9.1 Prelim business studies

1/126

Earn XP

Description and Tags

im gonna die jelp

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

127 Terms

what is a business?

A business can be defined as the organised effort of individuals to produce and sell, for a profit, the products (goods and services) that satisfy individuals’ needs and wants.

Production

refers to those activities undertaken by the business that combine the resources to create products that satisfy customers’ needs and wants

Other roles of business

profit, employment, incomes, choices, innovation, entrepreneurship and risk, wealth and quality of life.

Profit

A business recieves money (sales revenue) from its customers in exchange for products.

It must also pay out money to cover the numerous expenses involved in operating the business.

If the business’s sales revenue is greater than its operating expenses, it has earned a profit.

is what remains after all business expenses have been deducted from the business’s sales revenue

The business’s profit becomes the property of its owners.

Revenue

The total income generated from sales of goods or services before any expenses are deducted.

The money a business recieves as payment for its product

operating expenses

All the costs of running the business except the cost of goods sold. These expenses include rent, utilities, salaries, and marketing costs.

Employment

keeps the economy healthy. To be able to purchase products, consumers need money. Employed Australians will use the money they have earned from working at jobs provided by businesses to buy goods and services to meet their needs and wants, supporting business and opening up further opportunities for job creation.

Income

money received by a person for providing his or her labour, or a business from a return on its investments.

A business’s income is the amount it earns after covering all of its expenses: a return on its investments.

There are many different types of income that employees can receive. For example:

wage: money received by workers, usually on an hourly or daily basis, for services they provide to an employer

salary: a fixed regular payment, usually paid on a fortnightly or monthly basis but often expressed as an annual sum, made to a permanent employee of a business

bonus: a sum of money added to a person’s wages as a reward for good performance

overtime: time during which work is done outside regular working hours. Such time is usually paid at higher rates.

commission: the percentage of a sales price received by a salesperson for her or his services

fringe benefits: an extra benefit supplementing an employee’s money wage or salary; for example, a company car, private healthcare.

A business receives money from the sale of its products. As previously outlined, this is called sales revenue. From this revenue, all the expenses incurred in operating the business must be deducted. The amount that remains is the business’s profit. This becomes the business owner’s property and consequently their income.

If the business is a private or public company, it will have many owners referred to as shareholders. Usually, some or all of a company’s profit is divided among shareholders. This type of income is called a dividend

The amount of income a business can generate to pay wages and salaries, profits or dividends, depends largely on how successful it is in selling its products.

Shareholders

people who are part owners of a company because they own a number of shares. They invest in the company and may receive dividends from profits.

Dividend

a distribution of a company’s profits (either yearly or half-yearly) to shareholders that is calculated as a number of cents per share

Choice

is the act of selecting among alternatives

Innovation

Either creating a new product, service or process, or significantly improving an existing one.

Research and development (R&D) a set of activities undertaken to improve existing products, create new products and improve production.

Wealth

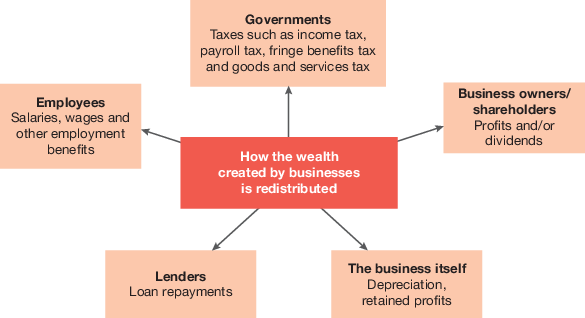

During normal operations, a business receives money from its customers in exchange for products. At the same time, it must also pay out money to other businesses to cover operating expenses. Operating expenses are the costs involved in the day-to-day operation of the business. The difference between the two amounts, the value added, represents the wealth (profit) created by the business. This wealth is then redistributed to employees, governments, lenders, owners/shareholders and the business itself

Quality of life

refers to the overall wellbeing of an individual, and is a combination of both material and non-material benefits

Many businesses have responded to quality-of-life issues and are implementing environmentally friendly procedures — for example, recycled materials, cleaner cars, less energy-consuming production and ‘green’ food products. Because business activities play a vital role in our lives, businesses have a responsibility to help provide what consumers want and to minimise what they do not want.

employees make income from?

wages, salaries, bonuses, overtime, commisions, and/ or fringe benefits

Business owners make income from?

Profit. (what remains after all business expenses have been deducted from sales revenue.)

Shareholders earn income from..?

