Econ Exam 2

5.0(2)

5.0(2)

Card Sorting

1/65

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

66 Terms

1

New cards

Short Run Production (SR)

time period when at least one input (otherwise known as factor of production) is fixed

2

New cards

Long Run Production (LR)

all inputs are variable

3

New cards

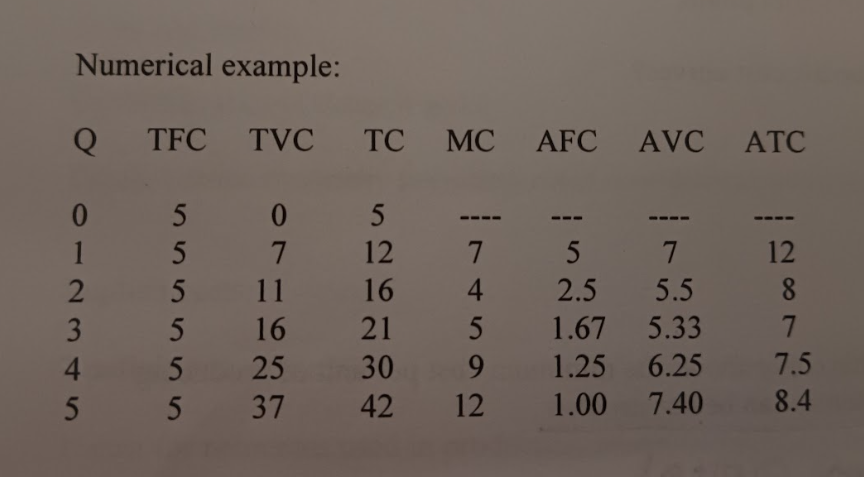

What are the Short Run Production Costs and what do they mean?

* Total fixed costs (TFC): costs that do not vary with output (also called overhead costs). This has to be paid no matter what and stays the same.

* Total Variable Costs: costs that vary with output. If there is more of a good or service TVC increases, less of a good or service TVC decreases.

* Total Costs: TFC + TVC

* Total Variable Costs: costs that vary with output. If there is more of a good or service TVC increases, less of a good or service TVC decreases.

* Total Costs: TFC + TVC

4

New cards

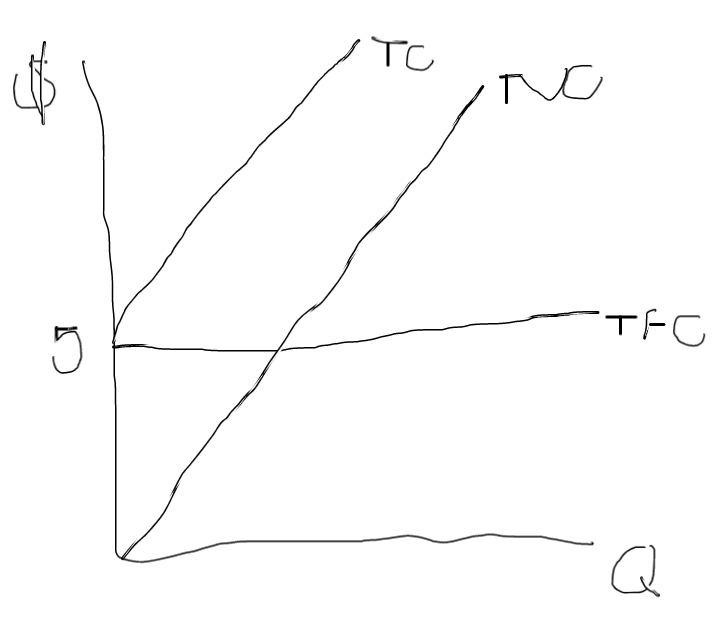

What does the graph for TFC, TVC and TC look like?

TVC and TC have to be parallel because they’re the same distance in between them

5

New cards

Average costs and Marginal Costs

* Average Fixed Cost (AFC) = Total fixed cost/Quantity

* Average Variable Cost (AVC) = Total Variable cost/Quantity

* Average Total Cost (ATC) = Total Cost/Quantity = (AFC + AVC)

* Marginal Cost (MC) = Δ TC/ ΔQ = ΔTVC/ΔQ

Marginal Cost also means a change in total costs when one more unit of output is produced.

* Average Variable Cost (AVC) = Total Variable cost/Quantity

* Average Total Cost (ATC) = Total Cost/Quantity = (AFC + AVC)

* Marginal Cost (MC) = Δ TC/ ΔQ = ΔTVC/ΔQ

Marginal Cost also means a change in total costs when one more unit of output is produced.

6

New cards

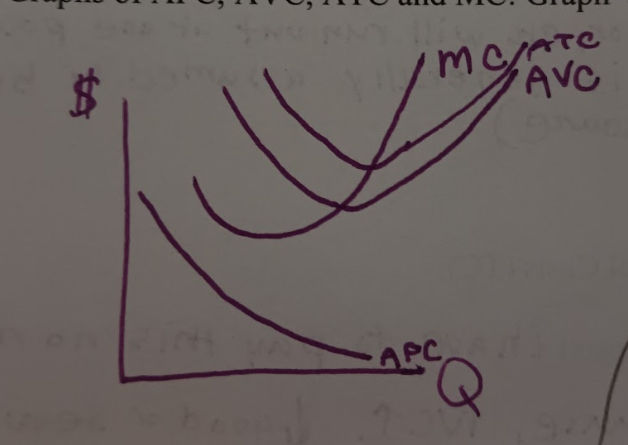

Graph of AFC, AVC, ATC, and MC

MC Intersects AVC and ATC at their minimum points

7

New cards

What will shift the SR Cost Curves?

