macro u2 test

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

66 Terms

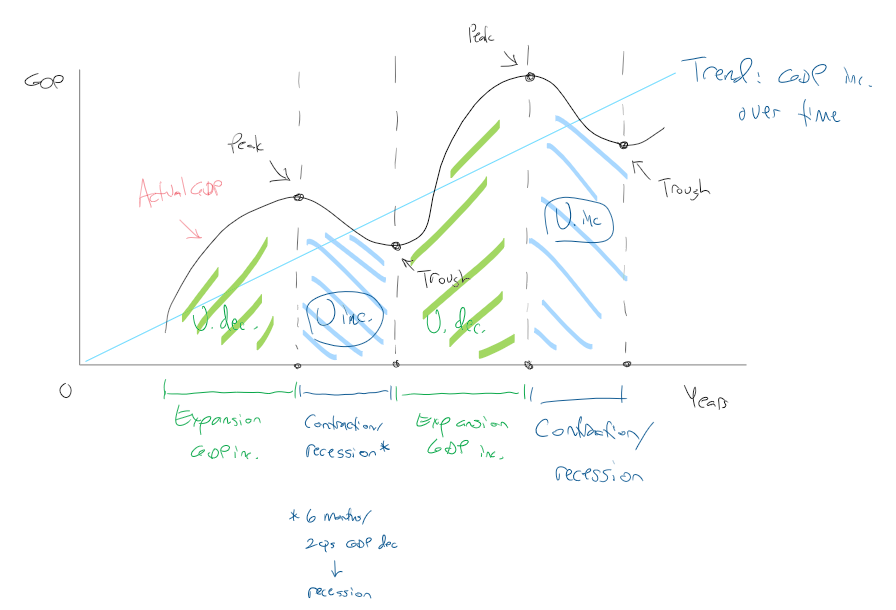

how does the cycle of GDP work

recessions and expansions over time, recessions every 6ish years

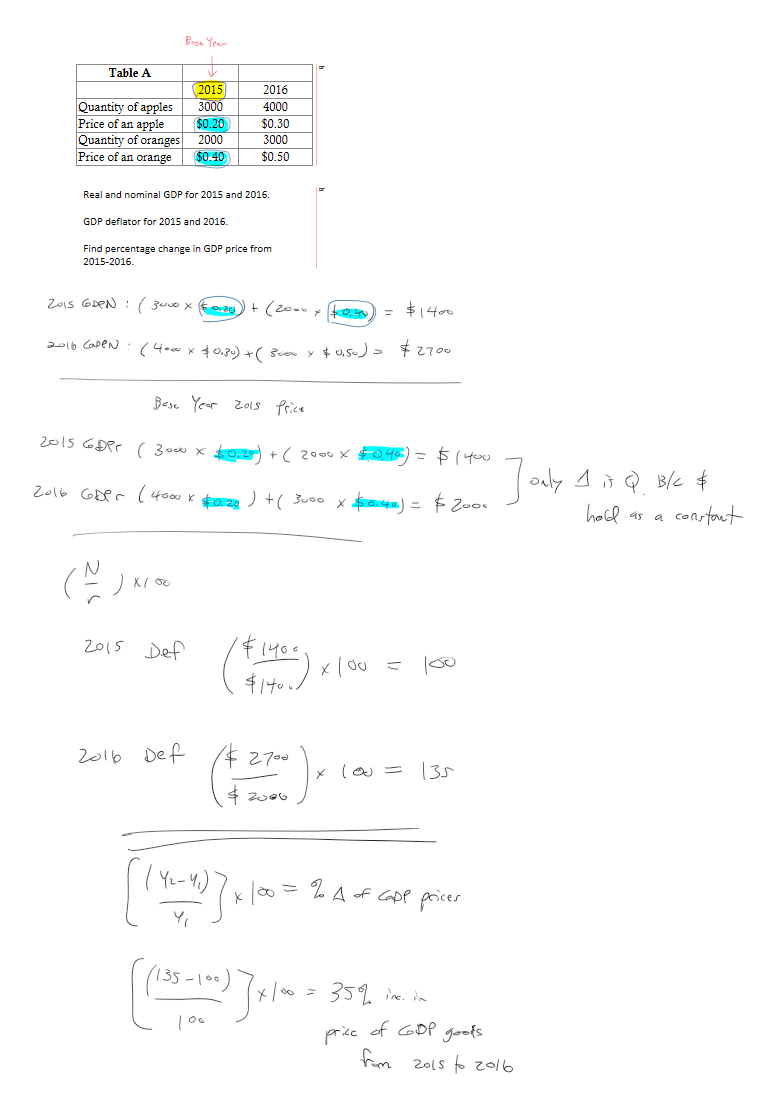

GDP nominal

current output and current prices, not adjusted for inflation

the price and quantity of each good added together (current price and current quantity)

GDP real

adjusted for inflation, uses constant price (starting from base year)

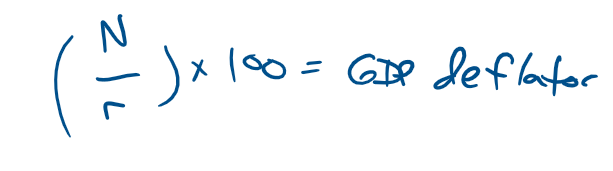

GDP deflator

removes inflation from the equation to give better prediction of GDP

N is nominal GDP, r is real GDP

the base year will always have a value of 100 for the deflator.

percent change formula

new-old/old x 100

practice problem using this information

civilian, non-institutional adult population

anyone in the US except for peopel under 16, people in the armed forced, and people whoare institutionalized

civilian labor force

subtract the retired people, homemakers, full time students over 16, and those not looking for a job “discouraged” from the civilian non-institutional adult population

you are left with:

