ECON 1110 Cornell

1/53

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

54 Terms

willingness to pay

the maximum amount that a buyer will pay for a good

economic surplus

the sum of consumer surplus and producer surplus or willingness to pay - cost

opportunity cost

value of the next best alternative onehas to give up to obtain it

sunk cost

a cost that has already been committed and cannot be recovered

marginal principle

one's decisions about quantities are madeincrementally.

interdependence principle

Your best choice depends on your other choices, the choices others make, developments in other markets, and expectations about the future. When any of these factors changes, your best choice might change.

Ceteris paribus

all other things held constant

Exogenous variables

variables that a model takes as given

Endogenous variables

variables that a model tries to explain (output)

absolute advantage

uses fewer resources tocomplete a task/produce a given unit of output than other economic agents

comparative advantage

if it can complete atask/produce a given unit of output at a lower opportunity cost than othereconomic agents

markets

setting that brings together sellers (suppliers, thesupply side) and buyers (demanders, the demand side)

perfect competition.

lots of buyers and sellers, sellers offer identical goods, easy to enter and exit the market

law of demand

consumers buy more of a good when its price decreases and less when its price increases

normal goods

Goods for which demand goes up when income is higher and for which demand goes down when income is lower.

inferior goods

Goods for which demand tends to fall when income rises.