* Technology Improvements

* Changes in Resources Prices

* Changes in business taxes

* Changes in Resources Prices

* Changes in business taxes

8

New cards

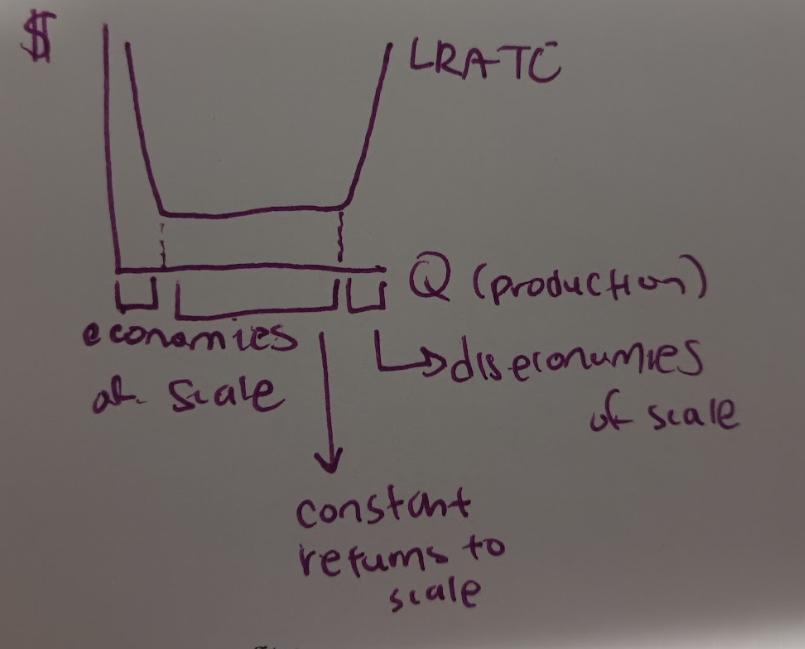

What is the Long Run Production Cost?

Long run average total cost curve (LRATC): this curve shows the minimum cost per unit of producing each level of output when any desired size of factory can be constructed (can vary capital)

9

New cards

What are the 3 regions of LRATC?

1. Economies of scale: as production increases, cost per unit decreases and so the LRATC is downward sloping.

* Why do economies of scale occur (for example it’s really expensive to make a drug)?: Specialization of labor and management, efficient capital, and fixed cost of design and development.

2. Constant returns to scale: as production increases, cost per unit stay the same and so the LRATC is horizontal.

* Why do constant returns to scale occur? The percentage change in output is equal to the percentage change in inputs.

3. Diseconomies of scale: as production increases, cost per unit increases and so the LRATC is upward-sloping.

* Why do diseconomies of scale occur? The firm is so large that management becomes difficult (becomes out of control b/c its big).

10

New cards

What does the graph for LRATC look like?

11

New cards

What are explicit costs?

monetary payments made to purchase resources

12

New cards

What are implicit costs?

1. Cost for resources used in production where no monetary payment is made.

2. The value of the firm’s resources in their best alternative use (better definition).

13

New cards

Accounting profits vs Economic Profits

* Accounting profit = revenues - explicit costs

* Economic profit = revenues - (explicit costs + implicit costs)

\-Accounting profits underestimate the economic costs and so overestimate profits

* Economic profit = revenues - (explicit costs + implicit costs)

\-Accounting profits underestimate the economic costs and so overestimate profits

14

New cards

Is it okay if economic profits equal 0?

Yes! This means firms are making a normal profit which is the minimum profit necessary to keep a firm in operation.

15

New cards

Market Structure

the level of competition, firm behavior, and economic outcomes are analyzed in markets

16

New cards

What are the 5 characteristics of Perfect Competition?

1. Many sellers and buyers: this means each buyer and seller has a negligible share of the market

2. Insignificant barriers to entry or exit: this means firms can freely enter or exit the market

3. Standardized product produced by each firm in the industry: each product is identical and so there is no brand or consumer loyalty (people will only care about prices)

4. Perfect information: each buyer and seller knows everything about price and quality of the product.

5. The firm is a price taker: since each firm is so small compared to the market, it cannot affect the market price (charge equilibrium price).

Example of a perfectly competitive industry: agriculture

17

New cards

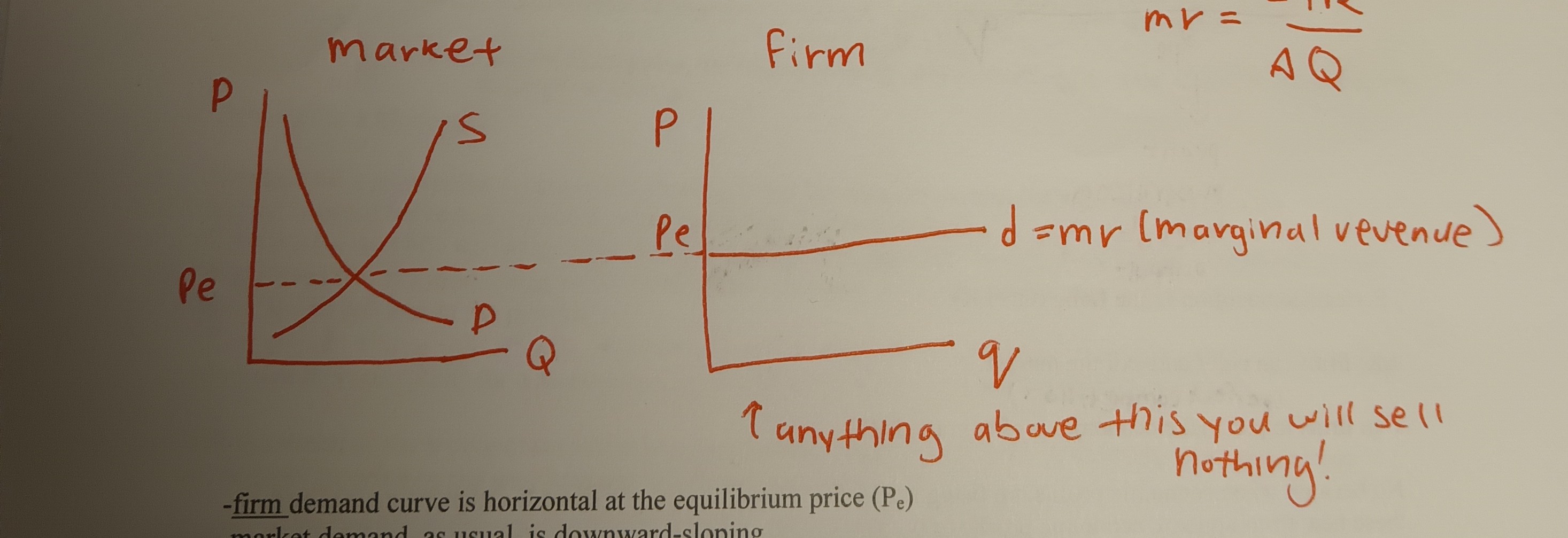

Market Demand Curve vs Firm Demand Curve

* Firm demand curve is horizontal at the equilibrium price (Pe)

* Market demand, as usual, is downward sloping

* Market demand, as usual, is downward sloping

18

New cards

Marginal revenue (MR) and the firm demand curve

* Marginal revenue is the increase in total revenue (TR) from the sale of another unit of output

