CFA Level II: Chapter 21: Free Cash Flow Valuation

1/57

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

58 Terms

The FCFF and FCFE formulas assume

company uses only debt and common equity to raise funds

Use of preferred stock requires the analyst to revise the FCFF and FCFE formulas to

reflect the payment of preferred dividends and any issuance or repurchase of such shares

free cash flow to the firm (FCFF)

Cash available to all of the firm's investors, including stockholders and bondholders, after the firm buys and sells products, provides services, pays its cash operating expenses, and makes short- and long-term investments

What does the firm do with its FCFF? (first step)

1. makes interest payments to bondholders and borrows more money from them or pays some of it back.

reduces the tax bill

free cash flow to equity (FCFE)

Cash Flow available for distribution to the c/s; after all obligations have been paid.

CFO - fixed capital investment + net debt increase

or

CFO - net cap expenditure + net borrowings

value of the firm (free cash flow formula)

= FCFF discounted at the WACC

FCFF = PV of expected future FCFF

WACC = weighted average cost of capital

+* excess cash and marketable securities, or land held for investment

Weighted Average Cost of Capital (WACC) =

required return on the firm's assets

value of equity (free cash flow) =

FCFE discounted at the required return on equity

Value of equity (given firm value )

firm value - market value of debt

Analysts often prefer to use free cash flow rather than dividend-based valuation (4 reasons)

1. Many firms pay no or low cash dividends

2. Dividends are paid at the discretion of the board of directors

3. If a company is viewed as an acquisition target - fcf is more appropriate measure because new owners have discretion

4. FCF may be more related to long-run profitability of a firm as compared to dividends

Ownership perspective in the free cash flow approach

acquirer who can change the firm's dividend policy, which is a control perspective

FCFF = (from net income)

= NI + NCC + [Int x ( 1- tax rate)] - FCInv - WCInv

NI = net income

NCC = noncash charges

Int = interest expense

FCInv = fixed capital investment (capital expenditures)

