Economics 102: Macroeconomics Ch 11. Money, Banking and Financial Markets

1/89

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

90 Terms

financial asset

something you can own

something of monetary value

that monetary value is derived from a contractual claim

Money

official medium of exchange

Stock

piece of paper that represents something of value

Bonds

contractual claim is with the municipality, corporation, or individual that issued the bond

Which of the following financial assets is a debt instrument - a promise by the issuer to pay the holder their principal plus interest at some future date?

Bonds

Stock

Legal Tender

Money

Bonds

What are the conditions for something to qualify as a financial asset?

something you can own, something with monetary value, something where that monetary value is derived from a verbal agreement

something you can own, something with monetary value, something where that monetary value is derived from a contractual claim

something you can hold, something with monetary value, something where that monetary value is derived from a contractual claim

something you can own, something with potential investment value, something where that monetary value is derived from a contractual claim

something you can own, something with monetary value, something where that monetary value is derived from a contractual claim

George reaches into his wallet and pulls out a $20 US bill to pay for his coffee. By using currency to make a purchase, what is George actually doing?

George is bartering with an established IOU.

George is exchanging value for the ownership in the underlying asset.

George is offering a trade in the amount of value of the medium of exchange.

George is paying with a government guaranteed note.

George is paying with a government guaranteed note.

Which of the following BEST explains the contractual obligation associated with stock?

The promise by a central bank to keep the economy strong so the business represented by the stock can be financially stable.

Commitment by the company that issued the stock to buy the stock of cash whenever the holder of the stock requests.

A commitment to the owner of stock to make the value of the stock increase, no matter what.

An ownership interest in a company.

An ownership interest in a company.

Which of the following lists is in the correct order, from least to most, of the market value of each of these financial assets?

Stock, Money, Bonds

Money, Bonds, Stock

Bonds, Stock, Money

Money, Stock, Bonds

Money, Stock, Bonds

time value of money

money that you have right now will be worth more over time

future value

how much money put in the bank today will turn into at some point in the future with the interest

present value

how much you need to save today to have a specific amount at some point in the future

annuity

a stream of equal payments

future value of an annuity

how much a stream of A dollars invested each year at r interest rate will be worth in n years

present value of an annuity

how much you will need today to receive a stream of payments A each year for n years if the money is invested at r interest rate

Which of these is an annuity?

Betty gets $50 in six months and $20 six months later

Bob gets $10 this year and $20 next

Jack gets $10 in three months and $10 six months later

Joan gets $100 every year for the rest of her life

Joan gets $100 every year for the rest of her life

How much will Bill and Mary need to put in the bank today at 4% interest to have $20,000 in five years for a down payment on a house?

$20,000

$16,000

$16,439

$17,439

$16,439

The time value of money means that:

A dollar received today is worth the same as a dollar received tomorrow

A dollar received tomorrow is worth more than a dollar received today

A dollar received today is worth more than a dollar received tomorrow

A dollar received two years from now is worth more than a dollar received today

A dollar received today is worth more than a dollar received tomorrow

If Martha puts $100 in the bank today at 6%, how much will she have in three years?

$124.10

$119.10

$112.10

$106.00

$119.10

If a couple saves $5,000 a year for five years at 5% interest, what is the future value of this annuity after those 5 years?

$30,000

$32,680

$27,628

$35,680

$27,628

The Money Supply

is the total quantity of money in the economy at any given time

M1

small savings accounts

money market funds

small time deposits

M2

large time deposits

large money market funds

repurchase agreements

Liquid

means that you can convert something into cash quickly

Which of the following measures of the money supply is largest?

M2

M1

Coins and currency

Time deposits

Checkable deposits

M2

Which of the following statements is true regarding the money supply?

M1 is more liquid than M2.

M1 is larger than M2.

M2 is more liquid than M1.

M2 is composed primarily of coins in circulation.

M2 is no longer used by the Federal Reserve.

M1 is more liquid than M2.