* formula for MR: MR = ΔTR/ΔQ

* in perfect competition, MR = P (equilibrium price)

* Thus, the firm demand curve is also the marginal revenue curve (MR-curve)

* formula for MR: MR = ΔTR/ΔQ

* in perfect competition, MR = P (equilibrium price)

* Thus, the firm demand curve is also the marginal revenue curve (MR-curve)

19

New cards

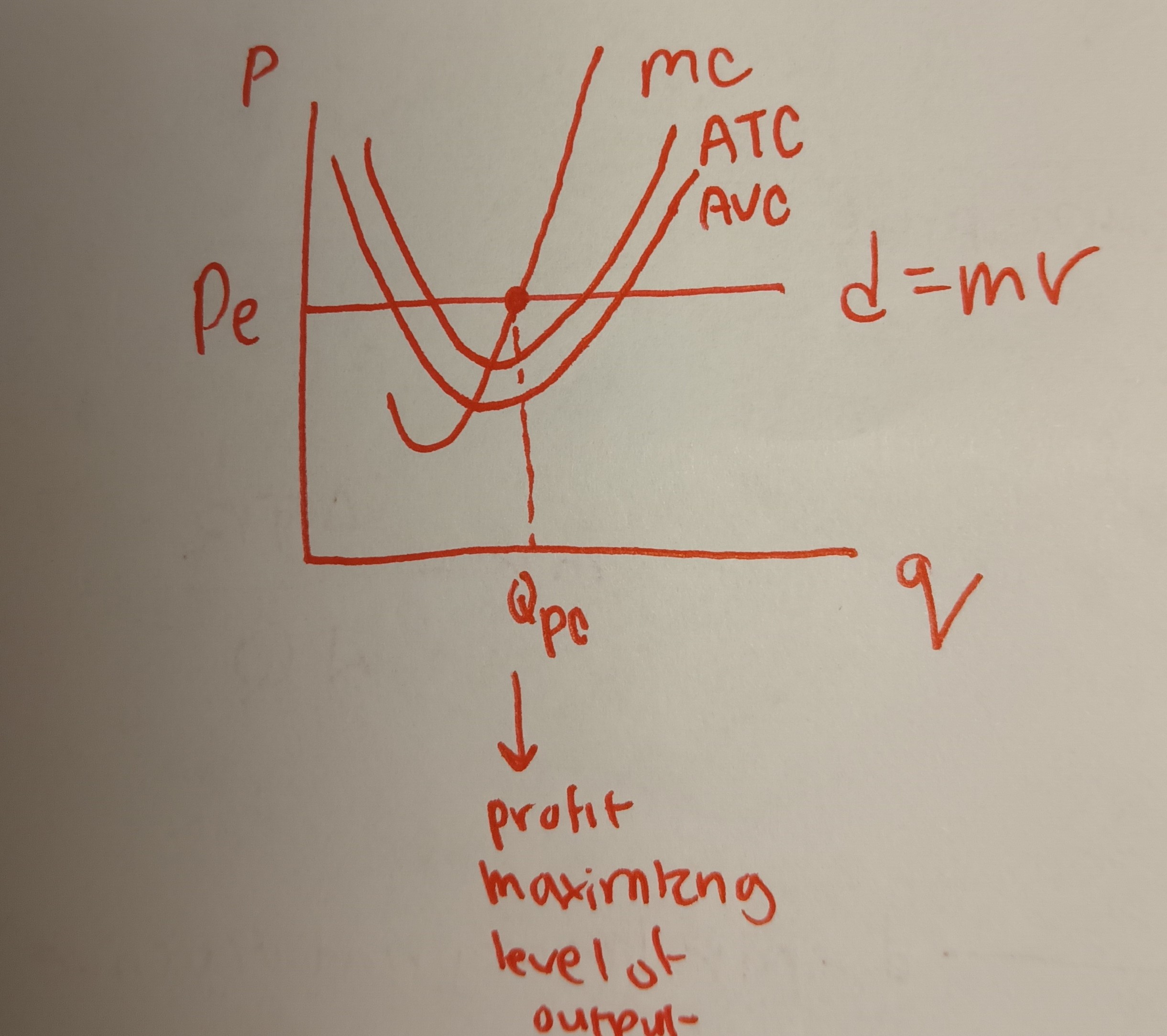

Profit Maximization in the Short Run (SR)

SR: no entry or exit of firms can occur

General profit-max rule: produce where MR = MC

Special profit-max rule for perfect competition: produce where P = MC

General profit-max rule: produce where MR = MC

Special profit-max rule for perfect competition: produce where P = MC

20

New cards

What is the rationale for the profit max-rule?

1. If a firm produces where MR > MC, it has made a profit on the last unit produced and so the firm should produce more output

2. If a firm produces where MR < MC, it has made a loss on the last unit produced and so the firm should produce less output

3. Thus, to max. profits, the firm should produce exactly MR = MC

Note: firms in the p.c. can make economic profits in the short run

21

New cards

Perfect Competition in the Long Run (LR)

* Long Run: firms can enter and exit the market

* Firms CANNOT make economic profits in the long run because when economic profits are being made, free entry allows new firms to enter the market and these new firms squeeze economic profits to 0.

* Firms CANNOT make economic profits in the long run because when economic profits are being made, free entry allows new firms to enter the market and these new firms squeeze economic profits to 0.

22

New cards

Characteristics of the LR in Perfect Competition

1. Firms produce at lowest point on their LRATC

2. Because firms produce at the lowest possible cost, firm charges lowest possible price

3. Firms must use most efficient, least costly production techniques (will go out of buisness if you don’t do this)

4. Firms make 0 economic profit or a normal profit

23

New cards

Characteristics of a Monopoly

1. One seller of good or service

2. No close substitutes for goods or services

3. High barriers to entry: high barriers to entry make it difficult or impossible for new firms to enter an industry

4. Monopolist is a price-maker: this means that the monopolist has considerable control over the price it changes. However they cannot change it ANY way they like

5. There is no equilibrium or market price in a monopoly

24

New cards

What are barriers to entry and what are some types?

Barriers to entry: impediments that protect an established firm from potential competition

* Legal barriers: these are barriers created by the government. Examples include patents, copyrights, licenses, and public franchises

* Control over essential inputs: one firm keeps other firms from entering an industry by denying them a crucial input

* Economies of scale: cause a natural monopoly which is when one firm can supply the entire market at a lower per unit cost than would be achieved by 2 or more firms. Examples include natural gas, water and electricity (utilities). Natural monopolies are regulated by the government b/c you can’t compete those away.

