Accounting

1/113

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

114 Terms

What is accounting

Language of business - tells the financial story of the business

‘Process of identifying, measuring and comunicating economic information to permit informed judgements and deicsions by the users of the information

To provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the entity.

Accounting methods have developed over thousands of years and are still developing

What does accounting allow us to do

Make business decisions (accounting analytics)

decide prices, calculate costs of products/services, evaluate different options, take out a loan

Measure Business performance

Know how well an individual, group, division, factory, product is performing. Know how well we use our capital to generate returns

Report a business’ financial performance, position and liquidity

Explain entity concept

A business can be a sole trader

single owner

personal liability of owner for business debts

Drawings

Partnership, Limited liability partnership

two or more owners

personal liability of owners for business debts

partnership salary and profit share

Company

Multiple owners- shareholders

Limited liability of owners for business debts

dividends and capital growth

Private limited company (Ltd)

Public limited company (PLC)

Listed Company

Who uses accounting information

Investors/analysts

Lenders

Suppliers

General Public

Customers

Government

Employees

Management

What are internal users and what may they use accounting information for

Managers are internal users and will use it for

marketing decisions

finance decisions

production decisions

HR decisions

What are external users and what may they use accounting information for

Investors’ decisions - dividend stream, capital growth

Lenders decisions - Interest, capital

What are the differences between financial accounting and management accounting

Financial accounting reports on past events using historical info, management accounting involves planning for the future using past and projected future info

Financial accounting is highly regulated by (IFRS,US GAAP) whereas management accounting is unregulated however professional bodies have guidelnines

Financial accounting involves detailed annual financial statements, whereas management accounting involves frequent management reports

Financial accounting follows a set format for statements, whereas management accounting involves no pre set and often detailed reports

Financial accounting has external and general purpose for wide range of users, whereas management accounting is internally used and specific purpose for management

Why is accounting important to me

understand busieness/ personal finance

interpret financial info

make better financial decisions

be a better managemr/ business person

Explain the 3 step financial accounting system

Step 1: record transactions

(double entry bookkeeping - Duality)

Step 2: analyse and summarise

(trial balance)

