What if there are multiple contracts with the customer?

What if you modify the contract

Identify the contract

A contract is an agreement between two or more parties that creates enforceable rights and obligations, can be: verbal, written, or implied

So is everything a contract? NO, for something to be a contract, it must meet all five of these criteria:

All parties have approved that contract and have committed to perform their obligations

The rights of each party regarding contracted goods or services are identified

Payment terms can be identified

Contract has commercial substance, meaning there is an expected change in future CF

It is probable that the contract will be fulfilled

What if the criteria aren’t met

Reassessment should be regular

What if money has been given(like a deposit) but the criteria are not all met

This is unearned revenue, unless:

The consideration is nonrefundable, and

Either there are no remaining obligations to transfer goods/services, or teh contract has been terminated

What if there are multiple contracts with the customer?

This should be combined and accounted for as a single contract if:

The contracts are negotiated as a package with a single commercial objective

Consideration for one contract is tied to teh performance or price of another contract; or

The goods or services represent a single performance obligation

What if you modify the contract

After both parties approve it you will have either: a new contract or a modification to an existing contract

New contract: contract scope increases and apprise increases appropriately

Modification: price/scope do not drastically change just adjust revenue to reflect the change

How do tou idenitify seperate performance ob. within the rev recog. process

Identify the separate performance obligations

A transfer may be a single good or a bunch of goods:

If teh promise to transfer the goods or services is not distinct from teh other goods or services, they will be combined into a single performance obligation

To be distinct, both criteria must be met:

Promise to transfer the good or service is separately identifiable from the other goods or services in the contract; and

To be separately identifiable one of the following conditions must be met:

The entity does not integrate teh goods or services with other goods or services within the contract

To G or S do not customize or modify other G or S

The G os S do not depend on or relate to other G or S

Customer can benefit either from teh good or service independently or when combined with the customer’s available resources

What should be considered when determining the transaction price of a contract

Determine the transaction price

Should be determined based on teh effects of 4 considerations:

Variable considerations- a range is given

Use teh range to either find teh expected value(using probability weighted total) or if there is a most likely amount, use that- whichever is the better predictor

Only recognize if it is probable that the revenue will not be either fully or partially reversed

Significant financing

TVM should be used to adjust the price

If teh time is less than the year, don't worry about it

Noncash considerations

Measure at fair value

Future value- current value x (1/((1+%)^yr))

Any considerations payable to the customer

Consideration is a reduction of revenue

How do you allocate teh transaction price to seperate performance obligations withini rev. recog.

Allocate teh transaction price to the separate performance obligations

General rule: use teh stand-alone selling price for each obligation

However, if there is a discount allocated in a proportional way

If stand-alone selling prices change, only use what the selling prices were at the inception of the contract

If the variable consideration is tied to specific obligations, you can assign it based on that

How do you decide when to recog. rev in rev. recognition:

over time or point-in-time

input or output

Recognize revenue when or as the entity satisfies each performance obligation

Revenue is recognized over time or at a point in time

To be satisfied over time, it must meet one of these criteria:

The entity’s performance creates or enhances an asset that the customer controls as it is created or enhanced

Customer simultaneously receives and consumes the benefits of the entity’s performance as the entity performs it

The entity’s performance does not create an asset with an alternative use to the entity, adn the entity has an enforceable right to receive payment for performance completed to date

It also must be able to measure revenue over time based on an output or input method

Output: What have you provided/what will you provide, or how much time has gone through, a survey, and appraisal

Input: what you put in/what you think you will need: expected cost, resources, labor hours, time elapsed

Can be recognized on a straight line basis if approriate

You can recognize revenue up to cost over time if you think you will break even, until it is measurable

Point in time is recognized when the customer has control, meaning:

Customer accept

The entity has the right to payment

The entity has transferred the unit

The customer has legal title to the asset

Customer has teh significant rewards and risks of ownership

Within rev. recog. what are teh follow JE:

When the contract is made with an unconditional promise but haven’t received payment:

When we satisfy the performance obligation but haven’t billed them:

Possible accounts to use in JE

When the contract is made with an unconditional but haven’t received payment:

Receivable

Contract Liability

Receivable will get reversed when we receive the money

Contract liability will be reversed when we perform the obligation

When we satisfy the performance obligation but haven’t billed them:

Contract asset

Revenue

Close teh contract asset to a receivable when we bill them

How are costs related to obtaining a contract accounted for?

if it would not have been incurred without obtaining the contract it can be captalyzed/amortized other wise it is expensed

example salesman on commission vs a salesman on salary

How are costs to fulfil a contract accounted for?