* Legal barriers: these are barriers created by the government. Examples include patents, copyrights, licenses, and public franchises

* Control over essential inputs: one firm keeps other firms from entering an industry by denying them a crucial input

* Economies of scale: cause a natural monopoly which is when one firm can supply the entire market at a lower per unit cost than would be achieved by 2 or more firms. Examples include natural gas, water and electricity (utilities). Natural monopolies are regulated by the government b/c you can’t compete those away.

25

New cards

Demand for a monopolist

* Demand is downward sloping because the monopolist’s demand curve is the market demand curve and that is also downward sloping.

* This means that if a monopolist wants to sell more of a product, it must lower its price and if it increases its price, it will sell less of the product (ex: if they increase natural gas prices, people could use less by changing the thermostat).

* This means that if a monopolist wants to sell more of a product, it must lower its price and if it increases its price, it will sell less of the product (ex: if they increase natural gas prices, people could use less by changing the thermostat).

26

New cards

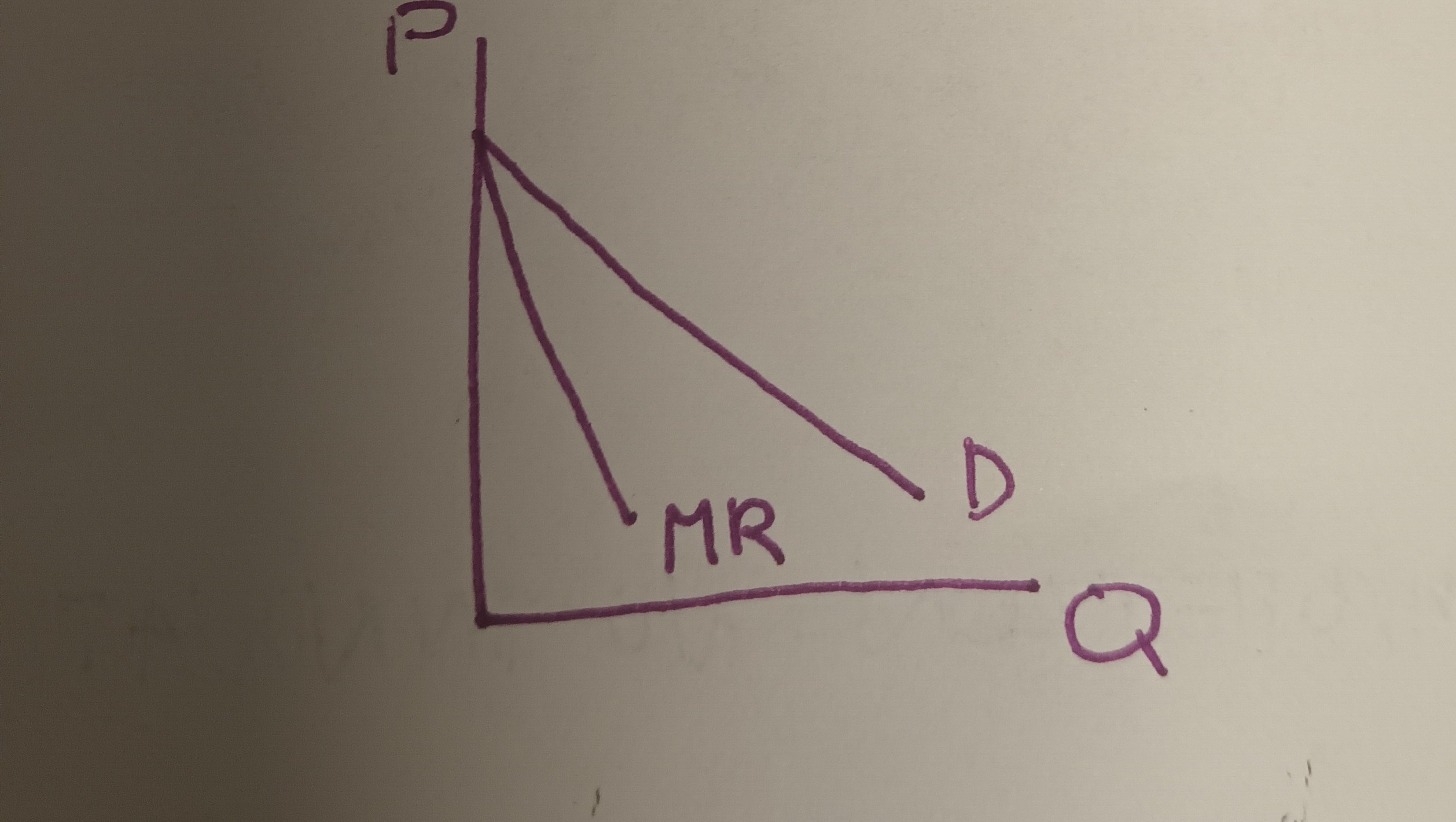

Marginal Revenue (MR) for a monopolist

* MR decreases as the monopolist sells more of its product because to sell more of its product, the monopolist must lower its price on the next unit and on all previous units sold.

\-This means the MR- curve is downward-sloping and is below the demand curve.

\-This also means that for monopolist, P > MR

\-This means the MR- curve is downward-sloping and is below the demand curve.

