Macro econ exam 1

0.0(0)

Card Sorting

1/127

Earn XP

Description and Tags

Last updated 6:59 PM on 3/15/23

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

128 Terms

1

New cards

Economics

the study of how best to allocate scarce resources among competing uses

The two branches of economics are closely \n intertwined, yet distinct: they address different \n questions.

The two branches of economics are closely \n intertwined, yet distinct: they address different \n questions.

2

New cards

Microeconomics

the study of how households and firms make decisions and how they interact in markets

3

New cards

Macroeconomics

the study of economy-wide phenomena, including inflation, unemployment, and economic growth.

4

New cards

Assumptions

=simplifications

simplify the complex world, make it easier to understand

Example: When studying international trade, we might assume the world consists of two countries and two goods.

simplify the complex world, make it easier to understand

Example: When studying international trade, we might assume the world consists of two countries and two goods.

5

New cards

Models

Economists use models to study economic issues. A model is a highly simplified representation of a more complicated reality.

Pros: Focuses only on what you want to know

Cons: Leaves out a lot of detail, does not focus of the complex whole-limitations

Pros: Focuses only on what you want to know

Cons: Leaves out a lot of detail, does not focus of the complex whole-limitations

6

New cards

marginal change

a small increment of adjustment to a plan of action

Rational people think on the margin

They will take an action only if marginal benefit exceeds marginal cost

Rational people think on the margin

They will take an action only if marginal benefit exceeds marginal cost

7

New cards

Economist play two roles

– Scientists: try to explain the world

– Policy advisors: try to improve it

– Policy advisors: try to improve it

8

New cards

In the first role:

economists employ the scientific method:

the dispassionate development and testing of theories about how the world works

As scientists, economists make positive statements

the dispassionate development and testing of theories about how the world works

As scientists, economists make positive statements

9

New cards

Positive statements

attempt to describe the world as it is

10

New cards

As policy advisors:

economists make normative statements

11

New cards

Normative statements

attempt to describe how the world should be, these can be confirmed or refuted, positive statements cannot