Employed Full Time or Part Time, counted during the week of the 12th of the month. Employed unpaid workers in family businesses, if working over 15 hours in that business. Those on sick leave, on strike, or on vacation during the week of the 12th of the month. Unemployed because they are actively looking for work but can't find work, or are waiting for better careers, or seasonal changes.

healthy vs. unhealthy employement rates

0-3% unemployed is overextended

4-5% is healthy

6+ is unhealthy

labor force participation rate

the participation rate is the percentage of the population that is either working or actively looking for work

frictional unemployment

a normal thing that happens when you are leavign a job and looking for another

structural employment

mismatch between the skills that workers in the economy can offer, and the skills demanded of workers by employers

cyclical unemployment

due to recessions, etc. not normal and bad news!

natural rate of unemployment

friticional + structural

actual rate of unemployment

frictional, structural, and cyclical combined

unemployment rate formula

number of unemployed/number in the CLF

labor force participation rate formula

CLF/pop total

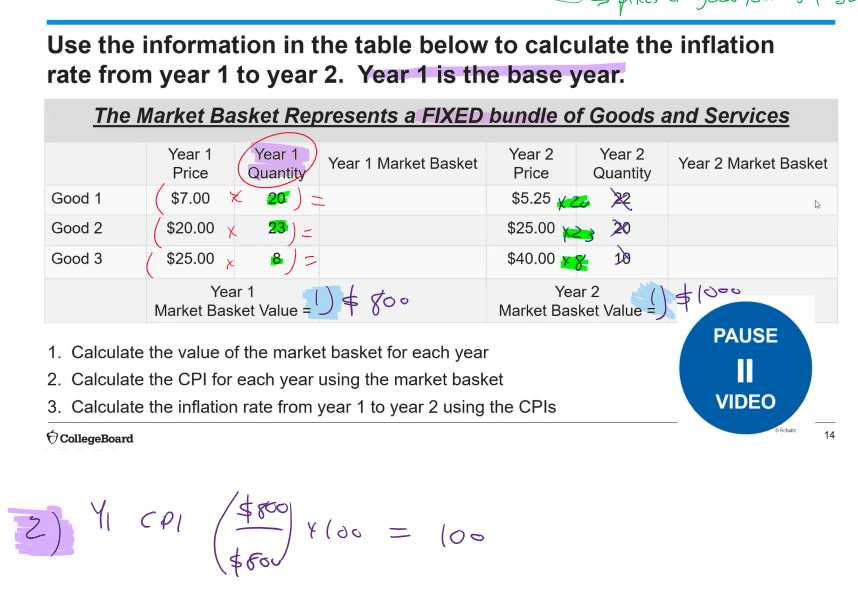

CPI

Consumer Price Index measures the average change over time in the prices paid by consumers for a FIXED "market basket" (what you are buying and the costs) of goods and services. Calculates inflation rates

base year CPI is always 100 because its the point of reference

measures inflation

in order to calculate the value of a market basket, one must

set the quantities constant using the base year as the reference point

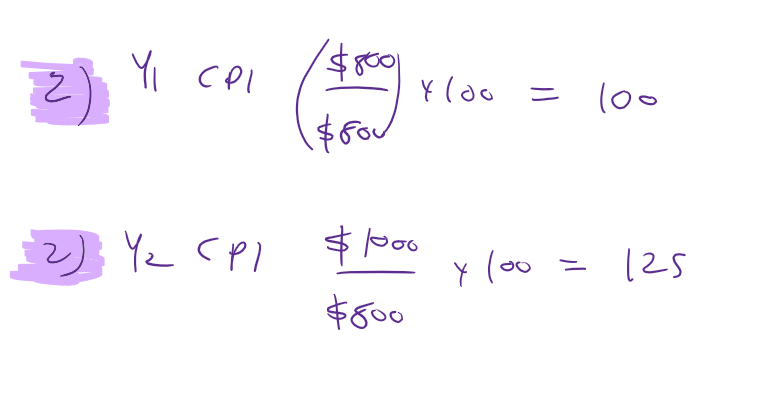

how do you calculate CPI

use the market baskets, then divide the current year by the base year and multiply by 100

inflation calculation

use the CPIs to plug in to new-old/old x 100

GDP

gross domestic product

4 parts: C, Ig, G, Xn

C

personal consumption in the economy

finished goods and services except for houses

Ig

gross private business investment monies

factory stuff, house construction, unsold inventory of products built in a year

G

government spending: schools, roads, police, etc.

gov. purchases of products and services

Xn

net foreign factor of trade: exports minus imports

typically a negative number

what doesn’t count in GDP

used goods

gifts or “Transfers” (private or public)

stock purchases

unreported business activities, illegal activies

financial transactions b/t banks and businesses (loans)

volunteering, family work, babysitting in cash

income approach to GDP: W+R+I+P+SA

wages: money earned by workers

rent: money earned by those who lease land/structures

interest: money earned by those who lend savings to firms and governments

profit: money earned by firm owners that is not paid out in wages, interest or rent

the income approach does not match the other approach, so how do we adjust it

-depreciation

-Businesses set aside money (spending) of their own to account for declining value of goods such as equipment. This is a loss of income to them.

-business taxes (sales tax)

When a consumer buys dinner at a restaurant, they pay sales tax. All of the money paid counts towards GDP when using the expenditure approach. But the restaurant does not keep the sales tax, instead passes it along to the government. This is a loss of income to the business.

-Net foreign income -

If foreigners earn money in the US (savings account, investments) that money leaves the US so does not represent an increase in income in US GDP. If US citizens earn money from investments in foreign places, then money flows into the US.

