Competitive Strategy II: New Entry, Industry Evolution, Differentiation - Tesla

1/23

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

24 Terms

barriers to entry US automative industry

1) economies of scale (BP, FC, labor, investment in tech)

2) large upfront CAPEX required to set up mass production (plants, technology/robots, overhead)

3) access to distribution

4) credible threat of retaliation (deep pocks incumbents, non-market weapons e.g. sales, advertising)

5) gov laws/regulations (protecting dealerships, lobbying)

two discontinuities tesla leveraged

electrification, autonomy

how did tesla overcome barriers to entry?

1) commercialising new tech (EV)

2) started by targeting tech enthusiasts segment where economies of scale were less of a disadv

3) strategic alliances for weaknesses (daimler - car eng, toyota - lean manuf, panasonic - battery)

4) open innovation (sharing patents) and co-opetition to create new standards/trend - e.g. competing with GM but collaborating with them for tech

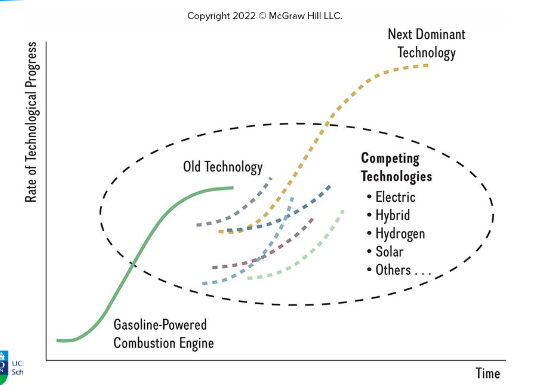

discontinuity/inflection point

a breakthrough innovation that fundamentally changes the tech in an industry. lowers the value of both tech know-how and complementary assets.

industry life cycle

intro: prod innovation, for tech enthusiasts

growth: prod innovation decreasing, process innovation increasing. for early adopters

shakeout: prod innovation decreasing, process innovation increasing. for early majority.

maturity: process innovation. for late majority.

decline: process & prod innovation both stopped. for laggards.

EV between intro & growth.

industry life cycle process / prod innovation

graph

crossing the chasm

gap separating early adopters and early/late majority (growth & shakeout/majority)

tesla chasm

tech enthusiasts: Tesla Roadster

early adopters: Model S, Semi

early majority: Model 3, Model Y (crossed the chasm - best selling), Model X (failed - too exp, prod/quality issues), Cybertruck (failing - too exp, quality issues, not designed for utility)

tesla strategy

focused differentiation

tesla success

internal:

1) tangible differentiation (truly innovative)

2) business model innovation (subscription model, software updates, minimal service req)

3) supporting infrastructure (charging stations - range anxiety)

4) vertical integration (control over design of components, no reliance)

5) data collection on consumer behavior

external:

1) gov support (tax subsidies)

2) env concerns/awareness & volatile oil prices

3) little interest in EVs from incumbents

4) exploited financial crisis to get access to facilities

5) location efforts - silicon valley know-how for FSD

tesla vs comp: design/r&d (value chain)

comp: multi-year planning, several complex moving parts, high investment for new models (1-6b)

tesla: 0.5b for model S, quicker dev bc fewer components, modular approach, form partnerships to fill missing competencies & reduce risk, created own IP, clear staging

tesla vs comp: supply network (value chain)

comp: large, global r/s, long-term contracts for specific tech, >1000 suppliers for each car mode

tesla: vertically integrated (distinctive design, no hold up), dual sourcing arrangements

tesla vs comp: production (value chain)

comp: massive plants (1-2b), slow manuf chains, costly errors, COGS 80% of selling price

tesla: bought during finanical crisis (1/3 of price), process innovation reduce prod costs, economies of specialisation (NY superchargers), share platforms reduce component costs

tesla vs comp: selling & distribution (value chain)

comp: huge dealer networks, sales & service intertwined, commissioned sales staff

tesla: no dealer network, set up its own stores & website (consistency and control), salaries rather than commission, sales separate from service bc EV req less service

tesla vs comp: marketing (value chain)

comp: long-term brand building, huge advertising expenditures, emotional elements

tesla: brand connected to Musk, used breakthrough models for publicity rather than advertising (lower marketing costs), focus on speed/style/performance before environmental benefits

tesla vs comp: customer service (value chain)

comp: dealers req servicing & parts sales, heavy on financing as element of business (loans, warrantees, etc)

tesla: service separated from stores, extensive supercharger network, over the air software updates, offers FSD upfront or subscription model

tesla comp adv costs / cost drivers

1) cost adv: marketing

2) economies of scale (-12% op margin to 13% with 50,000 to 250,000 units)

3) economies of learning (95% LC)

4) experience curve effects (investments in AI/robots shift the learning curve downwards. nextgen prod = 50% lower costs in platform)

5) economies of scope (sharing R&D, using common platforms across vehicles)

6) prod design (vertically integrated = more control)

7) input costs (gigafactory shanghai - lowers cost by 40% compared to US, vertically integrated so no risk of materials cost increasing e.g. lithium)

economies of learning

FC & VC decline as cumulative production increases. 95% learning curve = costs decrease 5% every time cumulative output doubles.

tesla comp adv WTP

1) tech leadership (software, autonomous driving)

2) product differentiation (style, performance, design)

3) service differentiation (showrooms)

4) complementary differentiation (superchargers, software)

lessons from tesla

1) indirect attack - start where there are fewer comp/higher margins and make your way down

2) start where disadv is less, use alliances to fill resource gaps (panasonic - batteries)

3) take adv of change & discontinuities (electrification)

4) place competitors in dilemma

5) critical to continually position company in future structure of the industry (tesla investment in AI, automation, FSD)

threats to sustainability

value created: imitation, substitution

value captured: hold-up, slack

tesla threats to sustainability

imitation: chinese comp able to produce at lower cost, incumbents have deep pockets, BYD was able to imitate

substitution: hydrogen fuel cell vehicles dont need to be plugged in (toyota, hyundai), advancement in solid state batters could undermine adv in lithium batteries

slack: musk distracted running five companies, staff exodus, managerial hubris (cybertruck fail), brand erosion

holdup: charging stations not prioprietary to tesla, others are benefitting from teslas innvations. low/no subsidies may erode value.

danger of duality

firm stuck in between cost leadership and differentiation. guarantees low profitability. + graph

approaches to dual strategy

1) cost effective service excellence (low unit costs but high level of service - anything touching the customer is premium)

2) focused service factory (single product to homogeneous segment: differentiation, scale & learning)

3) structural ambidexterity (separate org units. -one focused on cost one on diff)

4) value innovation (lowering costs by eliminating, reducing raising, creating some value components)