Costs that are incurred to fulfill a contract that are not within the

scope of another standard will be recognized as an asset if they

meet all of the following criteria:

o Relate directly to a contract.

o Generate or enhance the resources of the entity.

o Are expected to be recovered.

When is a contract modifaication considered a new contract and not just a modification

the scope and price increase approriately

What are the three main forms of repurchase agreements?

forward

a call optino

a put option

Three main forms of repurchase agreements include:

o an entity's obligation to repurchase the asset(a forward);

o an entity's right to repurchase the asset (a call

option); and

o an entity's obligation to repurchase the asset at the customer's request (a put option).

A forward or a call can be a lease or a financing arrangement

If it must repurchase for less than the original selling price, it is a lease

equal to or more is a financing arrangement

In this case the company will recog. an asset

recognize a financial liability for any consideration

received from the customer; an

recognize as interest expense the difference between the amount of consideration received from the customer

and the amount of consideration to be paid by the customer.

If it is a put option, the following conditions apply:

Generally they have three accounting options

financing: if the repurchase price is more than the expected market price

leasing: repurchase price is less than the original contract price and the customer has a significant economic incentive

right to return: repurchase price is less than or equal to the original selling price adn market value, and there is no economic incentive to return.

When can you recog revnue in Bill and hold arrangments

Must be a substantive reason for the arrangement (e.g., the customer has requested the arrangement because it does not have space for the product).

Product has been

separately identified

as belonging to the

customer.

Product is currently

ready for transfer to

the customer.

Entity cannot use the

product or direct it to

another customer.

when is revenue recognized in a consignment?

when the dealer or distributor sells the product to a customer; or when the dealer or distributor obtains control of the product (i.e., after a specified period of time expires).

What are teh following JE and how are they solved in LT construction

While we are incurring costs:

When we bill the customer:

When we recognize profit/gross profit

While we are incurring costs:

Construction in Progress 400,000

Cash 400,000

When we bill the customer:

Accounts receivable 50,000

Progress Billings50,000

When we recoginze revenue we must:

calculate gross profit using estimated revenue- estimated total cost

using the amount of costs spent/total cost find the percentage of completion

use teh percentage of completion to determine how much gross profit has been earned- if there has been a loss recoginze no matter what

make this JE

IF IT IS A LOSS DO NOT USE PERCENT COMPLETION SIMPLY JUST TAKE THE ENTIRE LOSS WHILE TAKING INTO ACCOUNT THE PRIOR GP

Construction expenses(total expenses)

Construction in progress(gross profit earned)

Revenue(plug)

what are the construction in progress and process billings to date accounts

Construction in progress- this is an current asset- it consists of all costs to date + all progress to date

Progress Billings is a current liability

IF CIP > Progress billings it is presented as an current asset

IF progress billings > CIP it is presented as a current liabilty

These are net together

How are the following changes accounted for and what are the caveats?

Change in accounting princple

correction in accounting error

change in accounting estimate

change in accounting entity

Change in accounting principle- retrosepctive

correct bg re in t he earliest year presented

do not record a loss or gain in current earnigns

if something is to lifo or invovles deprecitiation it is an estimate

if it is non gaap to gaap it is an error

correction in accounting error- restate

change in accounting estimate- prosepctive

change in accounting entity- retrospective

Does accumulated other comprhenzive income flow throguh retained earnings

no it is its own column in statement of se

if i say contracts were sold evenly throughout the year when can i say they were sold

7/1

Things included in teh notes to teh finacnail statements

Things included

All significant policies must be in the first or the second note, this could include the disclosure of:

Measurement bases used in the fs

Specific accounting principles used during the period:

Depreciation methods

Amortizations of intanigables

Inventory pricing

Use of estimates

Fiscal year definition

Special revenue recognition issues

Disclosures of risk and uncertainties

Related to major operations, products and geographic distributions

Relative importance of each business, if the entities operates in muktple businesses

Use of accounting estimates in the preparation of teh fs

If there is more of a risk of loss in one areas and mitigation would involve diversification you should disclose if the following 3 conditions are met

don’t list names of the companies just list teh number of companies

Concentration(of risk) excisits at teh fs date

The concentration makes the entity vulnerable to a near term severe impact

It is reasonably possible events will occur

Certain significant estimates, especially if it is reasonably possible they will materially change in teh near team, teh effect shold be disclosed

Further examples

Material information about specific assets or liabilities

Descriptions related to pension plans

Information about the nature of change in stockholders' equity

things not included in the notes to the financail statements

Things not included

Now it is important to note that these are not included in the notes to the fs simply bc they have homes in other parts of the statements

Compositions and detailed dollar amounts of AR balances

Details related to changes in accounting principles

Details of maturity amounts of LT debt

Yearly computation of depreciation, depletion, and amortization

How is the timing that you consider supsequent events determined

what if fs are revised?

