IE Unit 3- Trade policy

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

10 Terms

What are the main instruments of trade policy?

Trade policy instruments are tools used by governments to regulate international trade. According to your PDF, trade policy plays a major role in protection, development, and managing global competition, especially for economies where trade influences strategic outcomes. The PDF explains the global shift towards liberalisation, WTO rules, tariff bindings, subsidy disciplines, and new trade issues — all of which form the backbone of modern trade policy.

The major instruments include:

Tariffs – Taxes on imports to raise revenue or protect domestic industries.

Quotas – Quantitative limits on imports.

Export subsidies – Payments to domestic firms to boost exports.

Voluntary Export Restraints (VERs) – Export limits imposed voluntarily (often under pressure).

Non-tariff barriers (NTBs) – Product standards, licensing, health/safety rules.

Anti-dumping duties – Tariffs to counter dumping.

Safeguard measures – Temporary protection during surges of imports.

Exchange rate policy – Overvalued/undervalued currency affects trade.

Trade agreements – WTO rules, FTAs, preferential trade agreements.

Trade policy instruments aim to protect domestic producers, promote exports, correct market failure, and influence national development.

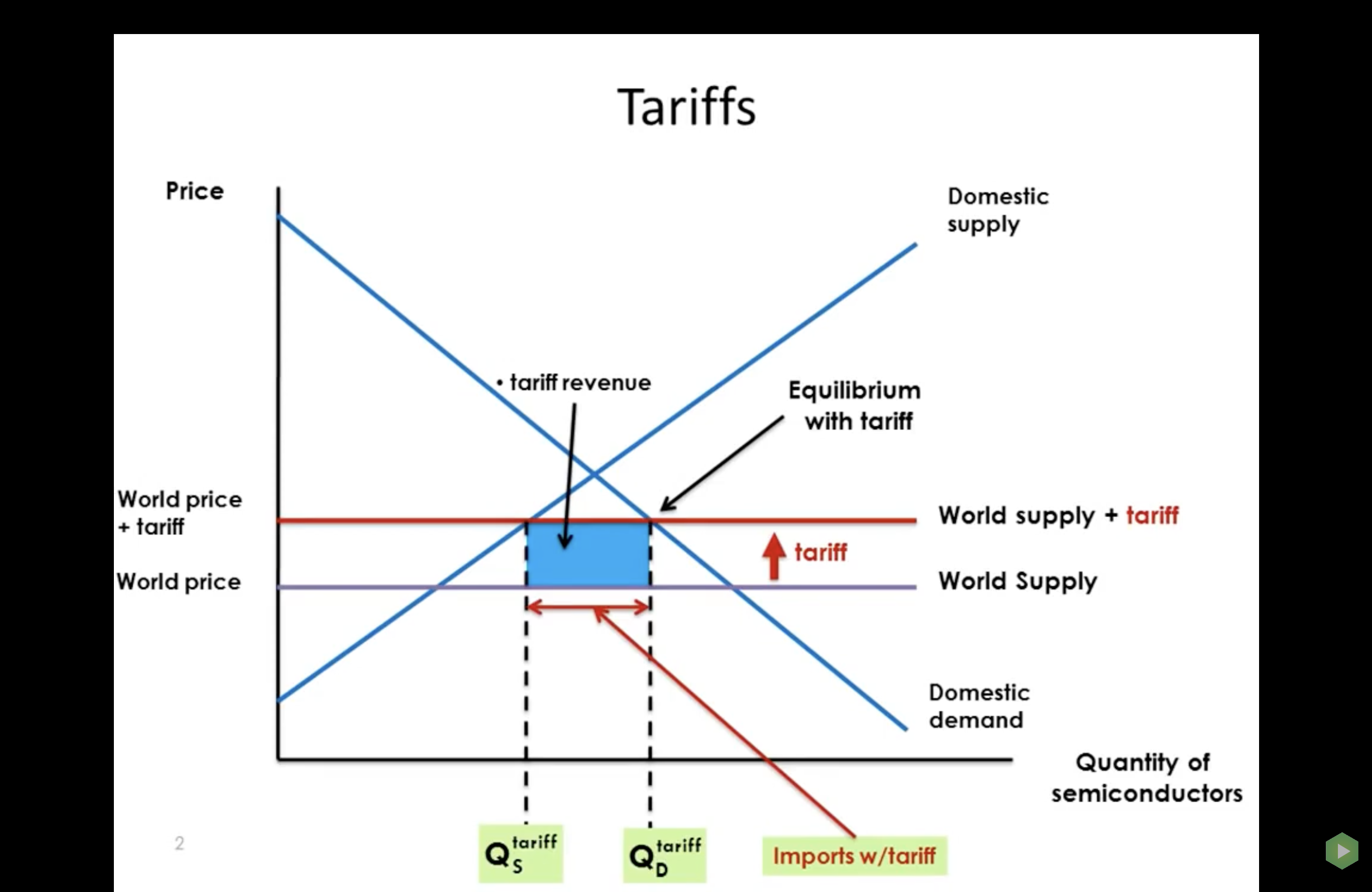

What is a tariff and what are its effects?

A tariff is a tax imposed on imported goods. The PDF explains that under WTO rules, tariff reductions have been central to world trade negotiations, with developing countries gaining significantly from liberalisation. Tariffs are subject to binding commitments that limit increases.

Types of Tariffs

Specific tariff: Fixed amount per unit.

Ad valorem tariff: Percentage of value.

Compound tariff: Combination of both.

Effects of a Tariff

Price increase: Domestic price rises, reducing imports.

Production effect: Domestic output increases.

Consumption effect: Domestic consumption decreases.

Revenue effect: Government collects tariff revenue.

Deadweight loss: Efficiency loss from production + consumption distortions.

Terms-of-trade effect: Large countries may gain if tariff lowers world price.

Tariffs protect domestic industries but reduce global efficiency.

Difference between tariffs and Quotas

Sr. No | Tariff | Quota |

1 | A tariff is a tax or duty imposed on imported or exported goods, typically based on their value, quantity, or weight. | A quota is a restriction on the quantity or value of goods that can be imported or exported within a specified period. |

