HKDSE Econ - CH11-13 (Short-run and long-run production, Intergration and expansion of firms)

1/44

Earn XP

Description and Tags

MUST ALSO REVISE NOTES

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

Production

The process of turning input into output

Variable factors

Factors which quantity changes when output changes

Fixed factors

Factors which quantity remains unchanged when output changes

Total product

Total amount of output produced at a certain level of employment of factors

Average product

Total product / number of variable factor

Marginal product

Change in total product

Law of diminishing marginal returns

When a variable factor is added continuously to a given amount of a fixed factor, the marginal product will eventually diminish, holding technology constant.

Marking scheme to support law of diminishing marginal returns

X is a fixed factor as its quantity remains constant when the output changes

Y is a variabl factor, so it is a short-run production

The MP decreases from A to B when the Cth unit of factor is put to use

Marking scheme to not support law of diminishing marginal returns

The quantity of X and Y both increase when the output changes. There are no fixed factors in the production. It is a short-run production

The MP does not diminish when the output increases

Total cost

Total variable cost + total fixed cost

Marginal cost

Change in TC = Change in TVC

Marginal revenue

Average revenue = Price when constant

Profit maximisation condition

P = MR = MC, where the seller is a price-taker in perfect competition

Effect of profit maximisation when P increases

MR increases → profit maximisation output increases → total revenue increases

Effect of profit maximisation when fixed cost increases

No change in variable cost → no change in MC → profit maximiation output remains unchanged

Total cost increases → total profit decreases

Effect of profit maximisation when variable cost increases

MC increases → profit maximisation output decreases

TC uncertain → profit uncertain

Average fixed cost

Keeps decreasing, but larger than or equal to 0

Average variable cost

Increases initially and eventually decreases

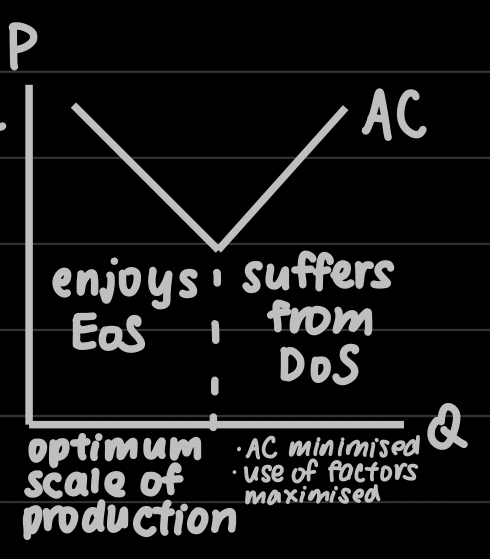

Optimum scale of production

AC / MC minimised

Use of factors minimised

Definition of economies of scale / diseconomies of scale

Firms (blank) from EoS / DoS

Advantages / disadvnatages associated with long-run production that increase / decrease the average long-run cost of production

Enjoy / suffer

How can production scale be expanded?

By increasing production output

Internal economies: increase in production scale of the firm

External economies: increase in production scale of other firms / entire industry

Internal EoS

Financial economies: lower borrowing costs / less collaterals

Marketing economies: advertising costs / extra services provided to customers spread over a larger output

Managerial economies: wider scope of specialisation → improves managerial efficiency and productivity

Research and development economies: research expenses spread over a larger output → develop technologies to decrease cost

Technical economies: more output → capital goods / machinery can be utilised more fully and efficiently

Purchasing economies: purchase raw materials in bulk → obtain discounts

Risk diversitifcation economies: diversify products / markets to reduce risk

External EoS

Managerial economies: more talented workers are attracted to the industry and trained

Marketing economies: Firms may benefit from the advertisement of other firms promoting similar products → create trends to attract customers

More supporting services: transport and communication networks are better developed

Technical economies: lower prices for backup services

Purchasing economies: larger industries have more bargaining power to purchase materials earlier than smaller industries

