Econ 102 - Chapter 9 - International Trade

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Comparative advantage (foundation of international Trade) explains why nations trade

Each country produces what it is relatively best at (lowest opportunity cost) and trades for the rest.

Result: Everyone can consume more than they could in isolation — borders don’t matter to the logic of comparative advantage

import

Buying goods/services from foreign sellers

ex: The U.S. buys electronics from Japan.

Who benefits?

Buyers (consumers) b/c lower price

export

Selling goods/services to foreign buyers

ex: The U.S. sells airplanes to Europe

Who benefits?

producers (suppliers)

Trade Costs

Extra costs of buying or selling internationally instead of domestically.

Examples:

Shipping fees, customs delays

Import/export taxes (tariffs)

Language or time zone barriers

Foreign legal regulation

Lower trade costs → more international trade

Trade Decision Rules

Import if: foreign price + trade costs < domestic price

Export if: foreign price − trade costs > domestic price

Globalization

The increase in global economic, cultural, and political integration

Why it’s growing:

Trade agreements reduce tariffs

Better transportation and communication

Internet & digital goods (low trade costs

Sources of Comparative Advantage

Abundant Inputs:

Geography and resources → Saudi oil, Canadian wood, Bangladeshi labor.

Specialized Skills (Learning by Doing):

Switzerland → watches

France/Wisconsin → cheese

U.S. → movies, tech.

Mass Production (Economies of Scale):

IKEA produces bookcases every 5 seconds using robots & bulk wood purchasing.

Opposites attract: trading partners with different resources gain the most.

Produce what you are relatively good at

World Supply

Total produced globally at each price.

World Demand

Total bought globally at each price.

World Price

The international equilibrium price (where global supply = demand).

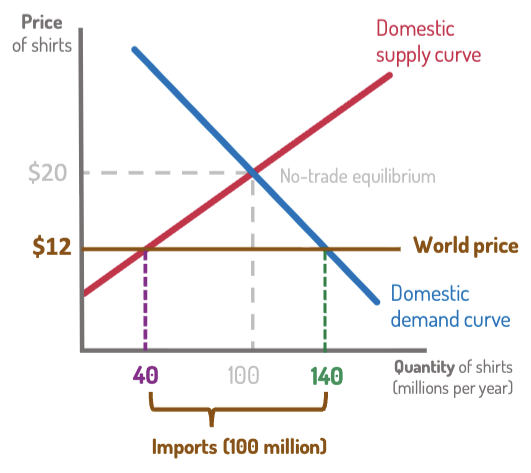

Imports — Step-by-Step

Example: T-shirt market, domestic price = $20, world price = $12.

New Price:

Price falls to world price ($12).Quantities:

Domestic supply ↓ (40 million)

Domestic demand ↑ (140 million)

Imports:

Gap filled by imports = 140 − 40 = 100 million shirts

Results:

Buyers gain → lower prices, more choices

Domestic sellers lose → lower profits

Total economic surplus increases

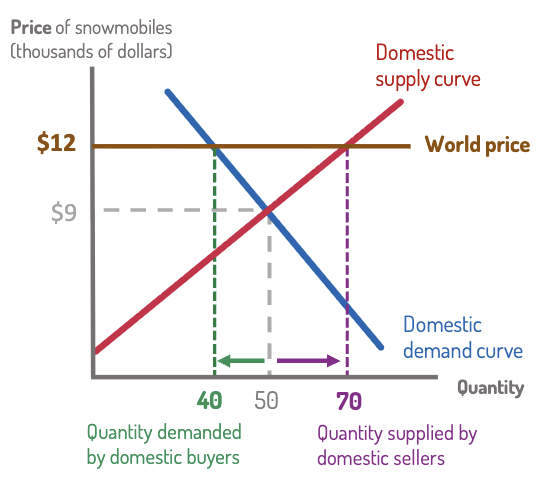

Exports — Step-by-Step

Example: Snowmobile market, domestic price = $9, world price = $12.