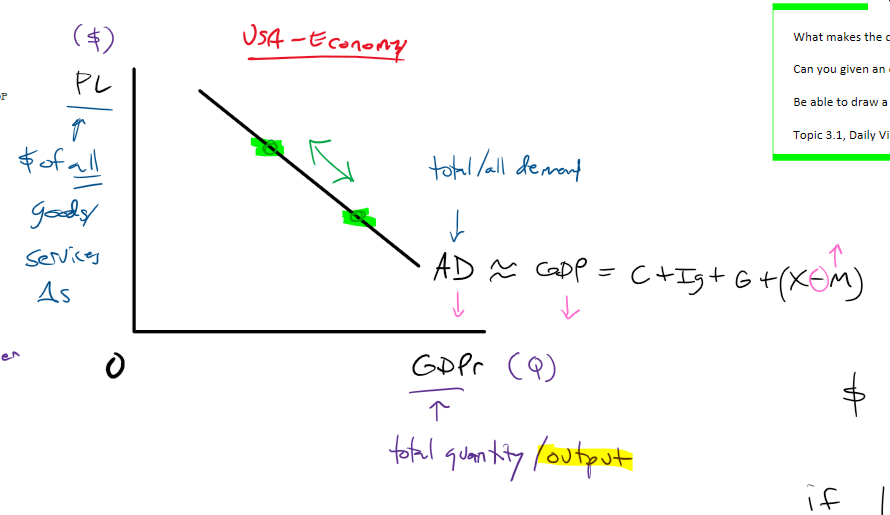

why is the AD (aggregate demand curve) downward sloping

real weath effect, interest rate effect, exchange rate/foreign purchases effect

these are all shifts ALONG THE CURVE

real wealth effect

-When price level rises, purchasing power of money decreases, so fewer goods purchase; movement up AD curve (vice versa is also true)

interest rare effect

-When price level rises, people demand more money (to buy they things they need) so interest rates rises; this makes buying goods (with borrowed money) more expensive, so fewer goods are purchased; movement up AD curve (vice versa also true)

exchange rate effect

-When price level rises, people look to buy cheaper foreign goods as a substitute, which decreases the quantity demanded of domestic goods; this is a movement up the AD curve (vice versa also true)

AD on a graph

what shifts the AD curve

GDP (c ig g xn)

shifters of C

Wealth: (owned: financial, real assets)

-more wealth = buy more G/S = C inc.

Income (earned: wages, salary)

-more income = buy more G/S = C inc.

Income taxes (govt takes)

-taxes dec = more income = buy more G/S = C inc.

Expectations of economic conditions (worry or hope)

-positive outlook of future = buy more G/S = C inc.

Consumption based upon borrow dollars

-based upon an interest rate (ir)

-cars, college education, appliances

-ir falls = such G/S cheaper = more purchased = C inc

-ir rises = such G/S expensive = less purchased = C dec.

shifters of ig

Spending on:

-non residential investment: machines, assembly lines of firms, factory production

-residential investment: buying new homes

-business inventories: goods on hand to sell

What makes these (above items) change?

-Expectation of future

-improvement/positive = more spending on capital = Ig inc.

-Interest rates (ir)

-fall = less expensive to buy capital = more spending = Ig inc.

-Unplanned changes in inventories (products being made)

-decrease in products on hand = more capital spending to produce more = Ig inc.

shifters of G—fiscal policy

changes in taxation (decrease in taxes means AD will go up)

changes in gov. spending (increase in spending means AD goes up)

shifters of G-federal reserve

lower interest rates = higher AD and vice versa

net exports shifters (exports minus imports, or X-M)

-Relative prices

-Real GDP in Japan inc = Japan income inc. = US exports to Japan inc.

-Relative incomes:

-Price level in US falls compared to Germany = US exports to Germany will inc because US exports cheaper relatively speaking

-Exchange rates:

-US dollar appreciates against India Rupee = US exports to India will dec because US exports more expensive relatively speaking