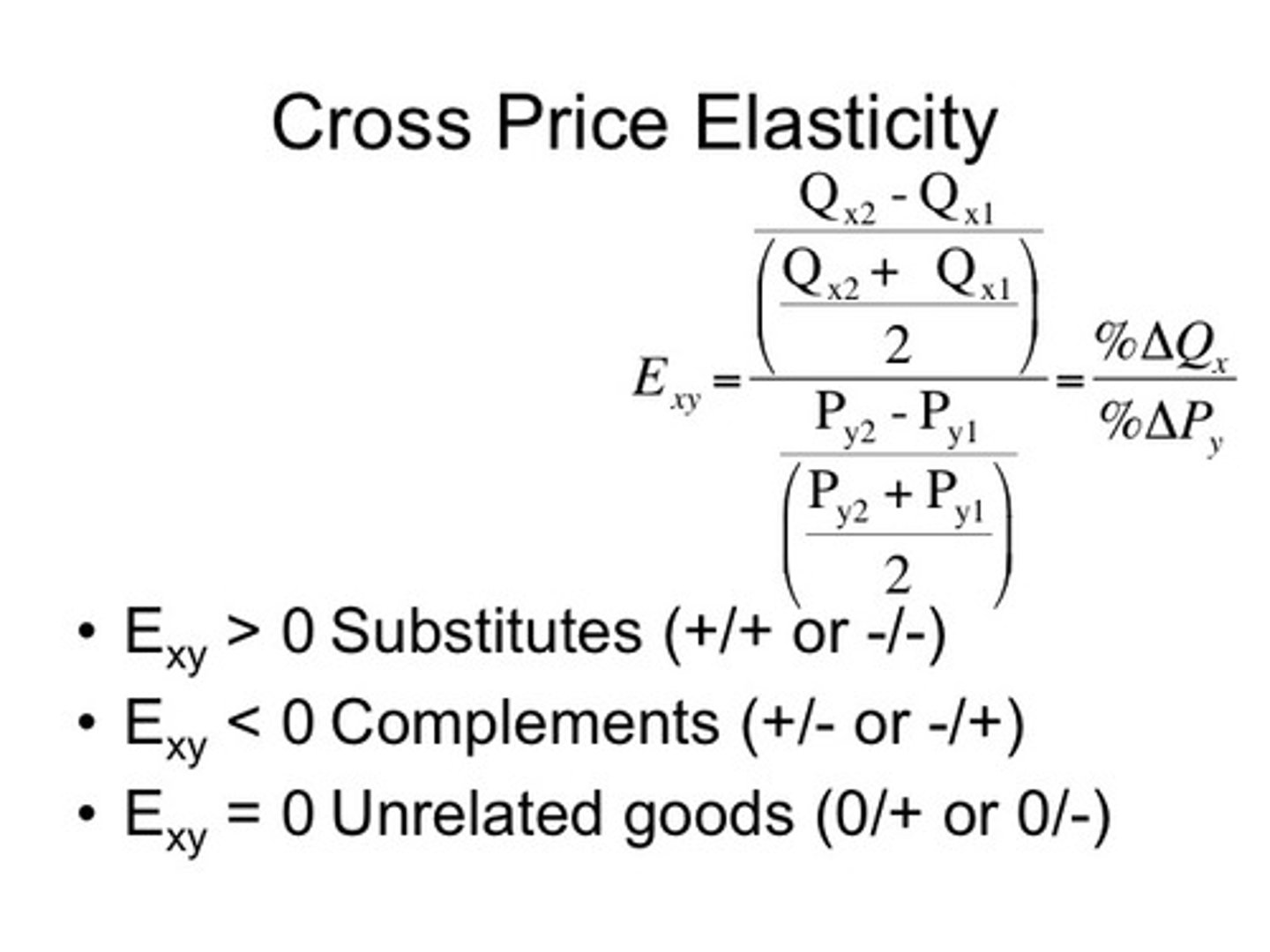

Substitutes

Goods and services that can be used for the same purpose.

Complements

gas and car, pasta and sauce, as price goes up of a complement demand goes down

market demand

made up of the sum of all consumer demands

law of supply

tendency of the quantity supplied to increase as the price increases (and vice versa).

5 major factors that affect supply

Input prices, productivity and tech, prices of related goods, expectations, number/type of sellers

