Diversification vs Specialization + Integration vs Outsourcing

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

45 Terms

What is growth in strategy?

Development of a company’s strategic business activities (SBAs).

What is the goal of corporate strategy?

To maximize the company's overall value by selecting the SBAs in which to invest and grow.

What is synergy?

When two or more SBAs (strategic business areas) generate more value together than separately.

What are the three main growth modes?

Internal growth, external growth, alliances.

What are the main growth paths?

Diversification vs specialization

Integration vs outsourcing

Internationalization

What internal efficiency gains can growth generate?

Lower production costs

Lower commercial costs

Lower management costs

What market power benefits can growth generate?

Lower supply costs, Lower financing costs

What other advantages can growth bring?

Risk reduction

Increased differentiation

Increased prestige for managers

Motivation internally

Positive signal to markets

What are the main limits to growth?

Financing constraints

Loss of control

Regulatory constraints

Organizational complexity

Dispersion of resources

High cost of learning new businesses

Costs can increase after a threshold

What types of synergies exist?

Product synergies

Technology synergies

Market synergies

What benefits can synergies provide?

Lower costs

Improved differentiation

Lower cost of differentiation

What are the risks of synergies?

Hard to evaluate ex-ante

Difficult to implement

Implementation costs

What is specialization?

Maintaining a single SBA without adding new skills.

Advantages of specialization?

Efficiency

Critical size

Good visibility (capital markets)

Disadvantages of specialization?

High risks

Dependence on one market

May require refocusing

What is diversification?

Strategy of developing new SBAs, requiring new skills.

Reasons to diversify?

Face new competitors

Develop new skills

Mobilize new resources

What is refocusing?

Reducing the number of activities to improve consistency.

What are the main types of diversification?

Market-driven (same products, new customers)

Product-related (new products, same customers)

Unrelated diversification (new products + new customers; no synergies)

What benefits does diversification bring?

Growth in mature markets

Risk reduction

Synergies & savings

Satisfying manager ambition

What are the disadvantages of diversification?

Strategic heterogeneity

Failure to reach critical size

Coordination costs

Conglomerate discount

What are the four diversification motivations?

Diversification of investment

Diversification of reinforcement

Diversification of redeployment

Diversification of survival

(Depends on attractiveness & competitive position)

What is the purpose of portfolio matrices?

To evaluate SBA coherence and guide investment decisions.

What are the two axes of portfolio matrices?

Competitive position

Environmental attractiveness

What are the typical strategic outcomes?

Invest / maintain

Selective investment

Maintain and “milk”

Divest

What are the four categories of the BCG matrix?

Stars (High RMS→ Relative Market Share, High growth)

Cash Cows (High RMS, Low growth)

Question Marks (Low RMS, High growth)

Dogs (Low RMS, Low growth)

What is the strategic action for Cash Cows?

Limit investments and use cash flow to fund other SBAs.

What is the strategic action for Question Marks?

Invest heavily or divest.