12

New cards

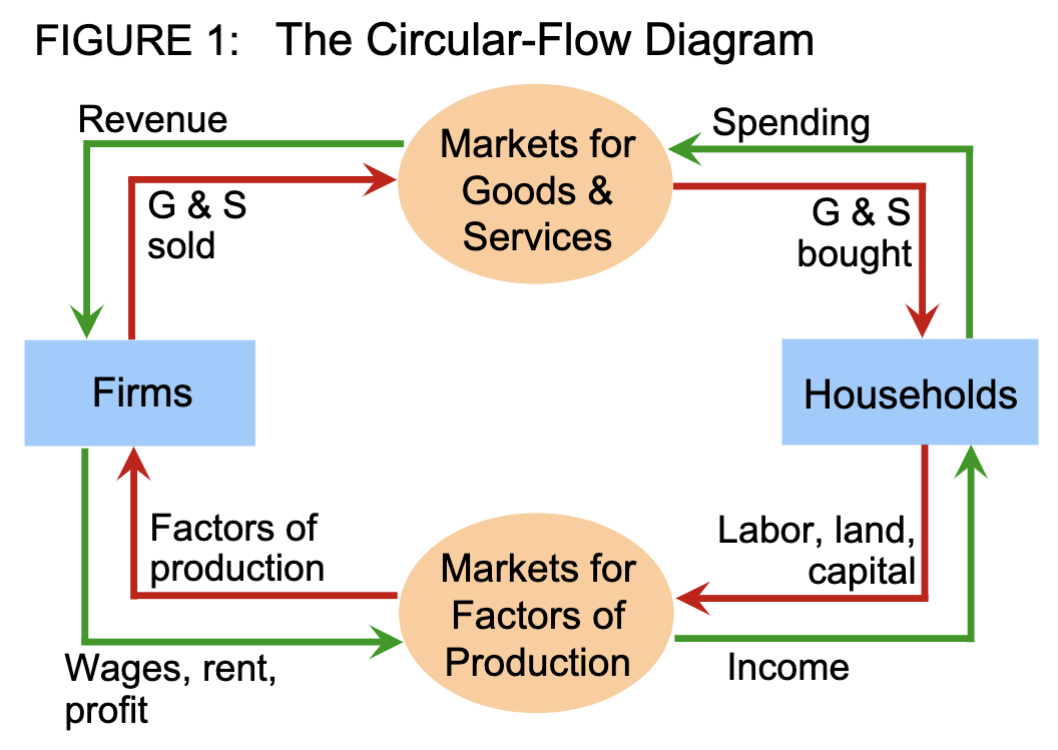

Circular-Flow Diagram

Aka a simple economy (no government, doesn’t exist so as to not complicate the model)

\

\-A visual model of the economy, shows how dollars flow through markets among households and firms

\

•Includes two types of “actors”:

– households: holders of houses, want goods (nice things) and services(doc., police) to increase utility, own factors of production (like labour, land, capital), but don’t know how to use them

– firms: own nothing, only ability to take factors of production and hand them back as goods and services

\

Households and firms depend on each other, must interact

\

• This happens in two markets:

– the market for goods and services: households spend money on goods and services, which then becomes revenue for firms, Firms sell goods and services which are bought by households

– the market for “factors of production”

\

What is fueling this? The need for happiness.

\

\-A visual model of the economy, shows how dollars flow through markets among households and firms

\

•Includes two types of “actors”:

– households: holders of houses, want goods (nice things) and services(doc., police) to increase utility, own factors of production (like labour, land, capital), but don’t know how to use them

– firms: own nothing, only ability to take factors of production and hand them back as goods and services

\

Households and firms depend on each other, must interact

\

• This happens in two markets:

– the market for goods and services: households spend money on goods and services, which then becomes revenue for firms, Firms sell goods and services which are bought by households

– the market for “factors of production”

\

What is fueling this? The need for happiness.

13

New cards

Market for Goods and Services

Money: Households R:(spending) pay money for goods and services and firms R:(selling) receive this money as revenue

Red: Firms>sold>goods>bought>household

Green: Firms

Red: Firms>sold>goods>bought>household

Green: Firms

14

New cards

Factors of production

Also called resources (inputs)

Goods and services are outputs

\

The households are sellers, the firms are buyers

Green arrows are the dollar flow from firms to households in wages, rent, income, profit.

\

the resources that the economy uses to produce goods and services, these include:

* labor (teachers, bakers, etc.)

* land

* capital (buildings & machines used in production to provide a service)

Money: Firms pay wages, rent, profit for factors of production which households receive as income

Firms>wages, rent, profit>Factors>Income>household

Item: Households sell factors to firms as factors of production

Household>land,labor,capital>factors of production>firms

Goods and services are outputs

\

The households are sellers, the firms are buyers

Green arrows are the dollar flow from firms to households in wages, rent, income, profit.

\

the resources that the economy uses to produce goods and services, these include:

* labor (teachers, bakers, etc.)

* land

* capital (buildings & machines used in production to provide a service)

Money: Firms pay wages, rent, profit for factors of production which households receive as income

Firms>wages, rent, profit>Factors>Income>household

Item: Households sell factors to firms as factors of production

Household>land,labor,capital>factors of production>firms

15

New cards

Production Possibilities Frontier (PPF)

A line or curve that shows all the possible combinations of two outputs that can be produced using all available resources

A graph that shows the combination of two goods the economy can possibly produce given the available resources and the available technology.

Moving along a PPF involves shifting resources (factor of production)

(e.g., labor) from the production of one good to the other.

When a country’s economy isn’t doing well its ppf shifts in

Straight line = constant oppc

steeper = higher oppc

A graph that shows the combination of two goods the economy can possibly produce given the available resources and the available technology.

Moving along a PPF involves shifting resources (factor of production)

(e.g., labor) from the production of one good to the other.