New Price:

Price rises to world price ($12).Quantities:

Domestic supply ↑ (70k)

Domestic demand ↓ (40k)

Exports:

Gap = 70 − 40 = 30k snowmobiles

Results:

Producers gain (higher price, more sold)

Consumers lose (pay more)

Total economic surplus still increases

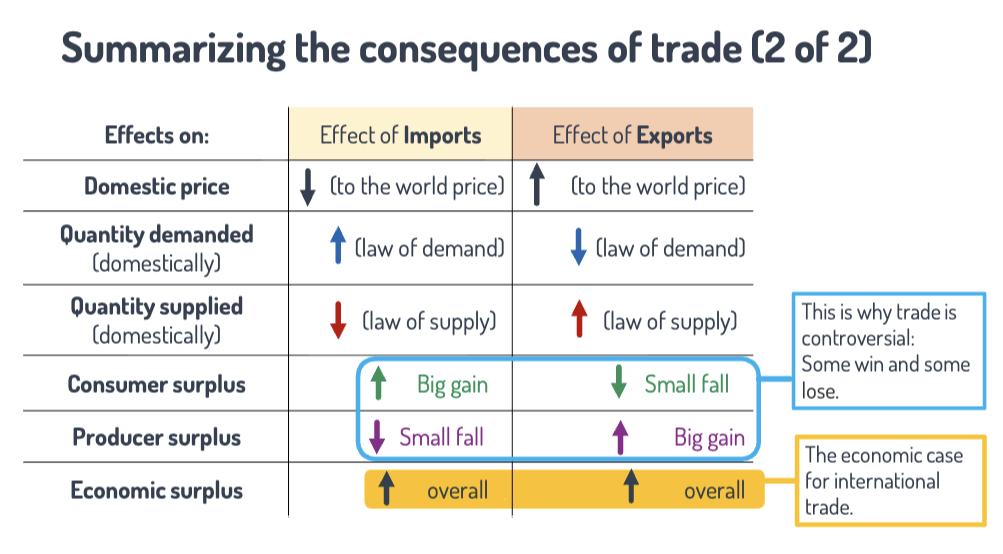

Summarizing Imports and exports

What happens to economic surplus after importing or exporting internationally?

an overall gain (an increase)

The Debate About International Trade

Arguments (have claims and counters)

National Security

Infant Industries

Unfair competition (Dumping)

Minimum Standards

Save domestic Jobs

(for more info, look at Chat or slides)

Tools of Trade Policy

Tariff

Red Tape

Import quotas

Exchange Rate Manipulation

Tariff

A tax on imported products.

increase trade costs

Effects:

Raises prices, reduces imports, raises gov revenue

Red Tape

Extra bruactractic barriers

Effect:

Reduce international trade but does not raise revenue for domestic government

Import Quotas

Limits on imports

Effects:

Reduce international trade just as tariffs do (exact same price and quantity outcomes) but does not raise government revenue.

Exchange Rate Manipulation

Adjusting currency values

Effects:

A country can use this tool to increase its exports and reduce its imports.

Exports ↑, imports ↓

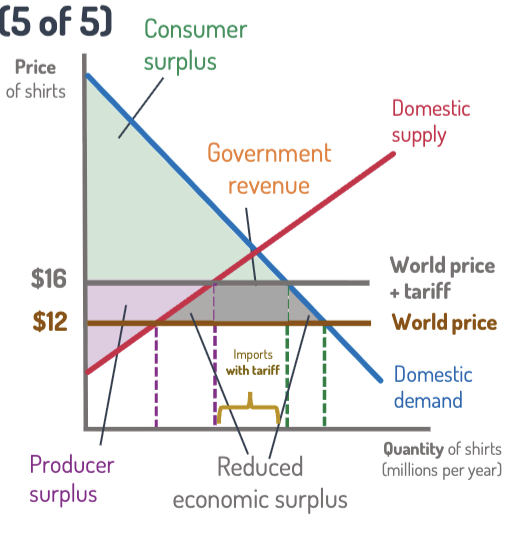

Tariffs — Step-by-Step Example

Free trade: World price = $12.

Imports = 100 million shirts.Tariff = $4 → new price = $16.

Effects:

Imports fall (gap shrinks).

Domestic producers gain slightly.

Consumers lose a lot (higher prices).

Government earns revenue = tariff × imports.

Deadweight loss: total surplus falls.

Tariffs = higher prices, less trade, lower efficiency.

Exchange Rate Manipulation Example

Scenario:

1 USD = 6 yuan → Boeing plane = ¥360M

China devalues yuan → 1 USD = 7 yuan → same plane = ¥420M

Results:

Chinese goods cheaper abroad → exports ↑

U.S. goods more expensive in China → imports ↓

U.S. producers lose; Chinese exporters win.

Effect on Income Inequality

Exports (high-skill goods):

→ Raises demand for educated workers → higher salaries.Imports (low-skill goods):

→ Reduces demand for low-skill workers → lower wages.

Result: Trade increases total wealth but widens income inequality.