Compliance and Getting Paid - Professional Issues Lecture

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

52 Terms

HIPPA Rules

Federal law, signed in 1996 that governs how health information can be used, shared, sent, and stored.

Privacy Rule (2002) governs use, disclosure, access of protected health information

Security Rule (2005) controls to keep health records secure and confidential

HITECH (2013) Health Information Technology for Economic and Clinical Health

incentive to transition to electronic health records

requirement for breach investigation, tracking and violation penalty structure

HIPPA Terminology

buisness associate - person or entity that performs certain functions on behalf of a covered entity, using the covered entit’s PHI

covered entity - health plans, healthcare clearinghouse, providers

minimum necessary - always use or disclose only the PHI that is necessary to accomplish a task or activity

Protected Health Information - PHI

18 elements of individual’s indentifiable health information that is held or electronically transmitted by a covered entity, if that inofmration relates to:

a past, present or future physical or mental health condition

the provision of healthcare or

the past present or future payment for healthcare

EPHI - electronic PHI any protected health information in electronic form

Elements of PHI

name - initials

full address

all dates directly related to individual

phone numbers

fax number

email address

social security number

medical record number

health plan ID number

account numbers

vehicle identifier VIN

certificate/license numbers

device indentifiers

web addresses

computer IP address

biometric ids (fingerprint)

full face photo

any other unique identifier or characteristic

PHI and Social Media

Media release is between the company and the pt not the clinician.

Don’t acknowledge someone is a pt, unless they say so first. then say very little.

taking videos/photos in the clinic setting - risky!

Patient Rights OCR Hot Topic

access to health data/clinical record

find out who received health data

confidential communications

notification of privacy practices

restrit sharing health data - to whom/which elements

prompt notification of breached PHI

request correction of errors in health record

file complaint for privacy violation

Disclosure Authorization NOT Requried

treatment - provision of healthcare services

payment - seeking payment for healthcare services provided

healthcare operations - administrative, financial, legal, and quality improvement activities necessary to run a covered entity’s business, and to support treatment and payment activities

Disclosure Authorization Required

Family or friends of the patient

attorneys working on behalf of the pt

when posting any information or photos of the pt on social media

tacit permission required from the pt to text or email PHI unencrypted

HIPPA Breaches

an impermissible use or disclosure of Protected Health Information (PHI) that compromises its security and/or privacy

loss or theft or hard copy patient records

unauthorized use or disclousre of PHI by employees

improperly disposing of records containing PHI

releasing patient records without proper authorization

texting or e-mail unencrypted PHI - if hacked

Breach Notification Requirements

contact individual patients

if contact info out-of-date for 10 or more patients, psot on website, or provide notice to print/broadcast media

more than 500 patients in state or juristiction , also provide notice to prominent media outlets covering the area

report to Secretary HHS

> 500 pts, withing 60 days

< 500 patients, within 60 days of years end

fines range from $100-$50,000 per violation (or per record) up to maximum penalty of $1.5 million per year/each violation - can also be criminal charges filed

Reasonable Safeguards

avoid using patient’s names in public areas

speak quietly when discussing a patient’s condition in publicc area - move conversation to a private area

turn computer monitros away from pt view

always password protect computers and mobile devices

always encrypt emails containing PHI when sending to an external system

Never test PHI to referral sources

Who are the Payors?

Government

Traditional Fee For Service

Federal - Medicare

State - Medicaid

Workers Compensation

Veterans Administration (VA) healthcare services

Commercial

Employer plans (sample)

national - Aetna, United HealthCare, Humana

Regional - Blue Cross Blue Shield

government sponsored

managed Medicare and Medicaid

state exchanges

Health Insurance Terms and Definitions

Coinsurance - a percentage of the change of medical care that the patient must pay based on benefit plan

Copayment - a payment in accordance with plan design

Deductible - a dollar amount the patient must pay each policy year before benefits are payable by the insurance company

Premium - money that is paid to an insurance company in exchange for insurance benefits

Allowed Amount - payment in full by an insurance company - contracted rates

Exclusions - items or services that are not covered under the patient health plan and for which the plan will not make payment

