Oligopoly, business objectives and rationalisation (Theme 3 CC3)

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Market Concentration

measures the degree of competition that exists within a market by calculating the market share of the largest few firms in the industry

Market Share

a company's product sales as a percentage of total sales for that industry. Calculated by TR (Firm) / TR (Industry) x100.

N Firm Concentration Ratio

The share of industry output in sales or employment accounted for by the top firms, the number of firms is measured by N. So the share of the top two firms would be a two firm concentration ratio, the market share of the top three a three firm concentration ratio. For example, a five firm concentration ratio of 60% shows that the five largest firms in the industry have a combined market share of 60%.

Oligopoly

A market structure in which only a few interdependent firms offer similar or identical products supplemented by high BTNs and BTXs, a high concentration ratio and collusion.

Product Differentiation

a positioning strategy that some firms use to distinguish their products from those of competitors, such as product formulation, packaging, marketing and availability.

Price wars

Mutually destructive situation where businesses involved compete by a series of intensive price cuts to threaten the competitiveness of rival firms.

Predatory Pricing

Anti-competitive and illegal strategy where firms set prices below their AVC in the very short run, in order to force other firms out the market.

Limit Pricing

Reducing the price of a good to just above average variable cost to deter the entry of new firms into the market. Prices are set at levels which are likely to make it unprofitable for potential entrants who might consider coming into the market

Kinked demand curve theory

In a non collusive theory, the theory that an oligopoly will face a demand curve that is kinked at current markets, as such to reflect how an oligopolist may react to price cuts made by their rival, but not price increases, reflected by the relationship between PED and revenue.

Collusion

Collective agreements between producers which restrict competition and prices in an overt or tacit way.

Collusive oligopoly

Where a few firms in an oligopoly act together as a cartel to avoid competition by resorting to agreements to fix prices or output.

Non-collusive oligopoly

Where firms in an oligopoly do not resort to agreements to fix prices or output. Competition tends to be non-price. Prices tend to be stable and the firms tend to be interdependent.

Uncertainty

A characteristic of competitive oligopoly where rivals reacting to changing in prices becomes unstable.

Overt collusion

When firms openly agree on price, output, and other decisions aimed at achieving oligopoly profits. These agreements are often verbal to avoid detection.

Tacit collusion

Firms indirectly coordinate actions by signalling their intention to reduce output and maintain pricing above competitive levels. Firms monitor each other's behaviour with unwritten rules developing which define ways of competition. Price leadership is an example.

Cartel

A formal organisation of producers that agree to coordinate prices and production

Price leadership

A form of tacit collusion in which one firm in an oligopoly announces a price change and the other firms in the industry match the change.

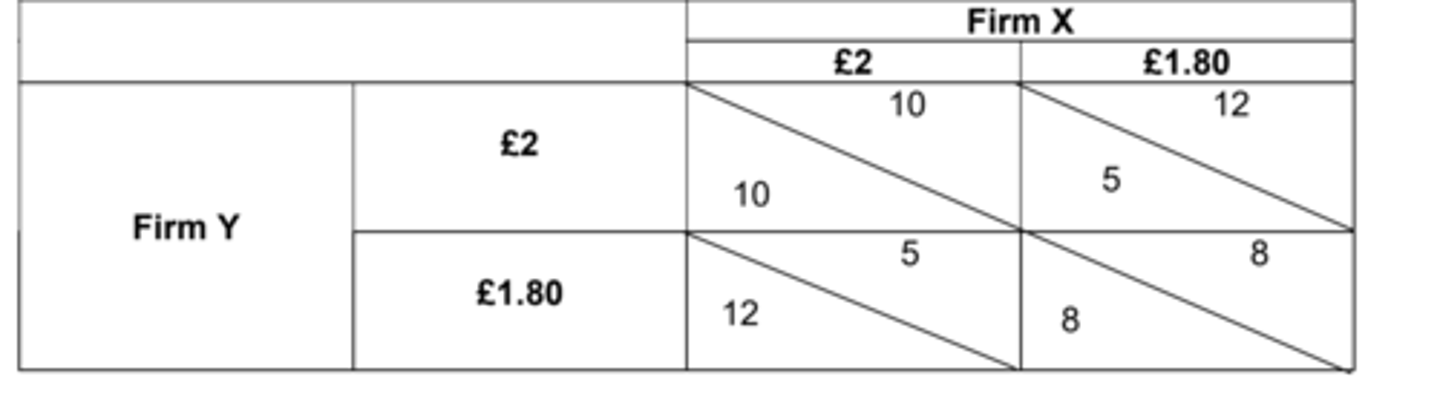

Game Theory

Used to show the benefits of collusion: the study of how people behave in strategic, independent situations where the actions of one firm directly affects all other firms, meaning that the best move for the game depends upon how other players react.

First mover advantage

Evaluation to Game Theory: Occurs when a company can significantly increase its market share by being first with a new competitive advantage, such as Dyson with its vacuum cleaners. This allows them to generate brand loyalty and premium pricing?

Penetration Pricing

Opposite of price skimming, setting a low initial price on a new product to appeal immediately to the mass market and attract new consumers and create brand loyalty.

Price skimming

Opposite of penetration pricing, a pricing policy whereby a firm charges a high introductory price, often coupled with heavy promotion at the launch of a new product, often because it faces little competition at the level of advancement that the technology is. Often seen with Apple where they initially 'skim' consumers with low PED by charging really high prices for new iPhones.

Cost-plus pricing

a method of setting prices in which the seller totals all the costs for the product and then adds an amount to arrive at the selling price, the markup represents the profit per unit.

Product line pricing

setting the price steps between various products in a product line based on cost differences between the products, customer evaluations of different features, and competitors' prices such as selling printers at a low price, and ink cartridges at a higher price.