\-This also means that for monopolist, P > MR

27

New cards

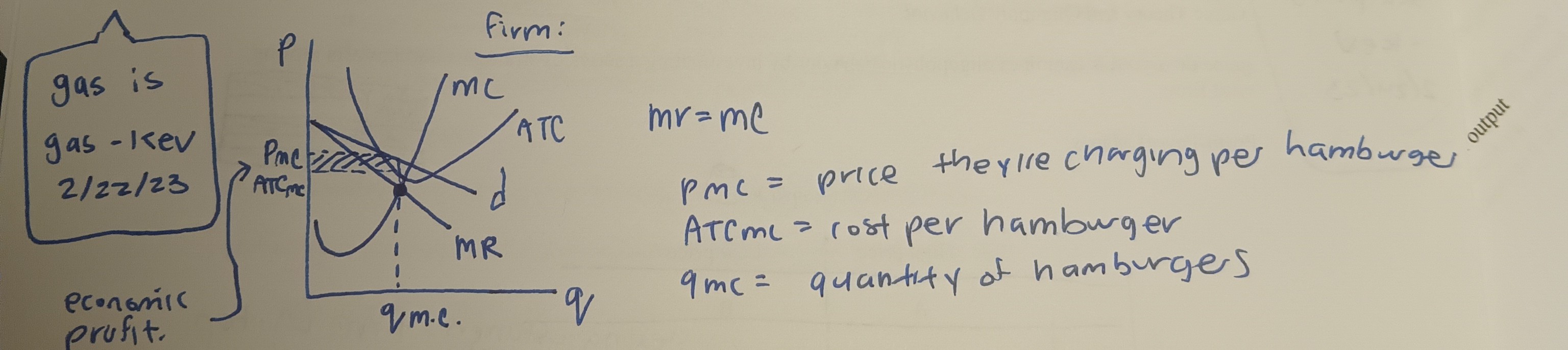

Graph of the monopolist’s demand and MR- Curves

28

New cards

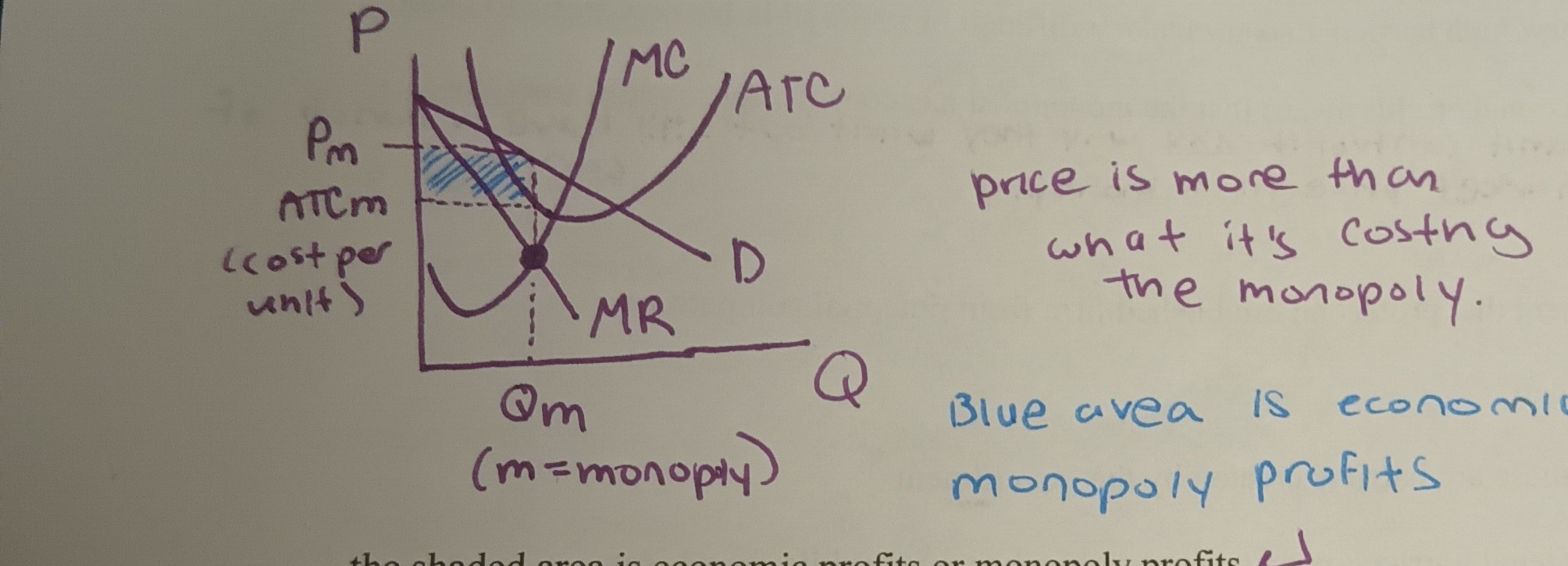

How does a monopolist max. profits?

They use the general profits max rule: monopolist produce where MR = MC

* The selling price is more than what it costs monopolies and they have no competition so you can expect them to make a profit.

* The blue shaded area is the economic or monopoly profits

* The selling price is more than what it costs monopolies and they have no competition so you can expect them to make a profit.

* The blue shaded area is the economic or monopoly profits

29

New cards

For a monopolist, can economic profits persist in the LR?

Yes because new firms cannot enter the market because of high barriers of entry

30

New cards

The case against monopolies

Monopolies compare unfavorably to a perfect competition because:

1. price and profits are higher under monopoly than p.c.

2. output is lower under monopoly than p.c. Monopolists restrict output in order to increase price (monopolies are creating artificial scarcity on purpose).

3. Monopolists do not produce a min LRATC

1. price and profits are higher under monopoly than p.c.

2. output is lower under monopoly than p.c. Monopolists restrict output in order to increase price (monopolies are creating artificial scarcity on purpose).

3. Monopolists do not produce a min LRATC

31

New cards

Other Problems with Monopolies

1. Monopolists cause inequality in income because higher prices and profits under monopoly represent a redistribution of income from consumers to the monopolist

2. Legal monopolies waste resources by lobbying the gov to keep their monopoly: this is called rent-seeking

32

New cards

A Case for Monopoly: Does monopoly encourage innovation?

First, what is innovation? It is the development of new products, new tech, and cost saving production techniques

* Argument that monopoly encourages innovation: monopolies have many resources to put into research and development (R&D) because they are large firms and have monopoly profits

* Argument that monopoly discourages innovation: monopolies have NO INCENTIVE to innovate because of a lack of competitive pressure

Thus it isn’t clear that monopolies encourage innovation and compare to P.C., monopoly is an inferior market structure.

* Argument that monopoly encourages innovation: monopolies have many resources to put into research and development (R&D) because they are large firms and have monopoly profits

* Argument that monopoly discourages innovation: monopolies have NO INCENTIVE to innovate because of a lack of competitive pressure

Thus it isn’t clear that monopolies encourage innovation and compare to P.C., monopoly is an inferior market structure.

33

New cards

Market Structure Spectrum

p.c.(------M.C.----------------------oligopoly-------)monopoly

34

New cards

Characteristics of Monopolistic Competition

1. Many sellers or firms

2. Firms do not consider the reactions of their rivals when making price and output decisions

3. Insignificant barriers to entry or exit: this means that firms can freely enter and exit the market

4. Firms are price makers: firms have some control over price but less control than a monopolist

5. Product differentiation: each firm’s product is not a perfect substitute for the product of competing firms (not everyone is selling the exact same thing: similar but not identical)

\-Note: it is product differentiation that gives each firm some price-making ability

35

New cards

Examples of M.C Industries

fast food (Wendy’s vs McDonald’s), gas stations, grocery stores, auto repair, law firms.