Step 3: prpare accounts

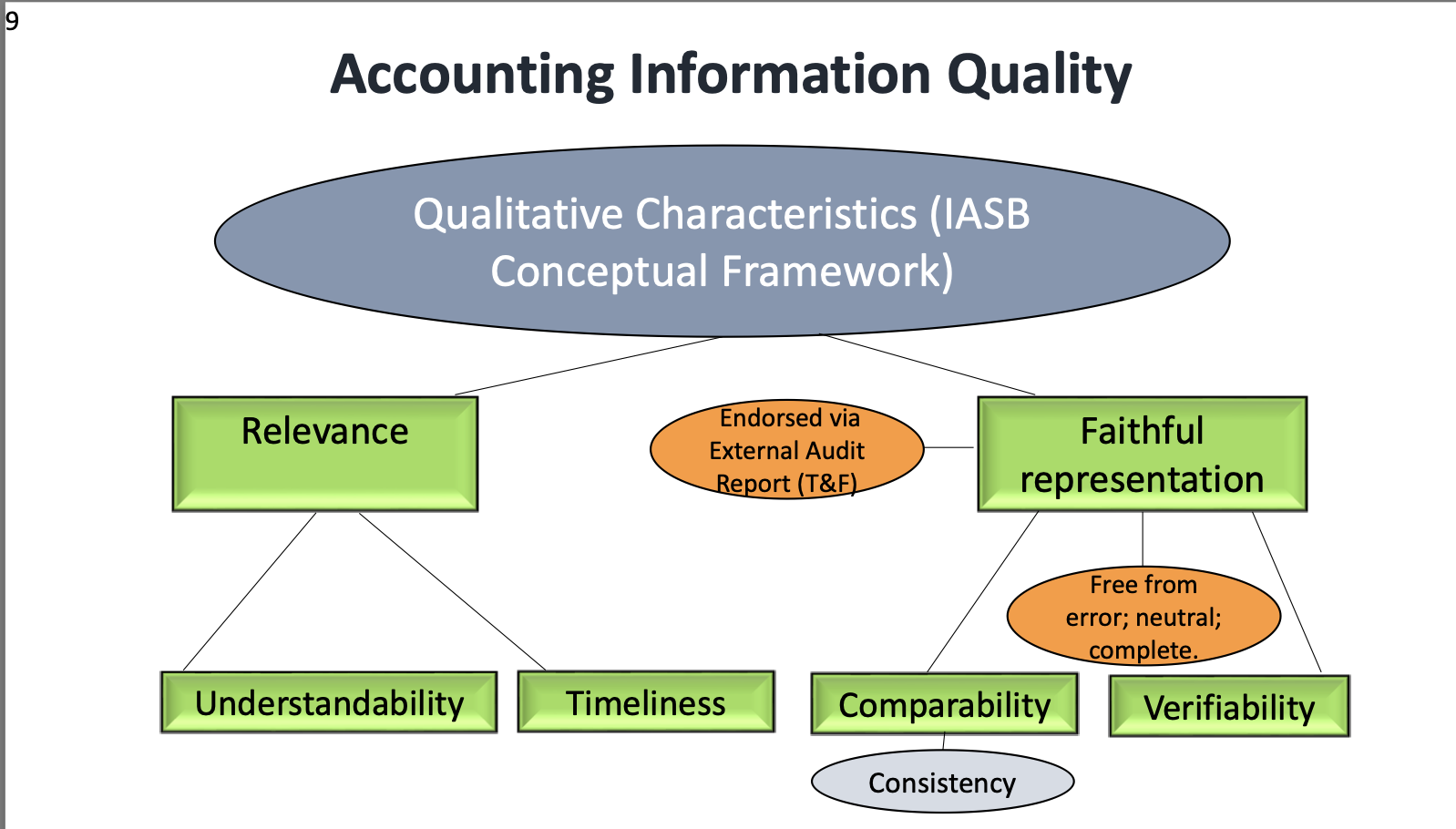

Explain the Qualitative characteristics (IASB Conceptual Framework)

Explain the Acounting Environment

IFRS / US GAAP is a widely used accounting rules and principles

144 Countries require IFRS use, including 15 of the G20

Remaing 5 are US, China India, Japan, and indonesia

US accounting standards are US GAAP, broadly similar to IFRS

What are the major financial statements

Statement of Profit loss/ Income statement

reports profit or loss for a period of time

Statement of financial position/balance sheet

shows assets liabilities and equity of a business at a particular point in time

Statement of Cash flows

Provides information on cash movements in or out of a period of time

What is an asset

something owned

A present economic resource controlled by the entity as a result of past events

What is a liability

Something owed

A present obligation of the entry to transfer an economic resource as a result of past events

What is equity

Shareholders’ funds

Residual interest in the assets of the entity after deducting its liabilities

Assets - liabilities = equity

or equity = capital + profit

what is capital

amount owner (s) invest in a business

What is profit

Income - expenses (for a period of time)

What is the accounting equation

assets - liabilities = equity

or

assets = equity + liabilities

What is the affect of trading on equity

Proffits increase the net assets and increase equity

Losses reduce net assets, which reduces equity

hencee the accounting equation to reflect this

Assets = Equity + Profit ( or Loss) + Liabilities

What should be on the income statement

Sales revenue

Less cost of sales = - ( Purchases + less closing stock)

Gross profit = Sales Revenue less: cost of sales

Less: Expenses

Net profit = Gross profit less: Expenses

What should be on the SoFP

Assets:

Non current assets

Current assets:

inventory

trade receivables

bank balance

Liabilities:

Current Liabilities

net assets = asset - liabilities

Equity:

Ordinary share capital

Retained earnings (profit)

Total equity = ordinary share capital + profit

Explain the trial balance

Sales on credit are trade receivables

purchases on credit are trade payables

Total Db = Total Cr

DB = Assets / Expenses

Cr = Liabilities / Incomes

What are the limitations of accounting

IT is powerful, but can be devise as those in the know are in a position of power