Exports and AD: positively related, Imports and AD: inversely related

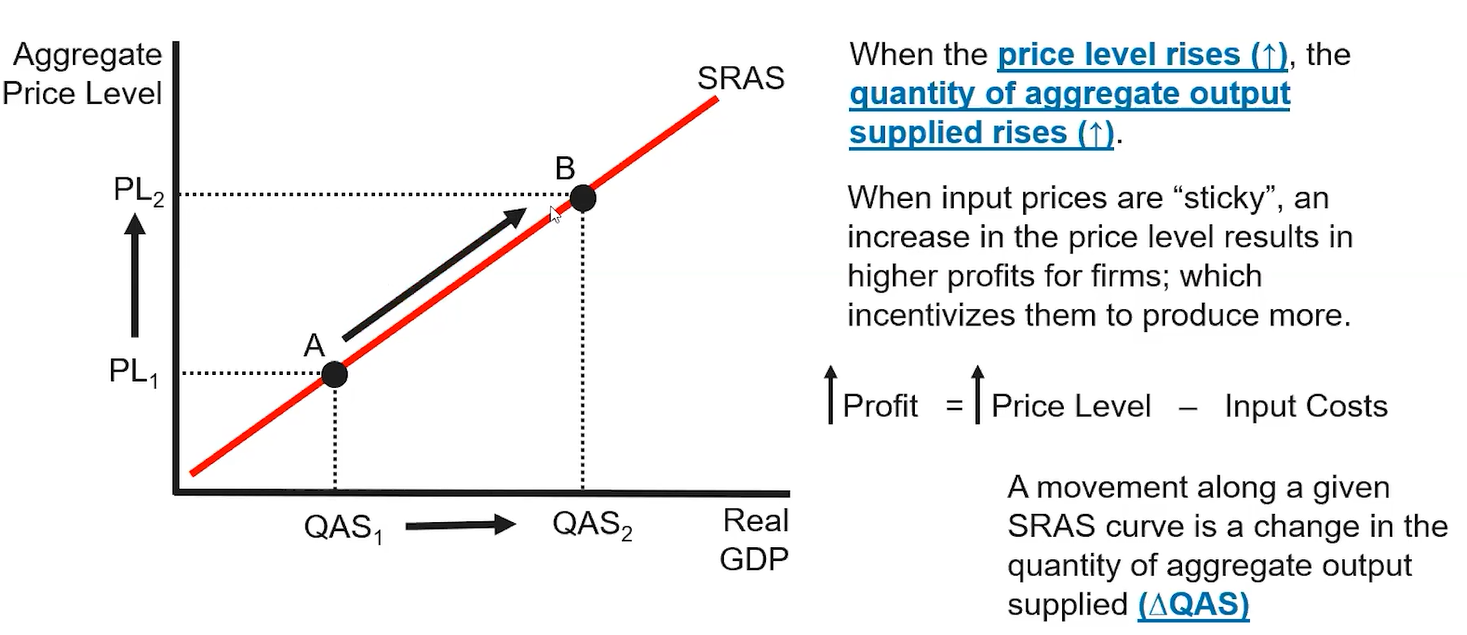

sras

short-run aggregate supply

a condition where wages and input costs have not adjusted to the price level

change in quantity of SRAS (movement along curve)

usinesses prefer to set/fix prices as much as possible

-often done through multi-year contracts, agreements

-employee wage contracts

-lease / rent agreements for factory

-fixed contract for commodity price (corn, diesel fuel, steel, etc.)

-this allows them to maximize profit

-makes them competitive when market price level (price people willing to pay) changes

Profit = price level - inputs costs

adjusting how much a firm is producing is movement along the curve

price level and its relationship to SRAS

when the price level falls, less quantity supplied, and vice versa

producing more output means hiring more workers-> shift up along the curve

what happens that shifts the SRAS

input prices

productivity

government policies

inflationary expectations

what shifts curve to the right

anything that makes it cheaper or easier to produce things

decrease in input costs, commodity prices (energy!!!), wages

increase in productivity (technology)

government policies: deregulation and subsidies

what shifts curve to the left

increase in input costs

destruction of resources

gov. policy (regulation increases or taxes)