2 | Tariffs are primarily used to generate revenue for the government and protect domestic industries from foreign competition. | Quotas are used to regulate and control the quantity of goods entering or leaving a country to achieve specific policy objectives. |

3 | Tariffs can be specific (based on quantity or weight) or ad valorem (based on the value of the goods). | Quotas can be absolute (limiting the quantity to a specific level) or tariff-rate (allowing a specified quantity at a lower tariff rate). |

5 | Tariffs can be used to protect domestic industries from foreign competition by making imported goods relatively more expensive. | Quotas can be used to protect domestic industries by limiting the quantity of imports and providing a captive market for domestic producers. |

6 | Tariffs are levied at the border and collected by customs authorities when goods enter or leave a country. | Quotas are administered by issuing licenses or permits that specify the allowed quantity or value of goods that can be imported or exported. |

8 | Tariffs can be adjusted or modified based on trade negotiations, international agreements, or changes in economic conditions. | Quotas can be adjusted based on policy objectives, market demand, domestic supply conditions, or changes in trade relationships. |

11 | Tariffs can be used as a tool for government revenue generation, trade policy control, and strategic market access management. | Quotas can be used to balance trade, protect domestic industries, manage scarce resources, or promote self-sufficiency in certain sectors. |

12 | Tariffs can be variable and adjusted based on trade policy objectives, economic conditions, or political considerations. | Quotas can be fixed or flexible, allowing adjustments based on market demand, domestic supply capabilities, or international trade agreements. |

13 | Examples of tariffs include import duties on automobiles, customs fees on electronic goods, or export taxes on agricultural products. | Examples of quotas include limits on the import of textiles from specific countries, restrictions on the export of rare minerals, or caps on the import of sugar. |

14 | Tariffs can be implemented unilaterally by a country without the need for specific agreements or negotiations. | Quotas may require negotiations, agreements, or commitments with other countries to establish import/export limits and market access conditions. |

15 | Tariffs can be differentiated based on the origin of goods, with different rates applied to products from different countries. | Quotas can be country-specific or applicable to a group of countries, limiting the overall quantity of imports from those sources. |

