ch 1-4 - f300

1/152

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

153 Terms

Define economics

How people make decisions about production, distribution, and consumption, all while inhabiting a world with limited resources

What purposes does money serve?

1) Medium of exchange

2) Imperfect store of value (the amt doesn’t change but the prices of goods do)

3) Unit of account (can measure things we value)

Commodity vs Fiat money

Commodity- HAS intrinsic value (e.g. gold)

Fiat - DOES NOT have intrinisc value (e.g. US dollars)

Define Finance

Subfield within economics that examines how people use markets and money to achieve their goals

Define Corporate Finance

How BUSINESSES allocate their scarce capital when facing an uncertain future

What is a corporation?

Legal arrangement of the business’ affairs chosen by the owners

What is capital?

The set of resources available to the business to produce whatever goods/services it sells (can be non-physical; think education)

Does a contract have to explicit or can it be an implicit agreemnt between two parties?

It can be implicit

Who are capital providers?

Owners and lenders

What are the 4 primary forms of business organizations?

1) Sole Proprietorships

2) Partnerships

3) Corporations

4) Limited Liability Companies (LLC)

Who are the residual clamiants (lowest priority claim on the biz’s cash flows)?

Owners

Define a sole proprietorship

Business organization where the owner is a single person and is solely responsible for controlling the business

Advantages of a sole proprietorship

Simpliest type of business to start

Lowest regulation

Owner gets to keep all the profits

Since personal assets and business assets are the same, the gov taxes the business’ profits as personal income (no double taxing)

Disadvantages of sole proprietorships

No specialization

Unlimited liability for business debts (creditos can look beyond the biz’s assets to the personal assets of the propreitor to satisfy debts)

When sole proprietor dies, business is sold or liquidated (no forever life)

Can’t raise a lot of capital

Assymetric information can use illiquidity

What is liquidity?

The degree to which one can quickly convert an asset to cash at the asset’s fair market value

What is a partnership agreement and why is it important?

It explains the clear set of rules the partners will follow.

Without it, the partnership will DISOLVE when a partner leaves the firm or dies

What is a general partnership?

All the partners typically have a say in the critical biz decisions and then share in the resulting gains or losses

The partners face UNLIMITED liability (if you provide 25% of capital, you are still responsible for 100% of the creditor’s claims)

Explain what a limited partnership is

There are two types of partners: general and limited

General - run the biz, make all the significant decisions, UNLIMITED liability

Limited - provide capital, do not run the firm, max loss possible is hte money they invested into the partnership **BUT if they become too involved, they will face unlimited liability

What are some benefits of partnerships?

Specialization

More longevity than SP

NO double tax: gov only taxes the profits of the firm ONCE as the partners’ personal income

What are some negative aspects of a partnership?

Agency costs

Unlimited liability (but limited partnerships can mitigate this)

Not as much capital raised compared to corps

What is an agency relationship?

A relationship where the owner (principal) hires another person (agent) to represent their interests

What is the principal-agent conflict (aka agency problem)?

When in an agency relationship, there is a conflict of interest between a principal and the agent.

What is the difference between direct and indirect agency costs?

Direct costs - easily assign a dollar value (employee steals 100 dollars, you need to install 5k security cameras)

Indirect costs- not quantifiable (manager doesn’t share potentially big money-making idea in fear of losing job)

What is a corporation?

A business and legal entity that is ENTIRELY SEPARATE and distinct from its owners

T/F: In the eyes of the law, a corporation IS a fictional person who can enter contracts?

True

How does a corporation pursue its business goals?

By creating a nexus of contracts

In what state do most large corporations live in and why?

Delaware

It has a Court of Chancery that specializes in corporate issues and uses judges instead of juries

What are the articles of incorporation? And what is it also commonly called?

AKA: charter

Articles of incoporation: the document used to form a corporation that contains basic info on the corporation, intended life, purpose, number of shares the corporation can issue, and info about the person setting up the corporation

What are bylaws?

The owners must draw up a corporation’s bylaws (rules and procedures used to govern the business)

Includes the process to amend the artices of incorporation and the bylaws in the future

Spell out what kind of stock gets issued and voting rights

Procedure the shareholders will follow to select the board of directors

What is the responsibility of the board of directors?

Hiring managers and overseeing the direction of the firm’s operations

Acts in the best interests of shareholders

Difference between S and C Corporations

IRS:

S Corp: 100 or fewer owners; owners can elect to have biz profits taxed ONCE at the personal level

C Corp: More than 100, IRS treats the owners as separate from the corp (therefore taxing both), C-Corps are fictional people who need to pay taxes (corporate income tax)

The after-tax profits to shareholders (dividends) are taxed at the personal income tax level

Does the IRS apply a lower tax rate on dividends/capital gains OR wage income?

