MGT 8803 - Finance

1/243

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

244 Terms

What metrics make a company successful in the long run?

taking care of customers who want to buy your products and services on a repeated basis

financial manager decisions

investment decisions

how to access capital from the financial markets in terms of debt and equity?

debt holders

investors who give capital to company and get principal and interest payment in return

equity holders or shareholders

owners of corporation, get leftover money after debt holders paid (residual claimants)

value creation

corporation is run with the objective of creating value for the shareholders

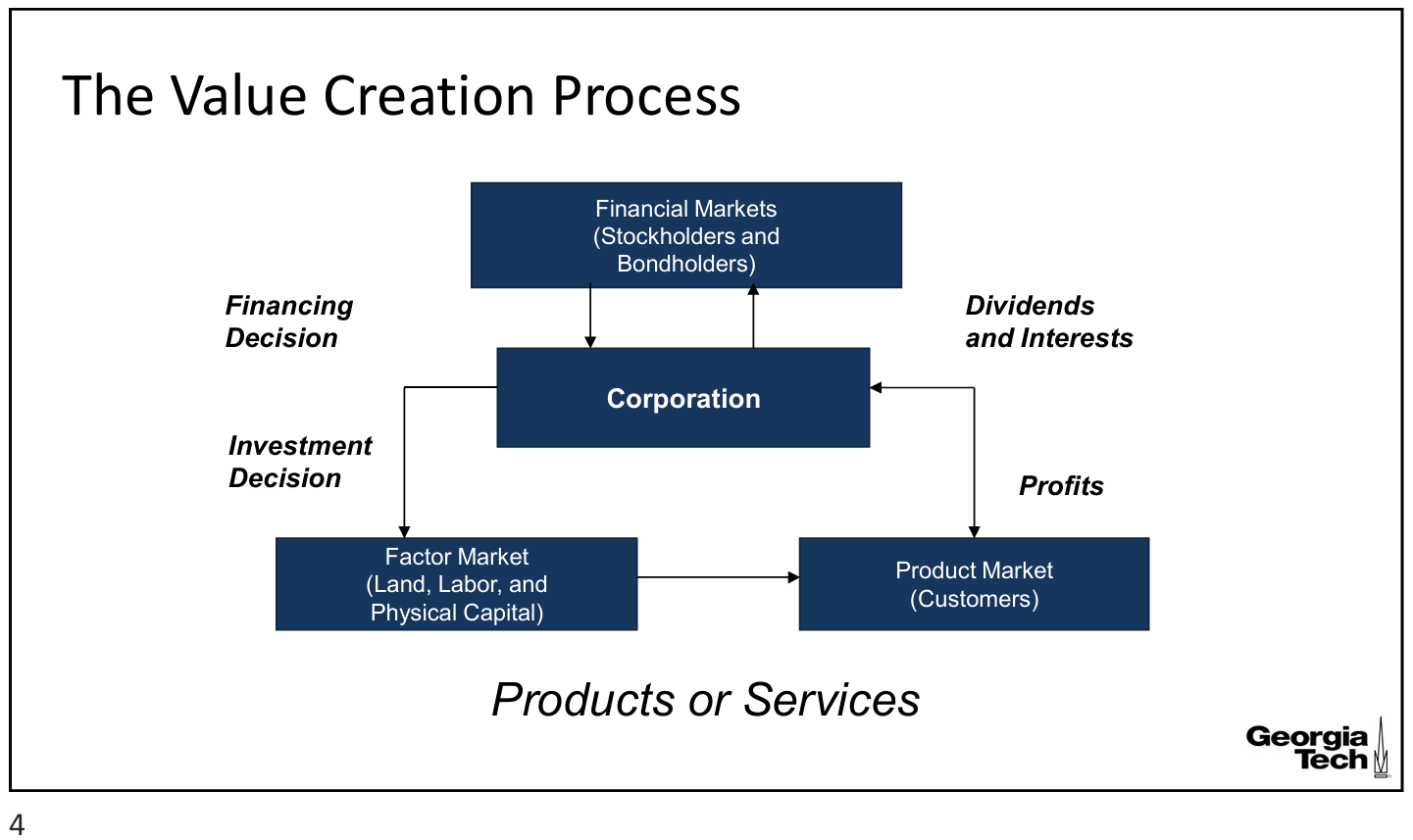

value creation process

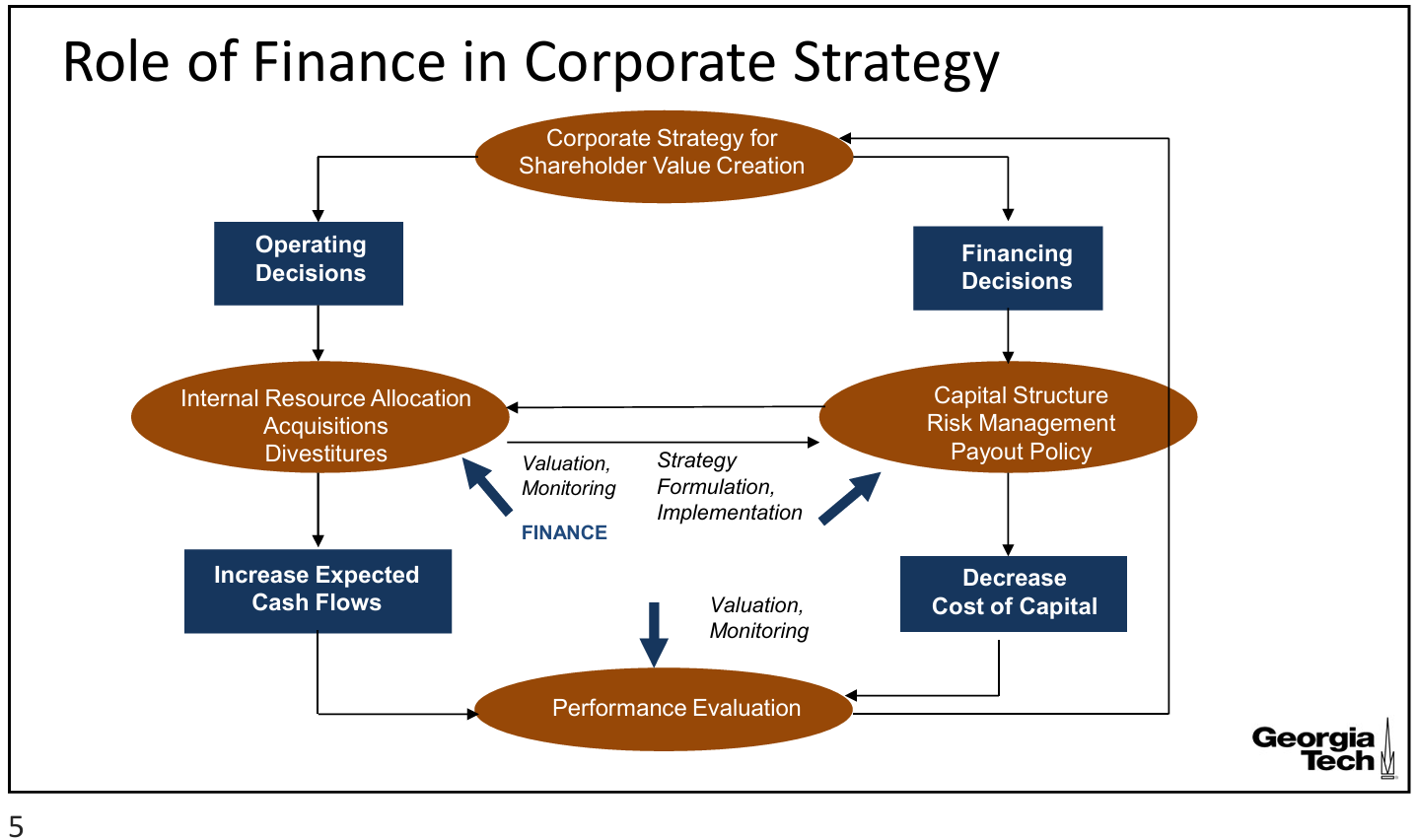

role of finance in corporate strategy

operating and financing

2 types of decisions in corporate strategy for shareholder value creation

operating decisions

internal resource allocation (how to allocate internal capital for future growth?)

acquisitions

divestures (firms or business units that aren’t doing well)

Finance: valuation and monitoring

increase expected cash flows

goal of operating/investment decisions

financing decisions

capital structure (how much debt? how much equity?)

risk management

payout policy

Finance: strategy, formulation, implementation

goal of financing decisions

decrease cost of capital

financing decision in the value creation process

financial markets (stockholders and bondholders) → corporation

operating/investment decision in the value creation process

corporation → factor market (land, labor, and physical capital)

