Mathematics related and key terms

1/32

Earn XP

Description and Tags

405 Exam 2

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

33 Terms

The savings that a large company can enjoy from producing goods in high volume, that are not available to a small company are called

economies of scale

Savings that come from combining the marketing and distribution of different types of related products are called

economies of scope

The merger of two companies in the same industry that make products required at different stages of the production cycle is called:

and an example

vertical integration

JP Morgan Chase: Offers retail banking, investment banking, asset management, and payment processing—all under one roof.

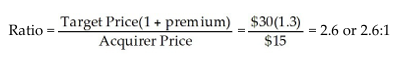

Joshua Transcontinental and George Equity Partners have entered into a stock swap merger agreement whereby Joshua will pay a 30% premium over George Equity Partners’ premerger price. If Joshua's premerger price per share was $15 and George Equity Partners’ was $30, then the exchange ratio that Joshua will offer is closest to

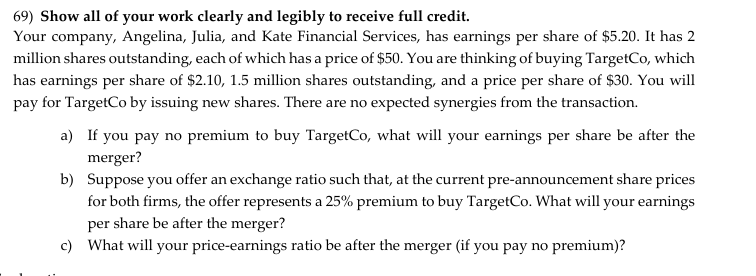

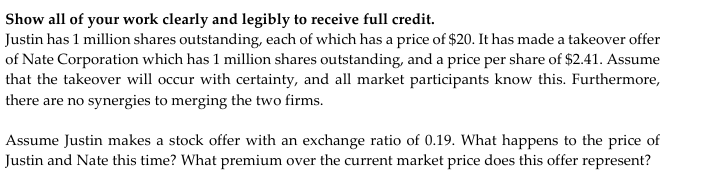

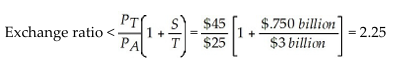

Madeline Group (MG) has announced plans to acquire Lauren Group (LG). LG is trading for $45 per share and MG is trading for $25 per share, with a premerger value for MG of $3 billion. If the projected synergies from the merger are $750 million, what is the maximum exchange ratio that MG could offer in a stock swap and still generate a positive NPV?

A rights offering that gives existing target shareholders the right to buy shares in either the target or the acquirer at a deeply discounted price once certain conditions are met is called a

poison pill

A situation where every director serves a three-year term and the terms are staggered so that only one-third of the directors are up for election each year is called a

classified/staggered board

When a hostile takeover appears to be inevitable, a target company will sometimes look for another, friendlier company to acquire it called a

white knight

When a target company makes a counter-bid to acquire the hostile bidder, this defense strategy is known as

involves the target company turning around and attempting to acquire the hostile bidder

Pac-Man defense

A target company pays a premium to repurchase shares from a hostile bidder in exchange for the bidder agreeing not to pursue the takeover. This is called

Greenmail

Which combination of defenses would be MOST effective in deterring a hostile takeover

Poison pill + classified board

You work for a leveraged buyout firm, Jarrod and Anthony Capital, and are evaluating a potential buyout of Sierra and Jaden Group. Sierra and Jaden Group’s stock price is $15 and it has 10 million shares outstanding. You believe that if you buy the company and replace its management, its value will increase by 50%. You are planning on doing a leveraged buyout of Sierra and Jaden Group, and will offer $20 per share for control of the company. The $20 per share will be entirely debt-financed.

Assuming you get 50% control of Sierra and Jaden Group, then the price of the non-tendered shares will be closest to:

Assuming you get 50% control of Sierra and Jaden Group, then your gain from this transaction will be closest to

12.50

62.5M

You work for a leveraged buyout firm, Isabella Capital, and are evaluating a potential buyout of Grace Inc. Grace's stock price is $18, and it has 3 million shares outstanding. You believe that if you buy the company and replace its dismal management team, its value will increase by 50%. You are planning on doing a levered buyout of Grace and will offer $25 per share for control of the company. This $25 per share will be entirely debt-financed.