Dividends/capital gains — reduces impact of double taxation

Benefits of corporation

Limited liability- if you buy stocks, you just lose the money you invested (not your personal assets)

Access to lots of capital (thanks to standardized ownership claims they issue in large number: aka stocks)

IF PUBLIC: less asymmetric information bc of SEC regulation and reliable info on NYSE/NASDAQ

Specialization

Doesn’t die unless it financially dies

Negatives about corporations

Regulations by SEC (securities and exchange commission)

Sarbanes-oxley (SOX): independent auditors are needed, regualtes financial reporting and omissions reporting

What makes a company a “public company”?

The company has shares traded on AT LEAST ONE of the stock exchanges (NASDAQ, NYSE)

What does it mean to “go dark”

Public company goes private (usually bc of compliance costs)

What is a limited liability company (LLC)?

New business enetity

Hybrid between proprietorships/parternships and corporations

All the advantages and disadvantages of SP and Partnerships BUT owners have limited liability like Corps

Do not have bylaws, articles of incorp, shares of stock, board of directors, annual meetings like Corps (so way simplier than Corps)

They CAN have large market capitalizations but most are small biz

What is the PRIMARY goal for every for-profit business REGARDLESS of its form?

MAXIMIZE THE VALUE OF THE FIRM!!!

Value: highest price a buyer would pay to buy the business

What is the total value of a corporation called?

Market cap = current price for one share of stock multiplied by # of shares OUTSTANDING (P*Q)

When considering the total value of US stocks, which size of cap company (large, mid, small) constitute the majority?

Large-cap

What is capital budgeting?

Process of identifying, evaluating, and managing long-term assets of the business

Compare what something is worth to its price

What is capital structure?

Mixture of funding sources management chooses

Debt and equity

CHOOSE the mix of debt/equity that maximizes value

What is leverage?

Extent to which the company uses debt to finance its asset purchase

What does it mean to lever up vs lever down

Lever up- increases the proportion of debt to equity (debt-equity ratio increases)

Level down- opposite

What does it mean when a firm is choosing to be unlevered?

It uses 100% equity financing

Advantage of using equity financing?

Company does not contractually have to pay the owners, ever BECAUSE owners are residual claimants who only get leftover cash

Does the source and use of cash matter in capital structure?

Yes! If you tell a bank that you need to pay off your gambling debt (lol not good)…high risk —bank will be mean with the loan

What is Working Capital Management?

How the firm manages day-to-day activiites involving short-term assets and short-term liabilites

Working capital = short term assets - short term liabilities

Deciding to sell to customers on credit is a WCM problem NOT Capital Structure bc of short horizons

If working capital is high, then opportunity cost…

Is high — capital can be used for something else more productive

What is commerical paper and why would a company chose it?

Commerical Paper: unsecured promissory note issued by banks and corporations with short-term borrowing needs (usually less than 9 mo)

If you need short-term financing

What are the 3 parts of value maximization?

Cash flow size

Cash flow timing

Cash flow riskiness

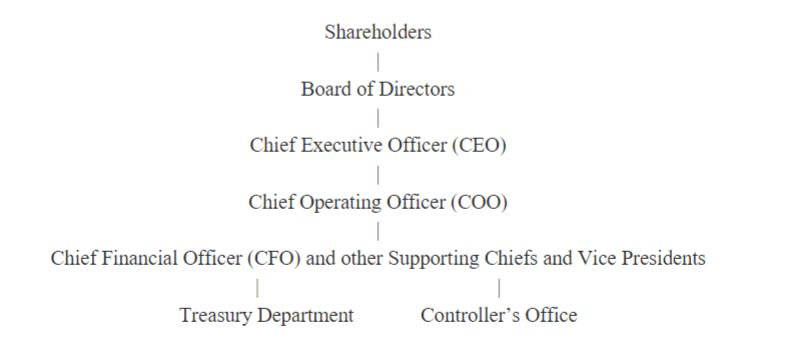

What is the typical corporate organizational structure?

What is the CEO?

Leader and face of company, has the vision for the company

COO’s role?

Actual day-to-day management

CFO role?

Financial planning, financial reporting, managing cash flows, in charge of controller’s office and treasure dept

What does the controller’s office do?

Handle the firm’s financial, managerial, and tax acct

AKA: accounting (cat!)

What does the treasury dept do?

Financial planning, evaluates CAPEX, manages the credit to customers, handles cash dlows, raises necessary capital, protect firm from financial risks

*Essentially: capital budgeting, capital structure, and WCM

Label the following as principal or agent:

Shareholders

Board of Directors

C-Suite

Shareholders: principals

Board: agents

C-Suite: agents

T/F: The C-Suite often suggests which board candidates the shareholders should elect

True

OPM stands for…

Other people’s money

What are the 2 factors that determine whether managers will act in the stockholders’ best interests?

