Chapter 13: Inventory

1/12

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

13 Terms

Audit approach

Quantity (normally arrived at by a year end inventory count (unless solely a perpetual system - controls-based approach)

Valuation

Disclosure

The physical inventory count

Evaluate management's instructions and procedures for recording and controlling the result of the physical inventory count

Observe the performance of the count procedures

Inspect the inventory

Perform test counts

Perform audit procedures over the entity's final inventory records to

determine whether they accurately reflect the count results

Either substantive procedures or tests of controls

Planning the inventory count

Factors to consider when planning attendance at the inventory count include the following:

The risks of material misstatement of inventory

Internal controls related to inventory

Whether adequate procedures are expected to be established and proper instructions issued for counting

The timing of the count

Whether the entity maintains a perpetual inventory system

Locations at which inventory is held (including any material amounts held by third parties)

Whether the assistance of an auditor's expert is required

Inventory held by third parties

The auditor shall obtain sufficient appropriate audit evidence by performing one or both of the following:

• Direct confirmation from the third-party regarding quantities and condition

• Inspection or other appropriate audit procedures (if third party's integrity and objectivity are doubtful, for example)

Attendance at inventory count

During the inventory count the auditors should observe whether the count is being carried out according to instructions, carry out test counts, and watch out for third-party inventory and slow-moving inventory and cut-off problems.

Audit procedures during attendance at the inventory count

Performing test counts

Documentation of audit work performed during the count

Audit procedures during attendance at the inventory count

• Observe whether the client's staff are following inventory count instructions to ensure the count is complete and accurate

• Perform test counts to ensure procedures and internal controls are operating effectively, and to gain evidence over the existence and completeness of inventory

• Ensure that the procedures for identifying damaged, obsolete and slow-moving inventory operate effectively to confirm valuation of inventory:

- Obtain information about the inventory's condition, age and usage

- Obtain information concerning the stage of completion of work-in-progress

• Confirm that inventory held on behalf of third parties is separately identified and accounted for to ensure that inventory is not overstated

• Obtain copies of the last goods received note (GRN) and the last goods despatch note (GDN) in order to confirm cut-off of inventory

• Conclude whether any amendment is necessary to subsequent audit procedures

• Gain an overall impression of the levels and values of inventories held in order to be able to judge whether the inventory figure in the financial statements appears reasonable

Performing test counts

The auditors perform test counts to ensure procedures and internal controls are working properly. The auditor should test counts from the inventories to the inventory sheets (to gain evidence of completeness) and from the inventory sheets to the inventories (to prove existence). Tests should concentrate on high value inventory. If the results of the test counts are not satisfactory, the auditors may request that inventory be recounted.

Documentation of audit work performed during the count

The auditors' working papers should include the following:

• Details of their observations and procedures performed

• The manner in which points that are relevant and material to the inventory being counted or measured have been dealt with by the client

• Instances where the client's procedures have not been satisfactorily carried out

• Items for subsequent testing, such as photocopies of (or extracts from) rough inventory sheets

• Details of the sequence of inventory sheets

• The auditors' conclusions

After the inventory count

After the count the auditors should check that final inventory sheets have been properly compiled (collected info from different place) from count records and that book inventory has been appropriately adjusted.

Key tests include the following:

• Trace (find sth that have been lost) items that were test counted to final inventory sheets: Kiểm tra xem những mặt hàng mà kiểm toán viên đã đếm thử có được ghi đúng vào bảng kiểm kê cuối cùng không.

• Agree sequence (series) of inventory sheets: tính liên tục của các phiếu kiểm kê

• Observe whether all count records have been included in final inventory sheets.

• Inspect final inventory sheets to ensure they are supported by count records.

• Confirm that continuous inventory records have been adjusted to the amounts physically counted or measured, and that differences have been investigated.

• Confirm cut-off by using details of the last serial number of GRN and GDN and details of movements during the count.

• Review replies from third parties about inventory held by or for them.

