EDEXEL GCSE BUSINESS paper 1

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

66 Terms

why do business carry out market research

assess risk

find gap in market

identify/understand competition

to make informed decisions

primary research

collecting information that didn't exist before but found through field research - valuble first hand contact

secondary research

research that gathers information that already exists

primary research pros and cons

pros

more relevant/specific to needs

up to date

direct customer contact

cons

need a well-designed questionnaire

time-consuming

expensive

secondary research pros and cons

pros

easier to find/collect quantitative data

can be free

less time consuming

cons

many not be reliable

more general

can be out-of-date

types of research methods

internet research

government reports

observation

questionnaire

focus group

customer feedback

what is a marketing mix

the 4 variables that are important when marketing a product

-product

-price

-promotion

-place

Product range

- all products made or sold by a business

-can mean a higher cost per unit due to less economies of sales

product differentiation

making your product stand out from competitors

- to position products/target market segments

- to gain advantage over rivals when faced with competition

demand

quanitity that consumers are willing to be able to buy at a current price level

e-commerce pros

pros

can be cheaper than renting/buying a store

wide market

direct form of selling with no middlemen so they don't need to give discounts to wholesalers

Wholesaler

buys in bulk hold stocks and sells to mainly retailers not customers. They get a discount from producers

factors affecting location

cost of site

labour costs

transport costs

sales potential

manager preferences

name six sources of finance available to a business (there are nine)

bank loan

overdraft

crowdfunding

family and friends

venture capital

share capital

trade credit

selling assets

retained profit

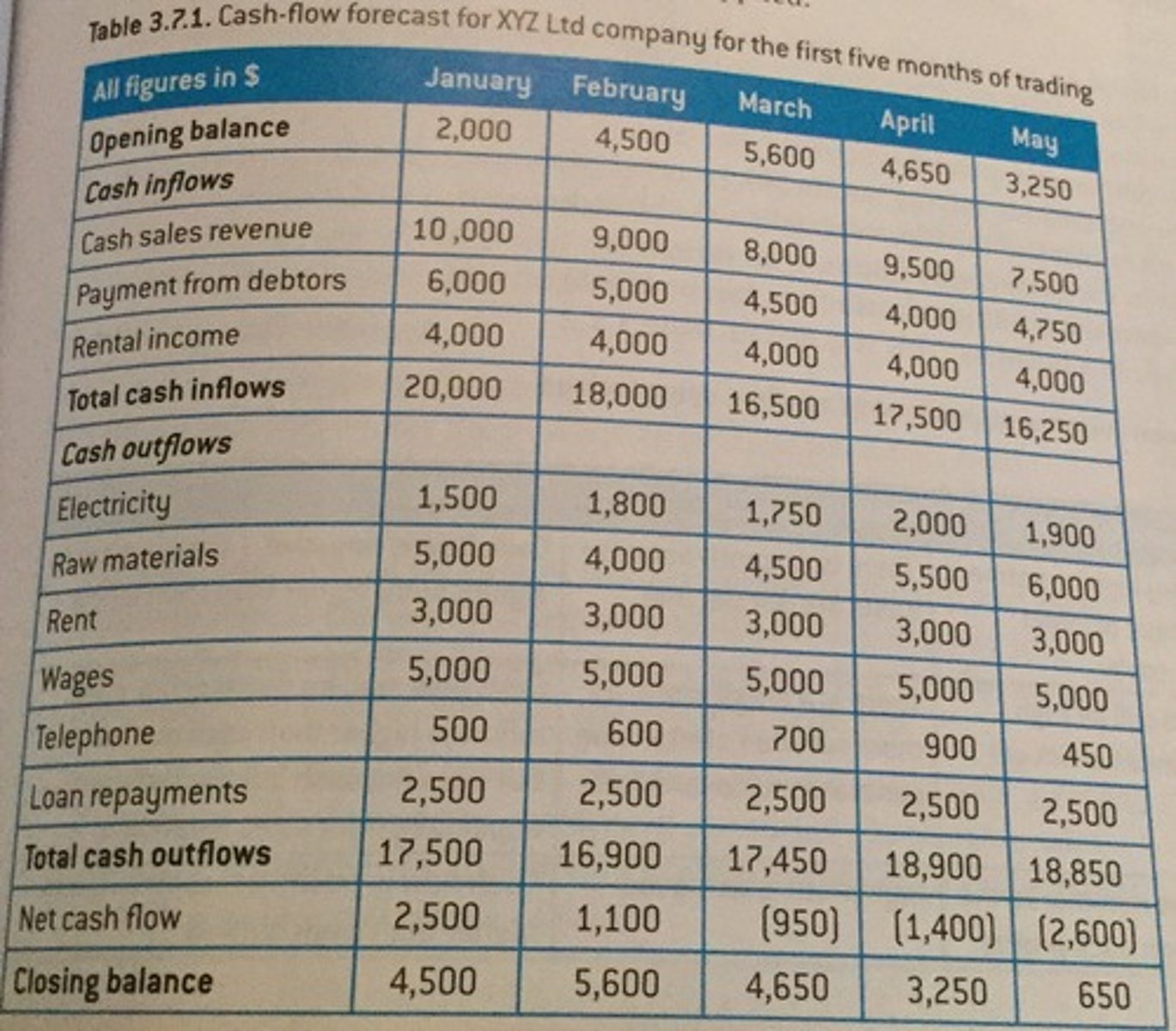

cash flow-forecast

predicts the businesses future cash inflows and outflows

solutions to cash flow problems

pay debts later, when u havs cash

ask for bills eariler

get a source of finance

gross profit margin

the percentage of sales revenue that is gross profit = gross profit/sales revenue *100

net profit margin

the percentage of sales revenue that is net profit = net profit/sales revenue *100

name laws that exist to protect employees

equal pay act

minimum wage act

discrimination legislation

health and safety acts

break-even

the point at which the costs of producing a product equal the revenue made from selling the product