Subsequent events are events that occur after the bs date but before teh fs are issued or available to be issued

Timing is considered when evaluating subsequent events

Public companies: must consider events from teh bs date to when the financial statements are issued/distributed to users

Private companies: must consider events from the bs date to when teh fs are prepared, finalized, and then made available to be issued

Revised Financial satmetns

Sometimes companies revise or reissue financial statements

Generally, we don’t need to consider issues that happened during the revision period unless an adjustment is required by GAAP or other regulatory requirements

Howeve,r if they are a non-SEC filer, the entity should disclose teh dates that have been evaluated when considering subsequent events

what is the difference between a recognied and a non recognized subsequent event

Recognized(type 1): provides additional information about conditions that existed as of the bs date

Must be recognized or adjusted

Examples:

Litagation that already was known about needs an adjustment to the liablitey

A receivable owed goes bankrupt

Nonrecognized(type 2): the conditions/event did not exist at the bs date

No adjustments need to be made

However, a disclosure may be required to prevent the fs from being misleading

Examples

Business combination

Loss of a plant due to a natural disaster

Sales of bonds or stock

Changes in fv of assets or foreign exchange rates

Loss on receivables from conditions occurring after the bs date

What is fair value measurement?

what should not use this framework?

what are teh different caveats related to related parties, orderly transactions, and transaction costs?

It is not simple to measure all assets so because of this we have to use fv measurement framework. Use this for all financial and nonfinancial assets besides:

Share-based compensation

Fv measurements used for lease classification or measurement; and

Measurements based on or using vendor-specific objective evidence of fair value

In general, fair value does not include any transaction costs but may include transportation costs, if location is an attribute of the asset or liability

This is an exit price(and generally does not take into account liabilities

This must be an orderly transaction meaning it is not forced or do to somehting like bankruptcy

The market participants must be buyers and sellers who are: not related parties, knowledgeable about teh asset or liability, willing to transact for the asset or liability, able to transact for teh asset or liability

There must be no discounts or inflated prices to reduce taxable income

What are the differnt valuation techinques and input levels fro fair value transactions?

When you choose this, you should try to maximize level one and two inputs and minimize level three

Level 1: quoted price in active markets for identical assets/liabilities

Level 2: quotes market prices for similar liabilities

Level three: unobservable inputs are used and this is based on assumptions

If you change techiniques that is considered a change in accounting estimate and therefore accounted for prospectively

Market approach: uses prices and relevant intofmration for market transactions involving idenitcal or comparable assets or liabilities to measure fair value

Below shows which markets to look at:

Financial Asset:

If applicable, choose the principal market or the market with teh greatest volume or level of activity

If there is no principal market, use teh most advantageous market:

This is the market with the best price(highest for an asset, lowest for a liability)

Transaction costs are used to determine this but are not ultimately used for the fair value measurement

NRV= selling price- transaction cost

However only the selling price is considered the fair value

Nonfinancial Asset:

Use teh market or the use of the asset that will generate teh most economic benefits

The reporting entity is assumed to have the most advantageous use unless specified otherwise

To determine this you may consider

In combination with other assets(building with land)

With other assets and liabilities

Stand-alone basis

For example we could consider land as use for industrial or residential, which ever gives us the highest value is the best

However, for liabilities teh best highest use concept is NA because liabilities do not have alternative uses

Income approach: converts future amounts, including cash flows or earnings to a single discounted amount to measure fair value

Can be applied to assets or liabilities

Cost approach: used current replacement cost to measure the fair value of assets

discourses requried in the notes the financial statements for fair value measures?

Disclosures

Valuation techniques, including judgments and assumptions

Uncertainty in teh fair value measurements as of the reporting date

How changes in fair value measurements affect teh entity’s performance and cash flows

Quantitative information about significant unobservable inputs: forecasted future cash flows, discount rate

Information about nonfinancial assets or liabilities for which measurements differ from the highest adn best use

Hierarchy for items that are not measured on the balance sheet but are disclosed in the notes

Discussion of the sensitivity of level 3 measurements

When do you measure something at fair value vs when do you measure something at historical value less costs to sell?