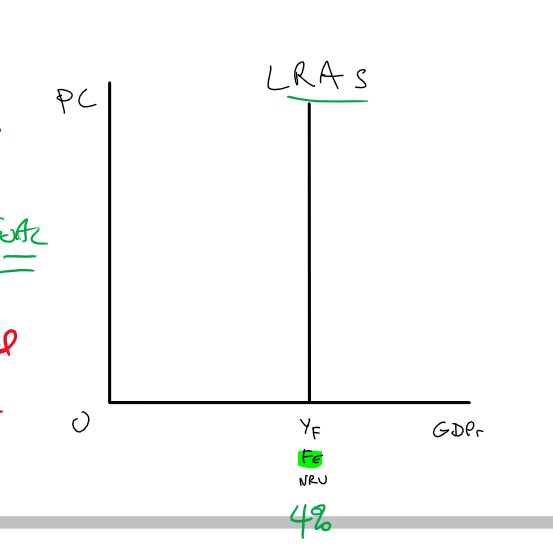

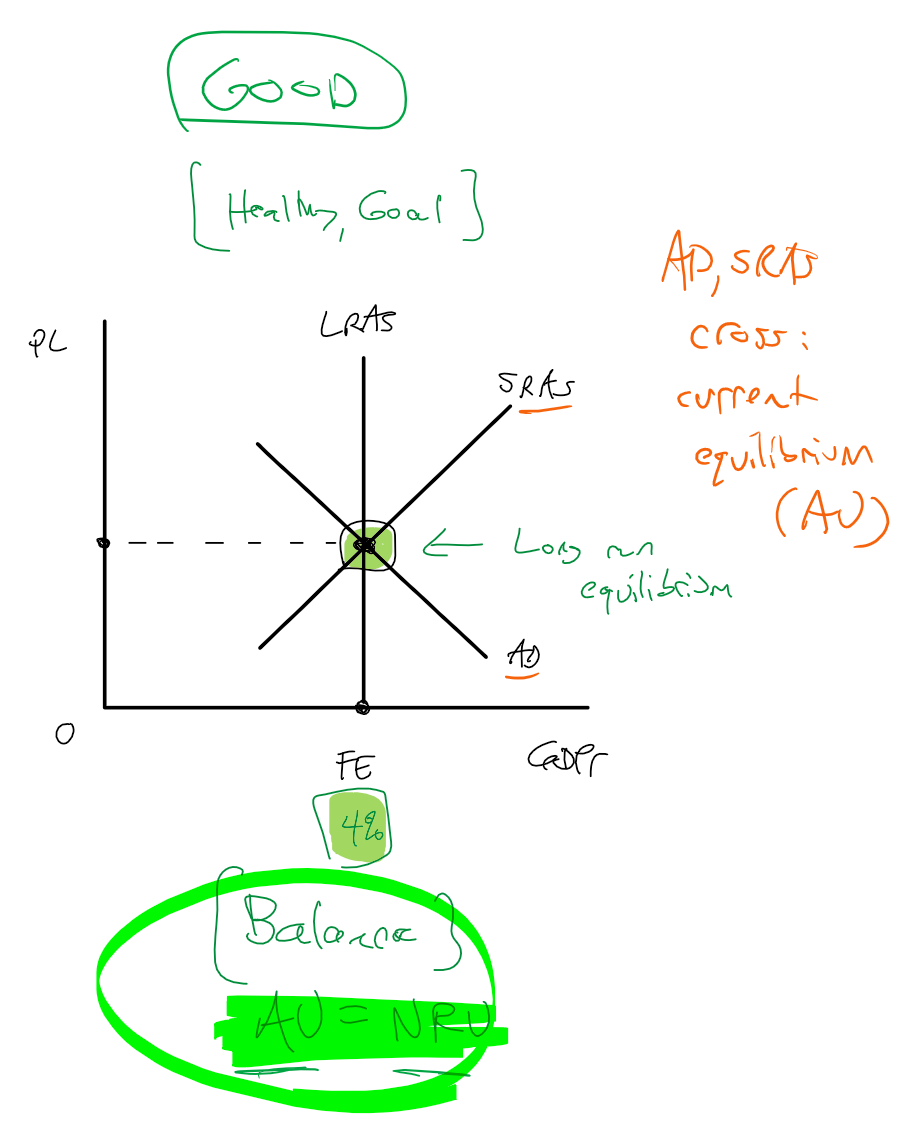

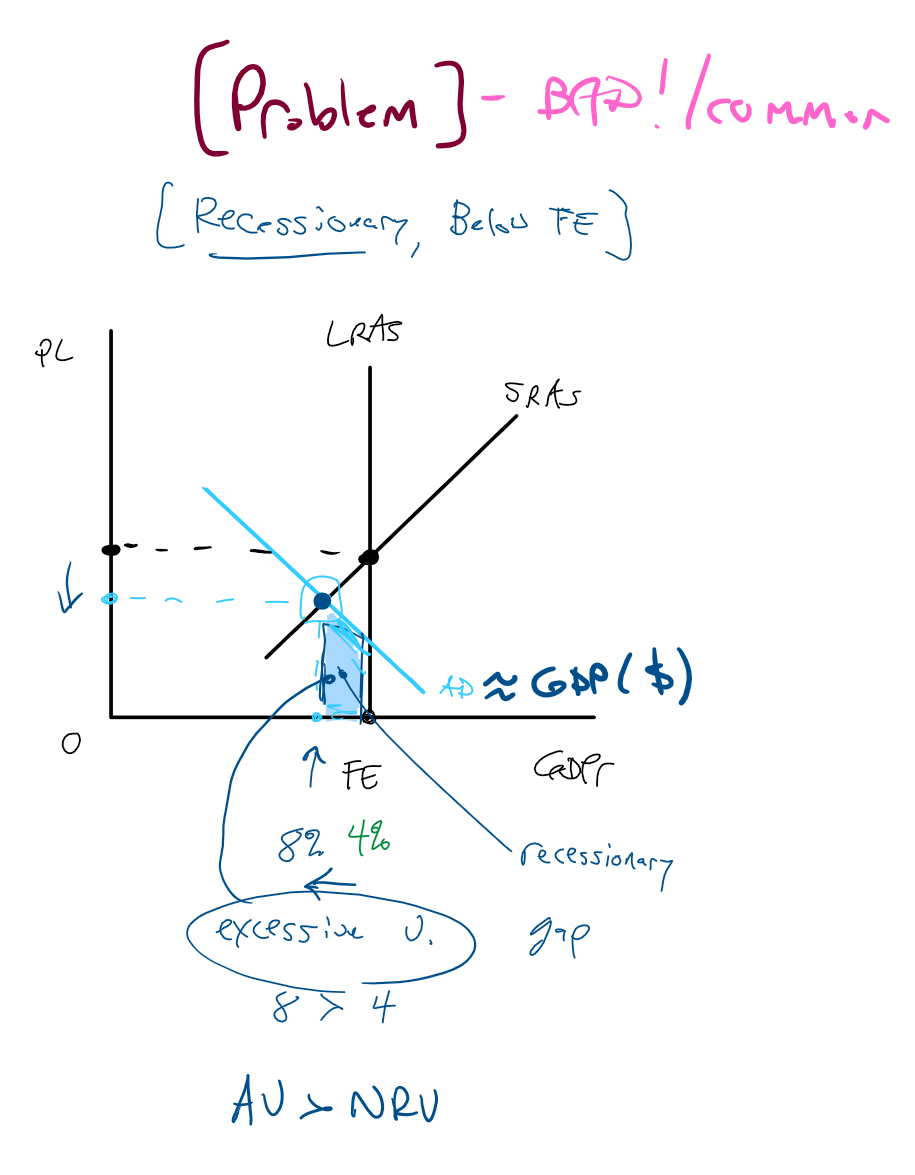

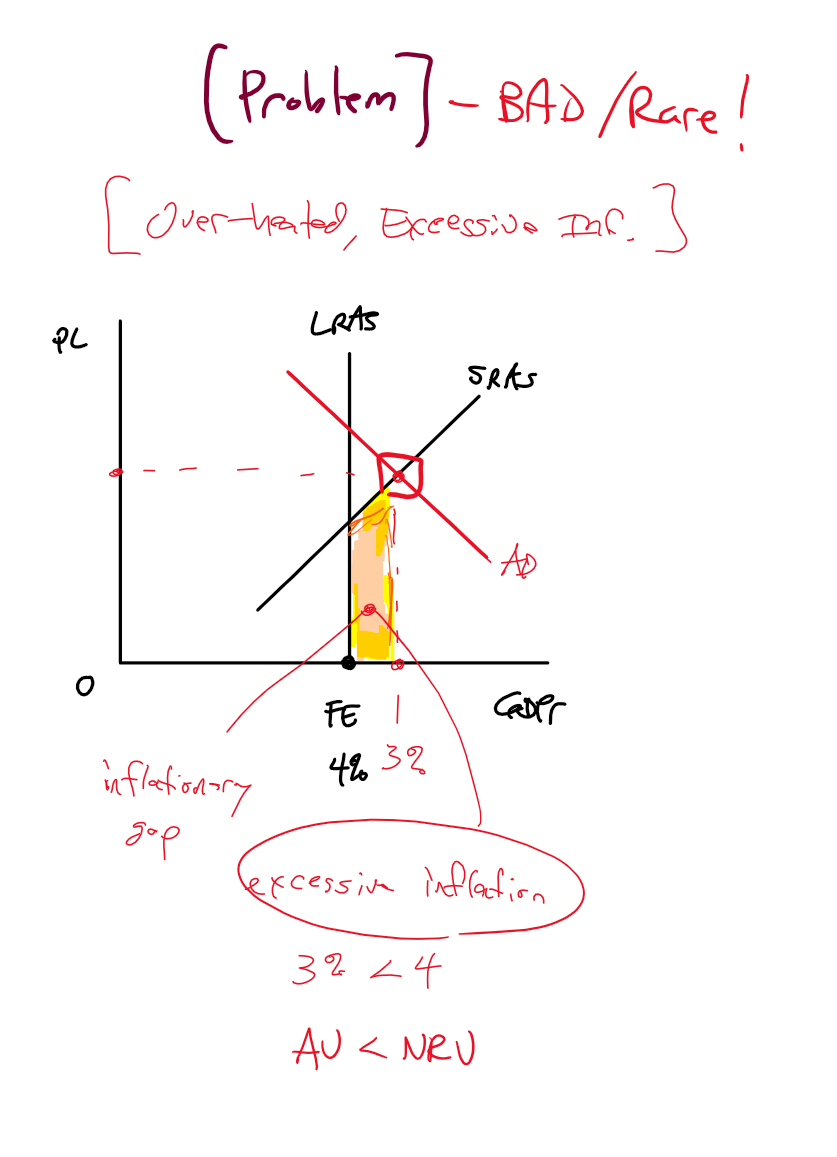

LRAS

vertical curve measuring full employment and the natural rate of unemployment

all input prices have fully adjusted to change in price level as opposed to SRAS

Yf = value of output

good LRAS

recessionary LRAS

excessive inflation (rare) LRAS

what is fiscal policy

actions taken by gov. to fix excesses in the economy when there is too much inflation or unemployment

two groups: congress and federal reserve bank

Goal: to speed up or slow down the economy (as needed)

-moving money into or out of the hands of consumers, producers

-moving money into or out of the banking system

congress fiscal policy

-taxation (inc. or dec.) -- money put into or out of the hands of consumers

-changing paychecks!

-also includes taxes on businesses

(paychecks change) C

-also business taxes Ig

-government spending (inc. or dec.) -- money into the economy

-Congress can approve building projects, stimulus checks, job programs, etc. -- G

-moving money into the economy

if there is a recession what is an action for fiscal policy

-decrease taxes (larger paychecks for consumers, lower business taxes for producers)