Loretta deposits money into her savings account. If all other factors are held constant, how does this affect M2?

M2 stays constant

M2 decreases

M2 increases

M2 decreases by the M3 amount

M2 stays constant

Which of the following is a component of M1?

Cash and coins in circulation

Government bonds

Gold

Certificates of deposit

Savings accounts

Cash and coins in circulation

In economics, the word 'liquid' refers to which of the following?

The ability to quickly and easily convert an asset to cash.

Water used in the sprinkler system at the Federal Reserve bank.

The nature of the product market.

The amount of free flow involved in the money supply.

The ability to convert money into gold.

The ability to quickly and easily convert an asset to cash.

Money

is anything that is widely accepted in exchange for goods and services

A Coincidence of Wants

when two parties to an exchange value the good they would receive as much as the good they would give away

Commodity money

money that’s in the form of a commodity with intrinsic value

Representative money

is not money itself, but something that represents money. it is exchangeable for a commodity

Fiat money

is money with absolutely no intrinsic value that is used as money. only has value because the government says it’s valuable

The government issues a new two-dollar and fifty cent bill. What is the intrinsic value of the new currency?

$2.50

Nothing

Always greater than $2.50

$2.50 plus or minus inflation

$2.50 plus or minus nominal interest

Nothing

Why was money created?

To provide the government with quick tax revenue.

As a means of taking advantage of people in lower income brackets.

To reduce the costs of making transactions in the economy.

It was created by the central bank to control interest rates.

To reduce the costs of making transactions in the economy.

Which of the following insures that the US dollar maintains its value?

The amount of gold on deposit with the Federal Reserve

The price of silver

Only the promise of the United States government

The intrinsic value of the paper it is printed on

The price of gold

Only the promise of the United States government

Assume that there are two parties to an exchange and that they value the goods they would receive as much as the goods they would give away. What do economists call this?

An exchange

A coincidence of coinage

Transactions costs

An alignment of barter

A coincidence of wants

A coincidence of wants

Money that has an intrinsic value is called what?

Commodity money

Gold

Fiat money

Representative money

Barter

Commodity money

What does it mean if everything in an economy can be quoted in terms of money?

It refers to money as the foundation of every transaction.

It means money is plentiful.

It means the Central Bank has increased the money supply.

It refers to money having a terminal value.

It refers to money as the foundation of every transaction.

Money is a medium of exchange because:

It fuels the stock market.

Two bills of like denomination have the same value.

Two bills of like denomination can be exchanged.

It can be used to satisfy any number of needs and desires.

It can be used to satisfy any number of needs and desires.

How does inflation prevent most of the money in use today from serving as a pure store of value?

During economic uncertainty, the purchasing power of money increases.

Inflation causes the purchasing power of money to increase over time.

Inflation causes the purchasing power of money to decrease over time.

Inflation causes consumers to invest in gold over time rather than spend money.

Inflation causes the purchasing power of money to decrease over time.

Money serves as a standard of deferred payment when:

it is no longer divisible.

it has intrinsic value.

it is used to buy something now and make payments later on.

it is exchanged for goods and services.

it is used to buy something now and make payments later on.

Why is gold NOT considered money?

Because despite being a unit of account, it is not a store of value.

Because despite being a medium of exchange, it is not a store of value.

Because despite being a store of value, it is not a medium of exchange or a unit of account.

Because despite being a standard of deferred payment, it is not a store of value.

Because despite being a store of value, it is not a medium of exchange or a unit of account.

The Fractional Reserve Banking System

a system in which banks hold back a small fraction of their deposits in a reserve and loan out the rest of their deposits in a reserve and loan out the rest of their deposits to borrowers

legally permits banks to hold less than 100% of their deposits as a reserve

The Required Reserve Ratio

the percentage of deposits that banks are required to reserve

Excess Reserves

bank reserves above and beyond the reserve requirement set by a central bank

money the bank has available to loan out

When someone deposits money into a savings account, this demand deposit becomes _____ to the bank?