Certificate of Coverage - patient’s benefit description

Timely Filing - submission of authorization, appeals, claims within payor designated timeframes

claim submission examples subject to change

CMS - within 1 calendar year

Anthem Blue Cross - 120 days

Aenta - 90 days

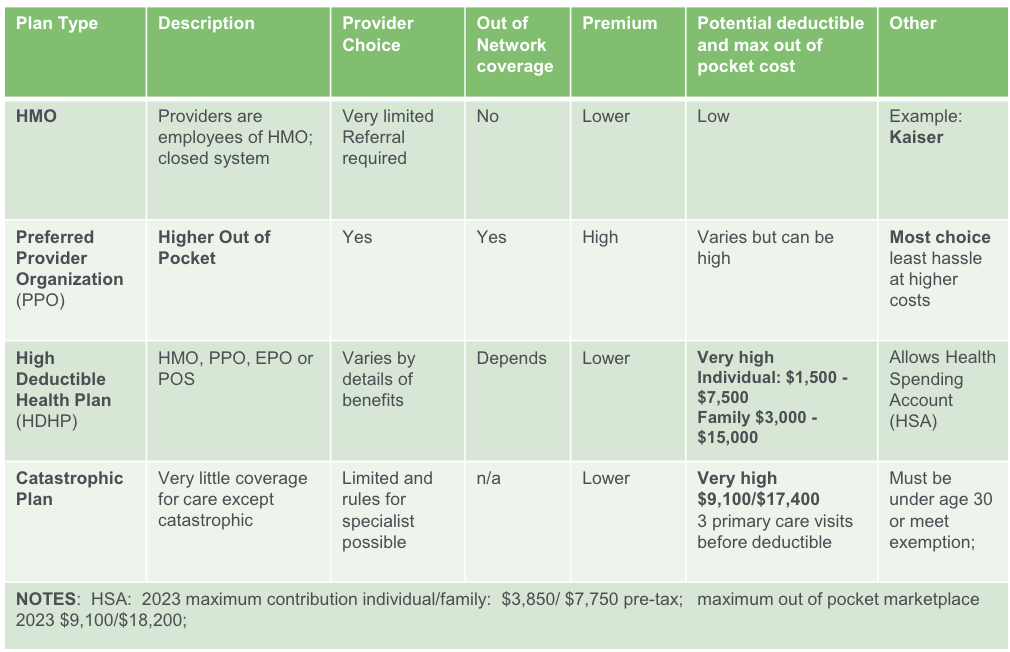

Common Health Insurance Plans 2023

Other Plan Types

Administrative Services Only (ASO) increasing for some

self-funded

claim processing

Employer decides benefits and assumes risk for claim payment.

Affordable Care Act Highlights

ended pre-existing conditions exclusions

keeps yound adults covered under parents plan until 26

ended lifetime limits on coverage

covers preventive care 100%

full access to ER services at any hospital

Expanded Medicaid in most states (40) with federal government support

Established public insurance exchanges/marketplace helps individuals purchase insurance on their own

benefit plan levels - catastrophic/bronze/silver/platinum

eligible for a tax credit based on income to reduce cost

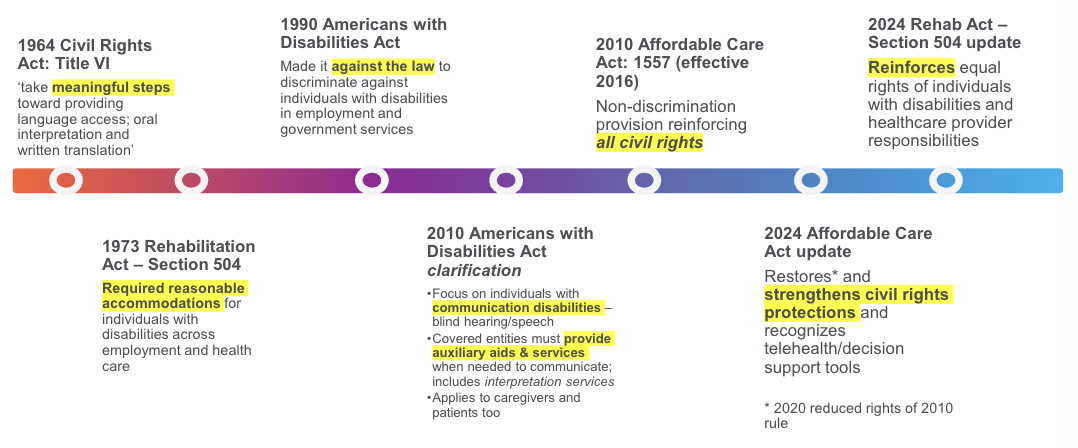

Regulatory Timeline

Rehabilitation Act 504: Update 2024

Discrimination on the Basis of Disability in HHS Programs or Activities

accessible medical equipment

medical treatment

integrated settings

child welfare programs and activites

web and mobile accessibility

aligned the Act with ADA

service anmals

mobility devices

communications

Medical Records (Medical Provider Records

- the document that explains all detail about the patient’s history, clinical findings, diagnostic test results, pre and postoperative care, patient’s progress and medication

Preauthorization (PreAuth)

- a decision by your health insurer or plan that a health care service, treatment plan, prescription drug or durable medical equipment is medically necessary. Sometimes called prior authorization, prior approval or precertification