-less money given to government = more money left in hands of C and Ig

-more money spent = C inc, Ig inc. = GDP / AD inc.

AD curve shifts to the right, closer towards FE / LRAS

-increase government spending (spending programs, money sent to people, businesses) G

-money moved from government G into the economy

-G inc. = GDP / AD inc.

AD curve shifts to the right, closer towards FE / LRAS

expansionary fiscal policy

actions by Congress to expand GDP, counteract a recession

contractionary fiscal policy

-actions by Congress to decrease GDP, counteract excessive inflation

automatic stabilizers

-policies already in place to help the economy

-created by previous legislation

-no further vote / action need by Congress to enact the policies

-kick in, start working automatically

Taxes (on consumers and businesses)

Unemployment insurance (money for jobless)

Temporary assistance (money to help meet basic needs)

Stabilizers act as expansionary and contractionary fiscal policies

discretionary policies

-need Congress to vote

-larger, more significant changes

-change in tax rates

-spending program bill

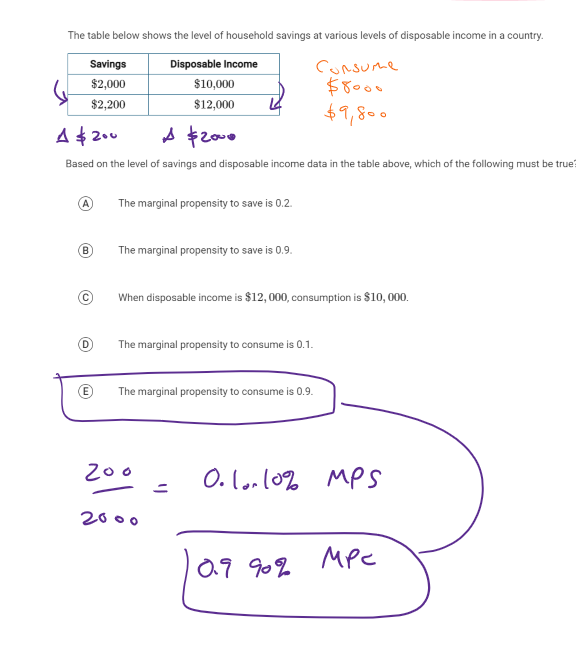

DI = C + S

DI: disposable income (money people earn or ahve)