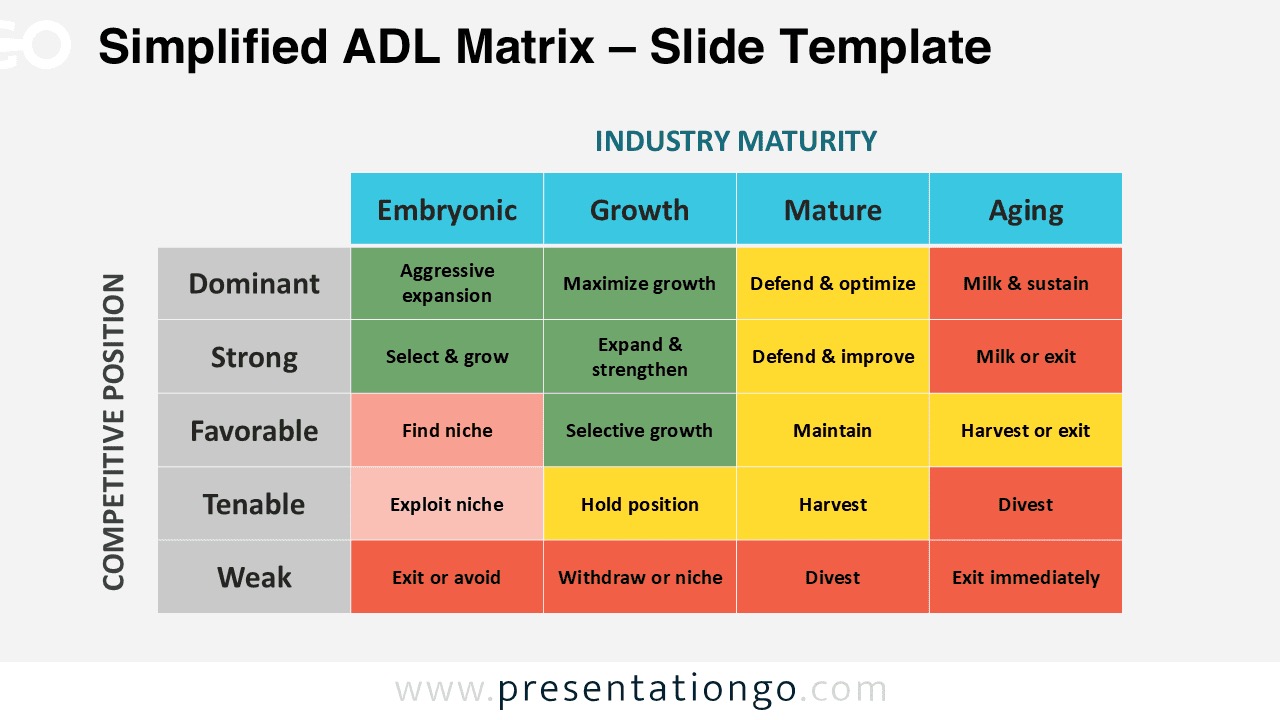

What dimensions does the ADL (Strategic Condition Matrix) matrix use?

Business maturity

Competitive position

What are its strategy categories?

Winning activities (maintain)

Dilemma activities (select)

Losing activities (withdraw)

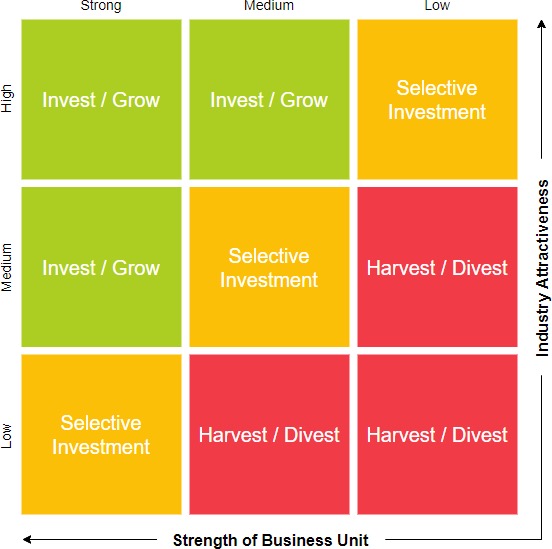

What dimensions does the McKinsey matrix analyze?

Business attractiveness

Competitive strength

Possible strategic recommendations?

Invest strongly

Hold position

Selective investment

Milk

Withdraw

What is vertical integration?

Taking over upstream or downstream activities in the value chain.

Upstream integration?

Securing supply sources, controlling processes.

Downstream integration?

Controlling distribution, improving differentiation, securing outlets.

Benefits of vertical integration?

Control over value-creating activities

Access to scarce resources

Secure supply & outlets

Reduced uncertainty

Lower transaction costs

Reduced competitive pressure

Financial benefits

Control areas of differentiation

What are the limits of integration?

Similar to diversification risks

May undermine core competencies

Risk of strategic autarky

High fixed investments

Reduced flexibility

Higher complexity

What is outsourcing?

Transferring previously internal tasks to external, legally autonomous partners.

What forms can outsourcing take?

Subcontracting

Outsourcing

Impartition

Key benefits of outsourcing?

Focus on core competencies

Lower capital investment

Flexibility

Lower procurement costs

Economies of scale

Demand risk reduction

Access to suppliers’ innovation

What are the main risks of outsourcing?

Dependency on suppliers

Loss of know-how

Loss of confidentiality

Loss of strategic capabilities

Fragility due to focus

Monitoring/control costs

Social cost (worker exploitation)

Environmental issues

What variables influence the choice between integration and outsourcing?

Impact on competitive advantage

Risk type & level

Transaction frequency

Specific investments

Financial capacity

The BCG Matrix

The ADL matrix

The McKinsey Matrix