• Reperform client's computation of the final inventory figure to ensure ti has been calculated correctly.

• Follow up queries and notify problems to management.

• Confirm necessary adjustments to book inventories have been made by inspecting the client's ledgers.

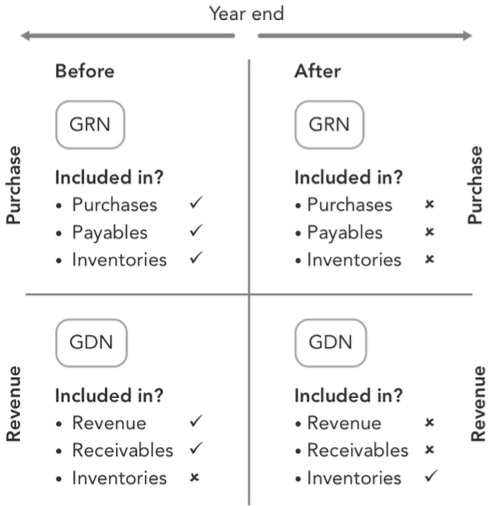

Cut-off

Cut-off testing is a specific audit procedure performed after the inventory count to ensure that all of the company's transactions have been included in the correct period.

Cut-off is usually tested by obtaining a sample of GRNs and GDNs either side of the year end and then matching them to purchase/sales invoices to ensure they have been included in the correct account balance(s). The auditor should have obtained the samples of GRNs and GDNs when attending the inventory count.

Continuous (perpetual) inventory counting

Physical inventory counts at the year end

From the viewpoint of the auditor, this is often the best method.

Physical inventory counts before or after the year end

This will provide audit evidence of varying reliability depending on:

The length of time between the physical inventory count and the year-end (the greater the time period, the less the value of audit evidence)

The business's system of internal controls

The quality of records of inventory movements in the period between the physical inventory count and the year end (the auditors will need to perform roll back or roll forward tests on these records)

Continuous (or perpetual) inventory

Management has a programme of inventory counting throughout the year.

Continuous systems make use of modern computing power to link inventory records to information about sales and purchases, as well as to management information such as an item's location within the entity.

This is the preferred method of monitoring inventory levels throughout the year, but its weakness is that over time the actual inventory level will tend to diverge (sai lệch) from what the computer says it should be, as a result of unrecorded transactions or theft.

As a result of this divergence, it will be necessary to perform physical inventory counts of selected inventory lines throughout the year to determine the extent of the system's divergence from actual inventory levels. All inventory lines should be subject to a physical count at least once a year.

Inventory valuation

Accounting for inventory: lower of cost (all costs of purchase and other costs incurred in bringing inventory ot its present location and condition.) and NRV (selling price - cost to sell-cost to complete)

An entity may use standard costs to value inventory provided that the standard costs approximate to actual cost.

Using the work of internal audit

Before using the work of internal audit, the external auditors need to evaluate and perform audit procedures on the entirety of the work that they plan to use, ni order to determine its adequacy for the purposes of the audit.

The evaluation includes the following:

Whether the work was properly planned, performed, supervised, reviewed and documented

Whether sufficient appropriate evidence was obtained to allow the internal auditors to draw reasonable conclusions

Whether the conclusions reached are appropriate in the circumstances and the reports prepared are consistent with the results of the work done

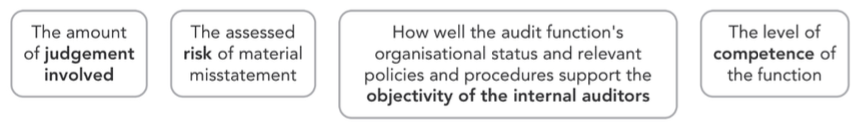

The nature and extent of the audit procedures performed on specific work of the internal auditors will depend on the external auditor's assessment of

External auditor's procedures to include reperformance of some of the internal audit work used.

Audit procedures might include:

• Examination of items already examined by the internal auditors

• Examination of other similar items

• Observation of procedures performed by the internal auditors