Predetermination (PreD)

- formal review of a patient’s requested medical care compared to their insurance’s medical and reimbursement policies. The aim is to determine if the intended care meets medical necessity requirements

Detailed (Standard) Written Order (DWO/SWO)

detailed prescription

Letter of Medical Necessity (LMN)

a letter written by your healthcare professional detailing your care

Getting Payment Based on

meeting/demonstrating care meets payor’s clinical criteria

Patient’s Certificate of Coverage, verification of benefits

must follow payor pre-authorization process

validate policy exclusion diagnosis driven benefit

money limits in benefit category

Common Denial Reasons

Service provided was not -

a covered benefit

medically necessary

a contracted service, regardless of medical necessity

authorized or payor not given proper notification

Service deemed - experimental, investigational, unproven

Claim or appeal submitted outside of timely filing

Denial and Delay: Clincial Documentation

Inadequate Clinical Notes

incomplete evaluation forms

contradictory indormation

illegible

lack of payor friendly terms

Patient wants vs needs.

out of warranty verbiage without specific rationale

lack of patient specific functional level documentation

lack of justification for definitive prosthesis vs. replacement socket

Other Documentation Considerations

Always document

communications with therapist, O&P clinician, physician

functional changes noted from patient use of device (pt report and/or clinical observation)

recommended use of device

wearing schedule

skin integrity

pain

risks and concerns

recommendations for device mods

Medical Records (Physician Records): Requirements supporting O&P Services

clearly document device justification

physician should be specific to the device i.e. MPK, MPF, myoelectric device, Myomo, CBrace if providing high end componentry

face to face encounter with MD

amended records; updated records

socket replacements do not need to justify the functional level

clinicians should be involved - this is an opportunity to get in front of the referral source and develop a relationship

Prior-authorization Process

Follow payor’s requirements for prior-authorization make sure to include

review clinical record for completeness nad accuracy

search for payor’s medical policy on internet

review clinical record in alignment with payor Medical Policy to ensure that medical necessity requirements are met

Tenets of Prosthetic Documentation

Allows physician ability to stablish and to justify medical necesity.

desire to ambulate (LE)

current funcitonal level with supporting activites (prosthetics)

expected functional level with supporting activities (difference between the 2 if applicable) (prosthetics)

agreement in proposed plan (specifically address any high end componentry)

are there any co-morbidities that will affect the patient from utilizing the device?

Right Now - Right Later- Better Care!

Pre-authorization (pre-auth) Cycle - defined by state statues, mandates timeframe for payor decision on pre-auth.

varies by state and based on urgency of service

shortest - 15 calendar days

Appeal Cycle

defined by state statutes, mandates timefrane for payor decision on appeals

varies by state from 30 days to 60 days

Relevance to Pre-auth Discovery

avoid 30-60 appeal cycle

pre-auth decision results

- 90% first pass approval rate (CMS = 40-50%)

days from submission to auth - 5 days

Myths

A LMN can be considered a Medical Record.

false - per CMS, LMNs, as well as DWO/SWOs, are NOT considered a medical record. You may use a LMN to support an encounter note/visit with the physician

MD Records are not needed if preauth is not required.

false - even though some insurance plans may not require MD Records for preauth is not needed insurance companies can still come back at claims adjudication and request MD Records. You cannot amned records after the device has been provided

Cautions

medical necessity does not equal benefit

suthorizations do NOT guaranteed payment

authorizations may NOT be aligned to patient’s benefit

claims payment is based upon

eligibility

benefits

medical necessity

clean coding

Review of Payor Medical Policy

defines:

payor’s position on medical necessity of services

defines criteria required to meet medical necessity

terms regarding medical policy

supported by payor’s research of outcomes based studies

established by payor’s Medical Management staff and reviewed annually

does not take into consideration a member’s benefit plan or certificate of coverage

Updated LCD allows. . .

MPKs for K2 users

Health Saving Accounts

Tax free saving opportunities.

Health Savings Account (HSA)

allows individuals to pay for current health expenses and save for future qualified medical expenses on a pretax basis. Funds deposited into an HSA are not taxed, the balance in the HSA growws tax-free, and that amount is available on a tax-free basis to pay medical costs

Flexible Spending Account (FSA)

allows an employee to set aside a portion of earnings to pay for medical expenses. Money paid into an FSA is not subject to payroll taxes.