ultimate goal of financial management

maximizing shareholder wealth

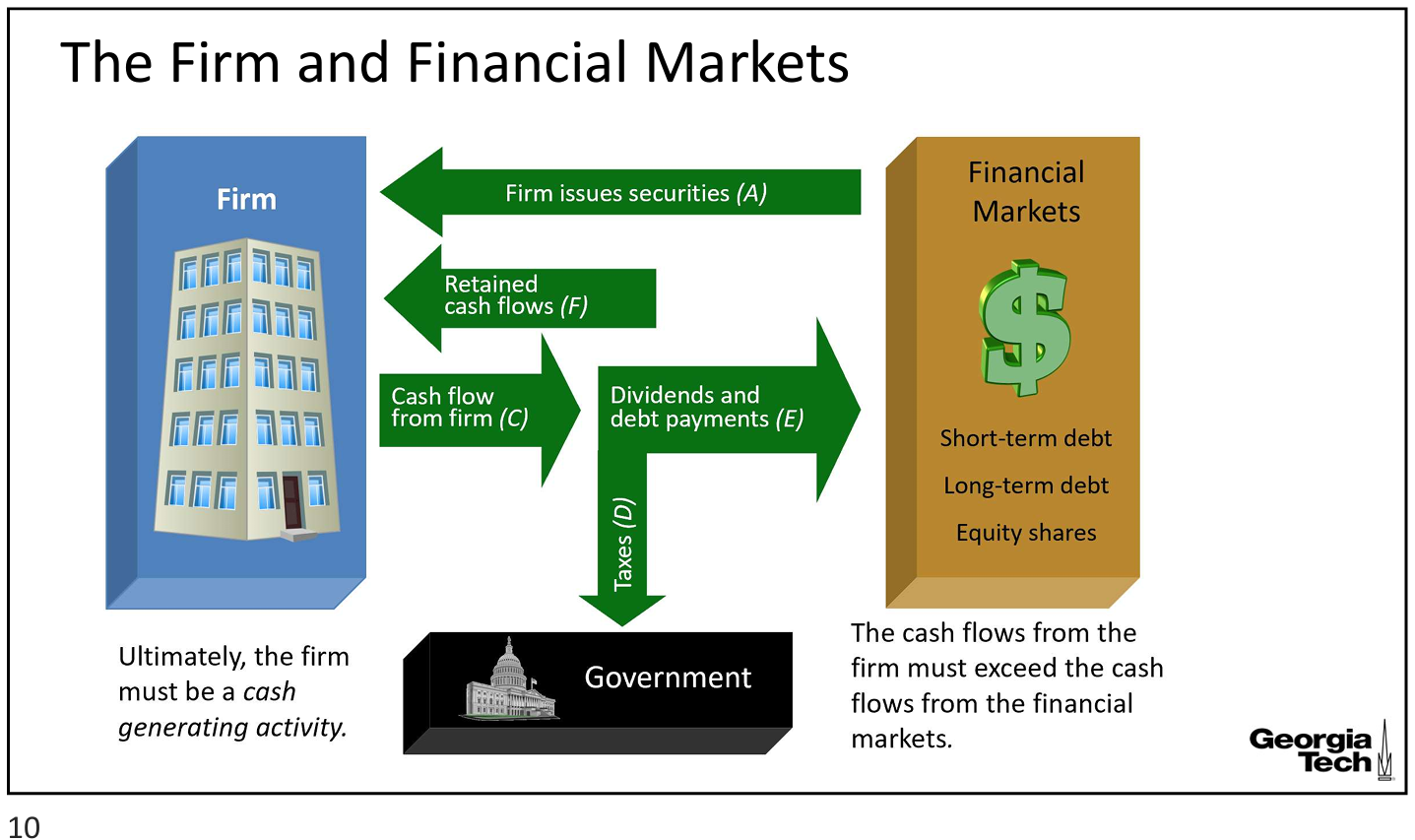

the firm and financial markets

cash generating activity

ultimately, firm must be a

exceed

the cash flows from the firm must _____ the cash flows from the financial markets

financial markets → firm

firm issues securities (A)

retained cash flows (F)

firm → financial markets

cash flow from firm (C)

→ dividends and debt payments (E)

→ taxes (D) to gov

capital budgeting or capital expenditure/investment decision

process of determining exactly which assets to invest in and how much to invest for future growth

capital budgeting steps

Identification

Evaluation

Selection

Implementation

identification

find out opportunities and generate investment proposals

types of investment

required

replacement

expansion

diversification

evaluation

costs, benefits; estimating the project’s relevant cash flows and appropriate discount rate

expected cash flow stream (benefits)

discount rate (cost of capital)

selection

choosing a decision making rule (accept/reject criterion)

decision rules:

net present value (NPV)

profitability index (PI)

internal rate of return (IRR)

payback period (PP)

implementation

establishing an audit and follow-up procedure (revisit whether you got the expected benefits or fell short)

monitor magnitude and timing of cash flows

check if project still meets selection criterion

decide on a continuation or abandonment

review previous steps if failure rate is high

what to look at on statement of cash flows

cash flows from investing activities (capital expenditures)

long

most investments are ____ term

time value of money

a dollar today is worth more than a dollar in the future (but how much more and what does it depend on?)