16 | Tariffs can be imposed to correct trade imbalances, protect infant industries, or ensure fair competition in the domestic market. | Quotas can be imposed to manage scarce resources, protect sensitive industries, or address potential threats to national security. |

17 | Tariffs can lead to increased prices for imported goods, reducing consumer choices and potentially affecting affordability. | Quotas can restrict market access for foreign producers, limiting consumer choices and potentially increasing prices for affected goods. |

18 | Tariffs can be classified as specific tariffs (e.g., $10 per ton) or ad valorem tariffs (e.g., 5% of the product's value). | Quotas can be classified as global quotas (total quantity limit) or tariff-rate quotas (allowing a specified quantity at a lower tariff rate). |

19 | Tariffs can be implemented as a tool for economic protectionism, strategic trade policy, or revenue generation for the government. | Quotas can be implemented to manage domestic supply and demand, balance trade, or protect sensitive industries from excessive competition. |

20 | Tariffs are more transparent as the costs are directly added to the price of imported goods and collected by customs authorities. | Quotas can be less transparent as the limited quantity may lead to non-tariff barriers, such as licensing requirements or allocation complexities. |

21 | Tariffs can be influenced by factors such as international trade agreements, tariff preferences, or anti-dumping investigations. | Quotas can be influenced by domestic production capacity, trade negotiations, market demand, or industry-specific considerations. |

22 | Tariffs can be adjusted to achieve economic or political objectives, such as protecting domestic industries or retaliating against unfair trade practices. | Quotas can be adjusted to accommodate changing market dynamics, address supply-demand imbalances, or respond to trade policy objectives. |

23 | Tariffs can be seen as a form of indirect taxation, as the burden of the tariff is ultimately borne by consumers through higher prices. | Quotas can limit the supply of imported goods, potentially leading to higher prices and reduced availability for consumers. |

24 | Tariffs can lead to market inefficiencies, increased administrative burdens, and potential distortions in resource allocation. | Quotas can create market uncertainties, administrative complexities, and potential opportunities for rent-seeking or smuggling activities. |

25 | Tariffs can be used as a negotiating tool in trade agreements or as a mechanism for protecting domestic industries from foreign competition. | Quotas can be used to manage sensitive sectors, balance trade, or address geopolitical concerns related to the import/export of certain goods. |

