GCSE Economics paper 2

1/114

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

115 Terms

economic growth

growth in GDP( value of output) over time

Gross Domestic Product (GDP)

The total value added of goods and services produced in the country in a year

rate of growth =

change in gdp/ original gdp * 100

GDP per capita

GDP divided by population

Boom

A period of rapid economic growth and high unemployment

recession

a period when the country's GDP falls for 2 or more consecutive quarters

determinants of economic growth

1. investment - increased investment in capital makes businesses produce more goods and services

2. changes in technology - makes capital more effective increasing the quantity it can produce

3. education and training - this increases the skill of the labour meaning a country and output more

4. labor productivity - more output per worker over a period of time

5. size of the workforce - increases the amount a country can produce

6. discovery of natural resources- stimulates economic growth

Benefits of economic growth

- rise in living standards: GDP per capita increases when the rate of growth is higher than the rate of growth of the population

-A reduction in poverty: higher tax revenue ~ increased budget for benefits and training

- increased in education and training

- rise in employment

Costs of economic growth

- environmental costs

- air pollution

- global warming

- congestion

- loss of non-renewable resources

- lower quality of life

- inequality

- inflation

employment

the use of labour in an economy to produce goods and services

unemployment

occurs when workers are willing and able to work at the current wage rates are unable to find employment

claimant count

The method of measuring unemployment according to the number of people who are claiming benefits

Labour Force Survey

A measure of unemployment based on a survey using the ILO definition of unemployment

level of unemployment

The number of people in the working population who are unemployed.

unemployment rate =

number of unemployed/ workforce * 100

seasonal unemployment

unemployment caused by a fall in demand during a particular season.

frictional unemployment

unemployment caused by time lags when workers move between jobs

structural unemployment

unemployment caused by a permanent decline if an industry or industries

cyclical unemployment

unemployment caused by a lack of demand in the economy

aggregate demand

the sum of all the demand in the economy

Benefits of unemployment

- workers need frictional unemployment to allow the movement of jobs

- wage rates are low since there is a surplus of workers available

- decrease in inflation due to the Philips curve

costs of unemployment to the government

- labour resources are wasted

- lower tax revenue

- increased spending on benefits

- increased in budget deficeit

distribution of income

How incomes are shared out between individuals and households

income

the reward for the service provided by a factor of production including labour

Wealth

The market value of all assets owned by a person, group or country at a specific point in time. Wealth is a stock of assets

types of income

-wages

-rent

-interest

- profit

- state benefits

Gross Income

income received before any taxes are taken or benefits given

reasons why income is unevenly distributed

- income-earning assets are distributed unevenly

- difference in wages

- reliance on benefits

- age

-gender

Distribution of wealth

How wealth is shared out between individuals and households.

reasons why wealth is distributed unevenly

- inheritance

- savings

- purchase of property

- enterprise

cost of living

The price level of goods and services bought by the average family

inflation

a sustained rise in the general price level over time

Price stability

When the general level of prices stays constant over time, or grows at an acceptable low rate

rate of inflation

the annual percentage rate of change in the price level, as measured, for example, by the CPI

CPI

method used to calculate the rate of inflation

How is CPI calculated?