Assuming you get 50% control, what will your gain from the transaction be

21.75

Rearden Metal has earnings per share of $2. It has 10 million shares outstanding and is trading at $20 per share. Rearden Metal is thinking of buying Associated Steel, which has earnings per share of $1.25, 4 million shares outstanding, and a price per share of $15. Rearden Metal will pay for Associated Steel by issuing new shares. There are no expected synergies from the transaction

If Rearden offers an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 20% premium to buy Associated Steel, then the price per share of the combined corporation after the merger will be closest to:

If Rearden offers an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 20% premium to buy Associated Steel, then the price per share of the Rearden immediately after the announcement will be closest to:

If Rearden offers an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 20% premium to buy Associated Steel, then the price per share of Associated Steel immediately after the announcement will be closest to:

If Rearden offers an exchange ratio such that, at current pre-announcement share prices for both firms, the offer represents a 20% premium to buy Associated Steel, then the actual premium Rearden will pay will be closest to

19.12

same as 19.12 since Rearden is buyer

17.21

14.1%

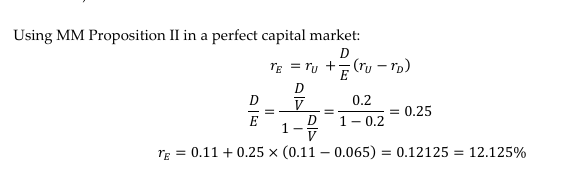

Suppose that Sofea and Saira Transcontinental currently has no debt and an equity cost of capital of 12%. The company is considering issuing bonds with an interest rate of 8% and using the proceeds to repurchase some of its stock. Assume perfect capital markets. If Harper decides to have a debt to-value ratio of 30%, the firm’s levered cost of equity would be closest to:

Which of the following companies is most likely to avoid using high levels of debt financing?

A biotechnology firm in early product development

Which of the following types of firms is most likely to have a high debt-to-equity ratio?

A regional electric utility

Which of the following firms would most likely choose to finance primarily with equity rather than debt?

A newly formed social media platform

Which of the following companies is most likely to maintain a conservative capital structure due to uncertain cash flows?

A luxury fashion brand with seasonal sales

A toehold helps a hostile bidder mainly because it:

Lets the bidder capture part of post-improvement value even if some shareholders don’t tender.

The free rider problem in hostile tender offers occurs when:

Non-tendering shareholders benefit from raider’s improvements without tendering.

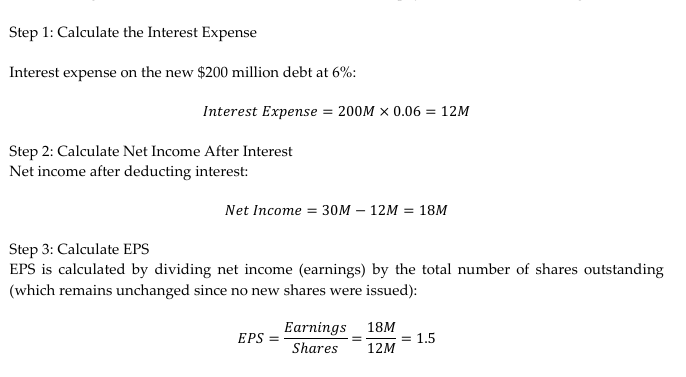

You are the CEO of Christian’s World Famous Pizza. You plan to raise $200 million to fund a major expansion by issuing either new shares or new debt. With the expansion, you expect earnings next year of $30 million. The firm currently has 12 million shares outstanding, with a share price of $80 per share.

Assume perfect capital markets. If you raise the $200 million by issuing new debt with an interest rate of 6%, what will the forecast for next year's EPS be?