Dividends.

True or False

An entrepreneur’s drive and motivation to establish and operate a business lie at the heart of our private economic system.

Yes, it is true that an entrepreneur's drive and motivation are essential for starting and successfully running a business, contributing significantly to the economy.

SME stands for?

Small and Medium Enterprises.

2.2.1 Determining the size of a business (Quantitative)

Number of employees

The number of owners

The legal structure (sole trader, partnership or company)

Amount of revenue earned

the amount of assets owned

market share (the proportion of total sales in a given market or industry that is controlled or held by a business) — a small market share, for example, may suggest that a business is small.

2.2.1 Determining the size of a business (Qualitative)

Who makes most management decisions, such as who to hire, what to produce and how to advertise a product?

Who provides most of the capital (finance)? The owner of a small business is likely to provide most of the capital.

Is the business independently owned and operated? Small businesses tend to be owned and operated by the same person

How many locations does the business have? A business that is locally based is likely to be small. Note that this does not mean that the business will only trade locally, as many small businesses are able to export products to overseas markets. Small businesses will be based in the one location whereas a large multinational corporation may have offices around the world.

Quantitative measurement according to ABS: Micro business

An enterprise with fewer than 5 employees.

Quantitative measurement according to ABS: Small business

An enterprise with 5 to 19 employees.

Quantitative measurement according to ABS: Medium business

An enterprise with 20 to 199 employees.

Quantitative measurement according to ABS: Large business

An enterprise with 200 or more employees.

Small to medium enterprises

defined by the Australian Bureau of Statistics as firms with fewer than 200 full-time equivalent employees and/or less than $10 million in annual revenue.

2.3 Classification by geographical spread

local, national, global

Local Businesses

a business that has a restricted geographical spread; it serves the surrounding area. Most are SMEs

National businesses

businesses that operate throughout an entire country, serving a broader market compared to local businesses.

examples: David jones, Bank of Queensland.

Global businesses

businesses that operate on an international scale, serving customers across multiple countries and often adapting products to different markets.

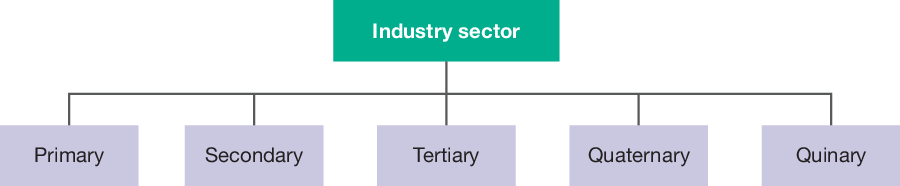

2.4 Classification by industry sector

Primary, secondary, tertiary, quaternary, quinary

Industry

refers to a specific branch of economic activity that produces goods or services, classified into sectors such as primary, secondary, tertiary, quaternary, and quinary.

Primary industry

involves the extraction and harvesting of natural resources, including agriculture, fishing, mining, and forestry.

Secondary Industry

involves the processing and manufacturing of goods from raw materials( primary), including construction and assembly.

example: iron ore, coal and limestone are turned into steel — a semi-finished product that is then used to manufacture cars.

Tertiary industry

involves the provision of services rather than goods, including retail, entertainment, and financial services. EXAMPLES: retailers, dentists, solicitors, banks, museum and health workers

Quarternary industry

includes services that involve the transfer and processing of information and knowledge. Examples include telecommunications, property, computing, finance and education.

Quinary industry

includes all services that have traditionally been performed in the home. Examples include hospitality, tourism, craft-based activities and childcare. It includes both paid and unpaid work.

2.5 Classification by legal structure: What are they?

sole trader, partnership, private company, public company, government enterprise.

Unincorporated?

Sole Trader and Partnership

Incorporated?

Company: Private and Public. refers to the process companies go through to become a separate legal entity from the owner/s

What is a sole trader and what are the legal requirements?

A sole trader is an individual operating a business on their own (ONE PERSON), retaining all profits and bearing full liability. Legal requirements include registration of the business name, obtaining necessary licenses, and tax obligations. The only legal requirement specific to a sole trader is that the name of the business be registered if the name is different from that of the owner.

A sole trader is not regarded as a separate legal entity; that is, the owner and the business are regarded as the same. This means that if the business is sued then the owner is sued, or if the business enters into a legal contract then the owner enters into the contract.