C: consumption, spending

S: savings money not spent

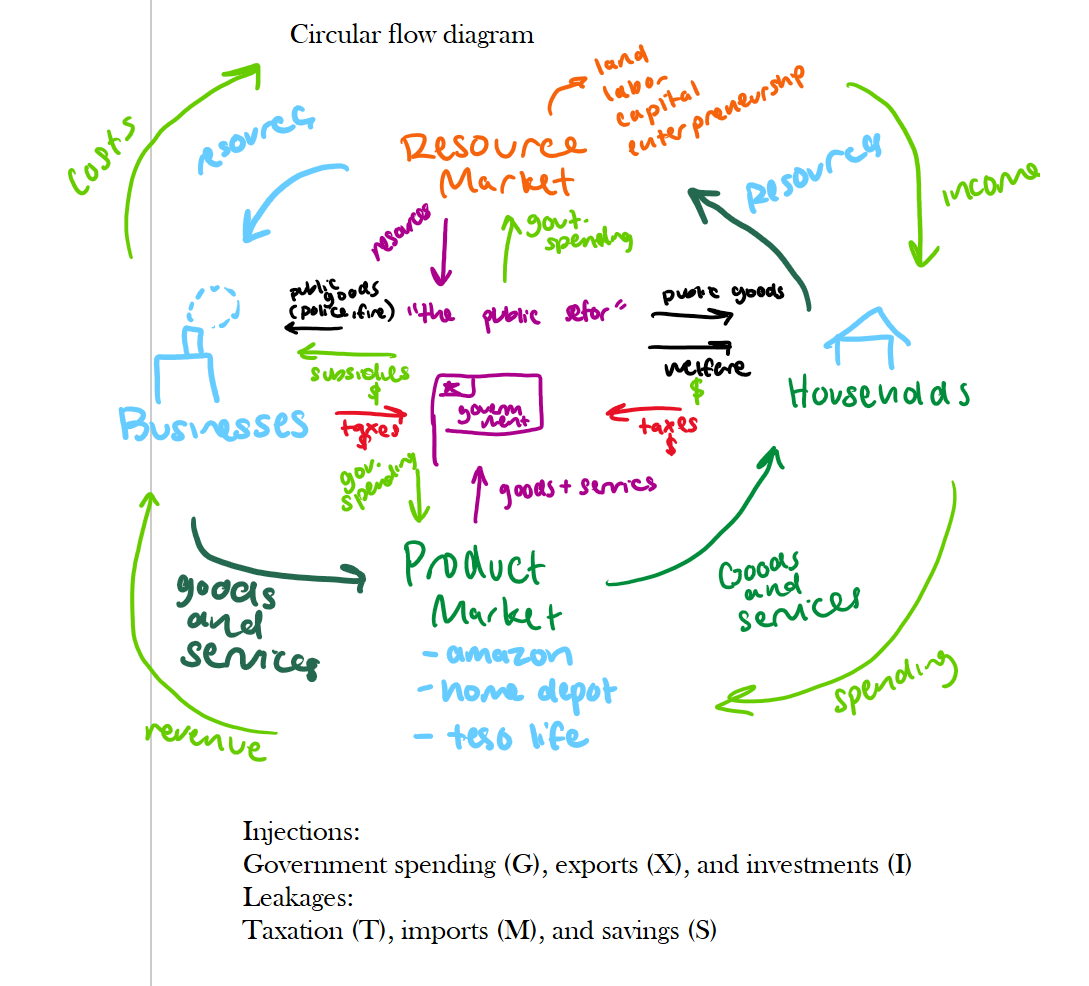

circular flow diagram, injections, leakages

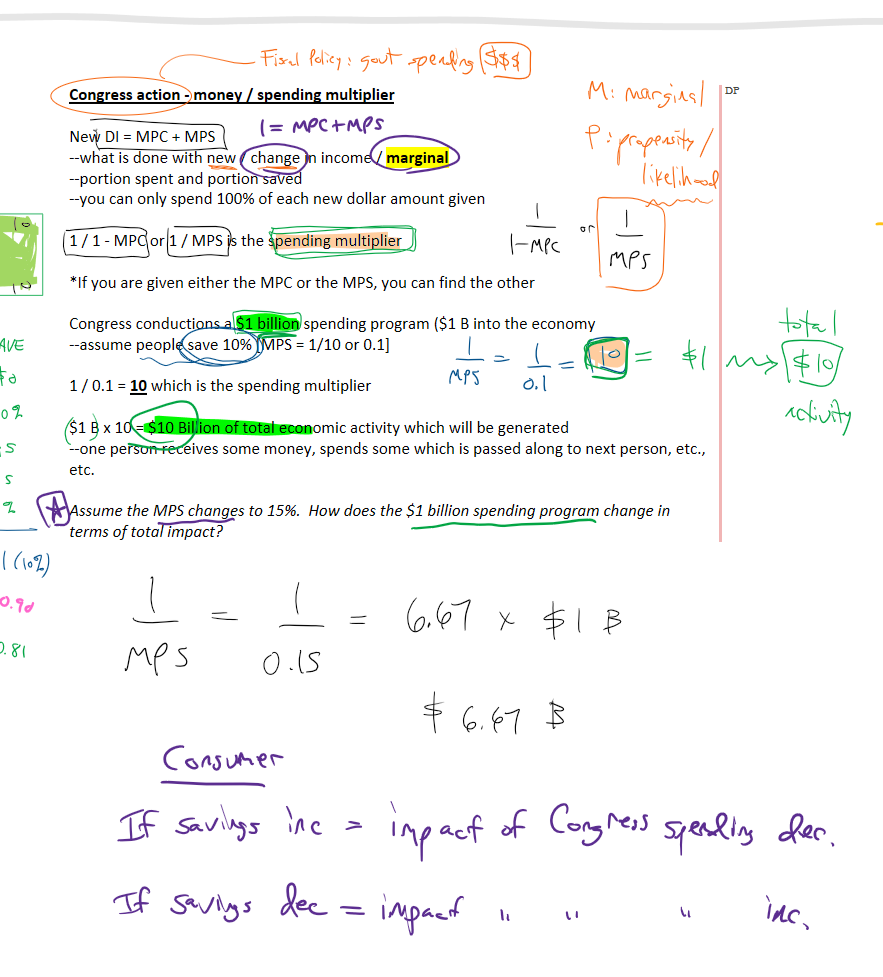

new DI =

MPC + MPS

1 = MPC +MPS

--what is done with new / change in income / marginal

--portion spent and portion saved