WCInv = working capital investment

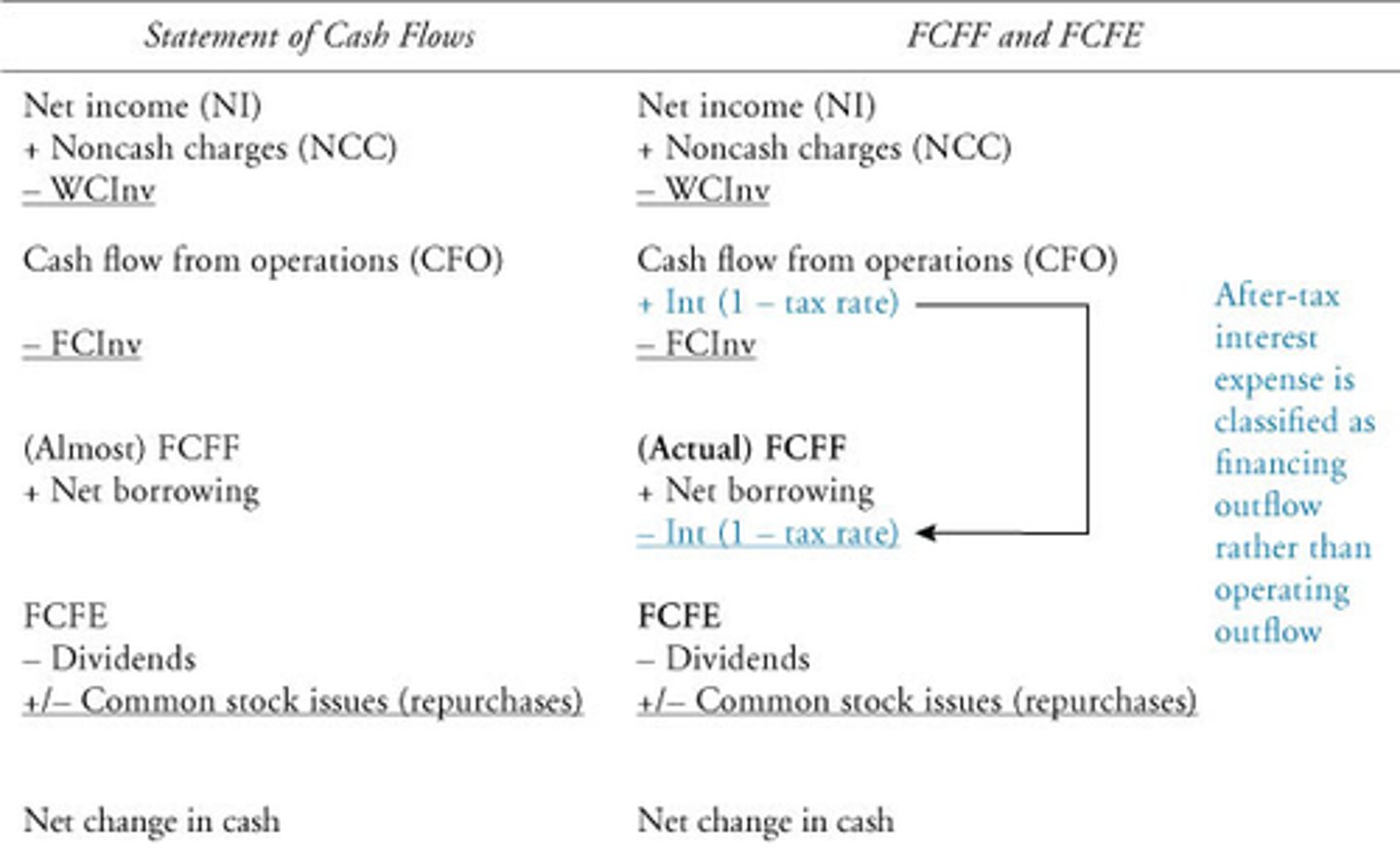

Almost FCFF (using statement of cash flows) formula

= (NI+NCC−WCInv) −FCInv

=CFO−FCInv

Actual FCFF (using statement of cash flows) formula

=(NI+NCC−WCInv)+Int(1−tax rate)−FCInv

=CFO+Int(1−tax rate)−FCInv

calculate FCFE directly from FCFF

= FCFF − Int(1 − tax rate) + net borrowing

Calculating FCFF from EBIT

= [EBIT × (1 − tax rate)] + Dep − FCInv − WCInv

Calculating FCFF from EBITDA

= [EBITDA × (1 − tax rate)] + (Dep × tax rate) − FCInv − WCInv

Calculating FCFF from CFO

= CFO + [Int × (1 − tax rate)] − FCInv

Calculating FCFE from FCFF

= FCFF − [Int × (1 − tax rate)] + net borrowing

net borrowing = long- and short-term new debt issues − long- and short-term debt repayments

Calculating FCFE from net income

= NI + NCC − FCInv − WCInv + net borrowing

Calculating FCFE from CFO

= CFO − FCInv + net borrowing

Calculating FCFF and FCFE Using the Statement of Cash Flows IMAGE

You can arrive at FCFF by starting with 1 of four finanical statement items

1. Net Income 2. EBIT 3. EBITDA 4. Cash flow from Operations

Noncash Charges (NCC) (Definition, and largest component)

added back to NI to arrive at FCFF because they represent expenses that reduced NI but didnt result in outflow of cash.

Largest noncash charge is usually depreciation

Noncash Charges (Categories - 6 )

1. Depreciation

2. Amortization of intangibles

3. Provisions for restructuring charges and noncash losses

4. Income from reversals of restructuring (-)

5. Amortization of bond discount added to net income and premium taken out

6. Deferred Taxes - result in differences of timing of reporting income and expenses for accounting

Fixed Capital Investment (Income statement)

investments in fixed capital do not appear on the income statement, but they do represent cash leaving the firm

FCInv (Formula)

= cap expenditures - proceeds from sales of long term assets

If no long-term assets were sold during the year:, FCInv formula

= ending net PP&E − beginning net PP&E + depreciation

If long-term assets were sold during the year, how to calculate FCInv (4 steps)

1. Determine Capex from item in statement of CF called purchase of fixed assets or purchases of PP&E

2. Determine proceeds of sales from fixed assets from an item in statement of cash flows "proceeds from disposal of fixed assets"