Regster a business name

via ASIC

Fee: 42 for 1 year

Check for licences and permits

Use the australian business licence and information service (ABLIS)

Varies by industry andlocation (eg. food handling, building or hairdressing)

Register for GST

Optional if under that threshold, unless you’re a texi driver (its mandatory)

Unlimited liability

refers to the financial obligation of a business owner where they are personally responsible for all debts and liabilities incurred by the business. In this scenario, creditors can claim personal assets if the business cannot meet its obligations.

Partnerships

owned and operated by between 2 and 20 people.

There are exceptions to this number, including medical practitioners and stockbrokers (allowed up to 50 partners); veterinarians, architects and chemists (allowed up to 100 partners); and solicitors and accountants (allowed up to 400 partners).

Owner and business are regarded the same

No seperate legal entity.

Unlimited liability

A partnership can be made verbally or in writing or by implication, that is, if two people set up a business together without a legally bidning partnership agreement.

The size and operations of the partnership are subject to specific requirements under the Partnership Act 1982 (NSW).

Limited partnerships were introduced to allow one or more partners to contribute financially to the business but take no part in the running of the partnership. In this case, the partner is referred to as a silent or sleeping partner.

Limited liability

a feature of corporate ownership that limits each owner’s financial liability to amount of money he or she has paid for the business’s shares.

Therefore, if the company goes into liquidation, the shareholders cannot be forced to sell their personal assets to pay for the debts of the business. This same protection does not extend to the directors of a company, as they have an obligation to ensure the company obeys the law and acts in the interests of the shareholders

Proprietary (private) companies ‘Pty Ltd’

2 to 50 private shareholders, often to be SMEs, family owned businesses

It is not listed on, and its shares are not sold through, a stock exchange.

However, closing a proprietary company is much more complex than closing a sole trader business or partnership. All shareholders of the company must agree to the company being wound up.

A liquidator will manage the process of selling the company’s assets, paying its debts and distributing funds from the asset sales among the shareholders.

Public companies

Companies that can sell shares to the public and are listed on a Australian Securities Exchange.

most are large in size and market a large range of products

at least one shareholder, with no maximum number

no restrictions on the transfer of shares or raising money from the public by offering shares

to issue a prospectus when selling its shares for the first time

a minimum requirement of three directors (two must live in Australia)

the word ‘Limited’ or ‘Ltd’ in its name

to publish its audited financial accounts each year, its annual report.

Government Enterprises (GBEs)

participate in commercial activities with the goal of making a profit. We may not always think of them as being businesses, but they actually run just like companies. However, GBEs carry out government policies while they deliver community services.

Federal, state, local

Example: Australia Post

Due to privatisation some government enterprises have become public companies.

Privatisation

The process of transferring ownership of a government-owned enterprise to the private investors, which often aims to increase efficiency and generate revenue.

examples:

AUSSAT — domestic satellite operator (now called Optus)

Qantas — international airline carrier

Commonwealth Bank — financial services

Telstra — telecommunications.

Factors influencing choice of legal structure

Size: as businesses expand, then the business may wish to seek the protection of limited liability.

Ownership: how much control and ownership of the business does the owner require?

Finance: how much finance is required to expand and what sources of funds are required?

As a business expands, it normally moves from an unincorporated structure to an incorporated structure.

External Environment

Includes those factors over which the business has very little control. such as government policy, technology, economic conditions and social attitudes.

Economic, financial, geographic, social, legal, political, institutional, technological, compretitive situation, markets

Internal enviroment

includes those factors over which the business has some degree of control, such as products, location, resources, management and business culture.

Products, location, resources, management and business culture

Sole trader: taxation

Tax structure: Income taxed at individual rates (0%-45%)

TFN: personal tax file number used. partnerships must apply for a seperate TFN via the ATO

Individual tax rates: Up to $18,200: 0%

Incorporated business: tax

Tax structure: incorporated businesses are taxed at the corporate tax rate: 30% for companies with an annual turnover of less than $50 million.

Small Business Tax offset: Companies with an aggregated turnover of less than $50 million may be eligible for reduced tax rate of 25%

Posible Double taxation

Tax Requirements in Australia

Federal tax obligations:

Businesses are subject to federal corporate tax rates on their taxable income

Goods and Services Tax (GST) obligations apply at the federal level if annual turnover exceeds $75,000

Pay as you Go (PAYG) withholding requirements for employees and certain contractor payments.

State Tax obligations:

Incorporated businesses may also be liable for state-based taxes like ayroll tax, land tax, and stamp duty, which vary by state jurisdiction.