--you can only spend 100% of each new dollar amount given

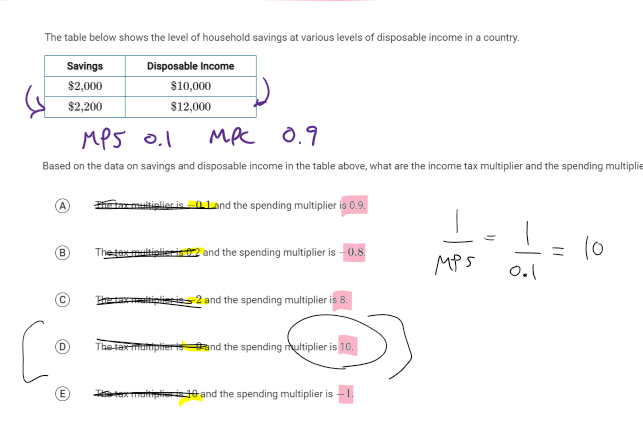

spending multipier

1 / 1 - MPC or 1 / MPS is the spending multiplier

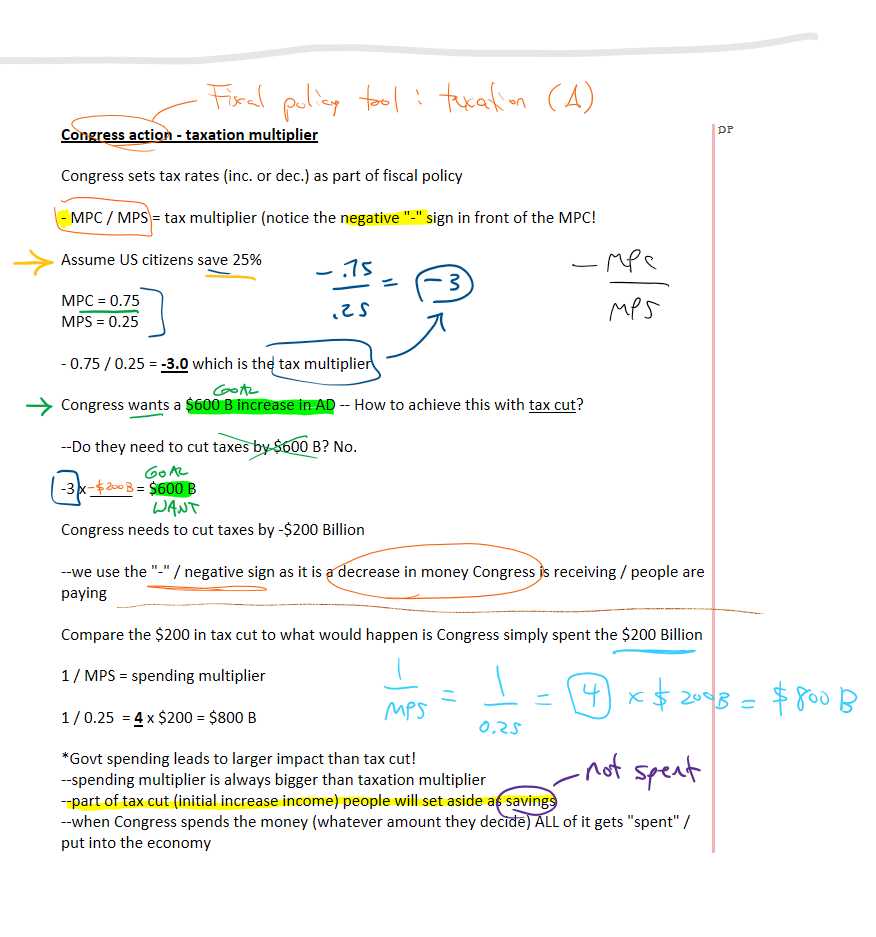

taxation multiplier

spending multiplier

practice problem

practice problem

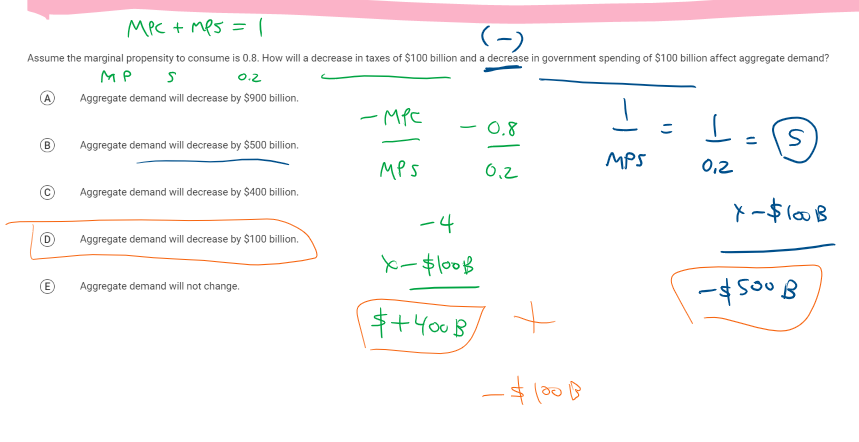

practice problem