1) How closely are management goals aligned with stockholder goals?

Can compensate with stock to help

2) Can managers be replaced if they do not pursue stockholder goals?

What is restricted stock?

The stock a manager will not own until a contractually specified number of years lapses (known as a vesting period)

What are options?

Firms give managers the option to buy the company’s stock at a bargain price.

Who ultimately controls the firm?

Stockholders — they elect the board who hire and fire managers

What is a proxy fight?

A way unhappy stockholders can act to replace existing management

The authority to vote someone’s stock

A group solicits proxies to replace the existing board and replace current managers

What is a takeover?

Poorly managed companies get acquired bc their share price is low (think Carl Icahn)

What is an advantage of debt?

The gov treats interest payments as business expenses and allows companies to deduct them when calculating income taxes

In contrast, profits disgorged as dividends to shareholders are not tax-deductible

What’s the benefit of equity as opposed to debt?

The firm has no contractual obligation to pay the owners

But with a loan, you have to pay them

What does a firm need to do to get the funding it needs from capital providers?

Convince capital providers that this project will make them better off than their next best investment will (aka their opportunity cost)

What is a subsidiary?

A company partially or wholly owned by another corporation, the parent or holding company

T/F: The interest rate is the rental rate

True

The interest rate is an equilibrium that results from the interaction between…

The providers and users of money

How does the use of funds determine the interest rate?

The bank will charge a higher interest rate for something more risky

When the collateral isn’t very liquid/high value, they will charge higher interest rates (shiatsu massage vs equipment)

What is the money market?

Instruments that span a year or less

Used by institutions for WCM

Explain what commercial paper and T-bills are

Money market instruments

Commercial paper: promissory note

T-Bills: issued by US Treasury (agency that collects tax revenues and pays its obligations); gov is borrower, ESSENTIAL component of money market

What types of assets form the capital market?

Long-lived financial assets

What is the longest-lived form of financing?

Stocks - ownership claims do not expire as long as the firm survives

Explain the differences between the private and public market

Private

Access to purchase securities is extremely limited to potentially just two counterparties

E.g. bank loan

No active and transparent market for private

Public

Anybody with money can participate

Instead of one loan with JPMorgan, you can create a million small loans (bonds)

A corporation will get a loan it needs (in the form of bonds) for a potentially lower interest rate through public markets than private ones

What are private equity firms?

Firms that buy large chunks of a company or the whole thing

What are unicorns?

Privately held copmanies with valuations of a billion dollars or more

Relative to public markets, private markets are…

Illiquid (cannot easily exchange ownership claims)

What is a floatation?

Attracting capital in public markets

What does private placement mean?

When a corporation enters a debt agreement with an institution that is not public

E.g. Google takes a loan from JPMorgan

T/F: Public debt and equity offerings must register with the SEC?

True

IPO stands for…

Initial public offering

What is an SEO?

Seasoned equity offering (aka seasoned issue)

Issuing more shares of stock

Can dilute the ownership stakes of the original shareholders

What are the two most important secondary equity markets in the US?

NYSE and NASDAQ

What makes public securities more attractive in comparison to private securities in the secondary market?

Public

Active and liquid secondary market

Purchasers of shares might be more willing to pay more for this feature

Due to SEC regulations, valuations and other info is more accurate than in private

Private

Opaque and illiquid secondary markets (if they exist at all)

Non-transparent reporting due to lack of SEC regulations

The success of the money-making idea often hinges on the producer’s ability…

to convince a consumer they need that thing

What is the most critical source of cash for a typical corporation?

Sales to customers

Who are stakeholders?

Economic agents who have claims on the biz’s cash flows but do NOT provide it capital

When the corporation is either sharing residual profits with the owners or reinvesting the profits in the biz to produce future earnings, it is…

spending internally generated equity

What are buybacks?

When a corp uses moeny it could’ve paid dividends with to instead purchase its own shares.

Steps of start-up funding

Own money

Friends and family

Crowdsourcing

Angel investor

Ventrue capitalists

Go private or public

What is an angel investor?

A successful entrepreneur who contributes capital and advice

Who are venture capitalists?

Pool money from investors, then seek out and buy stakes in promising start-ups with huge growth possibilities.

More hands on than Angel Investors

Can provide advice and highly skilled employees

If a firm decides to go the private path, then…

A private equity firm will purchase a significant chunk of shares and will oversee the acquisition process

What does an investment bank (aka underwriter) do?

Uses its experience, knowledge of market conditions, and relationships with wealthy clients to help the firm determine its value to the general public

Since the investment bank will typically guarantee the cient will get the money they need, how do they deal with the risk?

The bank will syndicate with other banks to spread out the risk

Investment bank’s fee is…

Up to 7% of the floatation value