External influence: Economic

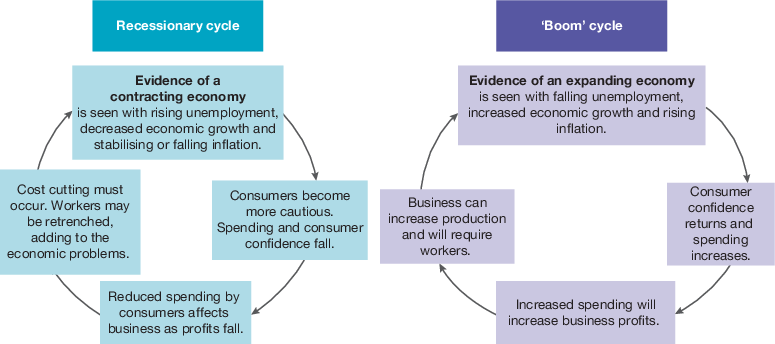

Economic cycles- (or business cycles) the periods of growth (‘boom’) and recession (‘bust’) that occur as a result of fluctuations in the general level of economic activity

External influence: Financial

A main source of finance for business is debt finance. Debt finance is significantly influenced by the level of interest rates. As interest rates increase, businesses will become more cautious in relation to taking on extra debt. On the other hand, as interest rates drop, then businesses will take on more debt.

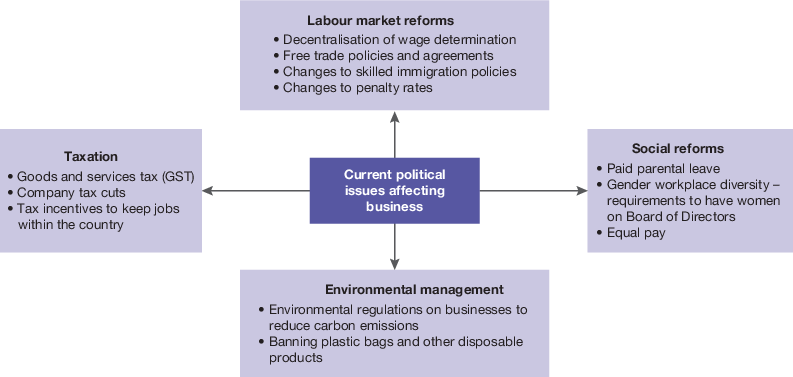

External influence: Political influences

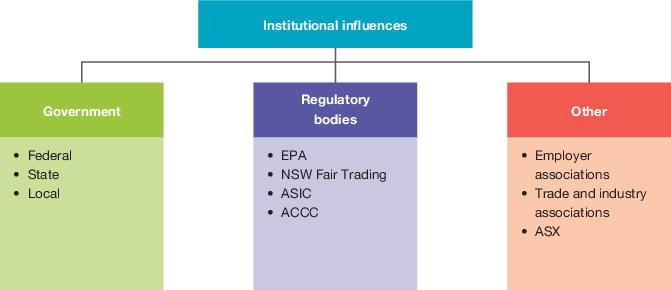

External influence: Institutional

Factors such as government policies, regulations, and institutions that impact business operations and decision-making. These influences can shape the business environment through laws, trade agreements, and support for industries.

External influences:tech

Factors such as technological advancements, innovations, and changes in consumer preferences that impact business practices and competitiveness. These influences can drive efficiency, productivity, and the development of new products and services.

External influences: Competitive situation

The dynamics of competition in a market, including the number of competitors, their strengths and weaknesses, and the overall market share distribution. These factors influence a business's strategies and performance.

TYPES OF MARKET CONCENTRATION: monopoly

Complete concentration by one business in the industry

Business has the ability to decide the price of the good or service because there are no competitors (i.e. the business is the price maker)

Customer has no influence over the price charged (i.e. the customer is the price taker).

TYPES OF MARKET CONCENTRATION: oligopoly

Consists of a small number of larger businesses that dominate the market

Are able to stay in control of the market because they spend large amounts of money on advertising and this enables them to restrict the entry of new competitors to the market.

TYPES OF MARKET CONCENTRATION: monopolistic

Most common type of market in Australia

Large number of buyers and sellers

The goods and services sold are differentiated from competitors using methods such as packaging, advertising, brand names and quality.

TYPES OF MARKET CONCENTRATION: perfect competition

Large number of small businesses that sell products that are the same or similar

Very little advertising is used to increase market share

The only way to achieve market share is through price competition.