When a country’s economy isn’t doing well its ppf shifts in

Straight line = constant oppc

steeper = higher oppc

16

New cards

Points on the PPF line

possible and efficient

17

New cards

Points under the PPF line

possible but not efficient

18

New cards

Points above the PPF line

not possible

19

New cards

opportunity cost

whatever must be given up to obtain some item.

20

New cards

PPF and opportunity cost

• Moving along a PPF involves shifting resources

(e.g., labor) from the production of one good to the other.

• Society faces a tradeoff: Getting more of one good requires sacrificing some of the other.

• The slope of the PPF tells you the opportunity cost of one good in terms of the other.

/gain

(e.g., labor) from the production of one good to the other.

• Society faces a tradeoff: Getting more of one good requires sacrificing some of the other.

• The slope of the PPF tells you the opportunity cost of one good in terms of the other.

/gain

21

New cards

Shift in ppf

More or less resources, and better technology

22

New cards

Why the PPF Might Be Bow-Shaped

• PPF is bow-shaped when different workers \n have different skills, different opportunity costs \n of producing one good in terms of the other. \n • The PPF would also be bow-shaped when \n there is some other resource, or mix of \n resources with varying opportunity costs. \n – E.g., different types of land suited for \n different uses

23

New cards

market economy

an economy that allocates resources through the decentralized decisions of many firms and households as they interact in markets for goods and services

24

New cards

property rights

the ability of an individual to own and exercise control over scarce resources

25

New cards

business cycle

fluctuations in economic activity, such as employment and production

26

New cards

3 Pillars in economic growth

1. Produce more 2. More jobs 3. Stable prices

27

New cards

inflation

an increase in the overall level of prices in the economy

28

New cards

The goods market

29

New cards

Demand

Demand comes from the behavior of buyers

30

New cards

quantity demanded

the amount of the good that buyers are willing and able to purchase at alternative prices.

31

New cards

Law of demand

the claim that the quantity demanded of a good falls when the price of the good rises, other things equal.

32

New cards

Demand schedule

A table that shows the relationship between the price of a good and the quantity demanded

33

New cards

demand curve

A graph of the relationship between the price of a good and the quantity demanded

Negative slope because people have different willingness to pay.

Negative slope because people have different willingness to pay.