If something is an investment or consider “avaible for sale’ it is measured at fair value

If something is used in operations it is measured at historical cost

Now lets say something was used in operations and is now available for sale:

Measured of the lower of: its carrying amount(bv-ad), or fair value less costs to sell

Any necessary impairment loss will flow through net income(contarry to afs securities which would flow through OCI)

note: land however is special, land is always considered to be held at historical cost whether or not it is used as an investment. To be considered held for sale there are very specific criteria and only then will be it measured at the lesser of selling price-costs or historical value*

Bonds held to maturity are recorded at amortized cost

If you aquire another company also get its property you must record this on your books at fair value and restart the depreciation process

cash and cash equivalents are consifered to be fair value

What are special purpose frameworks and what are the five discussed?

Fs titles must be different to show it isn’t accrual

Must include equivalents of: accrual bs and is and an explanation of changes in equity

Notice no SOCF

Disclosure should be similar to GAAP and include:

Summary of significant accounting policies

Informative disclosures similar to GAAP ones

Disclosures related items not show on teh face of financial statement:

Related party transactions, subsequent events, and uncertainties

cash basis

modified cash basis

tax basis

Price-level adjusted fiancnail statements

Regulatory basis of accounting

what should you consider when converting a cash to accural bs

Alot of times, entities need to convert for a loan or an ipo

Basially you need ot add everything that should be on the BS to the BS and modify the I/S to accural

BS conversion:

Debt proceeds need to become liabilities

Debt repayments will lower liabilities

Remember fixed assets were previously expnsed and need ot bapatlized

Use equity to balance

when converting cash to accural how do you do the following incoem statmetn items

revenue

cogs

operating expenses

Cash receipts to revenue conversion:

Cash basis revenue

+ending AR(this was earned during this period)

-beginging AR(this was earned in a prior period)

+beginging unearned revnue(this was earned in this period)

-ending unearned revenue(this is yet to be earned)

__________________________________________________

Accural revenue

Cash for purchases to COGS

Cash paid for purchases

- Beginging AP(this was expense during a prior period)

+ ending AP(this was expensed during this period)

+ beginning inventory(this was used during this period)

- ending inventory(this wasn’t usd during this period)

_______________________________________________________

COGS

Converting cash paid for operating expenses to accrual operating expenses

Cash paid for operating expense

+ prepaid beginning expense

- prepaid ending expense

+ ending accrued liability(epxenses accrued during this pernod)

- beginning accured liability(espenes accrued during prior period

What is ebitda? what are the two-methods to calcualte it

earnings before interest, taxes, depreciation and amortization

takes out the use of methods and esitmates

o Top-down: Sales – Cost of goods sold – Operating expenses (excluding depreciation and amortization)

o Bottom-up: Net income + Income tax expense + Interest expense + Depreciation and amortization

Dividen Payout formula and analysis

cash dividends/net income

performance metircs

low has higher growth oppurtunites

high has fewer growth oppurntuties

Dupont ROA equation

=asset turnover x profit margin

sales(net)/Avg. total assets x net income/sales(net0

TO shows manamgementiet efficeny and optional amount of assets

profit margin show competitietion/substitutes

horizontal versus vertical analysis

horizontal is useful in evaluting trend and materail changes

vertical analysis compates which assets in period-to-period comparisoin

what are teh gross profit margin and profit margin ratios

both profitabilty ratios

GP margin= sales(net)-cogs/sales

profit margin= net income/sales

what is the return on sales ratio

profitabilty ratio

income before interest income, interst expense and taxes/sales(net)

return on equity(ROE)

=net income/ average total equity

ROA x DFL = ROE

dfl= assets/equity

this shows financail risk

operating cash lflow ratio

OCF generated from core business

as a ratio goes up the risk of st distress goes up

= cash flow from opeations/current liabilites

curernt ratio and quick ratio adn cash ratio

liquidity ratios:

= current assets/current liabilyt

= cash and cash equivalents + ST marketable securites + receiveable/ current liabilities

= cash + marketable securities/ current liabilites

most conserivative measure of risk

what is the AR turnover ratio and the says sales in AR ratio

liquidty ratio

AR turnover= sales(net)/ average ar net

says sale= ending AR(net)/sales(net)/365

sales(net)/365= average daily credit sales

inventory turnover ratio and days in inventory ratio

inventory turnover- cosg/average inventory

days= ending inventory/cogs/365

to loww there is a shortage to high there is a surplus

AP turnover ratio and days of payable outstanding

cogs/average ap

ending ap/cogs/365

too low and we are paying too quick

too high we are struggling to pay

cash conversion cycle

= days sales in AR + days in eventory - days of payable outstanding

to strict or short we sell slow and collect fast

to lax we seel fast and collect slow