Parcial 1 - Economía II UFM

5.0(7)

5.0(7)

Card Sorting

1/80

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

81 Terms

1

New cards

Monopoly

One seller. Organizations operating with the advantage of special privileges granted by the government.

2

New cards

Price taker

a seller that cannot affect the price by his own actions.

3

New cards

Price searcher

a seller that must choose a price.

4

New cards

Competitive markets

markets in which all buyers and sellers are price takers.

5

New cards

Optimal allocation of resources

no unit of the good is being produced whose marginal opportunity cost exceeds its marginal benefit. And every unit of the good whose marginal benefit exceeds its marginal cost is being produced.

6

New cards

Characteristics of perfect competition

* There is a large number of buyers and sellers so nobody possesses market power.

* Market participants possess full and complete information of alternatives.

* Sellers produce a homogenous product.

* There is costless mobility of resources.

* Economic actors are price takers.

* Market participants possess full and complete information of alternatives.

* Sellers produce a homogenous product.

* There is costless mobility of resources.

* Economic actors are price takers.

7

New cards

Mistakes with perfect competition

* It has overlooked the entrepreneur, which is the driving force of real-world markets.

* It also ignores the plan-adjustment process that characterizes real-world market activity.

* It also ignores the plan-adjustment process that characterizes real-world market activity.

8

New cards

Fair competition

Open entry and exit

9

New cards

Cartel

cooperative arrangement between companies intended to promote a mutual interest. Sellers agreeing not to compete with each other.

10

New cards

Problems of cartels

* How to prevent competition among its members, who will try to circumvent the agreement

* How to keep new competitors from trying to enter the market

* How to keep new competitors from trying to enter the market

11

New cards

Predatory price-cutting

reducing prices below cost in order to drive a rival out of business or prevent new rivals from entering with the intention of raising prices afterward to recoup all losses.

12

New cards

Distribution of income

the product of the supply and demand for *productive services*.

13

New cards

Capital

produced goods that can be used to produce future goods.

14

New cards

Human capital

productive capabilities generated by investment and embodied in human beings, such as knowledge and skills.

15

New cards

Three types of rights

Actual, legal, moral

16

New cards

Unions

Groups of organized workers that claim to compete against corporations, but in reality they want to exclude other workers who would do the same work for less.

17

New cards

Veil of ignorance

Imagine you would have to choose the laws of society, but before choosing, you forgot everything about yourself.

18

New cards

Externalities

costs or benefits that fall on bystanders.

19

New cards

Negative externalities

costs imposed on others that are not taken into account when making a decision.

20

New cards

Externalities are also called

Spillover cost or external cost

21

New cards

Positive externalities

benefits from an action that the decision-maker does not take into account.

22

New cards

Internalizing an externality

when the actor finds out about the consequences of his actions, takes the externality into account and chooses to alter his behavior.

23

New cards

We can reduce externalities through

Negotiation, adjudication, legislation, command and control, taxes, Coase theorem

24

New cards

Negotiation

work it out for ourselves, it produces mutual gains from exchange.

25

New cards

Adjudication

a process for discovering who has which rights. It aims at maintaining the continuity of expectations.

26

New cards

Legislation

The creation of new rules

27

New cards

Command and control

legislation of physical restrictions.

28

New cards

Bubble concept

permit factories to exceed the limits at one point if they could make it up at another point.

29

New cards

Rights to pollute

firms with more emissions can buy these rights, so the total amount of emissions stays the same.

30

New cards

Coase theorem

a solution to externalities through the creation of new markets.

31

New cards

Pigouvian tax

a tax on a good that produces negative externalities, in hopes to reduce it.

32

New cards

Network externalities

The value of a good or service increases the more people use it.

33

New cards

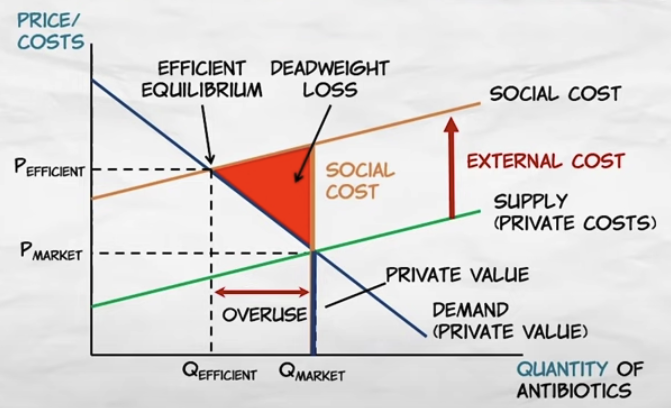

Externalities graph

34

New cards

Structured individualism

el individuo carga con los beneficios y costos de sus acciones.