INTERNAL INFLUENCES: TOPIC

The internal influences on a business include product, location, resources, management and business culture.

Product influences affect a range of internal structures and operations within the business.

Location will have a direct impact on the sales and profits of some businesses.

Factors to consider when choosing a location are:

visibility

cost

proximity to suppliers

proximity to customers.

The four main resources that influence a business are human, information, physical and financial.

Businesses can adopt a traditional hierarchical structure or a flat organisational structure.

Business culture can be seen in the unwritten or informal rules that guide how people in the organisation behave.

There are four essential elements of a business culture: values, symbols, rituals and heroes.

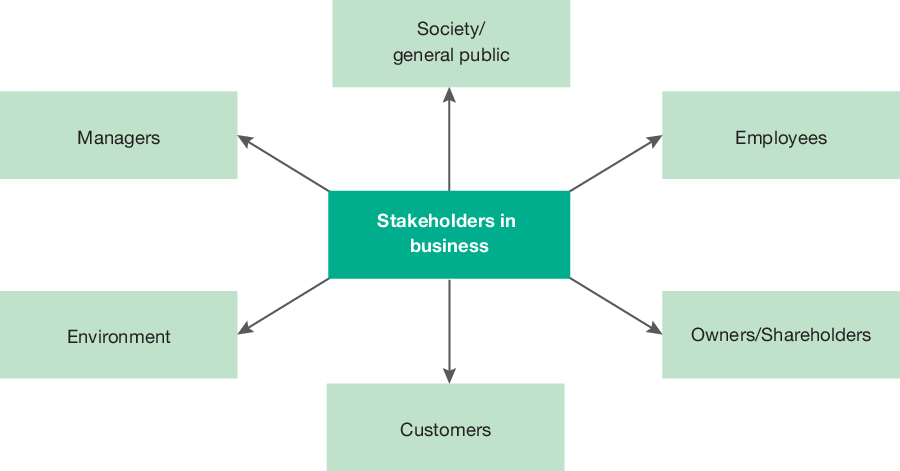

Stakeholders:

Businesses have many stakeholders that will influence their operations.

Shareholders have a direct influence on a business because they have voting rights on major business decisions.

Companies need to ensure that they maximise returns on their shareholders’ investments.

Managers will influence organisational policies and procedures as well as employees’ productivity.

Employees will influence the quality of an organisation’s products.

To ensure its future viability, a business should consider the needs of its customers.

Members of the community increasingly expect organisations to show concern for the environment and to be socially responsible.

There is growing pressure for businesses to adopt ecologically sustainable operating practices.

Business life cycle: Establishment

The first stage of the business life cycle where a new business idea is developed and launched. This phase includes planning, financing, and marketing efforts to establish the business in the market.

Business life cycle: Growth

The second stage of the business life cycle where the business experiences an increase in sales and profits. This phase often involves expanding operations, increasing market share, and improving products or services.

Merger: when the owners of two separate businesses agree to combine their resources and form a new organisation

Acquisition: the purchase of one business by another, where the acquired business becomes part of the purchasing company.

Business life cycle: maturity

The third stage of the business life cycle where sales and profits stabilize after significant growth. During this phase, businesses focus on maintaining market position, optimizing operations, and exploring new opportunities for sustainment.

Business life cycle: Post-maturity

The final stage of the business life cycle where the business faces decline in sales and profits. Companies may consider strategies such as diversification, rebranding, or exiting the market to respond to changes in consumer demand.

OR IN THE BOOK VERSION:

Steady state — the business continues to operate at the level it has been during the maturity phase

Decline — falling sales and profits ultimately resulting in business failure

Renewal — increasing sales and profits due to new growth areas.

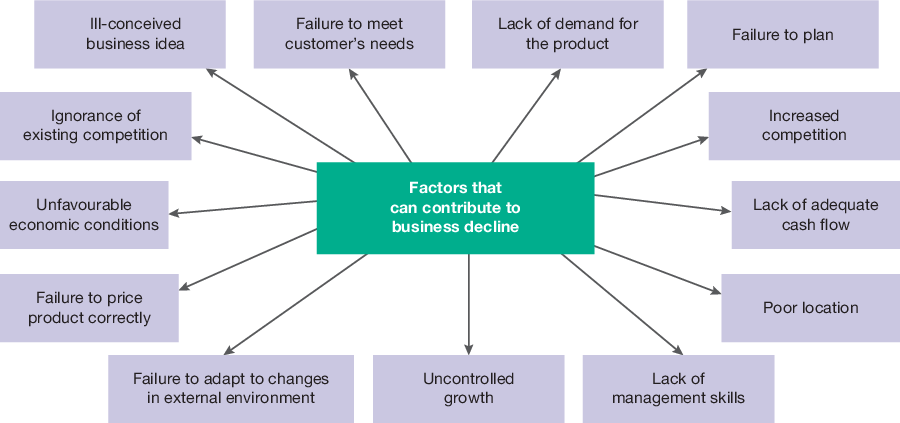

Factors that can contribute to business decline

Voluntary cessation

occurs when the owner ceases to operate the business of their own accord.