1. Fix the basket

2. Find the prices

3. Compute the basket's cost

4. Choose a base year and compute the index

5. Compute the inflation rate

What causes inflation

- increase in demand

- rise in cost

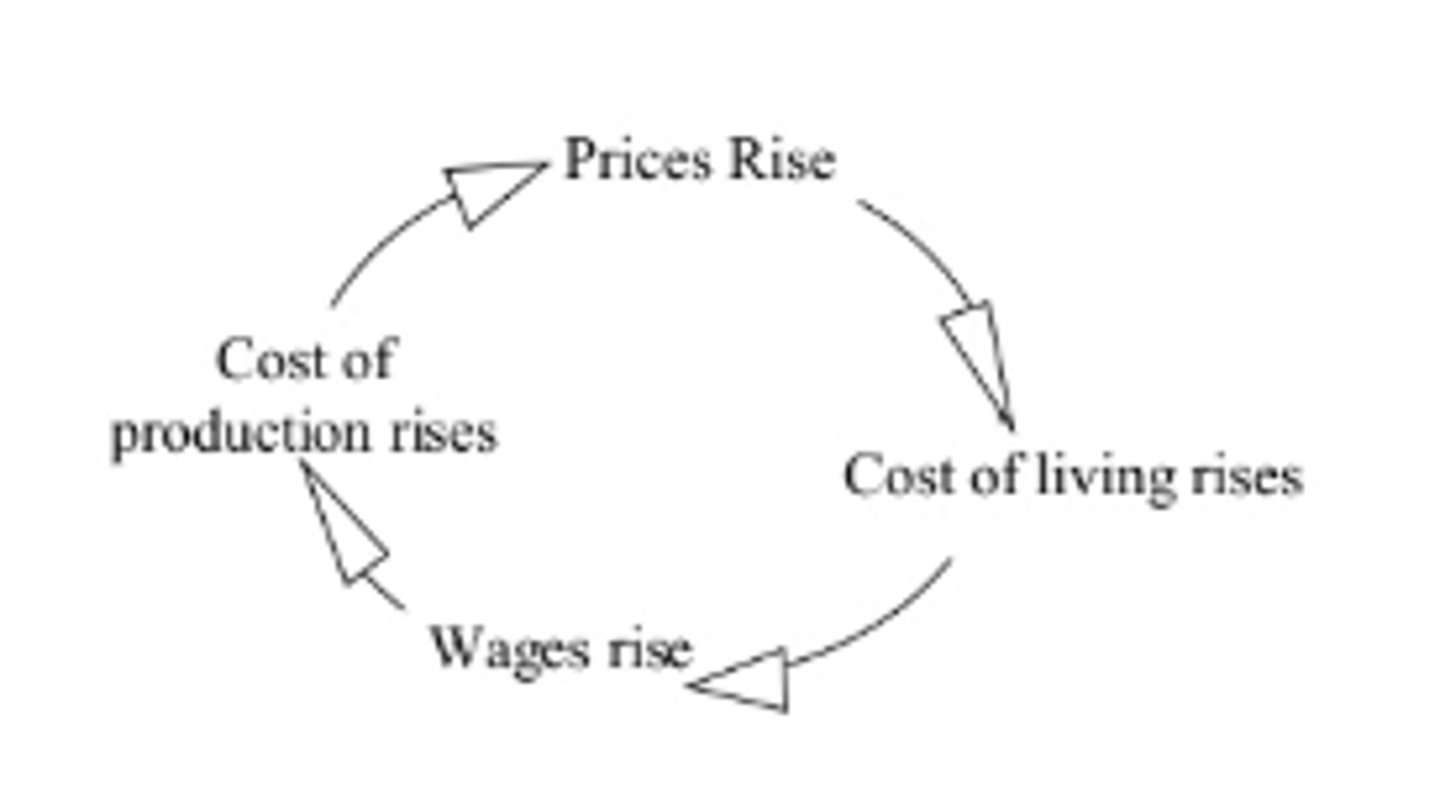

wage-price spiral

the process by which rising wages cause higher prices, and higher prices cause higher wages

consequences of inflation for consumers

- loss of consumer confidence

- shoe leather costs( consumers take more time and effort looking around for the best prices)

- real income may fall since the cost of living will increase

- debtors gain since their value of debt decrease

consequences of inflation for producers

- menu costs must be regularly updated

- wages will increase meaning a greater cost for firms

- uk economy will be less competitive causing unemployment

- creditors lose money during times of inflation

Government spending

the total amount of money spent by the government in a given period of time

direct tax

a tax on income or wealth

Government revenue

the source of finance for government spending

Examples of government spending

Health ,Education , Transport , Welfare, Defence, Foreign Relations/Affairs, Trade

examples of Direct Taxes

- income tax

-National insurance contributions

- cooperation tax

- inheritance tax

- capital gains tax

Indirect taxes

a tax on spending, often defined as a tax on goods and service

examples of indirect taxes

-VAT

- exercise duties

- gambling duties

Balanced budget deficit

when tax revenue = gov spending

Budget deficit

when gov spending > than tax revenue

Budget surplus

when gov spending < than tax revenue

Fiscal policy

A policy that uses government spending and taxation to affect the inflation of a country as a whole