35

New cards

Private or competitive sector

The market sector

36

New cards

Public sector

Conformado por el gobierno

37

New cards

Coerce

induce cooperation by threatening to violently reduce people's options.

38

New cards

Persuade

induce cooperation by promising to expand people's options.

39

New cards

Free-riders

people who accept benefits without paying their share of the cost of providing those benefits.

40

New cards

Paternalistic argument

the widely held belief that the powerful will take advantage of the weak unless government regulates certain kinds of voluntary exchange.

41

New cards

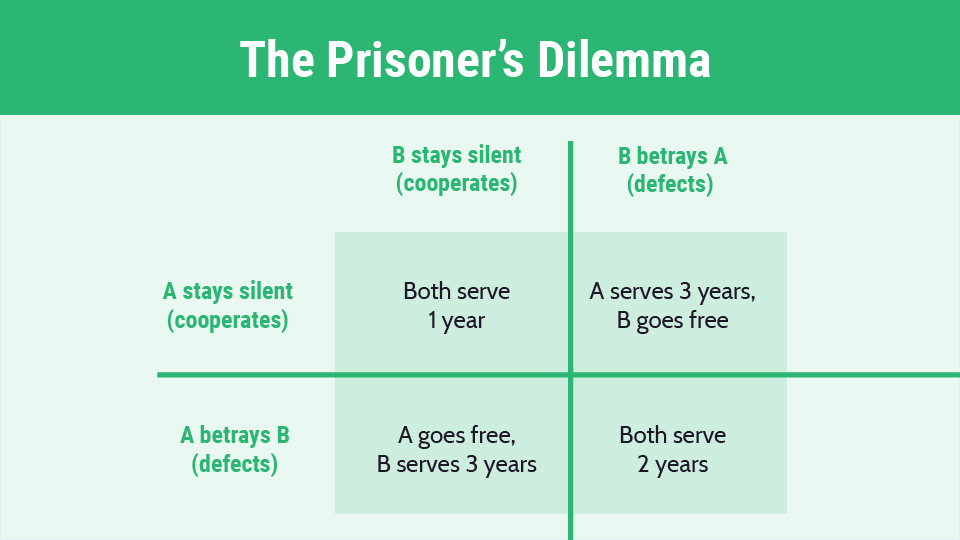

Prisoners dilemma

42

New cards

What the state is not

We are not the government

43

New cards

What the state is

Provides a legal, orderly, systematic channel for the predation of private property. it is the monopoly of violence.

44

New cards

Economic means of acquiring wealth

Production and exchange

45

New cards

Political means of acquiring wealth

seizure of another's goods or services by the use of force and violence.

46

New cards

Ways to raise government revenue

* Taxation

* Public borrowing or debt issue

* Money creation

* Public borrowing or debt issue

* Money creation

47

New cards

Neutral tax

aquel impuesto que no cambia la conducta.

48

New cards

Positive principles of taxation

analyze who bears the burden of taxes and what other economic effects can be expected to result from the imposition of taxes.

49

New cards

Normative principles of taxation

how tax policy can be used to design as desirable a tax system as possible.

50

New cards

Unit tax

a tax charged per unit of a good exchanged.

51

New cards

Ad valorem tax

a tax based on the dollar value of the goods sold.

52

New cards

Retail sales tax

taxes calculated as a percentage of retail sales, a type of ad valorem tax.

53

New cards

Excise tax

taxes placed on particular types of goods, can be either unit or ad valorem.

54

New cards

Tax incidence

the ultimate burden of the tax, after shifting has taken place.

55

New cards

Welfare cost of taxation is also known as

Excess burden or deadweight loss

56

New cards

Welfare cost of taxation

all the exchanges that could be made, but are not made, because of a tax.

57

New cards

Lump sum tax

a tax that completely eliminates the excess burden of taxation.

58

New cards

Ramsey rule

states that to minimize the excess burden of taxation, taxes should be placed on goods in inverse proportion to the elasticity of demand for the goods.

59

New cards

Compliance costs

the costs imposed on taxpayers to comply with the tax laws, such as collecting and keeping records.

60

New cards

Administrative costs

home by the government to collect taxes.

61

New cards

Political cost

home by the taxpayers and the government as a result of taxpayers trying to influence tax laws.

62

New cards

Earmarked tax

taxes whose revenues are designated to a particular spending activity.

63

New cards

General fund financing

the tax revenues are placed in the general fund, from which government programs are financed. The alternative to earmarking.