Involuntary cessation

occurs when the owner is forced to cease trading by the creditors of the business.

A company has two options when facing financial difficulties

Voluntary administration occurs when an independent administrator is appointed to operate the business in the hope of trading out of the present financial problems.

Voluntary or involuntary liquidation is the process of an appointed liquidator converting the business’s assets into cash.

skills for managers

interpersonal (people)

communication

strategic thinking

vision

problem solving

decision making

flexibility

adaptability to change

reconciling the conflicting interests of stakeholders.

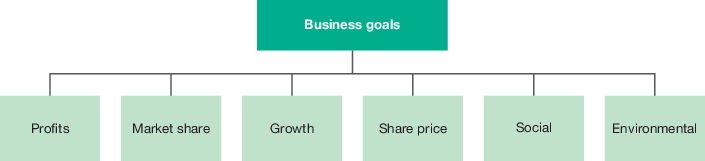

business goals

profits, market share, growth, share price, social, environmental

Business goals: Profit

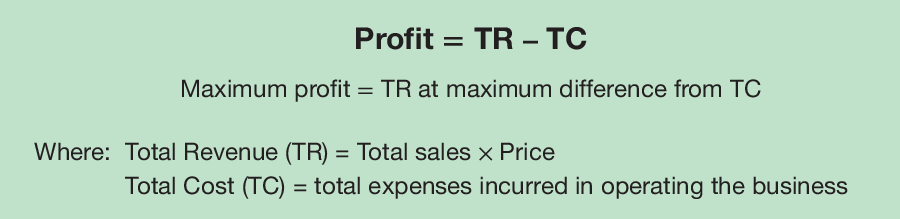

profit is what is left after the costs of producing and supplying the product (expenses) have been deducted from money earned from sales (revenue). If the business is unable to consistently make a profit, it will fail.

profit maximisation occurs when there is a maximum difference between the total revenue (that is, the number of sales made multiplied by the price) coming into the business and total costs being paid out

business goals: Market share

the percentage of an industry or market's total sales that is earned by a particular company over a specified time period. Increasing market share often indicates a company's competitive advantage and impact on sales growth.

Promotion- the methods used by a business to inform, persuade and remind a market about its products

Business goals: Growth

the increase in a company's sales, revenue, or overall size over time. This can be achieved through strategies such as expanding product lines, entering new markets, or improving operational efficiency.

Business goals: Shareprice

the price of a company's stock in the market, reflecting its perceived value and performance. An increasing share price is often a goal for businesses, as it indicates investor confidence and can raise capital for further growth.

Business goals: social goals

objectives that focus on the company's impact on society, including ethical practices, community involvement, and environmental sustainability. These goals aim to balance profit-making with the welfare of stakeholders and the community.

social justice

business goals: enviromental goals

objectives that aim to reduce a company's ecological footprint, promote sustainability, and ensure responsible resource usage. These goals are essential for preserving the environment and addressing climate change, aligning with corporate social responsibility.

sustainable development

Staff involvement

refers to the engagement and participation of employees in decision-making processes and initiatives within the organization. This fosters a collaborative work environment and can improve productivity and job satisfaction.

innovation, motivation, mentoring, training

7.2 classical approach to management

Classical approach: Stresses how best to manage and organise workers so as to improve productivity

Classical-scientific approach

By frederick w. taylor (1856-1915)

Scientific management: theory focused on optimizing workflows and efficiency through systematic observation and analysis of tasks.