34

New cards

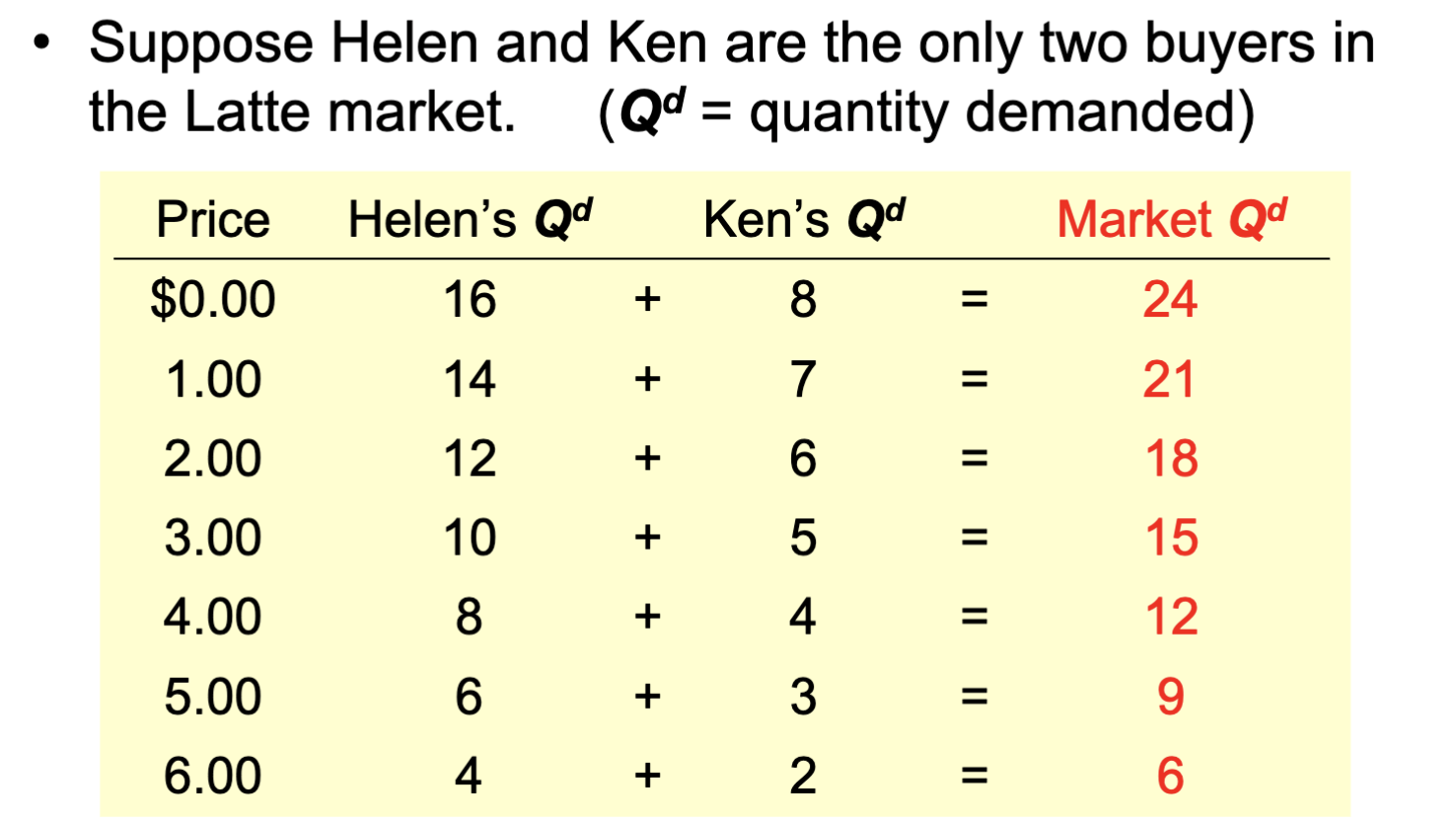

Market Demand

The quantity demanded in the market is the sum of the quantities demanded by all buyers at each price

35

New cards

Demand Function

Qd \= f(P)

36

New cards

How to know what price people want aka equilibrium price

Firms just throw prices out there and see what happens

37

New cards

Ten principles of Economics

people face tradeoffs, the cost of something is what you give up to get it, rational people think at the margin, people respond to incentives, trade can make everyone better off, markets are usually a good way to organize economic activity, governments can sometimes improve market outcomes, a country’s standard of living depends on its ability to produce goods and services, prices rise when the government prints too much money, society faces a short- run trade off between inflation and unemployment

38

New cards

normal good

Demand for this good is positively related to income.

39

New cards

inferior good

demand for this good is negatively related to income

40

New cards

Substitutes

an increase in the price of one causes an increase in demand for the other

41

New cards

Complements

an increase in the price of one causes a fall in demand for the other

42

New cards

Expectations

affect consumers' buying decisions

43

New cards

quantity supplied

the amount of a good that sellers are willing and able sell at alternative prices

44

New cards

law of supply

the claim that, other things being equal, the quantity supplied of a good rises when the price of a good rises

45

New cards

Supply schedule

a table that shows the relationship between the price of a good and the quantity supplied

46

New cards

supply curve

a graph of the relationship between the price of a good and the quantity supplied. Affected by Technology, expectation, and number of sellers.

47

New cards

The Supply function

Qxs \= f(Px)

48

New cards

equilibrium

a situation in which the market price has reached the level at which quantity supplied equals quantity demanded

49

New cards

equilibrium price

the price that balances quantity demanded and quantity supplied

50

New cards

equilibrium quantity

the quantity supplied and the quantity demanded at the equilibrium price

51

New cards

surplus

a situation in which quantity supplied is greater than quantity demanded

52

New cards

shortage

a situation in which quantity demanded is greater than quantity supplied

53

New cards

law of supply and demand

the claim that the price of any good adjusts to bring the quantity supplied and quantity demanded for that good into balance

54

New cards

Three steps to analyzing changes in equilibrium

1. Decide whether event shifts supply curve demand curve or both. 2. Decide in which direction curve shifts. 3. Use supply-demand diagram to see how the shift changes equilibrium price and quantity

55

New cards

Gross domestic product (GDP)

the market value of all final goods and services produced within a country in a given period of time.