A stock

An asset

A liability

A bond

A risk

A liability

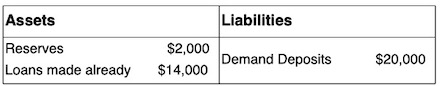

According to the T-account shown, if the required reserve ratio is 10%, what is the maximum amount of additional loans this bank can make?

$6,000

$26,000

$14,000

$4,000

$20,000

$4,000

How do banks make money?

Loaning out their excess reserves

Collecting interest on deposits

Money is moved not made

Loaning out required reserves

Fundraising

Loaning out their excess reserves

Under fractional banking, when a bank lends to a customer, which of the following happens?

Only a small fraction of deposits gets loaned out.

The money supply increases.

The banks go bankrupt.

The Banks make less money.

The money supply decreases.

The money supply increases.

A bank gets a demand deposit of $50,000. If the reserve requirement is 10%, what is the maximum the bank can loan out at this time?

$50,000

$65,000

$45,000

$15,000

$35,000

$45,000

The fractional reserve banking system

is a system in which banks hold back a small fraction of their deposits in a reserve and loan out the rest of their deposits to borrowers

Lydia deposits $70,000 into the First National Bank of Ceelo. The required reserve ratio is 9%. How much will the money supply increase if the bank loans out excess reserves?

$63,700

$6,300

$70,000

$77,000

$7,000

$63,700

When a deposit is made into a bank, what does the bank do?

The bank sets aside the entire amount for safekeeping.

The bank pays this amount to another bank.

The bank sets aside a required reserve and loans out the rest.

The bank loans out 120% of it.

The bank transfers all of it to the Federal Reserve.

The bank sets aside a required reserve and loans out the rest.

Which of the following is NOT true regarding the role of banks in the economy?

Banks connect savers with borrowers.

Banks control the fiscal policy of the country.

Banks are required to set aside a fraction of all deposits.

Banks provide the funds that people need to invest.

Banks increase the money supply.

Banks control the fiscal policy of the country.

How do banks make money?

Loaning out excess reserves

Borrowing from the Federal Reserve

Loaning out all their reserves

Making and selling coins

Paying interest to savers

Loaning out excess reserves

How does the economy change every time banks loan out excess reserves?

The long-run aggregate supply curve shifts inward.

The price level goes down.

Interest rates go down.

The money supply decreases.

The money supply increases.

The money supply increases.

The Multiplier Effect

describes how an increase in one economic activity leads to a much greater increase in economic output

Reserve Ratio

the fraction of a customer’s deposits that a bank is required to withhold on reserve in their vault or on deposit with the central bank

set by the Federal Reserve

gives the central bank power to influence and change the money supply

Excess Reserves

the fraction of a customer’s deposits a bank is able to loan out to borrowers, so they can earn a profit

The Money Multiplier

the relationship between the reserves in a banking system and the money supply

Required Reserves

the fraction of a customer’s deposits that a bank is required to withhold on reserve in their vault or on deposit with the central bank

When $1,000 gets deposited into the banking system, and the reserve ratio is 10%, what is the increase in the money supply?

$9,000

$1,000

$5,000

$10,000

$10,000

If banks have excess reserves of $5,000, and the money supply increased by $20,000, what is the reserve ratio?

20%

10%

15%

25%

25%

Besides being known as the reserve ratio, what is the fraction of a customer's deposits that a bank is required to hold in reserve also called?

Total reserves

Excess reserves

Federal Reserve

Required reserves

Required reserves

Assume that the reserve requirement is 25%. If banks have excess reserves of $10,000, which of the following is the maximum amount of additional money that can be created by the banking system through the lending process?

$2,500

$250,000

$40,000

$50,000

$40,000

The money multiplier is a relationship between which two drivers?

Reserves loaned out by banks and the total reserves.

Reserves in a banking system and the money supply.