64

New cards

Benefit principle

states that the people who benefit from the government's expenditures should be the ones who pay for them.

65

New cards

Ability-to-pay principle

states that individuals should pay taxes in proportion to their ability to pay.

66

New cards

Horizontal equity

individuals with an equal ability to pay should pay equal amounts of taxes.

67

New cards

Vertical equity

individuals with a greater ability to pay should pay more taxes.

68

New cards

Proportional tax

a tax that is the same percentage of a taxpayer's income no matter what the level of income.

69

New cards

Progressive tax

a tax that is a larger percentage of the taxpayer's income as income rises.

70

New cards

Regressive tax

a tax that is a smaller percentage of the taxpayer's income as income lowers.

71

New cards

Sumptuary tax

taxes designed to discourage the consumption of the taxed good.

72

New cards

Revenue-neutral carbon tax

el gobierno "devuelve" parte del impuesto sobre la contaminación

73

New cards

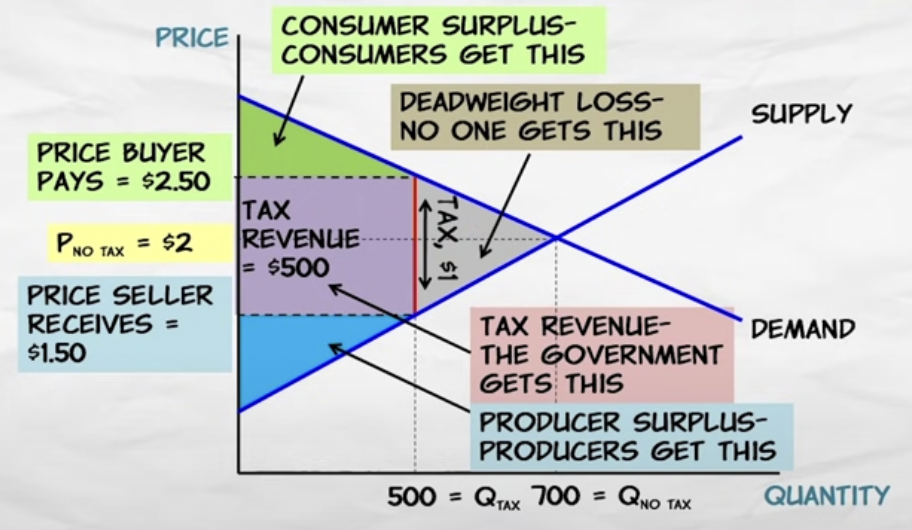

Tax graph

74

New cards

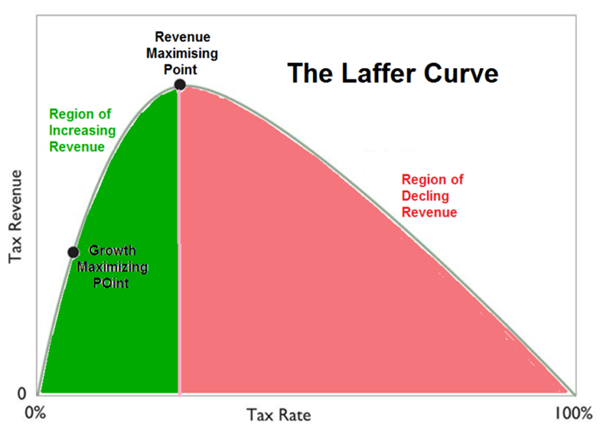

Laffer curve

belief that tax cuts generate additional revenue.

75

New cards

The old-time fiscal religion

*Deficits* emerged primarily during periods of war; budgets normally produced *surpluses* during peacetime, and these surpluses were used to retire the debt created during war emergencies.

76

New cards

Fiscal constitution

rules guiding fiscal choices

77

New cards

Multiplier effect

* By *creating jobs*, governments would save money that would have been spent on unemployment benefits.

* The increase in the number of emplyed people would create *additional spending power* and therefore boost the economy and tax receipts.

* Increased tax receipts would *pay off* the initial debt.

* The increase in the number of emplyed people would create *additional spending power* and therefore boost the economy and tax receipts.

* Increased tax receipts would *pay off* the initial debt.

78

New cards

Public choice theory

the application of economic methods to the study of political processes.

79

New cards

Market failure

There are certain areas where market forces do not opperate effectively and therefore we must have government corrective action.

80

New cards

Bifurcated view of human action

We know that people in markets are driven by self-interest, but we must also accept that people in government are driven by the same thing.

81

New cards

Public choice theory’s main question

What policy is likely to emerge from real-world democratic politics, and how does that compare to market alternatives?