All countries want this number to be high. It’s like a score/gpa for a country.

A way to measure happiness is to look at the amount of goods and services produced bcs households are happier with these.

\

There are two ways of calculating this, by totalling up the spending of a country, or totaling up the income, because they should be about the same. Known as: Income and expenditure

All countries want this number to be high. It’s like a score/gpa for a country.

A way to measure happiness is to look at the amount of goods and services produced bcs households are happier with these.

\

There are two ways of calculating this, by totalling up the spending of a country, or totaling up the income, because they should be about the same. Known as: Income and expenditure

56

New cards

The market value…

Goods are valued at their market prices, so: \\n - All goods measured in the same units \\n

(e.g., dollars in the U.S.) \\n

\- Things that don’t have a market value are excluded, e.g., housework you do for yourself.

(e.g., dollars in the U.S.) \\n

\- Things that don’t have a market value are excluded, e.g., housework you do for yourself.

57

New cards

…of all final (goods)…

intended for the end user

GDP only includes final goods – they already embody the value of the intermediate goods used in their production.

GDP only includes final goods – they already embody the value of the intermediate goods used in their production.

58

New cards

(Intermediate goods)

Not included in GDP

Used as components or ingredients in the production of other goods

Used as components or ingredients in the production of other goods

59

New cards

….goods & services…

GDP includes tangible goods

(like DVDs, mountain bikes, beer)

and intangible services

(dry cleaning, concerts, cell phone service).

(like DVDs, mountain bikes, beer)

and intangible services

(dry cleaning, concerts, cell phone service).

60

New cards

…produced…

GDP includes currently produced goods, \n not goods produced in the past. Produced this year.

61

New cards

…within a country…

GDP measures the value of production that occurs \n within a country’s borders, whether done by its own \n citizens or by foreigners located there.

62

New cards

…in a given period of time.

Usually a year or a quarter (3 months)

63

New cards

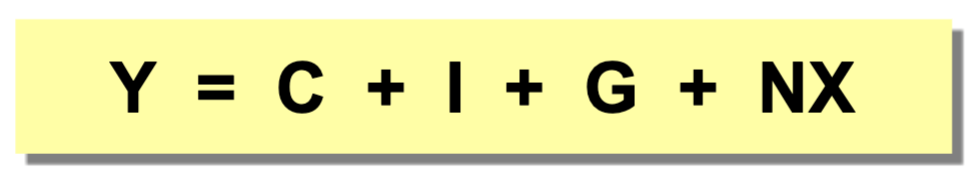

The Components of GDP

Recall: GDP is total spending.

\

Four components:

\- Consumption (C)

\- Investment (I)

\- Government Purchases (G)

- Net Exports (NX)

These components add up to GDP (denoted Y):

Y=C+I+G+NX

\

Four components:

\- Consumption (C)

\- Investment (I)

\- Government Purchases (G)

- Net Exports (NX)

These components add up to GDP (denoted Y):

Y=C+I+G+NX

64

New cards

Consumption (C)

Spending by households on goods and services with the exception of purchases of new housing

Note on housing costs: \n - For renters, C includes rent payments. \n - For homeowners, C includes the imputed rental value of the house, but not the purchase price or mortgage payments

Note on housing costs: \n - For renters, C includes rent payments. \n - For homeowners, C includes the imputed rental value of the house, but not the purchase price or mortgage payments

65

New cards

Investment (I)

Spending on capital equipment, inventories and structures, including household purchases of new housing

\

\- Business capital: business structures, \n equipment, and intellectual property products \n

\- Residential capital: landlord’s apartment \n building; a homeowner’s personal residence \n

\- Inventory accumulations: goods produced but \n not yet sold

\

“Investment” does not mean the purchase of \n financial assets like stocks and bonds.