It is subjective there is no right answer eg for the value of assets or profit an organisation owns/ makes

tells a financial story tellable in many ways- each potential biased

is partial- cannot measure everything in monetary terms- money measurements. Can create problems, ie ford pinto

Needs context. Limited value in interpreting accounting information without udetstatngin its context

Because not neutral - it sustains existing and inequitable social orders- critical accounting theory

Statement of financial position

Shows assets, liabilities and equity of a business at a particular date

provides a snapshot of the business

sometimes referred to as the balance sheet

encapsulates the accounting equation

A = C + L

What is the relationship between the SoFP, IS, CFS

statement of financial positions (point in time) are linked by IS and CFS (period of time)

Explain the layout of the assets section of SoFP

ASSETS

Non current assets

long term assets for example a car. XXX

Current assets

Short term assets for example inventory. XXX

Total Assets = (sum of above). XXX

Explain the layout of the liabilities section of SoFP

CAPITAL AND LIABILITIES

capital at the beginning of the period XXX

add profit for the year XXX

less drawings XXX

Capital at the end of the period XXX

non current liabilities

Long term liabilities XXX

Current liabilities

Short term liabilities. XXX

Total capital and liabilities XXX

Define non current assets

assets in long term use in the business

Define currrent assets

assets held by the business for < 1 year including inventory held for resale and cash balances

Current liabilities

Amounts due to be paid < 1 year including amounts owed to suppliers

non current liabilities

amounts due to be paid after a year, including long term loans

explain non current assets

3 main types:

tangibles: property, plant and equipment

intangibles: brand names, goodwill and patents

Investments ; share investments and derivatives

Valuation of tangible non-current assets

initially recorded at historic cost (purchase price). companies may use fiat values, ie the value that you could sell it for

The historic cost (or revalued amount) is used up by the business ie they wear out in use; wear out over time; become obsolete → economic benefits inherent in the asset reduce = depreciation

Define net book value

Historic cost/ revalue - accumulation of depreciation = Net book value (NBV)

Explain valuation of intangible/investment non current assets

intangibles

recorded at a cost only if purchased, not recognised if internally generated

brand names such as. Microsoft not shown as assets because usually internally generated

significant limitation of information value of financial statements

depreciation of intangibles is called Amortisation

Investments

recorded at their fair value

Explain market value (price) vs Book price

Price to Book ratio: (mv per share)/ (book value of net assets per share)

example price to book ratios (in 2020)

microsoft 12.92

Facebook 4.52

Nokia 1.31

what accounts for the difference?

assets stated at historic cost not at market value

assets mostly intangible on SoFP

Explain Depreciation

Non current assets benefit a business over a number of yeeats

Depreciation aims to spread (match) the cost of the asset over the years in which the benefit will be obtained

This is an example of the matching convention

2 main methods:

Straight line: equal annual amount: assets fall in value evenly

Reducing balance: Front end loaded; value falls mostly early on

What would the NBV look like for an asset that depreciates £200 a year and initially is worth 630

630, 430, 230, 30

Define Depreciation charge

amount charged (expense) to income statement to spread the cost of non-current assts over the life

Define Accumulated depreciation

Total depreciation charged to date on a asset since purchased

Define the net book value

cost of an asset minus the accumulated depreciation charged on it

What are current assets

Current assets are held for short term- ale or use in business’ normal operations

Examples include:

inventory

trade receivables

prepaid expenses

cash/bank or cash equibalent

Include at historic cost or net realisable cost (selling price) if lower _ Prudence

Explain the circulating nature of current assets

Inventories are sold on credit to customers, creating trade receivables which when customers pay receivables are converted to cash which is used to buy more inventory

Explain Liabilities

Present obligation of the entity to transfer an economic resource as a result of past events

Non current:

amounts to be settled in the longer term - ie after a year

examples include long term bank loans and debentures and loan stocks

current:

amounts to be settled in the short term ie within 1 year

examples include money owed to suppliers, bank overdrafts, non current liabilities in their last year