Objectives of Fiscal policy

- economic growth

- low unemployment

- price stability

- a balance in the balance of payments

multiplyer effect

a process by which an original change in incomes in the economy leads to a total change in incomes which is a multiple of the original change

expansionary fiscal policy

when the government decreases taxes to increase demand

contractionary fiscal policy

when the government increases taxes to decrease demand

what are the function of taxes

- government source of revenue

- control over demand

regressive tax

A tax for which the percentage of income paid in taxes decreases as income increases

progressive tax

A tax for which the percentage of income paid in taxes increases as income increases

Laffer Curve

a supposed relationship between economic activity and the rate of taxation that suggests the existence of an optimum tax rate that maximizes tax revenue.

deflation

a sustained drop in the price level

disinflation

a reduction in the rate of inflation

Hyperinflation

A very rapid rise in the price level; an extremely high rate of inflation.

Increase in government spending( Fiscal Policy)

increase in spending ~ increase in people spending ~ increase in demand ~ demand pull inflation

reduction in taxes ( Fiscal policy)

increase in disposable income ~ increase in aggregate demand since people can buy more things ~ demand pull inflation

A decrease in government spending( Fiscal Policy)

decrease in employment ~ due to Philips curve, a decrease in employment leads to a decrease in inflation

increase in taxes( fiscal policy)

decrease in disposable income ~ decrease in aggregate demand ~ disinflation

Income and wealth redistribution

Government action, using mainly taxation and benefits, to reduce inequalities of income and wealth

inheritence tax

a state tax collected on the property left by a person to his or her heir(s) in a will

monetary policy

A policy that aims to control the total supply of money in the economy to try to achieve the government's economic objectives, particularly price stability.

Objectives of Monetary Policy

- economic growth

- low unemployment

- price stability

-A balance in the balance of payments

Bank rate

The interest rate that the Bank of England uses when it lends money to other banks. Financial services providers take account of the Bank rate when they decide how to set interest rates on their own products.

interest rate policy

The use of interest rates to try to achieve the governments economic objectives

Interest rates

cost of borrowing credit for saving

Increase in interest rates( monetary policy)

credit for saving increases ¬ people spend less and save more ¬ aggregate demand decreases ¬ inflation rate decreases

decrease in interest rates(monetary policy)

cost of borrowing decreases ¬ more people will have money to spend ¬ increase in aggregate demand ¬ demand pull inflation

monetary policy lag time

long( 9months - 2 years)

fiscal policy lag time

short

supply side policy

Policies that increase the ability of an economy to supply more goods and services

reducing direct taxes(supply side policy)

- increases incentive to work

- if cooperation tax is high, firms may be unwilling to invest

reducing benefits( supply side policy )

- decrease in incentive to work if benefits are too high

encouraging enterprise( supply side policy )

- new businesses benifit from tax reductions and subsidies too encourage people to set up work

education and training( supply side policy )

the better trained the workforce, the the more able it is to produce goods and services

supply side time lags

very long

externality

the impact of one person's actions on the well-being of a bystander

positive externality

beneficial side effect that affects an uninvolved third party

negative externality

the harm, cost, or inconvenience suffered by a third party because of actions by others

government policies to correct positive and negative externalities

- Taxation

- subsidies

- state provision

- legislation and regulation

- information and provision

Exports

Goods and Services sold to other countries

imports

goods and services purchased from other countries

`international trade

the exvhange of goods and services between cou tries

benefits of imports and exports for consumers

- lower prices for consumers

- more innovative and better quality goods

- Greater choice of goods

benefits if imports and exports for producers

- Access to larger market meaning an increase in potential buyers

-increased competition leading to greater efficiency

- specialization and lower average costs

- lager markets for buying inputs and lower average costs

European Union

An Economic and political group of countries that have free trade with each other

Free trade

Free movement of goods and services between countries without any restrictions

Balance of payments

record of all financial transactions between one country and the rest of the world

current account

the record of trade in goods and services, income flows and transfers between one country and the rest of the world

trade in goods

export - imports of goods

trade in services

exports - imports of services

income flows

earnings on investment from abroad for example interest that foreigners earn on an investment in the UK and that UK nationals earn on investment abroad.

transfers

transfers do not reflect any actual trade. They cover the transfer of money or goods and services without any requirement of payment: for example, foreign or money sent home by relatives working abroad