36

New cards

Demand Curve for a firm in M.C.

* the firm’s demand curve is downward sloping but is more elastic or flatter than the monopolist’s demand curve because in M.C. each firm’s product has many close substitutes

* Since the demand curve is downward sloping, the MR-revenue curve is downward sloping and below the demand curve which implies P > MR for a firm in M.C.

* Since the demand curve is downward sloping, the MR-revenue curve is downward sloping and below the demand curve which implies P > MR for a firm in M.C.

37

New cards

Profit Max for firms in M.C.

firms use the general case of the profit-max rule: produce where MR = MC

38

New cards

Monopolistic Competition in the Long Run

Firms cannot make profit in the long run because free entry in M.C. allows new firms to enter the market and this increased competition forces economic profit to 0; firms make a normal profit in the LR

* The demand firm would get flatter, pmc gets lower, and then there is no profit.

However unlike P.C, firms do not produce at min. LRATC and so price under M.C. is higher than price under P.C.

* The demand firm would get flatter, pmc gets lower, and then there is no profit.

However unlike P.C, firms do not produce at min. LRATC and so price under M.C. is higher than price under P.C.

39

New cards

Price Discrimination

* Price Discrimination: The practice of charging different prices to different customers even though there is no difference in cost

* Can only occur where this is imperfect competition because the seller must have some control over the price they charge.

* Can only occur where this is imperfect competition because the seller must have some control over the price they charge.

40

New cards

What prices does a price discriminator charge?

1. firms charge price sensitive customers a low price; price sensitive customers have elastic demand (responsive to price). This could be the elderly or teenagers

2. Firms charge those customers who are not price sensitive a high price; those who are not price sensitive have inelastic demand (not responsive to price).

41

New cards

Why do firms do Price Discrimination?

Firms can increase revenues and so increase profits

42

New cards

Examples of Price Discrimination

movie tickets (buy earlier, they’re cheaper), airplane tickets, college tuition.

43

New cards

Characteristics of an oligopoly

1. Few sellers

2. Firms are price-makers: this means firms have significant control over price; more control than firms in M.C. but less than a monopolist

3. Price and output decisions of one firm affect the price and output decisions of other firms

4. High barriers to entry but barriers are lower than those for monopolist

Examples of a oligopoly: autos, aircraft production, breweries, soft drinks, breakfast cereals

44

New cards

What is Game Theory?

This examines oligopolistic behavior by investigating a series of strategies and payoffs among rival firms

45

New cards

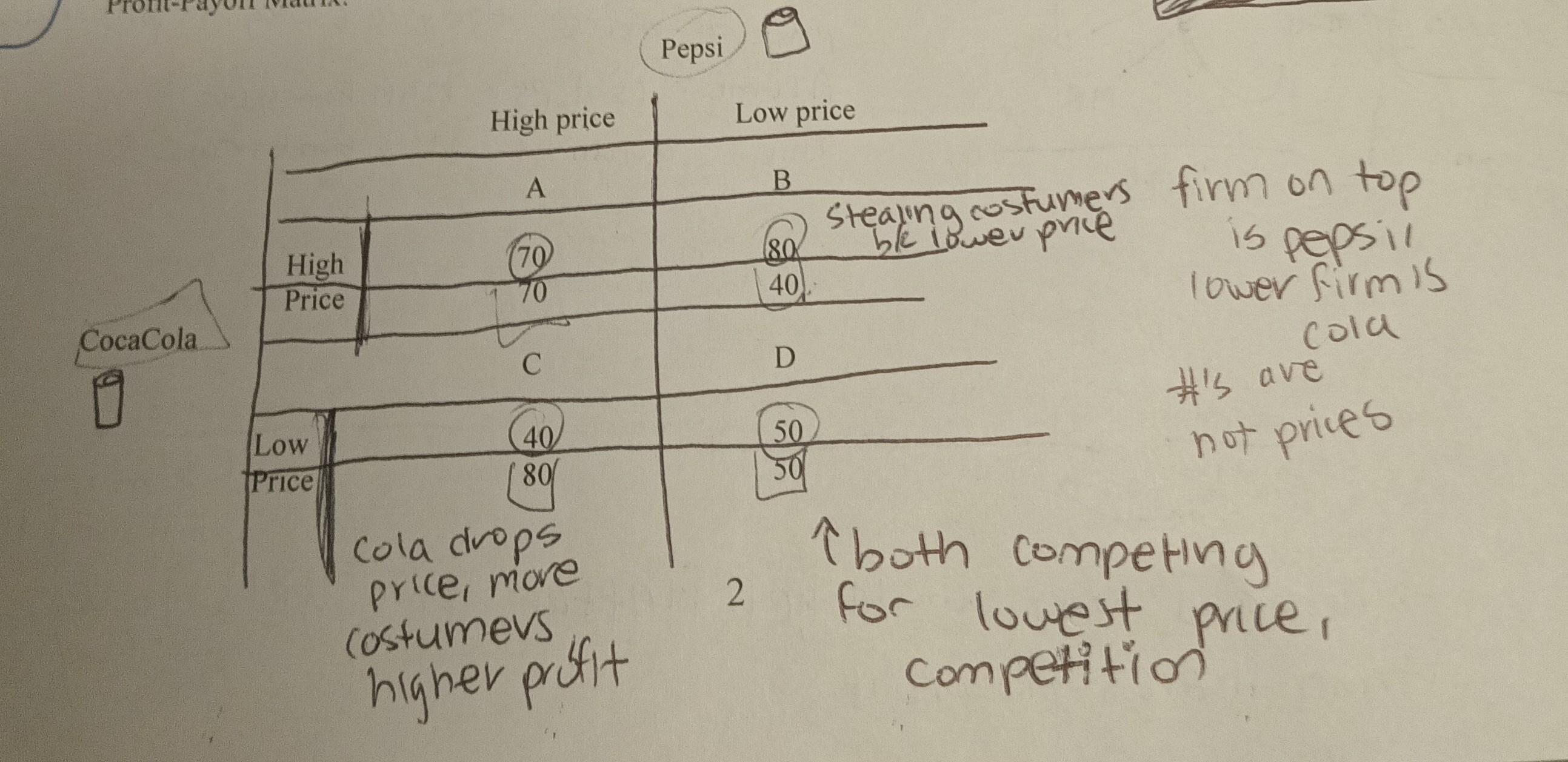

Profit Payoff Matrix

Payoff matrix has different cells which represent different price strategies for the two firms

* Cell A represents the situation where both firms keep their prices high; here both firms make a high profit; this cell represents cooperative behavior by the firms; i.e., the 2 firms cooperate to charge a high price

* Cell B and C represent the situation where one firm cooperates but the other doesn’t; this means one firm charges a high price while the other firm charges a low price; these 2 cells represent situations where one of the firms cheats; the cheating firm charges a low price and makes high profits while the cooperating firm charges a high price and makes low profits.

