Microeconomics Unit 6

1/26

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

27 Terms

Government role in private sector

Provide legal and social framework

Market failure #1

public goods: products that most people want but nobody wants to buy. So, the market doesn’t produce them.

Ex: Firehouse

Private goods

Rivalry: my use automatically precludes yours Ex: Clothes

Excludable: I can keep you from getting the benefit of my good Ex: Locking your car and keeping the key

Publics goods

Non-rivalry and non-excludable

Free riders: people who enjoy the benefit of a public good but don’t pay for it

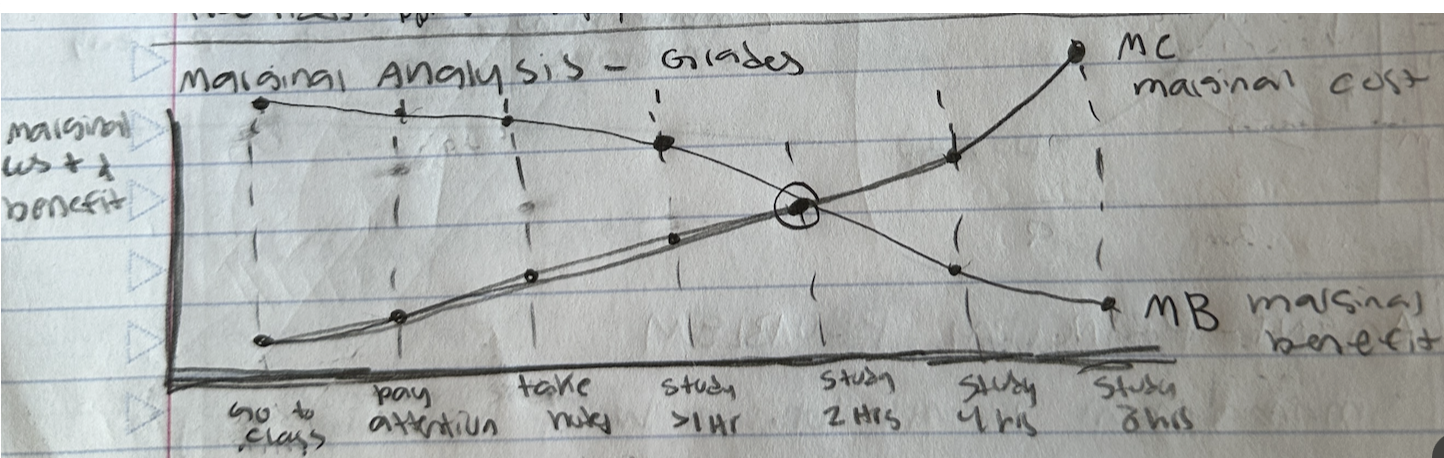

Marginal analysis

Marginal benefit vs marginal cost

Externalities (spillovers)

The positive or negative impact on a 3rd party that results when someone purchases a product

Result: overallocation or underallocation of the product purchased b/c the effect is outside the buyers and sellers