What are the limitations of the SoFP

Historic cost and historic nature

Estimates and judgements

which depreciation methods and rates to use

missing assets and money measurements

some intangible assets

Explain the nature of a limited company

limited company is a separate legal entity with perpetual existence

Owners (shareholders) granted Limited liability for company’s debts and losses

public company (plc) Ofers shared for sale to the public; private company (Ltd) cannot

to protect those dealing with it, limited liability included in the name, restrictions placed on the withdrawal of equity and audited annual financial statements are made publicly available

Governed by a board of directors, elected by shareholders

UK corporate governance code sets out how plc should be directed and controlled

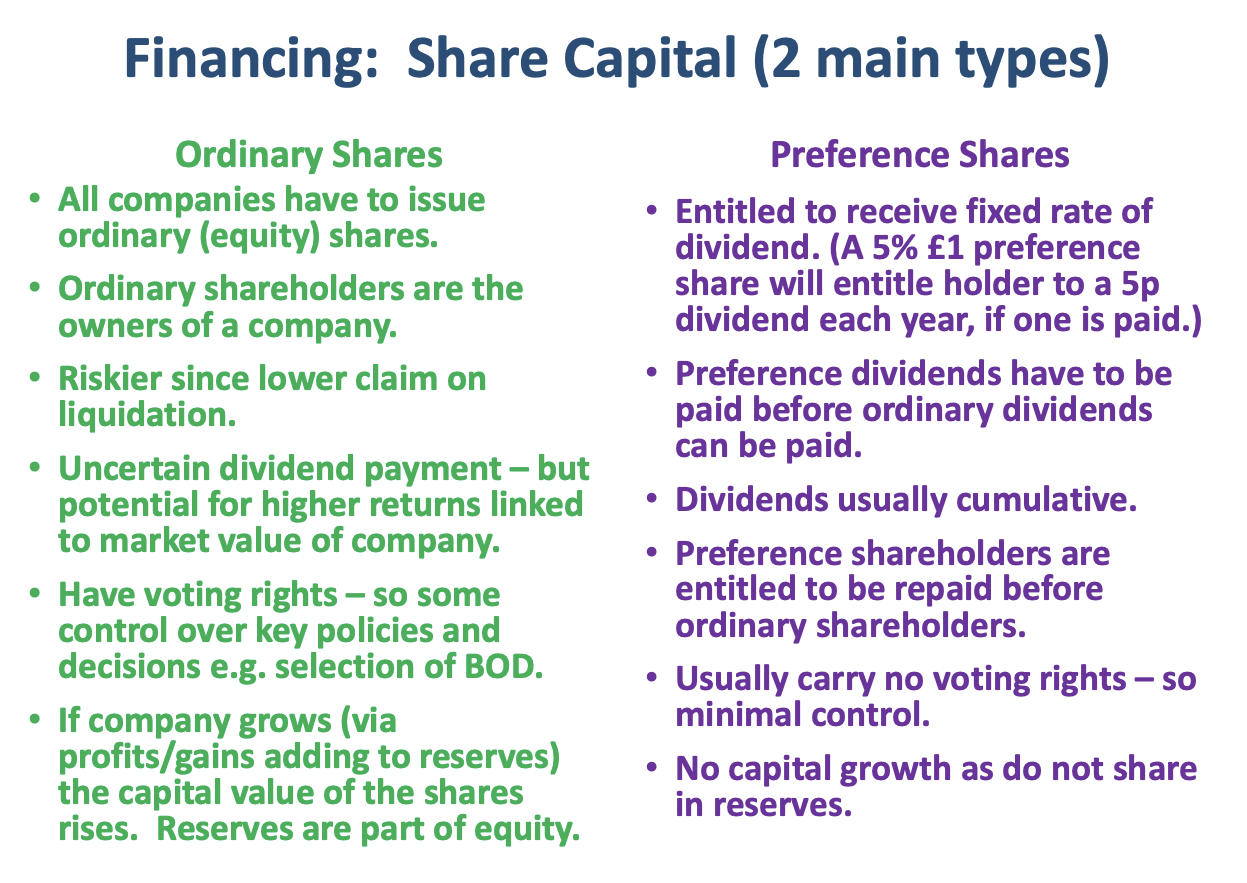

Compare the two methods of financing: share capital

define authorised share capital

it is the maximum amount of share capital that can be issued

define the nominal value

it is the shares of the initial (par) value at which shares are issued. It is usually low ie, £1 to facilitate trading