Required reserves and the money supply.

Reserves in the banking system and the interest rate.

Reserves in a banking system and the money supply.

Money

the portion of your wealth that you choose to hold in the form of cash or checking accounts

Personal Income

the ongoing flow of money into an individual’s life, including compensation from salaries, wages, bonuses and dividends or distributions from investments such as real estate or a business

The demand for money

the relationship between the quantity of money people want to hold and the factors that determine that quantity

Which of these is TRUE regarding money demand and price level?

It varies directly with the price level.

It does not vary with the price level.

It varies logarithmically with the price level.

It varies inversely with the price level.

It varies directly with the price level.

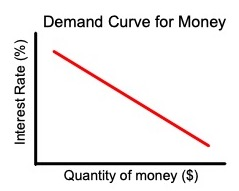

When looking at the demand curve for money, which of the following completes this sentence?

When interest rates are 20%, the demand for money is _____.

low but increasing rapidly before interest rates increase.

higher than it would be if interest rates are 10%.

lower than it would be if interest rates are 2%.

the same as it would be if interest rates are 15%.

lower than it would be if interest rates are 2%.

What coincides with an increase in the demand for money when the supply of money is unchanged?

Higher interest rates

No change in interest rates

Money demand soon declines

Lower interest rates

Lower interest rates

How does the demand curve for money shift?

It shifts down as the price level decreases.

It shifts down as real GDP increases.

It shifts up as interest rates increase.

It shifts up as the price level decreases.

It shifts down as the price level decreases.

As the price level decreases, how is the value of money impacted?

Increases, so people want to hold more of it.

Decreases, so people want to hold less of it.

Increases, so people want to hold less of it.

Decreases, so people want to hold more of it.

Increases, so people want to hold less of it.

The Money Market

an economic model describing the supply and demand for money in a nation

Because the central bank controls the money supply, it also controls what other economic driver?

It also controls market interest rates.

It also controls exchange rates.

It also controls the demand for money.

It also controls the demand for products and services.

It also controls taxes on savings and investment.

It also controls market interest rates.

What happens when money demand increases and all other things remain constant?

The money market finds a new equilibrium and the market interest rate falls

The money market remains at the same equilibrium

The demand curve for money shifts leftward, leading to a lower interest rate

The supply of money falls by an equal amount to compensate

The money market finds a new equilibrium and the market interest rate rises

The money market finds a new equilibrium and the market interest rate rises

When economists illustrate the money market, the demand curve is _____ while the supply curve is _____.

upward sloping; vertical

upward sloping; downward sloping

downward sloping; upward sloping

horizontal; vertical

downward sloping; vertical

downward sloping; vertical

How does high economic output lead to higher nominal interest rates?

It leads to higher income which leads to an equilibrium position for money

It leads to equilibrium in the economy which leads to higher rates

It leads to higher income which leads to lower demand for money

It leads to lower income which leads to higher demand for money

It leads to higher income which leads to higher demand for money

It leads to higher income which leads to higher demand for money

What is the economics model that describes the demand and supply of money in a nation called?

The money supply

The demand for money

The product market

The market for loanable funds

The money market

The money market

Maturity

the point at which the loan was due

Par value

face value

initial loan amount

Coupon rate

the annualized interest, also referred to as the coupon, divided by the initial loan amount

What is a coupon rate?

Annualized coupon divided by par value.

Quarterly coupon divided by par value.

Semi-annual dividend divided by current value.

Quarterly dividend divided by future value.

Annualized coupon divided by par value.

Most bonds pay interest:

Annually

Monthly

Quarterly

Semi-annually

Semi-annually

In the formula C = i / p, what does the p represent?

Interest rate

Present value

Property value

Par value

Par value

There is a company offering $5000 bonds which will earn an annual interest of $200. What is the coupon rate?

5%

7%

4%

10%

4%

Most bonds have par values of:

$500

$1,000

$25

$10,000

$1,000