\

\- Business capital: business structures, \n equipment, and intellectual property products \n

\- Residential capital: landlord’s apartment \n building; a homeowner’s personal residence \n

\- Inventory accumulations: goods produced but \n not yet sold

\

“Investment” does not mean the purchase of \n financial assets like stocks and bonds.

66

New cards

GDP equation

Consumption + Investment + Government Purchases + Net Exports

67

New cards

Government purchases (G)

Spending on goods and services by local, state, and federal governments

\

\- At the federal, state, and local levels.

\

Excludes transfer payments \n -Such as Social Security or unemployment \n insurance benefits.

\-They are not purchases of goods and services

\

\- At the federal, state, and local levels.

\

Excludes transfer payments \n -Such as Social Security or unemployment \n insurance benefits.

\-They are not purchases of goods and services

68

New cards

Net exports (NX)

We’re trying to figure out how much stuff the US produces by looking at the spending. But we spend money on a lot of stuff that’s not made here, aka imports, so we subtract them.

Also, some stuff that’s produced here, is being sold over seas, aka exports, so we add them to GDP.

Spending on domestically produced goods by foreigners (exports) minus spending on foreign goods by domestic residents (imports).

\

\- Net exports, NX = exports – imports

\- Exports: foreign spending on the economy’s goods and services

\- Imports: are the portions of C, I, and G that are spent on goods and services produced abroad

\

If net exports are negative, we have more imports than exports.

Also, some stuff that’s produced here, is being sold over seas, aka exports, so we add them to GDP.

Spending on domestically produced goods by foreigners (exports) minus spending on foreign goods by domestic residents (imports).

\

\- Net exports, NX = exports – imports

\- Exports: foreign spending on the economy’s goods and services

\- Imports: are the portions of C, I, and G that are spent on goods and services produced abroad

\

If net exports are negative, we have more imports than exports.

69

New cards

Real versus Nominal GDP

Inflation can distort economic variables like \n GDP, so we have two versions of GDP:

70

New cards

Nominal GDP

the production of goods and services valued at current prices

\

We’re going to value the production of goods in each year using the prices of those goods in each year

\

values output using current prices \n - not corrected for inflation

\

The change in nominal GDP reflects both prices \n and quantities.

\

(Price x quantity) + (Price x quantity)= Nominal GDP

\

We’re going to value the production of goods in each year using the prices of those goods in each year

\

values output using current prices \n - not corrected for inflation

\

The change in nominal GDP reflects both prices \n and quantities.

\

(Price x quantity) + (Price x quantity)= Nominal GDP

71

New cards

Real GDP

the production of goods and services valued at constant prices

\

values output using the prices of a base year is corrected for inflation

\

The change in real GDP is the amount that GDP would change if prices were constant (i.e., if zero inflation).

Aka gives you quantity produced each year.

Hence, real GDP is corrected for inflation.

\

(Price @ base year x quantity) + (price @ base year x quantity) = GDP

\

values output using the prices of a base year is corrected for inflation

\

The change in real GDP is the amount that GDP would change if prices were constant (i.e., if zero inflation).

Aka gives you quantity produced each year.

Hence, real GDP is corrected for inflation.

\

(Price @ base year x quantity) + (price @ base year x quantity) = GDP

72

New cards

GDP deflator

A measure of inflation in the prices of goods and services produced in the United States, including exports

\

A measure of the price level calculated as the ratio of nominal GDP to real GDP times 100

The GDP deflator is a measure of the overall level of prices.

One way to measure the economy’s inflation rate is to compute the percentage increase in the GDP deflator from one year to the next.

\

Nominal GDP

= ----------------- x 100

Real GDP

\

A measure of the price level calculated as the ratio of nominal GDP to real GDP times 100

The GDP deflator is a measure of the overall level of prices.

One way to measure the economy’s inflation rate is to compute the percentage increase in the GDP deflator from one year to the next.

\

Nominal GDP

= ----------------- x 100

Real GDP

73

New cards

Gross National Product

Total income earned by the nation's factors of production, regardless of where located.