Define a dividend

it is a payment made to company shareholders to reward them for investing

compare nominal value to market value

Once a company (plc) starts trading (and making profit`), their initial nominal share value may increase => market value

if a company with 50,000 £1 ordinary shares whose market value Is £1.50 want to raise £300,000 by a new issue of shares they will need to issue 200,000 shares.

This would be accounted for in the SoFP, as share capital (200,000) + share premium (100,000) = Capital raised (300,000). It is worth noting that share premium is a reserve account - part of equity section

Once a company issue shares any changes in the market price have no effect on company accounting records

Explain dividends

ordinary share dividends are a distribution of profits at the director’s discretion - ie distribution policy

distribution policy considers shareholders expectations - income vs capital growth

may be paid in two stages - interim (during the year) and final proposed (paid after year end)

What are loan capital and debentures

many businesses raise finance from loans as well as share capital

debentures are one form of (usually secured) long-term loan which can be listed on the stock exchange and traded like shares.

What must the annual report of a plc entail

Audited financial statements:

Income statement

statement of financial position

statement of changes in equity

cash flow statement

notes to the financial statements

Auditors report on the above

What are the uses for the SoFP

users can assess financial position of an entity to make informed decisions

shows how business are financed (equity and liabilities) and how its funds are used (assets) from which users can assess financial strength or risk

Provides basis for assessing value of a business/ shares

remember SoFP has limitations

for example it will not include key internally generated intangible assets

Explain the basic principles of corporate governance

responsibility: directors expected to manage/ lead within framework of prudent controls

Accountability: shareholders have right to receive company information and remove company directors

transparency: information to shareholders should be clear and understandable

Fairness: all shareholders to be treated equally and fairly

UK corporate governance code - Key principles

- leadership; effectiveness; accountability; renumeration; shareholder relations

Income statement

shows financial performance ( how much profit or loss has been made) over an accounting period

Link SoFP at the beginning and end of a reporting period, tells the story of what happened between two snapshots

presents income (revenue) less expenditure ( I - E) on an accruals basis ofr a particular concept

Accruals (matching) concept:

incomes/expenses recognised when they are learnt or used/ not when they are paid

matches expenses to the income they generate

ncude expenses in time periods they are used in, regardless of when they re paid

What is revenue ( income)

Income can be split into revenue and gains

revenue is income arising from ordinary activity of an entity such as sales, fees, interest, dividends, etc

gains are other items meeting the definition of an income such as unrealised gains from increases in revaluation of assets

What issues can we have when recognising revenues

multi part sales - such as mobile phone contracts

long term service provision of development contracts such as bridge, road or ship builiding

R&D projects eg pharmaceutical companoes

online trading - when is the point of sale?

what is the approach set out by IFRS 15 to revenue recognition

Recognise revenue (sales income) - when goods/ services are transferred to the customer - ie when contractual performance obligations are satisfied

Measurement - reflects consideration company expects to receive

A consistent policy should be adopted

Cost of Sales

cost of sales. = opening inventory ( stock) + purchases of inventory in the period - closing inventory (stock)

How do we value inventory

The lower of cost or net realisable value (NRV)

NRV = selling price - further costs before sale can be made

this is an application of prudence convention

Methods of deciding which entity is sold first

FIFO - first in first out

LIFO - last in first out (not acceptable in accounting standards)

AVCO - weighted average cost

different methods change the amount of gross profit (clearly accounting is a decision not an objective truth)

What is creative accounting?

The Use of accounting choices to produce overly positive views of a company’s activities and financial position for example by policy choices (estimation and judgement choices) as well as revenue manipulation through early recognition

what are potential Creative accounting objectives?