Time and motion studies

Classical- bureaucratic approach

Man weber and henri fayol

Bureaucracy- the set of rules and regulations that controls a business

Advantages | Disadvantages |

|---|---|

|

|

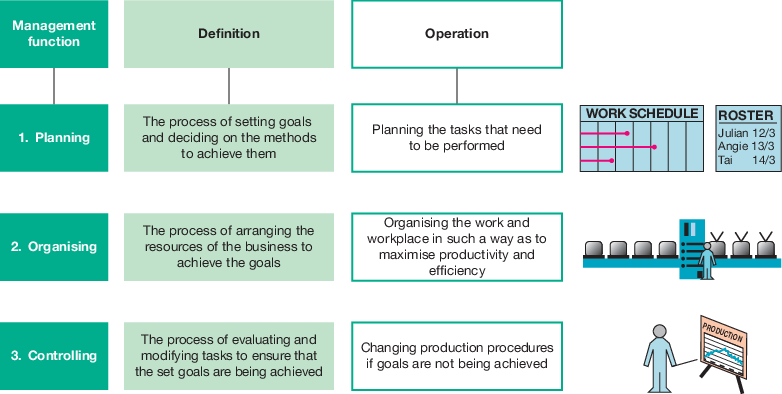

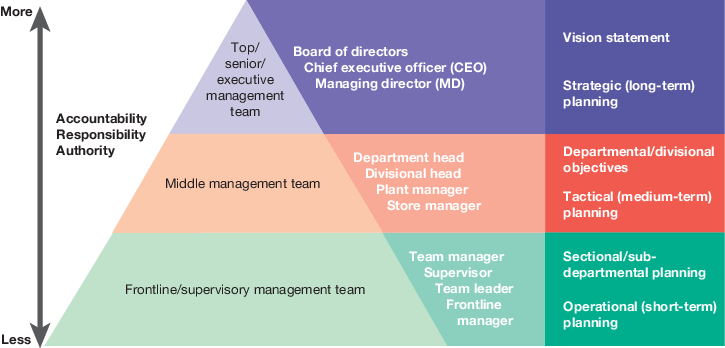

Levels of planning- strategic, tactical and operational planning

Strategic (long-term) planning is planning for the following three to five years. This level of planning will assist in determining where in the market the business wants to be and what the business wants to achieve in relation to its competitors.

Tactical (medium-term) planning is flexible, adaptable planning, usually over one to two years, that assists in implementing the strategic plan. Tactical planning allows the business to respond quickly to changes. The emphasis is on how the goals will be achieved through the allocation of resources.

Operational (short-term) planning provides specific details about the way in which the business will operate in the short term. Management controls the day-to-day operations that contribute to achieving short-term actions and goals. Examples of operational plans are daily and weekly production schedules.

Managment hierarchy

CLASSICAL—> Leadership styles: Autocratic and participative or democratic

TABLE 7.2Characteristics of the two main leadership styles | ||

Key feature | Autocratic or authoritarian manager | Participative or democratic manager |

|---|---|---|

Decision making | Makes all decisions and informs employees | Consults with employees, asks for suggestions then decides |

Control | Centralised — controls all activities | Shares decision making with employees |

Staff participation | Expects employees to follow orders | High level of employee empowerment |

Communication | Top-down | Two-way |

Motivation methods | External — rewards (carrot) and sanctions (stick) | Internal — sense of fulfilment, satisfaction |

Workplace example | Military officer during wartime; time of crisis | Professional organisations — intellectual abilities of employees are similar or complementary |

FOR SHORTCUT:

autocratic or authoritarian — strong, centralised control

participative or democratic — decentralised authority and power.

Behavioural approach to management

A management style that emphasizes understanding employee behavior and needs to improve motivation and productivity. It focuses on the social and emotional aspects of work and fosters teamwork and collaboration.

Elton mayo (1880-1949)

Advantages and disadvantages of the behavioural approach

Advantages

Disadvantages

Increased empowerment of employees — can take ownership of their work

Worker recognition and appreciation should lead to increased motivation

Improved relationships between managers and staff

Lack of control

Powerful people can disrupt the process

Communication is no longer top-down, so confusion may arise

It’s difficult to accurately predict employee behaviour

BEHAVIOURAL—> Participative or democratic leadership style

The main advantages and disadvantages of the participative or democratic leadership style | |

Advantages | Disadvantages |

|---|---|

|

|

Contingency approach to management

Advantages | Disadvantages |

|---|---|

|

|

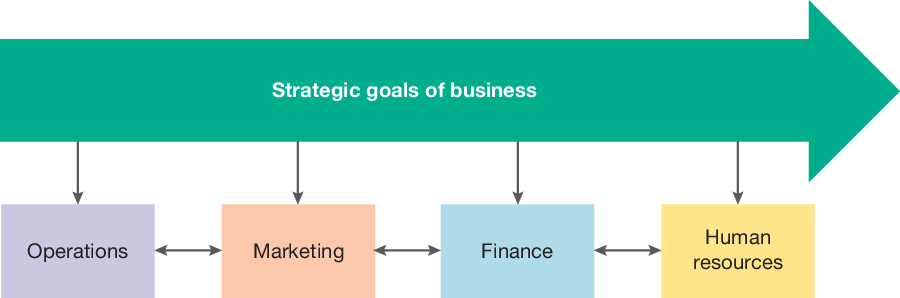

Strategic goals of business

operations

marketing

finance

human resources.