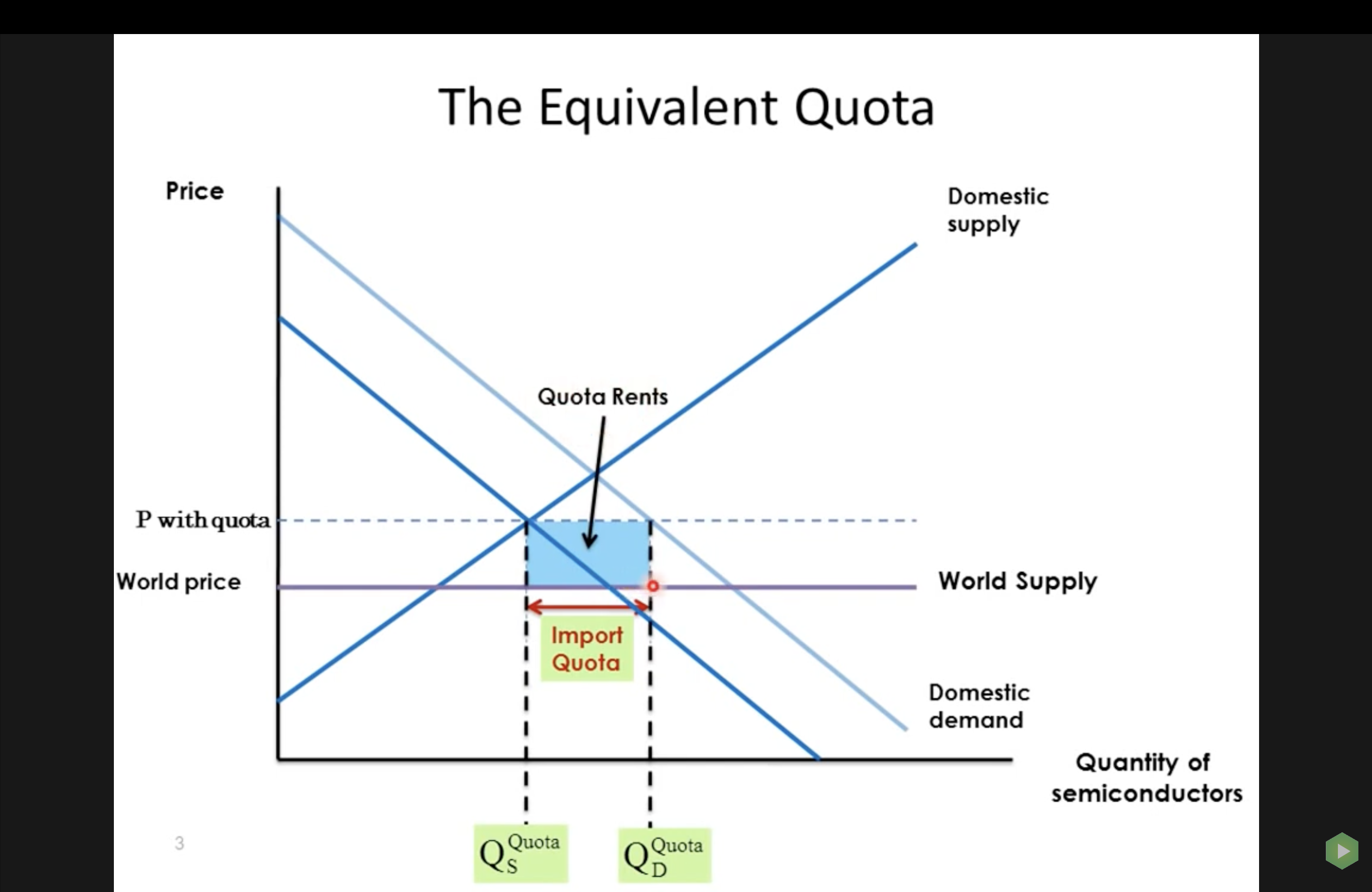

Diagrammatically difference between tariffs and quotas

What is the Rate of Effective Protection (ERP)?

The effective rate of protection (ERP) is a measure of how much tariffs protect the value added in a specific industry. It represents the percentage change in value added caused by the entire tariff structure.

Calculation: The ERP is calculated using the following formula:

E=(N−AB)(1−A)cap E equals the fraction with numerator open paren cap N minus cap A cap B close paren and denominator open paren 1 minus cap A close paren end-fraction

𝐸=(𝑁−𝐴𝐵)/(1−𝐴)

E= Effective Rate of Protection

N= Nominal tariff rate on the final product

A= Ratio of the value of imported inputs to the value of the final product

B = Nominal tariff rate on imported inputs

Relationship to nominal tariffs:

The effective rate can be significantly higher than the nominal tariff if inputs are not taxed or are taxed at a lower rate. For example, a 25% tariff on a finished car with a 25% nominal tariff on inputs can result in a 100% effective rate of protection.

Conversely, if inputs are taxed heavily, the effective rate of protection can be lower than the nominal tariff, or even negative, meaning domestic producers are worse off after the tariffs are implemented.

Purpose: The ERP gives a more realistic picture of how a trade policy affects domestic producers compared to looking only at the nominal tariff on the final product.

What is an optimum tariff?

An optimum tariff is a tariff rate that maximizes a large country's welfare. A sufficiently big importer can influence world prices. When it imposes a tariff, the world supply curve to that country becomes less elastic, forcing foreign exporters to lower prices.

Mechanism:

Tariff raises domestic price of imports.

Import demand falls.

Foreign exporters cut prices to retain market share.

Domestic terms of trade improve.

Welfare gain from improved terms of trade may exceed deadweight loss.

Only large countries can impose optimum tariffs.

Small countries face infinitely elastic world supply → no terms-of-trade gain → only losses.