* Cell D represents the situation where both firms charge a low price; both make the same low profits; this cell represents competition by both the firms.

This type of game theory represents the prisoners dilemma, where the best option is to have both people rat on each other or Cell D where both firms lower their prices.

* Cell A represents the situation where both firms keep their prices high; here both firms make a high profit; this cell represents cooperative behavior by the firms; i.e., the 2 firms cooperate to charge a high price

* Cell B and C represent the situation where one firm cooperates but the other doesn’t; this means one firm charges a high price while the other firm charges a low price; these 2 cells represent situations where one of the firms cheats; the cheating firm charges a low price and makes high profits while the cooperating firm charges a high price and makes low profits.

* Cell D represents the situation where both firms charge a low price; both make the same low profits; this cell represents competition by both the firms.

This type of game theory represents the prisoners dilemma, where the best option is to have both people rat on each other or Cell D where both firms lower their prices.

46

New cards

Collusion and Cartels

In Cell A firms cooperate; another name for this is called collusion or the firms set the price together and do not compete.

* When firms collude they may form a cartel, a formal organization of firms that attempts to act as if there was only one firm or acts like a monopoly

* The purpose of a cartel is to reduce output, increase price and share monopoly profits \*ex: OPEC

\*Note: collusion and cartels are illegal in the united states

* When firms collude they may form a cartel, a formal organization of firms that attempts to act as if there was only one firm or acts like a monopoly

* The purpose of a cartel is to reduce output, increase price and share monopoly profits \*ex: OPEC

\*Note: collusion and cartels are illegal in the united states

47

New cards

Obstacles to forming a cartel

1. Large number of sellers

2. Cost and demand differences among the firms

3. Existence of potential competition (ex: OPEC vs Fracking)

4. Cheating during economic downturn

\*Note by cheating, a firm charges a price below the cartel price.

48

New cards

Price leadership

* Another type of collusion or cooperation

* This is a tacit or informal type of collusion (there is never any direct communication)

* The price leader is the dominant or largest firm in the industry

* The other firms follow the price changes of the price leader and by doing this the forms reduce output, charge higher prices, and share monopoly prices

* This is a tacit or informal type of collusion (there is never any direct communication)

* The price leader is the dominant or largest firm in the industry

* The other firms follow the price changes of the price leader and by doing this the forms reduce output, charge higher prices, and share monopoly prices

49

New cards

Mergers and Oligopoly

Merger: combining the assets of 2 firms to form a single new firm

Mergers can reduce competition by reducing the number of competing firms

Mergers can reduce competition by reducing the number of competing firms

50

New cards

What are the 3 types of Mergers?

1. Horizontal Mergers: occurs when one firm combines with another firm that sells similar products in the same market (greatest chance of reducing competition). Examples include sprint and T-Mobile merging

2. Vertical Merger: a combo between firms in the same industry but at different stages in the production process (Disney buying Pixar)

3. Conglomerate Merger: these combine firm producing in different industries (mobile oil bought sears → went out of business)

51

New cards

What is the basic rationale for gov intervention in markets?

Market Failure: when markets fail to allocate resources efficiently.

52

New cards

Describe the market failure of monopoly power

A monopoly uses too few resources because it produces too little in order to increase prices

53

New cards

What can the government do to control monopoly power?

Use antitrust policy which are policies to increase competition and curb anticompetitive behavior

54

New cards

What are the two major antitrust policies and what did they do?

Sherman Act of 1890

* Prohibits a particular type of market conduct, i.e., conspiring to limit competition

* Outlaws a particular market structure, i.e., outlaws monopoly

Clayton Act of 1914: outlawed the following processes

* price discrimination: charging buyers different prices when it was not justified by cost differences. This is business to business, not business to customer.

* mergers: combinations of firms that substantially lessen competition or tend to create a monopoly

* tying contracts: these prevent a buyer from using the products of a competing supplier (such as when Microsoft had to have you buy their web supporter with your computer).

* interlocking directorates: these occur when the same person serves on the board of directors of competing firms (if this happens there might be collusion or forming of a cartel)

* Prohibits a particular type of market conduct, i.e., conspiring to limit competition

* Outlaws a particular market structure, i.e., outlaws monopoly

Clayton Act of 1914: outlawed the following processes

* price discrimination: charging buyers different prices when it was not justified by cost differences. This is business to business, not business to customer.

* mergers: combinations of firms that substantially lessen competition or tend to create a monopoly

* tying contracts: these prevent a buyer from using the products of a competing supplier (such as when Microsoft had to have you buy their web supporter with your computer).

* interlocking directorates: these occur when the same person serves on the board of directors of competing firms (if this happens there might be collusion or forming of a cartel)

55

New cards

Can antitrust laws be used when there are natural monopolies?

NO! Because one firm can produce at a cheaper per unit cost than more than one firm.

56

New cards

What is Public utility regulation?

When the government controls the price and output of natural monopolies

57

New cards

How is price regulated?

Public utilities are allowed to charge a fair return price, which means that ATC = price or where ATC includes a normal profit

58

New cards

What are the problems with fair return price?