Management compensation (profit based bonuses)

Tax considerations

Competitive onsiderations

Conceal poor managerial decisions

Satisfy demands of majority investors concerning levels of return

Explain matching( accrual concept)

resources (revenue expenses) are used to generate revenue

Matching (accruals) concept links expenses to the revenue they generate (regardless of when we pay for them)

Our accounting year ends on 31st December 2019 and we paid 30k for 15 months insurance from 1st Jan 2019. How much insurance expense relates to the year ending 31st December 2019

£30k is taken in the Statement of Cash Flows

6K is recorded on the SoFP as a current asset

24K is an expense on the income statement

Explanation: 30k/15months = 2k/month hence 12×2k =24k …

what effects do prepayments have?

prepayments decrease the expense recorded

Prepayemnts are current assets that entice the business to a service in the future

Leccy bills paid up to 30th September 2019 total 9k, but at the end of the year we havent received a bull for the last 3 months of our financial year. How would this accrual (expense owed) be recorded

9k of cash payment onto the SoCF from payments already made

accrual of 3k recorded on the SoFP as a current liability (negative)

12k electricity expense recorded on Income statement

What effects do accruals have on the statements?

accruals increase the expense recorded

Accruals are owing at the date of the SoFP under current liabilities

What happens when trade receivables go bad?

not all debts owed to a business will be paid

bad debts are written off - ie removed from the trade receivable current asset (derecognised)

The amount written off becomes an expense and is included in the IS

Bad debt causes trade receivables to go down in the SoFP

Bad debt causes bad debt expense to go up on the IS

Why is cash flow important?

most users of financial statements appreciate the importance of cash in a business

Cash is the ‘lifeblood’ of an organisation

many profitable companies have gone bust because of mismanaged cash flow

Many business valuation models are based on predicted cash flows

Is the profit that a business makes a reliable indicator of its cash balances?

no - a profitable business less may have large sums tied up in inventory and trade receivables and may have invested in new non-current assets

What is the purpose of the Cash flow statement

Provides info about how cash is managed - generated, raised and spent

In conjunction with IS and SoFP provides info on liquidity, viability and financial adaptability

historical cash flow information may assist in judgements about future cash flows

define Cash

cash is cash in hand and current bank balance

It is worth noting that bank overdrafts are considered negative cash

define cash equivalents

short term, highly liquid investments readily convertible to cash

What are the inflows of cash

customers (trading)

interest received

dividends received

issue of shares

receipt of loans

sale of non-current assets

What are the outflows of cash

Suppliers (trading)