Strategic goals of business: operations

The difference between manufacturing and service operations | |

Manufacturing operations | Service operations |

|---|---|

Tangible items are produced — they may be customised, but generally they are standardised and often mass produced. | Intangible and customised, or made to suit the individual’s requirements |

Generally located close to supplies of raw materials or inputs (transport costs are of major concern) | Must be close to markets — location and proximity to users of services is vital. |

Zoning determines actual siting. | Zoning may allow for home-based flexibility. |

High capital costs in operations but can achieve some economies of scale | High training/education costs but can operate with low capital costs |

Employs unskilled or technically skilled people, so average cost of labour/workforce is low. | Focus is on skilled/experienced/semi-skilled and professional staff, so labour costs are relatively higher. |

Quality of output is standardised and backed by warranty. | Quality varies depending on the strength of industry regulations, skill, experience, knowledge and honesty of practitioner. Backed by public liability insurance. Customer or client relations are ‘everything’. |

Uses manufacturing technology | Uses office automation |

Manufacturer generally makes the product and then awaits sale (thereby risking unsold stock). | The server only acts once the demand for a service is identified — hence less risk. |

The goods last beyond the time over which they are paid for — they tend to be durable. | Services by their nature are inherently non-durable, though the actual work done may have lasting effects. |

Operations: Quality management

the strategy which a business uses to make sure that its products meet customer expectations

reduced waste and defects

reduced variance in final output

strengthened competitive position

improved reputation and customer satisfaction

reduced costs

increased productivity and profits.

Operations: Quality control

the use of inspections at various points in the production process to check for problems and defects

Operations: Quality assurance

the use of a system so that a business achieves set standards in production

Operations: Quality improvement

Total quality management- an ongoing, business-wide commitment to excellence that is applied to every aspect of the business’s operation

Quality improvement focuses on two aspects: total quality management and continuous improvement.

Strategic goals of business: Marketing

Marketing- a total system of interacting activities designed to plan, price, promote and distribute products to present potential customers.

Strategic goals of business: Marketing (THE 4 PS)

The 4 Ps refer to Product, Price, Place, and Promotion, which are key elements in developing an effective marketing strategy.

Strategic goals of business: Marketing (IDENTIFICATION OF TARGET MARKET)

Target market: a group of customers with similar characteristics who presently, or who may in the future, purchase the product

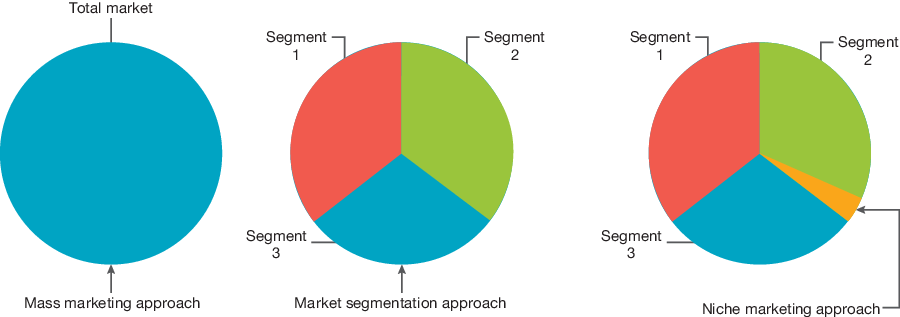

Mass marketing approach

in mass markets the seller mass-produces, mass-distributes and mass-promotes one product to all buyers

Market segmention approach

when the total market is subdivided into groups of people who share one or more common characteristic

occurs when the total market is subdivided into groups of people who share one or more characteristics based on four elements or dimensions: demographic, geographic, psychographic and behavioural

primary target market the market segment at which most of the marketing resources are directed

secondary target market usually a smaller and less important market segment

Strategic goals of business: Finance

Name of statement/report | Description of the statement/report |

|---|---|

|

|

|

|

|

|