Fully Insured Plan

insurance carrier collects the premiums and pays the health care claims based on the coerge benefits outlined in the policy purchased.

insurance company assumes risk and manages its own administrative tasks

employer contracts with health plan and pays a monthly premium

Self-Funded Plan

employer assumes risk (becomes the insurance company) but hires a company for all administrative tasks

employer chooses network, plan design, managed care provider

employer maintains reserves and all unspent portions are retained by employer

Worker’s Compensation

insurance covers job-related injuries only

no monthly premiums

adjusters price shop

full reimbursement for approved medical expenditures

Health Insurance

preventative care and episodic

monthly premiums

set reimbursement rates

cost sharing deductible/coinsurance/copay

Texting with Patients Dos

determine if PHI is required

alert patient on risks of non-secure email/text

obtain specific permission to communicate without encryption and document in EHR before proceeding

delete patient photos/videos from personal cloud accounts

follow minimum necessary rule at all times, limit PHI use

Texting with Patients Don’ts

send PHI unencrypted without consent

refuse sending unsecure PHI if you have consent

think hackers aren’t watching and waiting for mistakes

store PHI, patient photos/videos, emails on personal accounts

provide more than the minimum PHI in any communication

Texting with Referral Sources/Payers Do’s

delete text message with PHI

delte PHI before replying to a text

reply to texts/emails if it doesn’t include PHI

encrypt emails containing PHI to referral sources

Texting with Referral Sources/Payers Don’ts

include PHI on texts

foward patient text messages to the referral source

reply to texts with PHI. If email has PHI, do not reply with an unencrypted email

include PHI in the subject line of your email

False Claims Act (FCA) 1863

purpose - to combat fraud against the federal government

Key Provisions

imposes liability on individuals and companies who defraud governmental programs

allows whistleblowers (qui tam actions) to report fraud and share in any recovered damages.

penalties include treble damages and civil penalties ranging from $5,500 to $11,000 per false claim

Anti-Kickback Statute (AKS) 1972

purpose - to prevent fraud and abuse in federal healthcare programs

key provisions

prohibits the exchange of renumeration to induce or reward referrals for services covered by federal healthcare programs

applies ot both sides of the transaction (giver and receiver).

violations can result in fines, imprisonment, and exclusion from federal healthcare programs

Stark Law (Physician Self-Referral Law) 1989

purpose - to prevent conflicts of interest in physician referrals

key provisions

prohibits physicians from referring Medicare patients for designated health services to entities with which they have a financial relationship, unles an exception applies

penalties include fines up to $15,000 per infraction and exclusion from Medicare and Medicaid programs

Civil Monetary Penalties Law (CMPL) 1981

purpose - to impoe penalties for various forms of fraud and abuse in federal healthcare programs

key provisions

authorizes the imposition of civial monetary penalties for a wide range of violations, including false claims, violations of the Anti-Kickback Statute, and Stark Law violations

penalties can include fines up to $50,000 per violation and assessments of up to three times the amount claimed.

What Constitutes Fraud?

knowingly misrepresenting a material fact in oder to gain a financial benefit

So how does a CPO defraud the US Government?

What is a False Claim?

when a provider or supplier knowingly omits critical elements from their claim and submits it for payment it is intentionally dishonest and is legitimately considered fraud

in a hurry

taking shortcuts

just don’t want to do the work

trying ot get paid for what they didn’t provide

punishable under the law

What is a Reverse False Claim?

when a provider or supplier realizes they have recieved an overpayment but does not take steps to refund it within 60 days, their administrative error becomes a Reverse False Claim

gosh, i wont do that again

i earned this money and learned my lession

no one knows this but me

i need this money

punishable under the law

Penalties for submitting False Claims

Civil Penalties

fines - up to $11,000 per flase claim

damages - up to three times the amount of damages the government sustains due to the false claims

Criminal Penalties

fine - up to $250,000 for individuals

imprisonment - up to 5 years

Risk Areas and Scenarios

OIG- 1 Billing for items or services not provided

OIG - 6 Upcoding

OIG - 7 Unbundling

OIG - 2 Billing for services the DMEPOS supplier believes may be denied

OIG - 5 Billing for items or services not ordered

Practicing without a license

15 states require a license to practice O&P

some of those states require Residents or students to register before practicing

2 states require certification but not a license

not all licensure states require ceritfication in order to get a license to practice

not all licensure states that DO require certification to get a license require you to maintain certification as part of the license. People will drop their certification and keep the license

Affordable Care Act Marketplace Plans

DC and 17 states have their own state run marketplaces. 33 states rely on federal government marketplace

Platinum - covers 90% on average of your medical costs - you pay 10%

Gold - covers 80% on average of your medical costs; you pay 20%

Silver - covers 70% on average of your medical costs; you pay 30%

Bronze - covers 60% on average of your medical costs; you pay 40%

Catastrophic - catastrophic policies pay after you have reached a very high deductible. Catastrophic plans must also cover the first three primary care visits and preventive care for free, even if you have no yet met your deductible.