Entrepeneur

A person who organizes, manages, and takes on the risks of a business

unlimited liability benefits

- owner 100% control

- owner keeps profits

- accounts not public

- quick easy to set up

unlimited liability drawbacks

- more risks (owner legally responsible for any debts)

- potential loss of belongings to pay off debt

Partnership Benefits

- Easier to raise financial capital

- Partners may combine ideas and expertise

- shared risk

Partnership Disadvantages

- decisions made by one partner affect all

- one partner leaves and business no longer exists

- profit shared

- desagreements

Private limited company benefits

- limited liability; can only lose money up to what invested

- customers may trust 'ltd'

- continues trade even when shareholders change

Private limited company drawbacks

- shareholders reduce control of main owner (depending on proportion of business sold as shares)

- shareholders may disagree

- financial information published

- more info reported to government

- more complex set up

Franchise Advantages

- brand image/reputation already established

- expensive marketing costs covered

- training provided

- established customer base

- increased chance of survival

Franchise Disadvantages

- high initial investment

- owner has little decision freedom

- have to pay royalty to franchisor (%revenue)

- restrictions on where

Impact of technology on marketing mix

- customers can easily compare price online

- new tech demands continuously innovated products

- many businesses switching to social media for promotion

- e-commerce provides customisablility

Interest rate calculation

total repayment-borrowed amount / borrowed amount *100

Stakeholder objective examples

- manager wants bonus

- employees want good pay/working conditions

- customers want value for money

- local community want investmet and >pollution

- government wants low unemployment and competitive markets

- shareholders want dividends + growth

- suppliers want regular orders

stakeholder conflict

This can occur in business when stakeholder objectives are different

e.g. shareholders want more profit, managers want o reinvest and grow

- workers want higher pay, customers want lower prices

consumer law

- right to return

- goods delivered safely

- business should disclose full information about product

- to a good standard

Employment Law

- health and safety requirements met in workplace

- fair recruitment/redundancies

- minimum wage

advantages of legislation

- compliant businesses less likely to be fined

- compliant businesses veiwed as proffessional / caring

- compliant businesses have improved relationship with stakeholders

disadvantages of legislation

- laws can be restricting

- uncompliant businesses get bad publicity

- uncompliant businesses may be fined

- business must know law and keep up to date

increased unemployment?

decreased consumer demand

good economy?

people earn more, more disposable income

increased inflation?

business costs sharply rise

lower interest rates

make it cheap to borrow money, so businesses borrow and therefore spend more money on labor and machinery

- demand increases

increased taxes

reduced disposable income

weaker pound?

foreign demand rises

SPICED?

Strong Pound Imports Cheap Exports Dear

technology investment

expensive, but improves efficiency and long term costs

Why does cash matter?

- to pay suppliers/debts

- to promote business/buy raw materials

How to improve cash flow

- reducing cash outflow (costs)

- increasing price inflow (increasing selling prices)

- finding new sources of finance to make payments

- insist customers pay on time

- take longer to pay debt

Benefits of market segmentation

- differenciate

- meets customer needs

- build close customer relationships

reliable date

- come from representative sample

- questions should enable relavant answers

Purpose of market research

To identify and understand customer needs

To identify gaps in the market

To reduce risk

To inform business decisions

financial aims/objectives

survival

profit

sales

market share

financial security

Non-financial aims and objectives

Social goals

personal satisfaction

challenge

independence and control

location depends on

labour

raw materials

market

transport

to add value

speed of service

convinience

USP

branding

better quality/design

bank overdraft

covers short term expenses that can be repaid quickly

flexibility

variable interest rates

trade credit

the practice of buying goods and services now and paying for them later

but there's a trade credit limit

Why new business ideas come about

- changes in technology

- changes in what consumers want

- products and services becoming obsolete

personal savings

Personal savings is money that has been saved up by an entrepreneur. This source of finance does not cost the business, as there are no interest charges applied

venture capital

Venture capital is money invested by an individual or group that is willing to take the risk of funding a new business in exchange for an agreed share of the profits. The venture capitalist will want a return on their investment as well as input into how the business is run.

share capital

Share capital is money raised by shareholders through the sale of ordinary shares. Buying shares gives the buyer part ownership of the business and therefore certain rights, such as the right to vote on changes to the business. This can slow down decision-making processes.

share capital benefits

- Share capital is a source of permanent capital - Shareholders cannot have a refund on their shares. Instead, if they want to sell their shares, they must find someone else to sell them to

- There are no dividends to be paid if the business has a poor year - Shareholders are not promised dividends every year, as dividends are only paid if the business has made sufficient money to pay all of its costs

Disadvantages of share capital

- Loss of control as new shareholders must have a say in the business.

- Dividends may need to be paid

- vunerable to takeover

- Only available to LTD's and PLC's

bank loan

A fixed amount loan from a bank which is generally used to finance long-term assets

long time to approve

crowdfunding

Crowdfunding involves a large number of people investing small amounts of money in a business, usually online

benefit crowdfunding

It acts as a form of market research. If people don't invest, it means the business idea is not attractive or distinctive enough, indicating that the business is likely to fail.

It provides opportunities for individuals to start up a business even if they don't have access to other sources of funding

Disadvantages of crowdfunding

A share of the business may have to be given to investors

May not be able to raise the money needed / difficult

business must be interesting