wages and salaries

overheads

interest paid

dividends paid

loan repayments

purchase of non-current assets

corporation tax paid

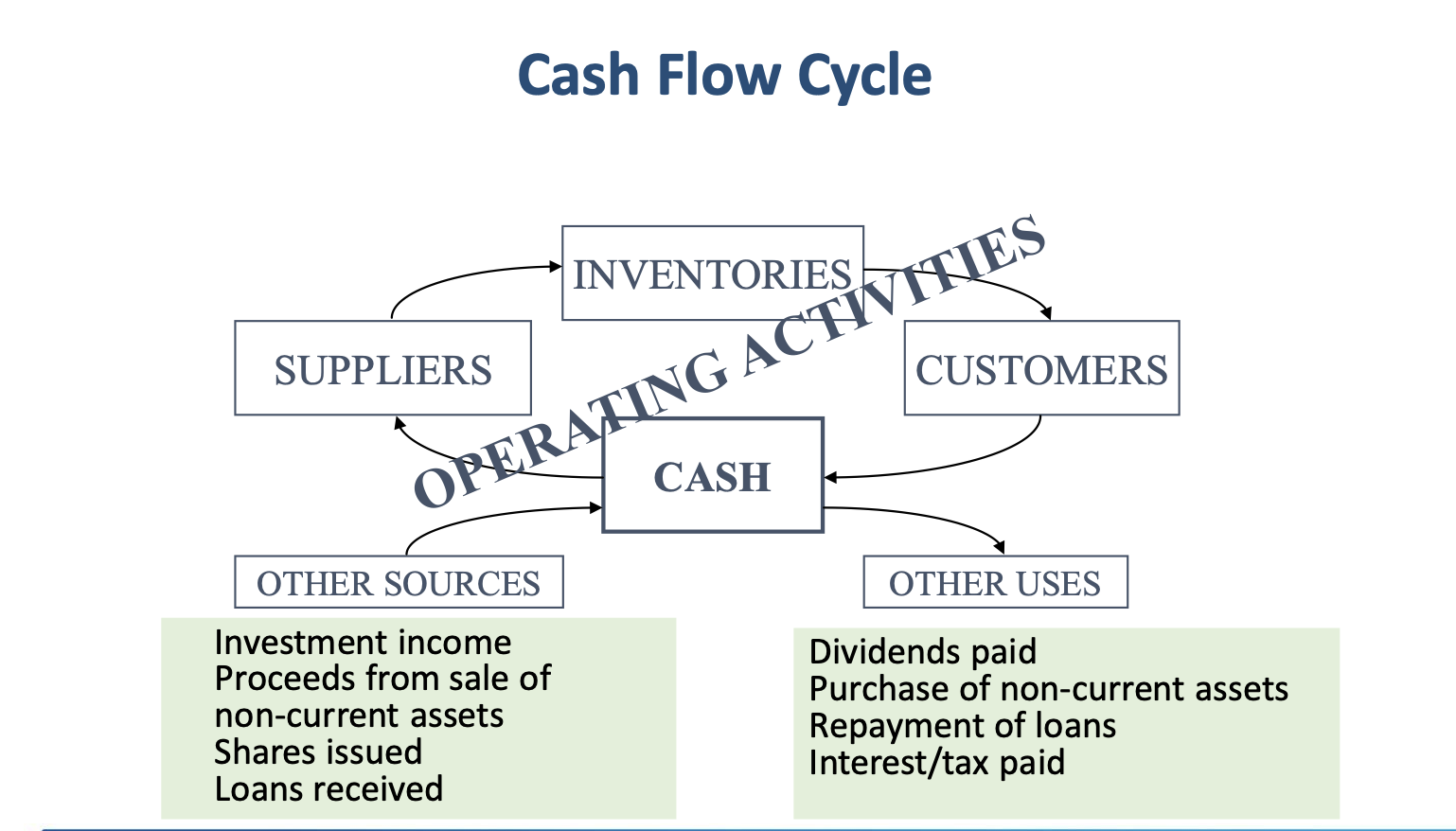

What is the cash flow cycle

how can we categorise cash flows

cash flow is analysed into the sourcses and uses of cash according to activity

operating activities (arise from trading activities)

investing activities (arise from purchase/disposal of non current assets)

financing activities (arise from changes in long term financing)What

What Is the standard layout of the CFS

Cash flows from operating activiteies

±

Cash flows from investing activities

±

Cash flows from financing activitites

=

net increase (or decrease) in cash and cash equivalents over the period

what are the 2 methods of CFS

direnct and indirect (if a company chooses direct they also have to show indirect method)

Direct shows actual cash flows from sales purchases, payments of wages and overheads

Indirect reconciles operaing profits with operating cash flows

adjustments in the CFS

closing inventory - increases tie up cash (outflow) decreases release cash (inflow)

trade receivables - increase tie up cash (outflow) decreases release cash (inflow)

trade payables - decrease tie up cash (outflow) increases release cash (inflow)

Note depreciation - add back to profit as a non cash expense

explain the impact of Tax, interest and dividends on the CFS

these are 3 significant payments made by business during fincnaicl periods

the amounts recorded on the CFS will be the amounts actually paid

Payments of interstate and tax shown as deductions from the cash generated from operations

payments of dividends shown with cash flows from financing

What steps can be taken to ensure a business overdraft does not continue to grow?

raise additional long term funding through some means such as a loan

reduce inventory level

arrange longer credit terms from suppliers

if additional non current assets are needed consider lease or hire

collect trade receivables quicker

Why is cash management important

Liquidity is important as profitability

all areas of working capital must be carefully monitored and controlled

stock levels kept optimum - ties up cash, theft, storage costs

controls in place to ensure payments are made from trade receivables. (for example payment reminders and scrutiny before credit