surplus

A situation in which quantity supplied is greater than quantity demanded

market equilibrium

a situation in which quantity demanded equals quantity supplied

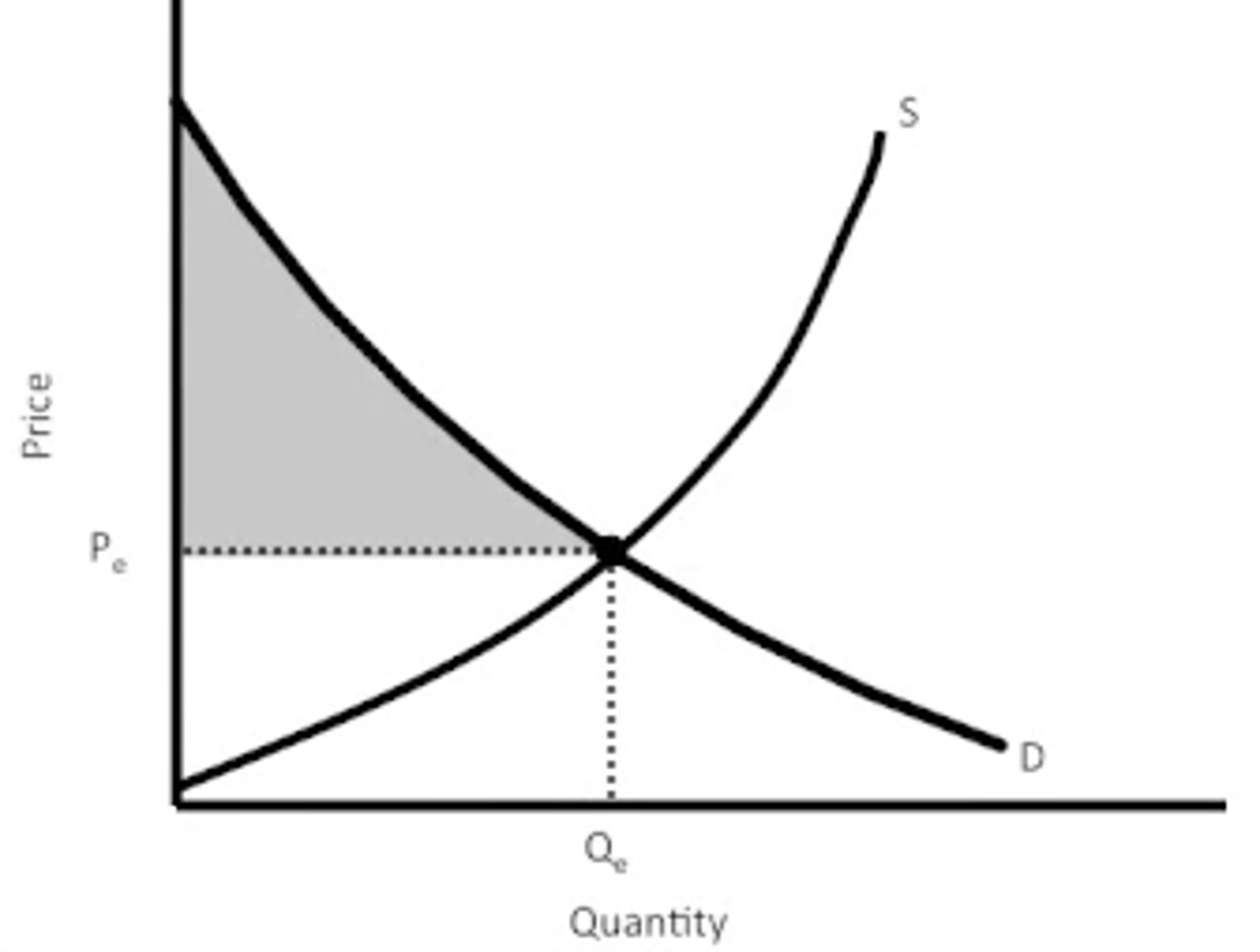

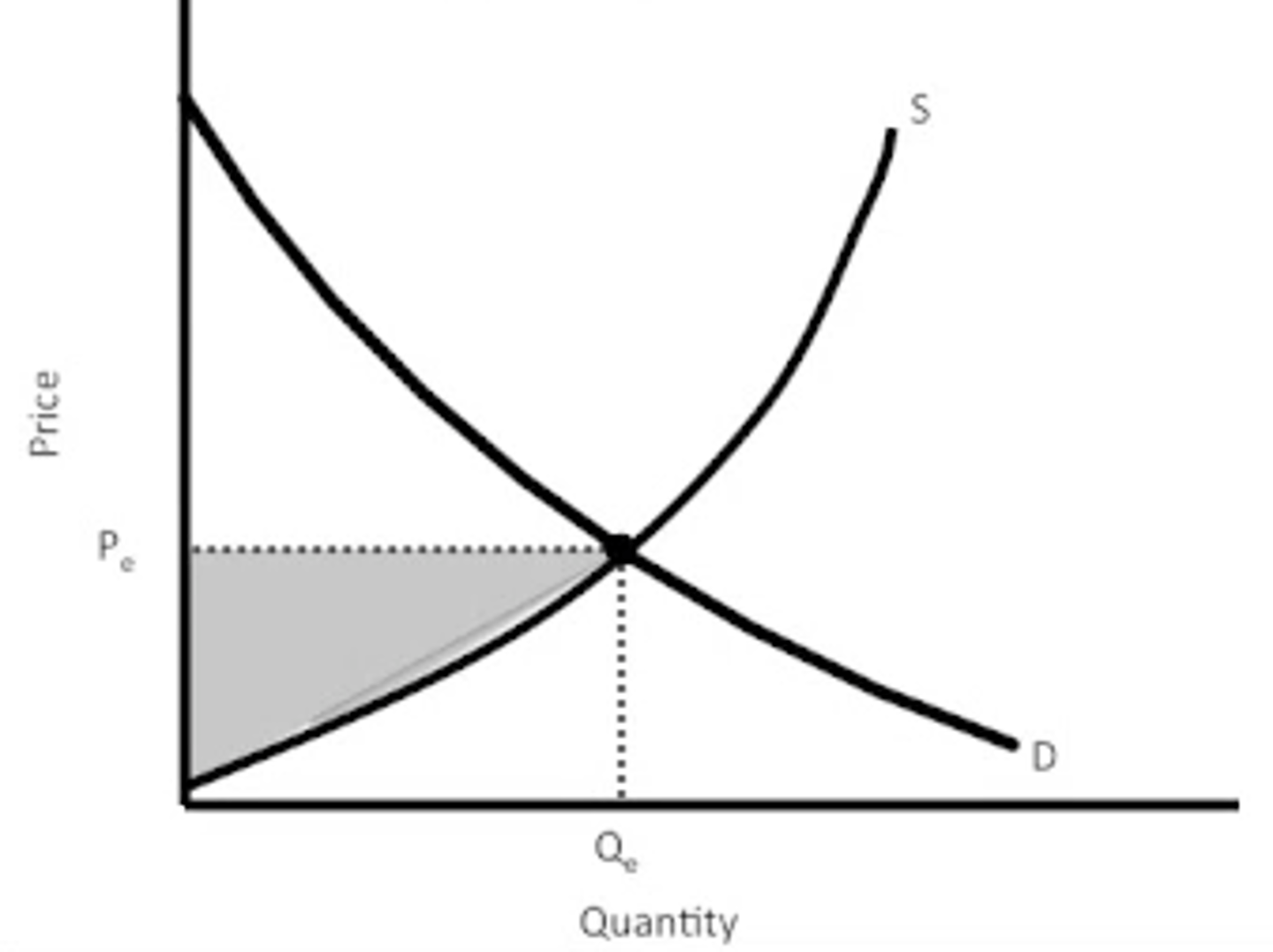

consumer surplus

producer Surplus

Pareto efficiency

total surplus is maximized

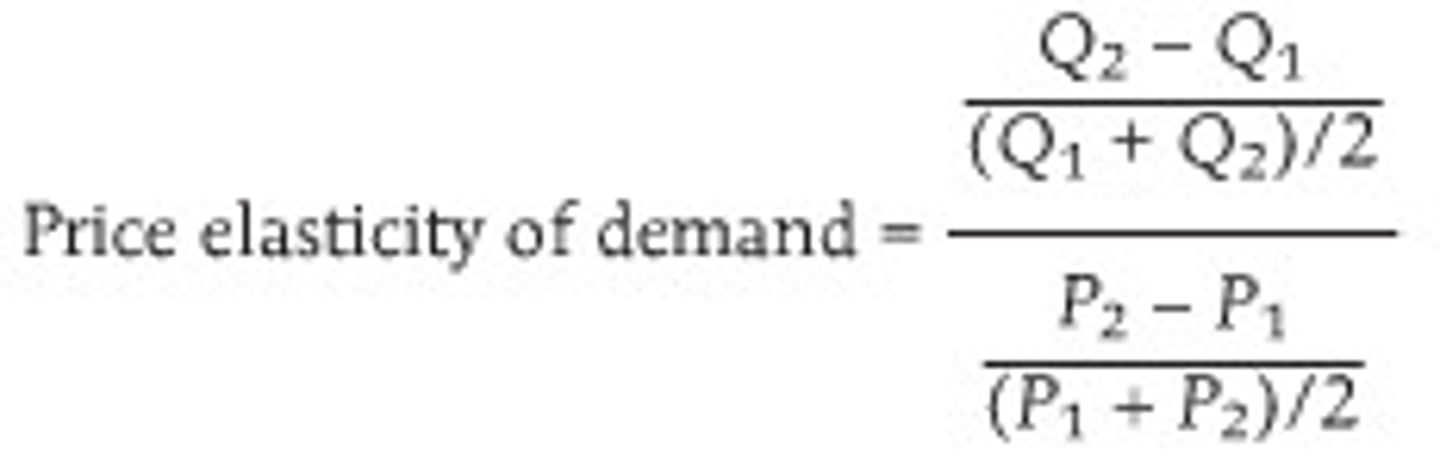

price elasticity of demand

measures a percentage change inquantity demanded for a 1% change in the price of the good orservice

price elasticity of demand formula

% change in quantity demanded / % change in price

Perfectly inelastic demand

the case where the quantity demanded is completely unresponsive to price and the price elasticity of demand equals zero

perfectly elastic demand

the case where the quantity demanded is infinitely responsive to price and the price elasticity of demand equals infinity

price elasticity of demand midpoint formula

demand is elastic

if elasticity is greater than 1

demand is inelastic

if elasticity is less than 1

total revenue

area under price and behind quantity

price effect

after a price increase, each unit sold sells at a higher price, which tends to raise revenue