3. Calculate FCInv = capital expenditures - proceeds from sale of long0term assets

4. Capi ex or sales are not given directly find the diff. on asset sales from income statement and PP&E figures from balance sheet

FCInv = ending net PP&E - beginning net PP&E + depreciation - gain on sale

Working capital investment.

investment in net working capital is equal to the change in working capital, excluding cash, cash equivalents, notes payable, and the current portion of long-term debt

Interest expense

Interest was expensed on the income statement, but it represents a financing cash flow to bondholders that is available to the firm before it makes any payments to its capital suppliers. Therefore, we have to add it back

Free cash flow to the firm

operating cash flow left after the firm makes working capital and fixed capital investment

one unique feature of the statement of cash flows: interest expense is considered

an operating cash flow, whereas we'd like to call it a financing cash flow

FCFF adjust for the two cash flows to bondholders to calculate FCFE

1. after-tax interest expense

2. new long or short term borrowings

Treat preferred stock

just like debt, except preferred dividends are not tax deductible

Two approaches to forecast FCFF and FCFE

1. Historical FCF + growth rate

2. Forecast components of FCF and calculate each separately

Forecasting the components of free cash flow

1. More realistic method because you can assume each component of free cash flow is growing at a different rate over some short-term horizon

2. future capital expenditures, depreciation expenses, and changes in working capital

Capital expenditures two dimensions

1. outlays required to maintain capacity

2. marginal outlays needed to support growth

when forecasting FCFE with components and their growth - common to assume?

the firm keeps a target debt-to-equity ratio

FCFE = (with a target debt- to- asset ratio)

NI − [(1 − DR) × (FCInv − Dep)] − [(1 − DR) × WCInv]

dividends, share repurchases, and share issues have what effect on FCFF and FCFE?

no effect

what things have no effect on FCFF and FCFE? (3)

1. dividends

2. share repurchases

3. share issues

Dividends and share repurchases represent

uses of those cash flows and don't affect the level of cash flow available

Difference between FCFE and DDM models?

FCFE takes the control perspective - value should be immediately recognized

DDM - takes the minority perspective - value is not realized until dividend polic reflects the firm's long-run profitability

Why is Net Income a poor proxy for FCFE?

It includes noncash charges, and it also ignores cash flows that dont appear in the income statement i.e. investments in working capital and net borrowing

Why is EBITDA a poor proxy for FCFF?

It doesnt reflect cash taxes paid by the firm, ignores cash flow effects of investments in working capital and fixed capital

Sensitivity Analysis

shows how sensitive an analyst's valuation results are to changes in each of a model's input

two major sources of error in valuation analysis:

1. estimating future growht of FCFF and FCFE

2. Base years for the growth forecasts

Single Stage FCFF Model Assumes

(1) FCFF grows at a constant rate (g) forever, and

(2) the growth rate is less than the weighted average cost of capital (WACC).

Single Stage FCFF Model

value of the firm=

FCFF1/(WACC−g)

=(FCFF0×(1+g))/(WACC−g)

FCFF1=expected free cash flow to the firm in one year

FCFF0=starting level of

FCFFg=constant expected growth rate in FCFF

WACC=weighted average cost of capital

WACC (weighted average of the rates of return)

=(we×re)+[wd×rd×(1−tax rate)]

We = market value of equity / (market value of equity + market value of debt)

Wd = market value of debt / (market value of equity + market value of debt)

We

market value of equity / (market value of equity + market value of debt)

Wd =

market value of debt / (market value of equity + market value of debt)

Single-Stage FCFE Model formula

= FCFE1 / (r−g)

= (FCFE0 ×(1+g)) / (r−g)

FCFE1 = expected free cash flow to equity in one year

FCFE0 = starting level of

FCFEg = constant expected growth rate in FCFE

r=required return on equity

single-stage FCFE model is often used in

international valuation, especially for companies in countries with high inflationary expectations

Most important aspect of a multistage model

value is always estimated as the present value of the expected future cash flows discounted at the appropriate discount rate

terminal value in year n = (trailing)

(trailing P/E) × (earnings in year n)

terminal value in year n = (leading)

(leading P/E) × (forecasted earnings in year n+1)