This theory is used in trade negotiations and retaliatory tariff arguments.

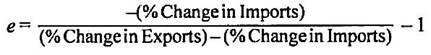

Kindelberger has stated the formula for optimum tariff in the following form:

TO = 1/ (e-1)

Here TO denotes the optimum rate of tariff and e stands for the elasticity of the offer curve of the foreign country at the specific point.

The co-efficient e or the elasticity of offer curve can be measured as below:

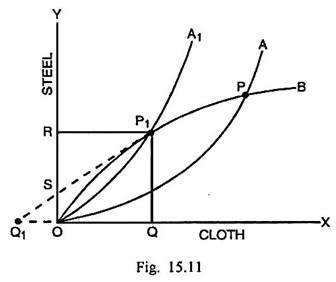

The rate of optimum tariff can be derived geometrically with the help of Fig. 15.11.

What is an import quota and how is it different from a tariff?

An import quota is a quantitative restriction on the volume of imports. It directly limits the amount of foreign goods entering the domestic market.

Differences from Tariffs

Price vs Quantity:

Tariff → raises price but allows unlimited imports.

Quota → fixes quantity regardless of price.

Revenue:

Tariff → government collects revenue.

Quota → quota rents go to licence holders or foreign exporters.

Market Power:

Quotas distort markets more severely.

Tariffs allow price-adjustment mechanisms.

Stability:

Quotas create monopolistic or cartel-like behaviour.

Tariffs maintain competition.

Quotas are considered more distortionary and are discouraged under WTO rules.

what is an export subsidy

An export subsidy is a government payment to a company that exports goods to make them cheaper for foreign buyers. This can include direct payments, tax breaks, or low-cost loans to encourage exports and boost a country's competitiveness in the global market. For example, a government might subsidize the marketing and shipping costs of goods to make them more affordable internationally according to WTO

How it works

Government incentives: Governments provide financial assistance to exporters through direct payments, low-cost loans, or tax benefits.

Reduced prices: These incentives lower the price of goods for foreign consumers, making domestic goods more competitive abroad.

Increased exports: The goal is to encourage companies to export more of their products, sometimes even discouraging domestic sales to increase export quantities.

Impacts and regulations

Economic effects: Export subsidies can lower world market prices for a product, which can be beneficial for consumers in importing countries but can hurt producers in those nations, notes AgripolicyKit. They can also lead to market volatility and disrupt the supply of other countries.

WTO regulations: The World Trade Organization (WTO) has agreements to regulate export subsidies.

Except for specific exceptions like for Least Developed Countries, the WTO generally prohibits most direct export subsidies.

WTO-compliant subsidies that benefit general domestic production, rather than being specifically tied to exports, are considered alternatives to direct export subsidies.

GRAPH FROM GOOGLE

What is the political economy of trade policy?

The political economy of trade policy examines how interest groups, lobbying, electoral incentives, and political institutions influence trade outcomes. The PDF explains that strategic trade issues, WTO negotiations, and global political tensions affect tariff decisions, export competitiveness, and protectionist pressures.

Key Ideas

Protection benefits small groups (industries)

Costs are spread across consumers

Small groups lobby harder for protection

Democracies respond to voter pressure

Politicians use trade policy to secure political support

Bureaucratic incentives affect implementation

Political economy explains why countries do not always choose free trade even if it maximises welfare.

What characterises trade policy in developing countries?

The PDF discusses how developing countries have undergone major trade policy reforms, shifting from inward-looking strategies to global integration. Trade liberalisation, WTO membership, tariff reductions, and export promotion have transformed their economies.

Key Features

Import substitution in early stages

High tariffs

Quotas

Licensing

Exchange controls

Shift toward export-led growth

SEZs (Special Economic Zones)

Export incentives

Lower tariffs

FDI encouragement

Structural Challenges

Weak institutions

Poor infrastructure

Narrow export base

Vulnerability to external shocks

Role of WTO and trade agreements

Developing countries push for fair agricultural trade, development aid, intellectual property flexibility, and special safeguard measures.

Trade policy in developing countries aims to balance protection, development, and integration into the world economy.