quantity effect

after a price increase, fewer units are sold, which tends to lower revenue

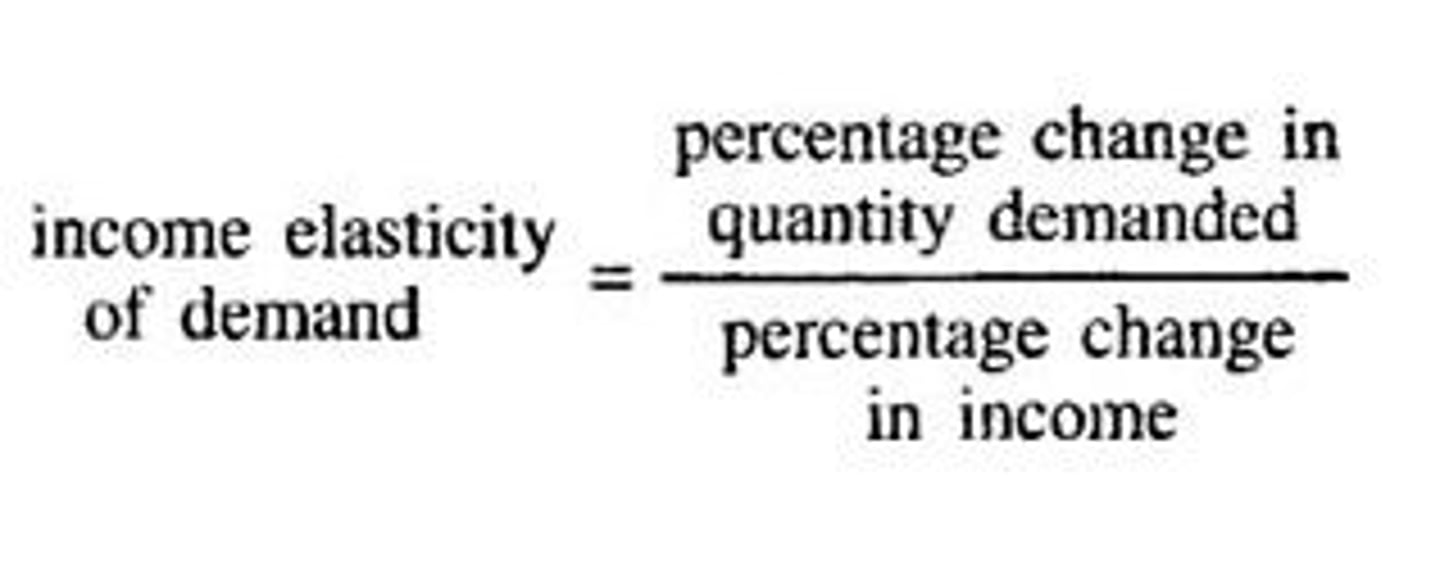

income elasticity of demand

if income elasticity is negative

inferior good

if income elasticity is positive and below 1

normal, good, necessity

if income elasticity is positive and above 1

normal good, nonnecessity (luxury)

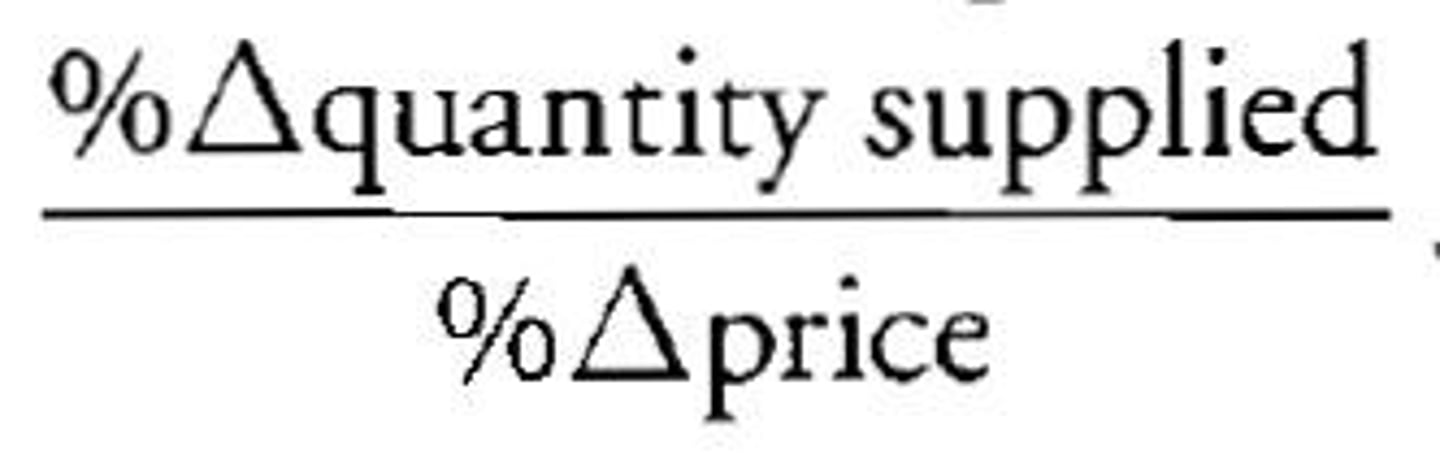

price elasticity of supply formula

deadweight loss

the loss in total surplus thatoccurs whenever an action ora policy reduces the quantitytransacted below the efficientmarket quantity.

Market interventions

price ceiling/floor, taxes, quotas

price ceiling

A legal maximum on the price at which a good can be sold

if price ceiling is above equilibrium price

non binding price ceiling

price floor

A legal minimum on the price at which a good can be sold

if price floor is below equilibrium price

non binding price floor

shadow markets

"rent under the table" or paying below minimum wage

quota

a cap on how much ofa good/service can be sold atmost in a market

excise tax

a tax on the production or sale of a good

tax incidence

the division of the burden of a tax between buyers and sellers

tax wedges

difference between price paid by consumers and price received by producers

Tax revenue

tax rate * quantity sold

administrative cost

ll the resources used inits collection on the governmentside and spent by parties subjectto the tax on evasion (notnecessarily of illegal kind).