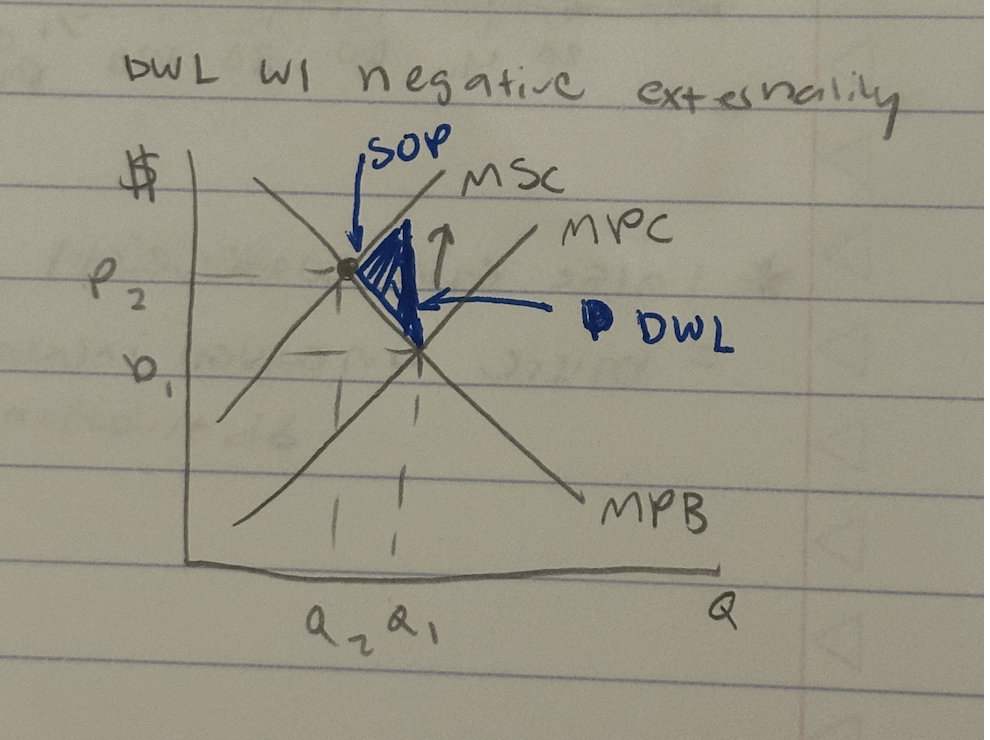

Negative externalities

Impact on others is bad: government wants to decrease output Ex: Cigarettes

How does the government discourage negative externalities?

Supply: Tax product

Demand: Warning labels, age limit, can’t advertise

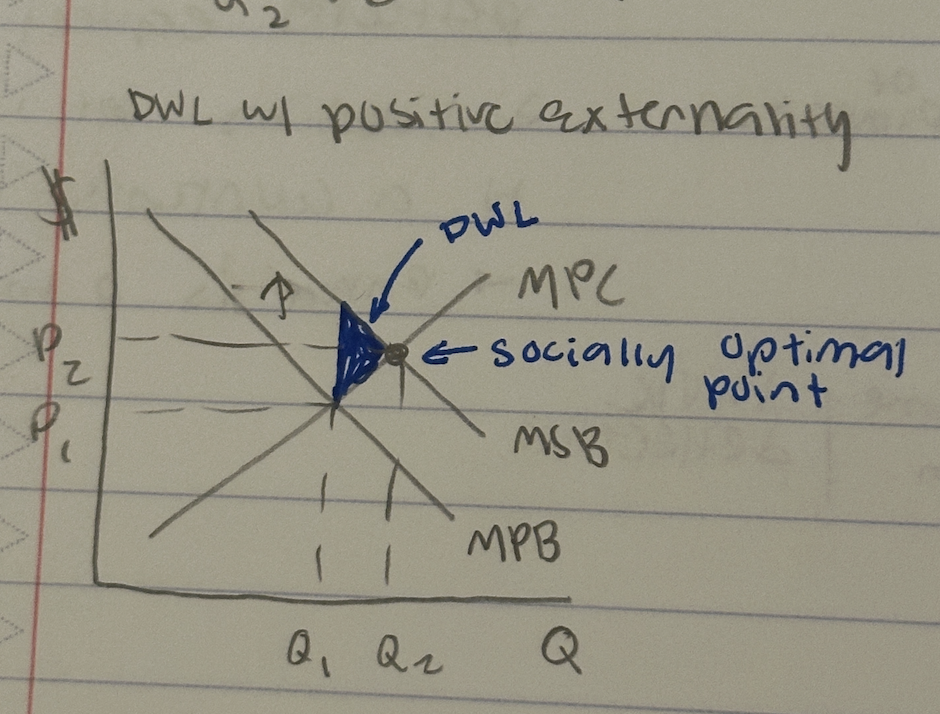

Positive externalities

Impact on others is good: government wants to increase output Ex: college education

How does the government incorage positive externalities?

Supply: State subsidy

Demand: Financial aid

Supply

(MPC) Marginal Private Cost: the cost to the firm of making one more unit

(MSC) Marginal Social Cost: the cost to the firm & society of making one more unit

Demand

(MPB) Marginal Private Benefit: the benefit to the buyer of a product from purchasing one more unit

(MSB) Marginal Social Benefit: the benefit to the buyers & society when purchasing one more unit

Consumer tax incidence

The rectangle above the equilibrium price

Producer tax incidence

The rectangle below the equilibrium price

If the D curve is inelastic

the producers can push more tax incidence onto the buyers, they are not sensitive to price

D inelastic; change in Q is small

Government revenues will be higher

D elastic; change in Q is large

Government revenues will be lower

If D curve is elastic

producers can’t push more tax incidence onto the buyers, they are sensitive to change in price. Producers must pay more of the tax

DWL on PC market graph

SOP: S=D

DWL on monopoly graph

SOP: MC = D

DWL w/ positive externality

SOP: MPC = MSB

DWL w/ negative externality

SOP: MPB = MSC

Anti-trust laws

against collusion in oligopolies

against interstate monopolies

Price regulation

ATC pricing (fair returns) p=ATC

MC pricing (Socially optimal) p = MC

Disclosure laws

removing info failures

Lorenz curve

graphically demonstrates a country’s income inequality

Gini coefficient

measures the degrees of deflection from a perfectly equal distribution of income to a countries population

ranges from 0 (best) to 1 (worst)