future value = FVt =

PV * (1+r)t

FV Excel

=FV(r, t,, -PV)

present value

amount of money you need to invest today in order to duplicate some future dollar amount

present value = PV =

FVt / (1 + r)t

PV Excel

=PV(r, t,, -FV)

unknown interest rate Excel

=RATE(t,, PV, -FV)

unknown # periods Excel

=NPER(r,, PV, -FV)

present value of an annuity (PMT) =

(r * PV) / ( 1 - (1 + r)-t )

present value of an annuity Excel

=PMT(r, t, -PV)

net present value

measures value created for shareholders by the investment project

NPV =

C0 + C1/(1+r) + C2/(1+r)2 + … + CT/(1+r)T

NPV > 0

accept

project increases shareholder value

NPV < 0

reject

project destroys shareholder value

NPV = 0

depends

have to look at all past cash flow projections

negative

early cash flows (like C) are typically ____ for most investment projects because of large upfront investments

highest

choose project with _____ NPV

independent project

acceptance or rejection is independent of the acceptance or rejection of other projects

mutually exclusive project

can accept A or can accept B or reject both but cannot accept both

payback period

number of periods (usually years) required for the sum of the project’s expected cash flows to equal its initial cash outlay

the time it takes for a firm to recover its initial investment

payback period limitations

who decides cutoff?

penalizes long-term projects

completely ignores cash flows beyond cutoff

lowest

choose project with _____ payback period

internal rate of return

discount rate that makes the NPV = 0

>

accept project if IRR __ cost of capital

profitability index

the present value of an investment’s future cash flows divided by its initial cost

AKA cost/benefit ratio

PI =

(CF0 + NPV) / CF0

PI > 1.0

accept

highest

choose project with _____ PI

problems with IRR

multiple IRRs can exist for same project (- to + CF and + to - CF)

scale problem

timing problem

crossover rate

calculate IRR of A-B or B-A

NPV vs. IRR

will generally give same decision

exceptions:

non-conventional cash flows (signs change more than once)

mutually exclusive projects (initial investments, timing of cash flows substantially different)

cash flows, cost of capital (k)

NPV calculation inputs

NPV

NPV decision inputs

NPV > 0

NPV decision rule - accept

NPV < 0

NPV decision rule - reject

Y

does NPV adjust cash flows for time?

Y

does NPV adjust cash flows for risk?

Is NPV consistent with maximization of firm’s equity value?

Y

cash flows, cost of capital (k)

PI calculation inputs

PI

PI decision inputs

PI > 1

PI decision rule - accept

PI < 1

PI decision rule - reject

Y

does PI adjust cash flows for time?

Y

does PI adjust cash flows for risk?

Is PI consistent with maximization of firm’s equity value?

Y

but may fail to select project with highest NPV when ME

cash flows

IRR calculation inputs

IRR, cost of capital

IRR decision inputs

IRR > cost of capital

IRR decision rule - accept

IRR < cost of capital

IRR decision rule - reject

Y

does IRR adjust cash flows for time?

Y

does IRR adjust cash flows for risk?

Is IRR consistent with maximization of firm’s equity value?

Y

but may fail when projects ME, non-conventional cash flows

cash flows

PP calculation inputs

PP, cutoff period

PP decision inputs

PP < cutoff period

PP decision rule - accept

PP > cutoff period

PP decision rule - reject

N

does PP adjust cash flows for time?

N

does PP adjust cash flows for risk?

Is PP consistent with maximization of firm’s equity value?

N

rule of thumb for how long it takes money to double

interest rate * time = 72

cash flow statement, cash flow investments

if you want to determine the amount of capital expenditures a company made during the previous year, you should find the company’s most current ______ and look under the caption _________

independent, consistent

if capital projects with conventional cash flows are _____, the NPV and IRR methods should result in _____ “accept” or “reject” decisions

preferred method for evaluating and selecting projects for long-term investments

NPV

principles for relevant cash flows

record cash flows when the money actually moves (NOT accrual)

with-without: Imagine 2 worlds, one in which the investment is made and one in which it is rejected. All cash flows that are different in these 2 worlds are relevant, and those that are the same are irrelevant.

sunk costs

not relevant for present decision

test marketing costs

marketing research expenses expended

erosion costs

cash flow transferred to a new project from sales and customers of other products of the firm

opportunity costs

lost revenues from alternative uses of the asset

depreciation

non-cash expense; add back to income after tax to calculate the investment’s after-tax cash flow (ATCF)

ATCF =

(Revenue - Costs - Depreciation) (1 - Tax) + Depreciation

= (R - C) (1 - Tax) + D(Tax)

working capital

changes that are a result of an investment decision are relevant to the decision; have to lock up some amount of current assets in the project

at beginning of project life, treat as cash outflows

at end, treat as cash inflows

price, volume factors to consider when making cash flow estimates

competition from existing products

competition from technological advances

values to customer