The value of goods and services produced by the citizens of a nation irrespective of the geographical limits in a financial year is known as GNP

The value of goods and services produced by the citizens of a nation irrespective of the geographical limits in a financial year is known as GNP

74

New cards

Inflation

“Average” increase in price level

Alternative Measures of Inflation

\-GDP Deflator

\-Consumer Price Index

\-Producer Price Index

\-PCE Deflator

Alternative Measures of Inflation

\-GDP Deflator

\-Consumer Price Index

\-Producer Price Index

\-PCE Deflator

75

New cards

Consumer Price Index (CPI)

A measure of the overall cost of the goods and services bought by a typical consumer

\

An index in statistics is a sample of a population. In this case, we take a sample of products that an urban family of four usually buys, and track these prices. The price change of this index/sample mimics or represents the price changes of the overall economy.

\

An index in statistics is a sample of a population. In this case, we take a sample of products that an urban family of four usually buys, and track these prices. The price change of this index/sample mimics or represents the price changes of the overall economy.

76

New cards

How to calculate CPI

1\. Fix the “basket.”

The Bureau of Labor Statistics (BLS) surveys consumers to determine what’s in the typical consumer’s “shopping basket.”

\

2\. Find the prices. The BLS collects data on the prices of all the goods in the basket.

\

3\. Compute the basket’s cost. Use the prices to compute the total cost of the basket.

\

4\. Choose a base year and compute the index.

cost of basket in current year

100 x --------------------------------

cost of basket in base year

\

5\. Compute the inflation rate. The percentage change in the CPI from the preceding period.

CPI this year – CPI last year

inflation rate = ----------------------------- x 100%

CPI last year

The Bureau of Labor Statistics (BLS) surveys consumers to determine what’s in the typical consumer’s “shopping basket.”

\

2\. Find the prices. The BLS collects data on the prices of all the goods in the basket.

\

3\. Compute the basket’s cost. Use the prices to compute the total cost of the basket.

\

4\. Choose a base year and compute the index.

cost of basket in current year

100 x --------------------------------

cost of basket in base year

\

5\. Compute the inflation rate. The percentage change in the CPI from the preceding period.

CPI this year – CPI last year

inflation rate = ----------------------------- x 100%

CPI last year

77

New cards

Inflation rate

the percentage change in the price index from the preceding period

78

New cards

producer price index

a measure of the cost of a basket of goods and service bought by firms

Because firms eventually pass on their costs to consumers in the form of higher consumer prices, changes in the PPI are often thought to be useful for predicting changes in the CPI.

Because firms eventually pass on their costs to consumers in the form of higher consumer prices, changes in the PPI are often thought to be useful for predicting changes in the CPI.

79

New cards

Contrasting the CPI and GDP Deflator

Imported consumer goods:

included in CPI

excluded from GDP deflator

\

Capital goods:

excluded from CPI

included in GDP deflator (if produced domestically)

\

The basket:

CPI uses fixed basket

GDP deflator uses basket of currently produced goods & services

This matters if different prices are changing by different amounts.

included in CPI

excluded from GDP deflator

\

Capital goods:

excluded from CPI

included in GDP deflator (if produced domestically)

\

The basket:

CPI uses fixed basket

GDP deflator uses basket of currently produced goods & services

This matters if different prices are changing by different amounts.

80

New cards

Comparing Dollar Figures from Different Times with CPI

Inflation makes it harder to compare dollar amounts from different times.

Example: the minimum wage

\- $1.25 in Dec 1963

\- $7.25 in Dec 2013

Did min wage have more purchasing power in

Dec 1963 or Dec 2013?

To compare, use CPI to convert 1963 figure into

“2013 dollars”...

\

cpi= 30.9 in year T

CPI = 234.6 today

Example: the minimum wage

\- $1.25 in Dec 1963

\- $7.25 in Dec 2013

Did min wage have more purchasing power in

Dec 1963 or Dec 2013?

To compare, use CPI to convert 1963 figure into

“2013 dollars”...