It tends to reduce the incentives for a public utility to innovate or contain costs (there’s no reward for becoming more efficient)

* There’s no incentive or reward for this b/c the public utility makes the same profit regardless of its efforts

* There’s no incentive or reward for this b/c the public utility makes the same profit regardless of its efforts

59

New cards

Describe the market failure of spillover costs

Spillover costs or cost externality: a cost imposed on people other than the producers and consumers of a good or service

* Example of a spillover cost: pollution

* Example of a spillover cost: pollution

60

New cards

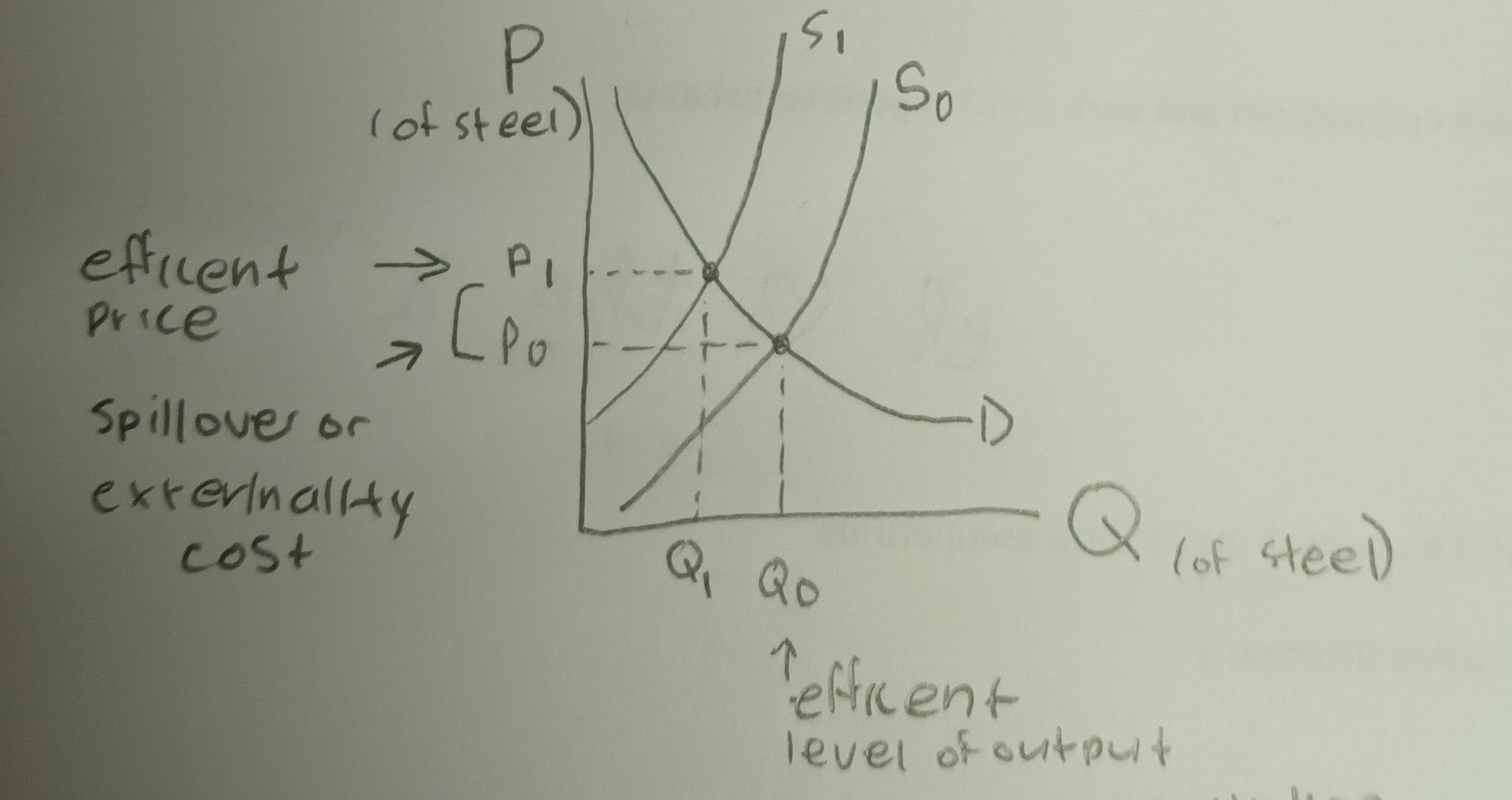

Describe the graph of spillover costs

D: Demand for the product

S0: Supply without the spillover costs

P0: Price without spillover costs

Q0: Output without spillover costs

S1: Supply with the spillover costs of pollution

P1: price with spillover costs

Q1: output with spillover costs

S0: Supply without the spillover costs

P0: Price without spillover costs

Q0: Output without spillover costs

S1: Supply with the spillover costs of pollution

P1: price with spillover costs

Q1: output with spillover costs

61

New cards

What is the amount of the spillover cost?

Spillover cost: P1 - P0

* Without the spillover cost included there is too much pollution, the price is too low, there is overproduction, and there is an overallocation of resources

* With the spillover costs included the firm produces the efficient amount of pollution, charges the efficient price and produces the efficient amount of output.

\*Note: in general, the efficient amount of pollution is not 0 pollution b/c it is not economically efficient.

* Without the spillover cost included there is too much pollution, the price is too low, there is overproduction, and there is an overallocation of resources

* With the spillover costs included the firm produces the efficient amount of pollution, charges the efficient price and produces the efficient amount of output.

\*Note: in general, the efficient amount of pollution is not 0 pollution b/c it is not economically efficient.

62

New cards

How can the government force firms to produce the efficient amount of output and so produce the efficient amount of pollution?

1. Command and control regulation: the government imposes restrictions on the amount of the polluting activity

2. Incentive based regulations: the government uses fees or taxes to induce firms to decrease the polluting activity.

\*Note economists favor incentives b/c it allows the firms themselves to develop the most efficient way to reduce pollution; however, command and control regulation has been the most common approach to reducing pollution.

63

New cards

What are the 3 characteristics of private goods?

1. Divisible: it is possible to divide the good into units small enough to be purchased by individual consumers

2. Exclusion: this means that only those who purchase the good can consume the good

3. Rival consumption: consumption of the good by one person decreases the amount available for other consumers.

These 3 characteristics allow private goods to be efficiently produced by the market

64

New cards

What are the 3 characteristics of public goods?

1. Indivisible: it is not possible to divide the good into units small enough to be purchased by individual consumers

2. Non-exclusion: this means that those who do not purchase the good can still consume the good

3. Nonrival consumption: consumption of the good by one person does not decrease the amount of available for other consumers

These 3 characteristics lead to the free rider problem which leads to underproduction of public goods by the market

Examples of public goods: national defense, police protection, highways

65

New cards

Describe the market failure of Economic Inequality

* The market system on its own usually leads to an unequal distribution of income with many having too little income

66

New cards

How does the government contribute to the income of the poor?

By giving the poor transfer payments: payments by the government to households for which no goods or services are rendered

Examples of transfer payments: social security, unemployment insurance, food stamps, earned income tax credit, welfare.

Examples of transfer payments: social security, unemployment insurance, food stamps, earned income tax credit, welfare.