1.2.9 Indirect taxes and Subsidies

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

6 Terms

Indirect tax

A tax on expenditure

Types of indirect tax

Ad Valorem - Tax increases in proportion to the value of the good (VAT) - Causes a pivotal shift in supply curve

Specific tax - Tax increases in proportion to the amount bought. (Excise duties on alcohol, tobacco and petrol)

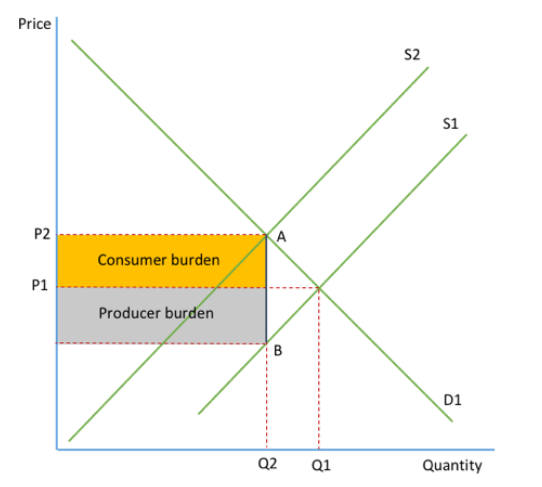

Impact of tax

Consumer - Sees high prices and suffers from the tax burden indicated

Producer - Sees a rise in costs and a fall in output shown by the tax burden area.

Government - Sees a rise in tax revenue of the two areas combined.

Incidence of tax

The tax burden on the taxpayer:

If PED is perfectly elastic or PES perfectly inelastic producer pays all tax

If PED is perfectly inelastic or PES perfectly elastic consumer pays all tax

Subsidy

A sum of money provided by the government to encourage production/consumption of a good or service.

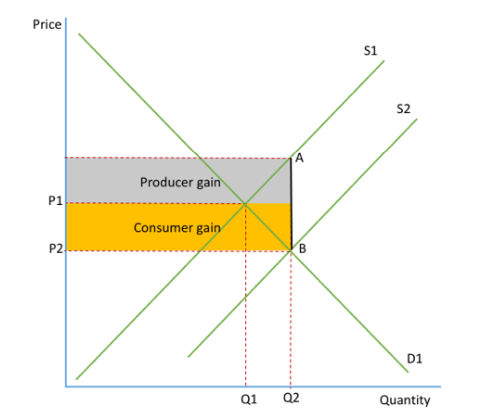

Impact of a subsidy

Consumers - A fall in price

Producer - Fall in costs anda rise in output

Government - Total area represents the size of the subsidy