\

cpi= 30.9 in year T

CPI = 234.6 today

81

New cards

Amount in todays dollars =

Amount in year T dollars x Price level today

-------------------

Price level in Year T

-------------------

Price level in Year T

82

New cards

Indexation

A dollar amount is indexed for inflation if it is automatically corrected for inflation by law or in a contract.

\

For example, the increase in the CPI automatically determines

the COLA in many multi-year labor contracts

the adjustments in Social Security payments and federal income tax brackets

\

For example, the increase in the CPI automatically determines

the COLA in many multi-year labor contracts

the adjustments in Social Security payments and federal income tax brackets

83

New cards

nominal interest rate

the interest rate as usually reported without a correction for the effects of inflation

\

\n Interest rate not corrected for inflation \n Rate of growth in the dollar value of a deposit or debt

\

\n Interest rate not corrected for inflation \n Rate of growth in the dollar value of a deposit or debt

84

New cards

real interest rate

the interest rate corrected for the effects of inflation

Corrected for inflation

Rate of growth in the purchasing power of a deposit or debt

\

Real interest rate = (nominal interest rate) – (inflation rate)

Helps to predict how much interest you are actually getting back

Calculated by predicting the inflation rate

In the future, after inflation has occurred and you know know what it actually is, you can recalculate the interest rate to get the realized real interest rate.

Corrected for inflation

Rate of growth in the purchasing power of a deposit or debt

\

Real interest rate = (nominal interest rate) – (inflation rate)

Helps to predict how much interest you are actually getting back

Calculated by predicting the inflation rate

In the future, after inflation has occurred and you know know what it actually is, you can recalculate the interest rate to get the realized real interest rate.

85

New cards

Labour statistics

Produced by Bureau of Labor Statistics (BLS), in \n the U.S. Dept. of Labor

Based on a monthly survey of 60,000 \n households: Current Population Survey \n Based on “adult population” (16 yrs. or older)

Based on a monthly survey of 60,000 \n households: Current Population Survey \n Based on “adult population” (16 yrs. or older)

86

New cards

BLS divides population into 3 groups:

employed: paid employees, self-employed, and unpaid workers in a family business

unemployed: people not working who have looked for work during previous 4 weeks

not in the labor force: everyone else

The labor force is the total # of workers, including the employed and unemployed.

unemployed: people not working who have looked for work during previous 4 weeks

not in the labor force: everyone else

The labor force is the total # of workers, including the employed and unemployed.

87

New cards

*Employed:*

* This category includes those who worked as paid employees, worked in their own business, or worked as unpaid workers in a family member’s business. Both full-time and part-time workers are counted. This category also includes those who were not working but who had jobs from which they were temporarily absent because of, for example, vacation, illness, or bad weather. Work for at least one hour a week.

88

New cards

*Unemployed:*

This category includes those who were not employed, were available for work, and had tried to find employment during the previous four weeks. It also includes those waiting to be recalled to a job from which they had been laid off.

89

New cards

*Not in the labor force:*

This category includes those who fit neither of the first two categories, such as full-time students, homemakers, and retirees and children.

90

New cards

labor force

the total number of workers, including both the employed and the unemployed

91

New cards

unemployment rate

the percentage of the labor force that is unemployed

92

New cards

labor-force participation rate

the percentage of the adult population that is in the labor force

93

New cards

natural rate of unemployment

the normal rate of unemployment around which the unemployment fluctuates

94

New cards

cyclical unemployment

the deviation of unemployment from its natural rate

95

New cards

discouraged workers

individuals who would like to work but have given up looking for a job

96

New cards

frictional unemployment

unemployment that results because it takes time for workers to search for the jobs that best suit their tastes and skills

97

New cards

structural unemployment

unemplyoment that results because the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one

98

New cards

job search

the process by which workers find appropriate jobs given their tastes and skills

99

New cards

unemployment insurance

a government program that partially protects workers' incomes when they become unemployed

100

New cards

union

a worker association that bargains with employers over wages, benefits, and working conditions