Internal DoS

Financial economies: large outstanding loans → increase in borrowing costs

Banks face higher risk when a large sum of money is borrowed again and again → increase interest rate to compensate for higher risk

Marketing economies: market becomes saturated → marketing costs increase

Managerial economies: too large in scale

External DoS

Purchasing economies: excessive expansion in production output bids up prices of raw materials / inputs

Increase in transport costs: over-concentration of business activities leads to traffic congestion

Technical economies: firms providing backup services also suffer from DoS → increase price

Internal integration vs external integration / expansion

Internal: within a firm’s own capacity → opening more branches / introducing more products

External: combine with another firm

General motives of integration

Make use of established brand’s goodwill to decrease advertising costs

Enjoy economies of scale to reduce average cost

Better use / reduce duplicates of faciltiies and resources (synergy effect)

Vertical forward integration

Expand to a business in the later stage of prodcution / that provides market outlets for produts

Obtain market information through market outlets

Ensure steady supply of market outlet of products

Reduce transaction cost

Develop relationship with customers

Vertical backward integration

Expand to a business in the preceding stage of production / that provides inputs or raw materials for production

Ensure steady supply of inputs to prevent risk of disruption to production due to inadequate supply of input

Horizontal integration

Expand to a business selling similar / the same produts

Increase market share / market power by influencing market price

Reduce competition, eg avoiding price wars

Lateral integration

Expand to a business selling similar but not competitive products

Reduce risk through diversification (use profits of one business to cover the loss of the other)

Conglomerate integration

Expand to a business in a completely unrelated industry

Reduce risk through diversification (use profits of one business to cover the loss of the other)

Perfect vs imperfect competiiton

Buyer / sellers have perfect / imperfect information on the market

Market

A set of arrangements that allow a transaction to take place

Buyer

Seller

Product

Price

P competition (eg. discounts)

Non-P competition (eg. gifts / advertisements / improve product quality)

Price-taker

Firms lose all customers when they set price different from other sellers

No influence on market price

Price-searcher

Buyers / sellers are not fully informed on every aspect of the market

Market information involves cost to obtain

Characteristics of perfect competition

Many sellers

Free entry

Homogenous product

Perfect market information

Price-taker

Behaviour of sellers in perfect competition

No non-P comp (sellers can sell whatever Q they want at the same P)

P comp (not expected to do so)

P changes when D / S change

MC same for all individual sellers (profit maximisation: MC=MR=R)

Characteristics of monopolistic competition

Many sellers

Free entry

Heterogenous products

Imperfect market information

Price-searchers (seller can determine price on their own)

Behaviour of sellers in monopolistic competition

P competition and non-P competition

Characteristics of oligopoly

Many sellers but with several dominant sellers

Free or restricted entry

Homogenous or heterogenous products

Imperfect market information

Price searcher:

Sell heterogenous products

Customers favour certain brands

Hold significant market share

Behaviour of sellers in oligopoly

P competition and non-P competition

Interdependent / price leadership

Consider the reaction of competitors when making business decisions (will follow competitors if they lower P) → keep lowering prices → leads to price wars (lowering P below the cost of production to increase market share)

Price tends to be rigid (agree on same / similar P) → non-P competition

Characteristic of monopolistic competition

One seller (no close substitutes)

Restricted entry

Heterogenous (eg electricity) or homogenous (eg 1st class in MTR) products

Imperfect market information

Price-searcher (set P to maximise profit)

Behaviour of sellers in monopoly

Face P copmetition and non-P competition from

Sellers of substitutes

Producers using similar production process / resources

Competition to be the only seller (eg. licenses)

Business risk from inefficient operation

Sources of monopoly power

Natural monpooly (high set-up costs → EoS decrease AC → no room for second producer)

Government provision of strategic goods

Ownership of patent / copyright (right of an inventor to buy / sell / produce their product)

Ownership of essential technologies (eg. possession of superior raw materials)

Sole ownership of franchise (license to operate in a particular trade / business)

Collusion / integration with firms (collaborating with firms to increase joint profits eg. cartels)