1.50

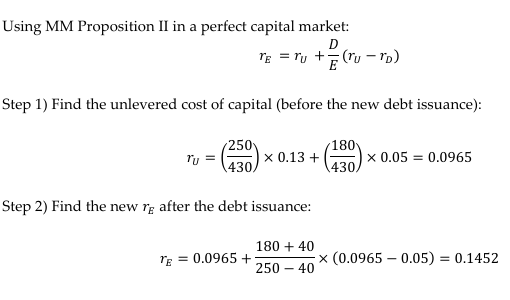

Gaby and Roozhan Motors (GRM) currently has common stock with a market value of $250 million and debt valued at $180 million. The firm's stockholders expect a return of 13%, while debtholders require a return of 5%. Assume perfect capital markets. Suppose the firm issues an additional $40 million in debt to repurchase stock. If the risk of the debt remains unchanged, what will be the expected return on equity after this transaction?

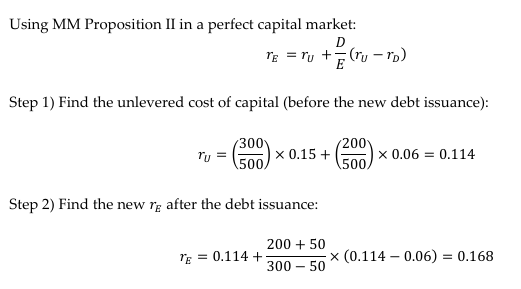

Ananya and Cara FinTech (AC) currently has common stock with a market value of $300 million and debt with a value of $200 million. Investors require a return of 15% on the firm’s stock and 6% on its debt. Assume perfect capital markets. Suppose the firm issues an additional $50 million in debt to repurchase stock. If the risk of the debt does not change, what will be the new expected return on Titan's equity after this transaction?

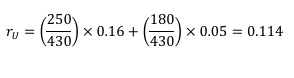

Ally, Caroline, and Emily Inc. currently has common stock with a market value of $250 million and debt with a value of $180 million. Investors require a 16% return on the firm’s stock and an 5% return on its debt. Assume perfect capital markets. Suppose the firm issues $180 million of new stock to fully repurchase its debt. What will be the expected return on equity after this transaction?

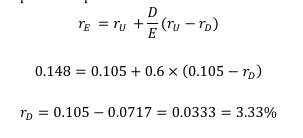

Nicole Ltd. is an all-equity firm whose shares have an expected return of 10.5%. The firm undergoes a leveraged recapitalization, issuing debt and repurchasing stock, until its debt-equity ratio reaches 0.60. Due to the increased financial risk, shareholders now expect a return of 14.8%. Assuming there are no taxes and that the firm’s debt is risk-free, what is the interest rate on the debt?

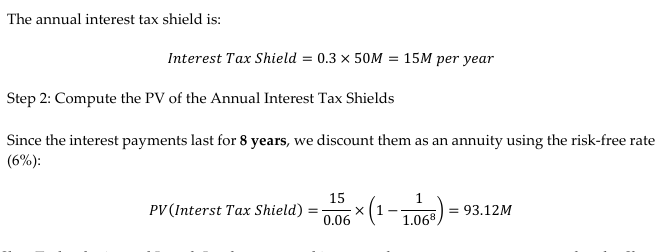

Mahathir Corp. restructures its existing debt and agrees to pay $50 million in interest annually for the next 8 years, and then repay the principal of $1 billion in year 8. These payments are risk-free, and the firm's marginal tax rate will remain 30% throughout this period. If the risk-free interest rate is 6%, by how much does the interest tax shield increase the value of the firm?

Shae Technologies and Joseph Inc. have entered into a stock swap merger agreement whereby Shae will pay a 24% premium over Joseph’s premerger price. If Joseph's premerger price per share was $36 and Shae's was $50, what exchange ratio will Shae need to offer?

36 x (1+.24)=44.64

44.64/50=0.8928

0.8928 × 100=89.28 x $50 = 4464

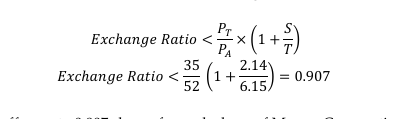

The Pedro Corporation has announced plans to acquire Manny Corporation. Pedro is trading for $52 per share, and Manny is trading for $35 per share, implying a premerger value of Manny of approximately $6.15 billion. If the projected synergies are $2.14 billion, what is the maximum exchange ratio Patrick could offer in a stock swap and still generate a positive NPV?