Ensure tot are full advantage of credit from suppliers, helpful if the supplier term is longer than the customer credit term

Failure to manage cash ca lead to serious consequences

What are the potential consequences of poor cash management?

managemmnt tied up dealing with liquidity

increase interest charges

inability t negotiate favourable credit with suppliers

unlikely that funds will be available to support investment in non current assets or other growth/development plans

lenders recalling loans if their is default of payments

inability to pay suppliers

inability to pay employees

business failure

What are the purposes/usefulness of CFS

help users assess company’s liquidity

help users compare performance of different companies

historic cash flows useful indicator of the timing, amount and certainty of future cash flows

reveals how investing activities are financed, eg from internally generated resources, borrowijng, share issues or cash balances

tracking sources and uses of cash over several years shows financiang and investing patterns/ trends. This may help predict future management action

What are the limitations of CF analysis

only one years cash flow reviewed

investing and financing activities irregular

profit figures may give better indication in long term of company’s ability to pay dividends, wages, settle debts etc

historic cash flows- problems of predictions of future

What are the 4 common types of ratios

Profitability - How successfully the business is trading

Liquidity - How effectively cash is managed in the business

Financial Gearing - How efficient the financial structure of the business is

Investment - How much return the investors can get from shares

How can we interpret ratios

Ratios may be compared to:

past periods of the same company (time series comparisons or trend analysis

Similar business operating in the same industry across the same period (competitor comparisons)

Industry averages (cross sectional comparisons)

Analysts predictions and forecasts of performance

What are the profitability ratios

Return on Capital employed (ROCE)

100X Operating profit (PBIT)/(Equity + non-current liabilities)

Return on equity

100X profit after tax/Equity

Asset turnover (AT)

Sales/Capital Employed

Gross profit margin (GP margin)

100x Gross profit/sales

Expenses:sales

100xExpenses/sales

Operating profit margin (OP margin)

100x Operating profit (PBIT)/Sales

how can we connect ROCE, OP margin and Asset Turnover

ROCE = OP Margin * Asset turnover

What are common liquidity ratios

they are concerned with a business’ ability to meet short term (current) liabilities as they fall due

current ratio

Current Assets/Current liabilities: 1

Acid test ratio

(Current assets-inventories)/current liabilities : 1

what do the liquidity ratios tell us

Current ratio:

2:1 considered good result but depends on business nature/size eg manufacturing tend to have higher current ratio than supermarkets

Higher figure not always positive, may indicate levels of inventory, trade receivables or even cash are too high

Quick Ratio (acid test)

Measures availability of liquid resources (excludes inventory as it is the least liquid asset) to meet current liabilities

Measure of extreme short term liquidity

< 1: ! means company doesnt have enough liquid short term assets to cover short term liabilities

explain the working capital ratios

inventory days

365 X inventory/COS

trade receivable days

365 X TR’s/Credit Sales

Trade payables days

365 X TP’s/Credit Purchases

What is the working capital cycle

Working capital cycle = inventory days + trade receivable days - trade payable days

collect trade receivables as quickly as possible without antagonising customers

pay trade payables as slowly as credit terms allow without antagonising suppliers

keep inventories as low as possible whilst ensuring sufficient to meet demand

What is Financial Gearing

financial gearing measures extent of debt finance (fixed interest) in a business compared to equity (shareholders funds)

As the proportion of debt financing rises, gearing rises, which is an indicator of financial risk

What is the gearing ratio

the gearing ratio = 100x long-term (non-current) liabilities/(Equity + long term liabilities)

a rough guide would suggest:

low gearing <10 percent

moderate gearing 10-50 percent

high >50 percent

also preference shares are usually treated as debt and year end or averaged figures are used

what are the impacts of financial gearing

higher gearing = higher volatility of return to equity holders - ie risks of return erosion are greater

Equity share prices tend to be lower in highly geared companies

Additional borrowing is difficult for highly geared companies

Result:

companies sensitive to their gearing levels resulting in various accounting initiatives to achieve OFF BALANCE SHEET FINANCE - eg sale and lease back