AP MACRO UNIT 4

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

35 Terms

The Financial Sector

Network of institutes that link borrowers and lenders

Assets

Items that the bank OWNS (anything tangible or intangible)

Liabilities

Items that the bank OWES

Liquidity

The ease with which an asset can be converted to a medium of exchange

3 Functions of Money

A medium exchange- money can easily be used to buy goods and services with no complications of barter system

A unit of account- money measures the value of all goods and services.. Money acts as a measurement of value (1 goat= $50= 5 chickens)

A store of value- Money allows you to store purchasing power for the future

What is the transaction demand for money?

People hold money for everyday transactions

What is the asset demand for money?

People hold money since it is less risky than other assets

If interest rate increases, the quantity of money demanded…

decreases

If interest rate decreases, the quantity of money demanded…

increases

Shifters of Money Demand

changes in price level

changes in income

changes in banking tech.

change in GDP

Shifters of Money Supply

the reserve requirement

the discount rate

open market operations (buying and selling gov. bonds)

Unexpected inflation causes the demand of money and interest rate to…

demand for money: increases

interest rate: increases

The increase for supply of money causes interest rate and investment will to…

Lower interest rate

Increase investment

When interest rates are high, the opportunity cost of holding money (the interest income you could have earned by holding an interest-earning asset instead)…

increases, which causes the quantity of money demanded to decrease.

The money supply includes assets like…

only assets that are readily usable as a medium of exchange, such as cash, coins, and balances in checking and savings accounts (like demand deposits).

Assets like bonds and real estate are not considered part of the money supply because they are not immediately available for making payments.

Monetary policy is…

when the central banks changes the interest rates by changing money supply

Money Multiplier Equation

1/ RR

Federal Funds Rate

the interest rate banks charge each other for overnight loans of reserves

What is maturity?

the length of time until a financial instrument, like a bond or loan, is repaid in full

If the interest rate increases, bond prices will…

fall

If the interest rate decreases, bond prices will…

increase

Fractional Reserve Banking

a system where banks are required to hold only a fraction of their deposits as reserves and can lend out the rest

Excess Reserves

the amount of a bank's total reserves that are held above the legal minimum

Demand Deposits

funds held in bank checking accounts that can be withdrawn on demand without prior notice

Owners Equity

the residual claim on a company's assets after all liabilities are paid off

Barter System

Goods and services are traded directly. There is no money exchanged.

Commodity Money

Something that performs the function of money and has intrinsic value )gold, silver, cigarettes, etc.)

Fiat Money

Something that serves as money but has no other values or uses (paper money, coins, digital currency, etc.)

Stock

Represent ownership of a corporation and the stockholder is often entitled to a portion of the profit paid out as individuals

Bonds

Loans that represent debt that the government business, or individual must repay to the lender

Reserve Requirement

the percentage of a banks deposits that is must hold as reserves.

directly affects the amount of money a bank can lend out

Money Multiplier

the concept that an initial change in the monetary base can lead to larger change in the overall money supply due to how commercial banks create money through lending.

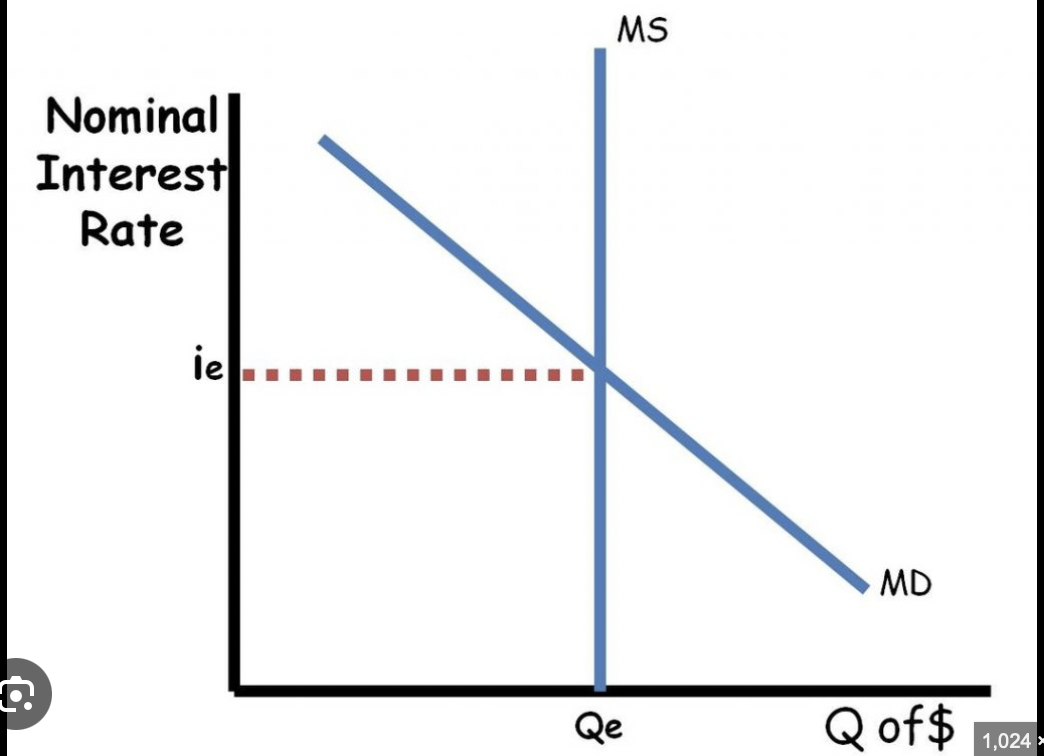

Money Market Graph

Real Interest Rate

The percentage increase in purchasing power that a borrower pays (adjusted for inflation)

nominal IR - expected inflation

Nominal Interest Rate

The percentage increase in money that a borrower pays (not adjusted for inflation)

real IR + expected inflation